The future of exchange wars is essentially a comprehensive dimension competition of "technology + system + law."

When the digital asset industry faces a series of sudden risk events, how can users and the industry ensure asset security?

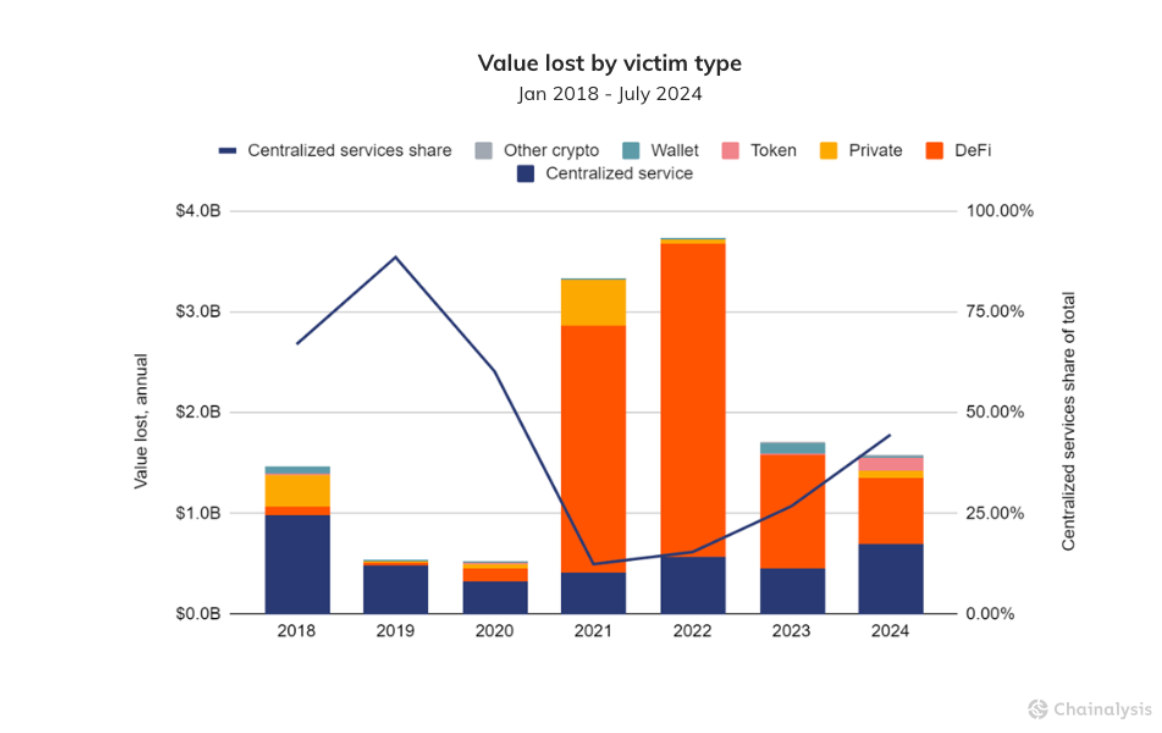

Chainalysis mentioned in its report last year that crypto criminals have gradually shifted their targets to centralized trading platforms, with the value of stolen cryptocurrencies and the number of hacking incidents both rising significantly. Especially as the methods and capabilities of hackers become increasingly specialized, management processes and system loopholes beyond "technical risks" are gradually becoming new security hazards.

Objectively speaking, as the digital asset industry gradually matures, security, as the lifeline of industry development, is no longer merely a game of code, but a competition of rules and institutional systems. In this context, whoever can transform the regulatory framework into a security premium will undoubtedly gain an advantage in competition.

The Watershed from "Technology-Driven" to "System-Driven"

The essence of financial history is the pricing history of risk and trust.

Just as traditional finance has evolved over a century to gradually perfect a regulatory system centered around the Basel Accords, completing a critical transition from barbaric growth to maturity.

In the current context where the total market size of digital assets has surpassed $3 trillion, the growth rate of losses from security incidents during the same period has far exceeded the expansion of market size. This also exposes the limitations of pure technical protection. To some extent, the digital asset industry needs to fill the institutional gap and achieve a transition from "technology-driven" to "system-driven."

In short, licensed compliance is also a necessary maturation stage for the digital asset industry.

In this context, compliance is not only a safety baseline but also the cornerstone of industry trust. In recent years, the systemic risks of unregulated platforms have shown a diversified trend, whether due to technical vulnerabilities, management process flaws, or liquidity crises, all of which have severely impacted market participants.

In contrast, regulated platforms (such as licensed exchanges in Hong Kong) can effectively avoid these risks and have not experienced serious security incidents, thanks to their more comprehensive risk control systems and compliance frameworks.

For this reason, institutional investors and high-net-worth clients are more inclined to choose regulated platforms. These platforms, through "technology + system + law" multiple safeguards, become a solid foundation for systemic risk management.

The Necessity of Hidden Costs and Compliance Investment

From the perspective of data accounting, although the Securities and Futures Commission's website provides reference licensing application fees of only a few thousand Hong Kong dollars, the cumulative costs required to streamline processes and meet the aforementioned compliance capital operations may reach tens of millions of dollars.

However, even though the cost of licensed compliance is high, its long-term value far exceeds short-term costs. Taking Hong Kong's first regulated licensed exchange, OSL, as an example, it invests tens of millions of dollars annually in compliance operations:

The application process for compliance licenses is complex and strict, involving the establishment of legal compliance teams, investment in security and technical resources, implementation of fund segregation and risk management mechanisms, establishment of auditing and reporting systems, and conducting compliance training and education.

For this reason, the market share of compliant platforms among institutional investors and high-net-worth clients continues to rise—OSL's Chief Institutional Business Officer (CIBO) Zhang Yinghua has disclosed that when Bitcoin's market capitalization surpassed $2 trillion, security was no longer a cost item but a "rigid ticket" for institutional entry:

"Currently, institutions and high-net-worth clients place great importance on security; they prefer to store BTC in compliant exchanges like OSL or choose to invest in BTC ETFs to avoid the risks of wallet loss or asset theft."

It is evident that compliance investment is not a cost burden but the core of long-term competitiveness.

The "Security First" Revolution in Exchange System Construction

Compared to offshore exchanges that prioritize user experience, regulated licensed exchanges always place security at the absolute top of their priorities. Of course, in the digital asset field, there is no perfect solution that can balance all aspects simultaneously, so platforms must make trade-offs between technology, user experience, and security.

The security advantages of licensed exchanges are most directly reflected in their architectural design—on the dimensions of technology and exchange architecture, regulated platforms ensure the security of user assets through multiple security measures.

Specifically, these platforms typically employ the following methods to build their security moat:

● Technical Protection: Licensed exchanges like OSL use cutting-edge cryptocurrency storage technology, keeping private keys and backups in appropriately certified devices, such as certified hardware security modules (HSM), to ensure the security of user data and transaction information, preventing hacking and data breaches;

● Cold and Hot Wallet Isolation: 98% of user assets at licensed exchanges must be stored in cold wallets, while no more than 2% of user assets can be kept in hot wallets, and there must be guarantees for 50% of assets in cold wallets and 100% of assets in hot wallets, which can be provided through third-party insurance, trust funds, or bank guarantees;

● Custodial System Protection: Regulated exchanges typically require independent third-party custodians to hold assets, ensuring that the exchange itself cannot arbitrarily use user assets, further enhancing security and transparency;

● Whitelist Address Mechanism for Regulating Customer Deposits and Withdrawals: Licensed exchanges use a whitelist address mechanism to ensure that users are trading with their own or acceptable third-party wallet addresses. To verify whether a whitelist address is held by the user, methods such as "message signing tests" or "micro-payment tests" can be used;

● Insurance Coverage: Some licensed exchanges also provide users with additional insurance coverage against asset losses due to platform vulnerabilities, hacking, etc., offering stronger security guarantees and risk mitigation. For instance, OSL has launched a record-breaking $1 billion insurance plan to provide more comprehensive asset protection for clients;

Conclusion

As Bitcoin and other digital assets gradually become part of balance sheets, compliance and licensing issues are increasingly becoming new topics for the development of digital asset exchanges.

This is not only a technical issue but also a revolution in cognition and institutional governance. Therefore, it requires industry practitioners and users to work together to promote the construction of a "security first" industry culture:

Users choose licensed platforms, and practitioners embrace regulatory frameworks to jointly build a sustainable digital asset ecosystem.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。