Author: Techub Exclusive Interpretation

Written by: Glendon, Techub News

Since Bitcoin fell below the $90,000 mark on February 25, triggering a comprehensive crash in the cryptocurrency market, the market has been sliding down like a slide. Early this morning, Bitcoin briefly dropped to around $82,200, marking a new low since November 12, 2024; Ethereum also fell to around $2,100, erasing all gains since August 2024.

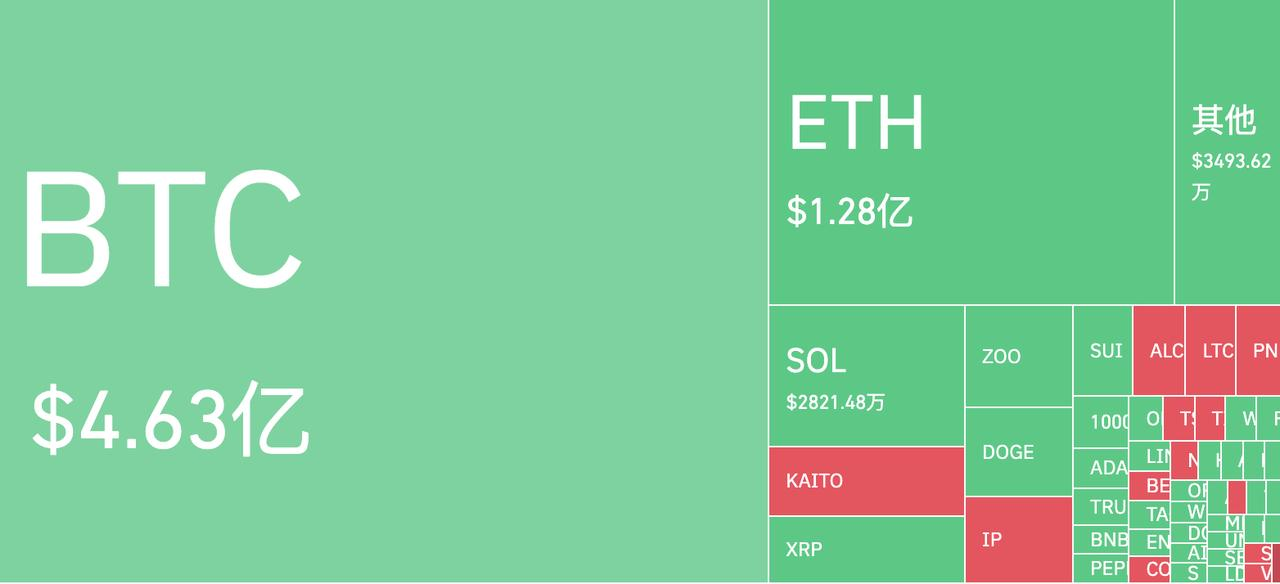

According to Coinglass data, as of the time of writing, the total liquidation amount across the network in the past 24 hours exceeded $772 million, with Bitcoin and Ethereum accounting for 60% and 17% of the liquidation amounts, respectively, while a large number of altcoin long positions were also collectively liquidated in the past two days.

As market sentiment remains in a state of "extreme fear," despite the significant declines in Bitcoin and Ethereum, there is still no sign of a bottoming out. So the question arises: what caused this round of decline in the cryptocurrency market?

Based on various factors and analyses, I believe that this market crash may be a "panic sell-off" phenomenon triggered by multiple negative factors resonating together.

Macroeconomic Policy Factors

On a macro level, we can consider the uncertainty of Trump's recent policies, the bubble in the U.S. stock market, and the failure of expectations for interest rate cuts by the Federal Reserve.

First, although Trump has publicly expressed support for Bitcoin as a "strategic reserve asset," he has not actively promoted the formulation of related cryptocurrency policies since taking office. In fact, even before Trump took office, the market had already been driven to its peak by various optimistic expectations from investors. With Trump's ongoing tariff plans (such as imposing tariffs on imports from Mexico and Canada), some analysts have pointed out that this has raised public concerns about a trade war, leading to increased risk aversion and prompting investors to sell off high-risk assets like Bitcoin.

Additionally, the legislative process for Bitcoin-related bills at the state level in the U.S. has also begun to face obstacles. Currently, over 30 states in the U.S. have proposed bills related to strategic Bitcoin reserves and digital asset investments, but some state governments have vetoed related proposals. The most significant impact has come from South Dakota's legislative body, which seems to have delayed and effectively killed the "allowing state governments to invest in Bitcoin bill." During the same period, strategic Bitcoin reserve bills proposed in Montana and Wyoming were also vetoed.

These occurrences have exposed the divergence between the Trump administration and state-level policies, leading investors to suddenly realize that the passage of Bitcoin legislation may not be as smooth as they had imagined. When expectations repeatedly fall short, it undoubtedly weakens market confidence in the Trump administration's "Crypto-friendly" commitments.

On the other hand, the bubble in the U.S. stock market and the Federal Reserve's lack of plans for interest rate cuts have also impacted the cryptocurrency market.

According to First Financial, as of February 26, U.S. stocks have faced sell-offs for four consecutive days, with popular tech stocks plummeting from high levels, with cumulative declines ranging from 10% to 35%. Some analysts have pointed out that this sell-off sentiment for overvalued tech stocks is gradually spreading to the cryptocurrency sector, as investors worry about a potential stock market bubble burst, leading to a rapid decrease in risk appetite and causing funds to withdraw from high-volatility assets like Bitcoin and Ethereum. Meanwhile, the Federal Reserve has shown no intention of cutting interest rates, and in a high-interest-rate environment, the dollar's appeal as a global reserve currency has increased, causing some funds to flow back from risk assets like cryptocurrencies to dollar-denominated assets.

The Cryptocurrency Market Burdened by "Negative Buffs"

The cryptocurrency market has recently been beset by both internal and external troubles, accumulating numerous "negative buffs."

Since February, Bitcoin spot ETFs have experienced a severe "bleeding effect." As an important channel for institutional fund inflows, the fund flow data is also a key indicator affecting market confidence. However, throughout February, Bitcoin spot ETFs have seen almost all net outflows, including significant net outflows exceeding $100 million.

According to iChaingo data, from February 18 to 26, U.S. Bitcoin spot ETFs experienced seven consecutive days of net outflows, with a net outflow of as much as $1.14 billion on February 25, setting a record for the largest single-day net outflow since their launch, reflecting institutional investors' pessimistic expectations for short-term price trends.

In contrast, while the situation for Ethereum spot ETFs is better than that of Bitcoin, it also experienced five consecutive days of net outflows from February 20 to 26. However, the negative factors facing Ethereum are not limited to this.

In fact, Ethereum has long been trapped in a scaling dilemma, which is a major reason for its relatively sluggish price over the past two months. Ethereum plans to alleviate the scaling issue through the Pectra upgrade, but the process of launching this upgrade has not been smooth. According to CoinDesk, the Ethereum Pectra upgrade was activated on the Holesky testnet but ultimately failed to confirm, and as of now, Ethereum officials have not disclosed the reasons for the failure of the test network.

Additionally, Solana, which once thrived on meme coins, has recently faced multiple blows. Under the onslaught of Trump's meme coin TRUMP and the meme coin LIBRA promoted by the Argentine president, the potential value of the meme coin market has severely shrunk, leading many investors to lose interest in meme coins, with some analysts even suggesting that the meme coin craze is nearing its end. Consequently, the meme coin market that Solana relied on has entered a state of stagnation.

Even more concerning is that Solana is about to face the largest-scale SOL token unlocking "storm." According to Cointelegraph, Solana will unlock over 11.2 million SOL tokens (worth about $2 billion) on March 1, which undoubtedly adds to the pressure on SOL's market performance. Crypto analyst Artchick.eth has stated, "It is expected that over 15 million SOL (about $2.5 billion) will enter the circulating market in the next three months." As a result, SOL briefly dropped to around $130, marking a new low since September 18, 2024.

Frequent Hacking Incidents

On the night of February 21, the cryptocurrency exchange Bybit was hacked, with over 400,000 Ethereum and stETH (total asset value exceeding $1.5 billion) stolen, becoming the largest theft in the history of the cryptocurrency industry, which also raised further questions about cryptocurrency security and triggered panic selling among many investors. Although Bybit has made efforts to minimize the negative impact, the massive amount of Ethereum stolen by hackers has undoubtedly become a "landmine" affecting market performance.

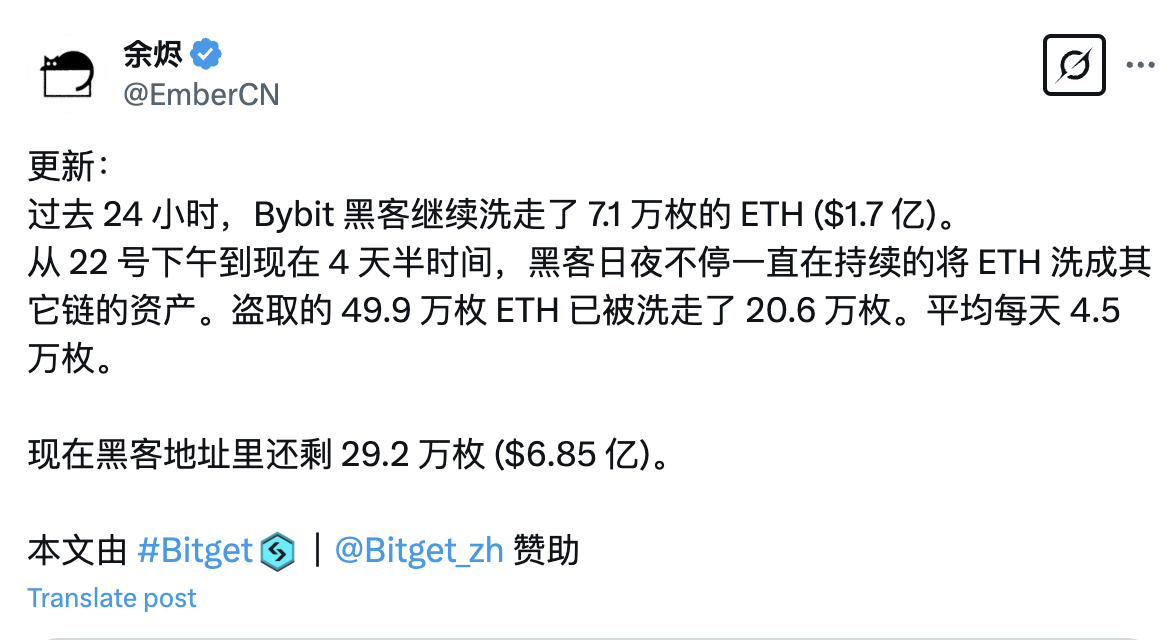

As of the time of writing, according to X user Yu Jin's monitoring, in the past 24 hours, addresses marked as Bybit hackers have laundered about 71,000 Ethereum (worth about $170 million). So far, the laundered Ethereum has reached about 206,000, but the hacker address still holds 292,000 Ethereum (worth about $685 million). Previously, Yu Jin had stated that the hacker is expected to exchange all remaining ETH for other assets (such as BTC, DAI, etc.) within half a month.

In addition to Bybit, the stablecoin payment platform Infini was also hacked on February 24, with nearly $50 million in crypto assets stolen. Although the amount stolen is far less than that of the former, the occurrence of consecutive hacking incidents has not only undermined investor confidence but also directly impacted market performance.

In summary, this round of decline is not only a market demand adjustment but also a comprehensive response to the withdrawal of institutional funds, macroeconomic policy impacts, hacking incidents, and bubble bursts. I believe that, essentially, the continuous rise of cryptocurrencies like Bitcoin since the end of 2024 has accumulated a significant amount of profit-taking positions. However, since early February, Bitcoin's price has been oscillating in the $90,000 to $100,000 range without breaking through resistance, coupled with a lack of significant positive support. Therefore, even in the absence of major negative factors, the selling of these profit-taking positions will exert tremendous pressure on market prices.

However, although the current market is facing multiple factors of impact, it is still too early to declare that "the bull market is over."

Yu Jianing, co-chair of the Blockchain Committee of the China Communications Industry Association, stated in an interview with Beijing Business Daily, "The current decline is likely a technical adjustment rather than a long-term trend reversal." I believe that in the short term, we need to be wary of further bottoming risks triggered by the selling crisis, but from a medium to long-term perspective, the market clearing may lay the foundation for a new cycle. Furthermore, if the Trump administration proposes cryptocurrency-related policies and the strategic Bitcoin bills in various U.S. states are passed, it will undoubtedly bring unpredictable developments to the entire cryptocurrency market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。