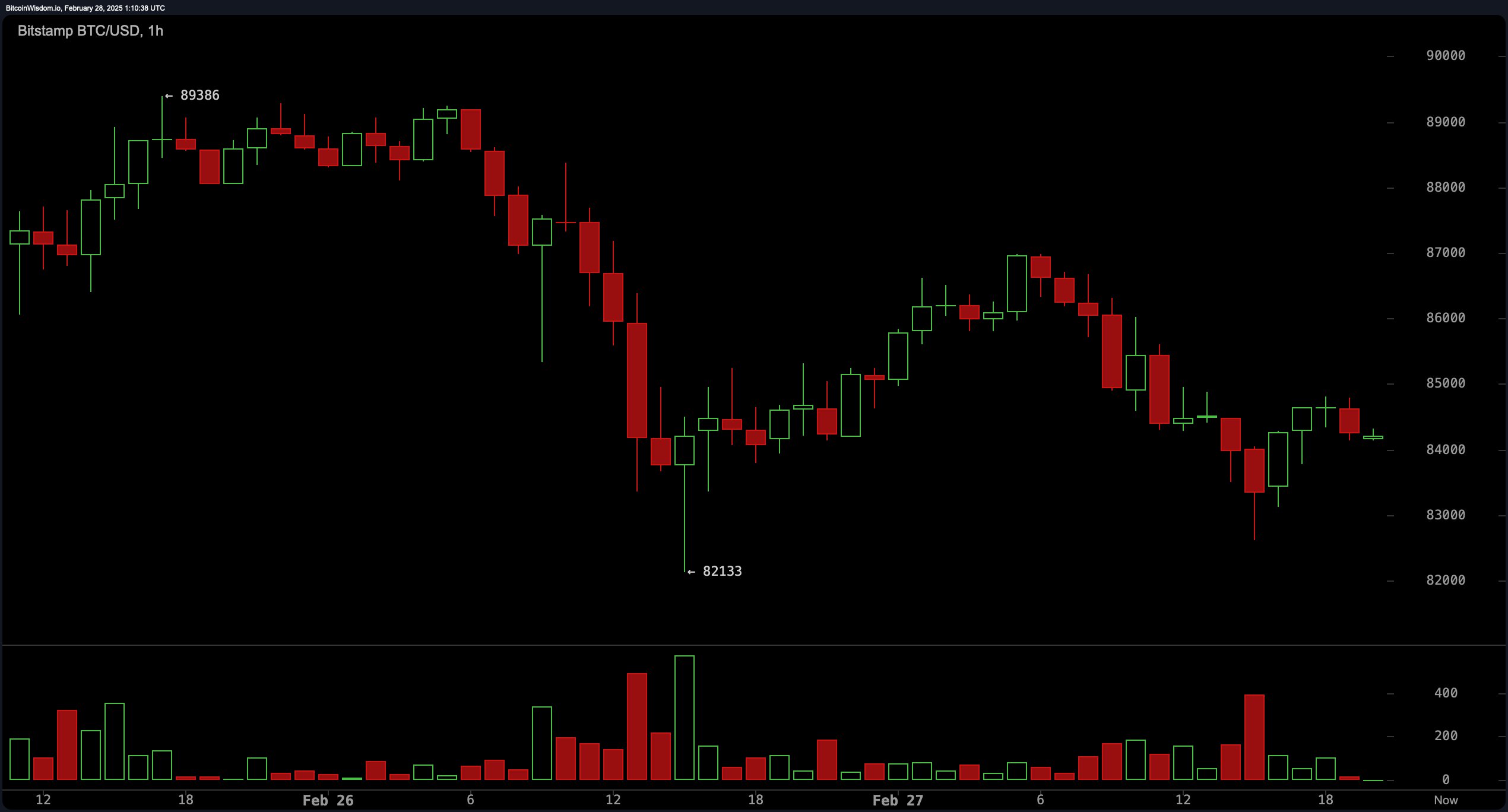

At the time of writing at 8:00 p.m. EST, bitcoin (BTC) hovered at $84,258 on Bitstamp, dipping 0.34% in a day and retreating 13.9% weekly. The Feb. 28–March 2 window promises either electrifying gyrations or lethargic drift. A pivotal catalyst looms: the Feb. 28 expiration of $5.07 billion in bitcoin derivatives contracts, per futures data—events historically known to ignite volatility as traders recalibrate positions.

BTC/USD 1H chart via Bitstamp on Feb. 27, 2025. Price: $84,258 per bitcoin.

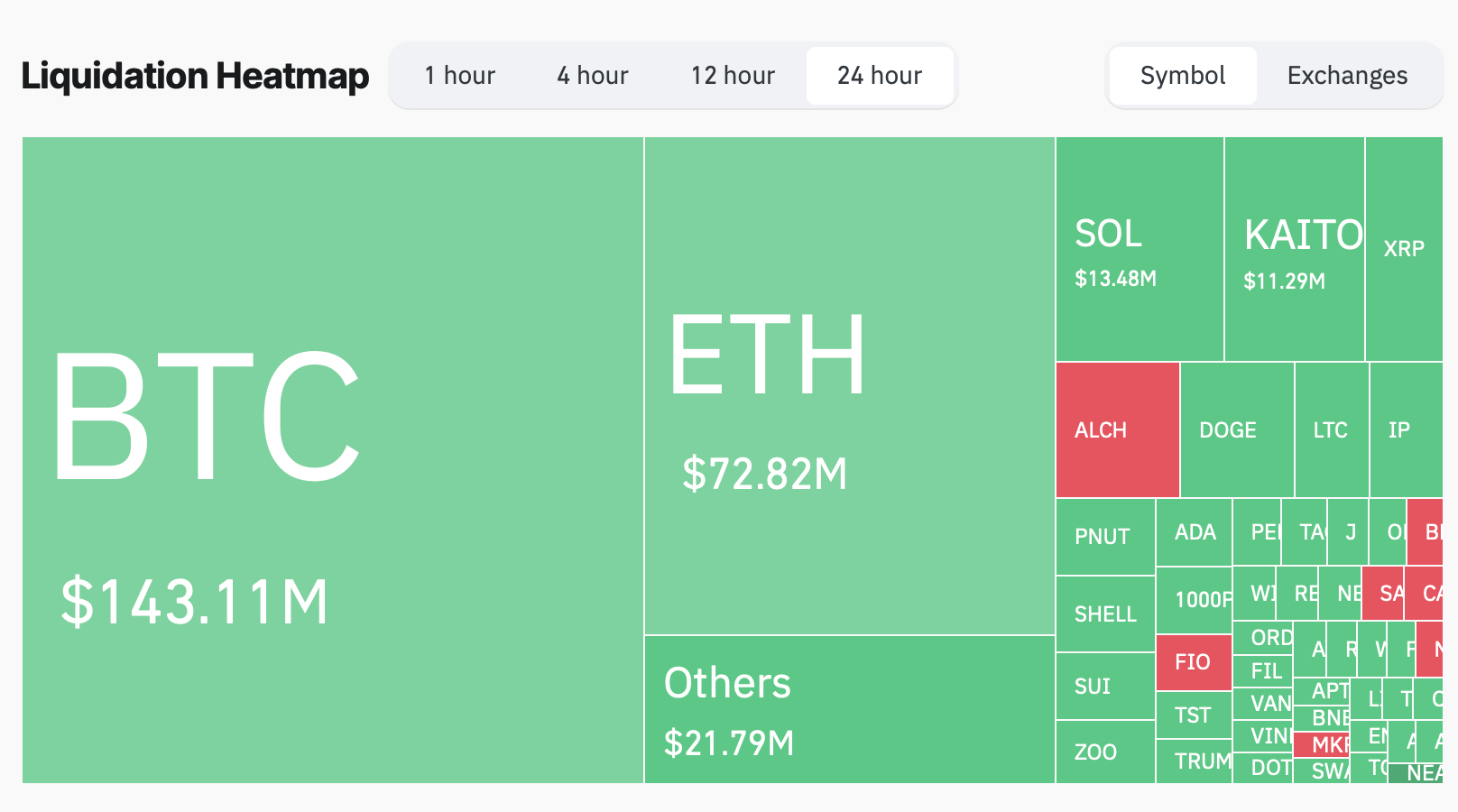

Market sentiment remains quite fragile. spot bitcoin ETFs hemorrhaged massive value this week, though institutional acquisitions by firms like Metaplanet provided faint optimism. Crypto derivatives markets saw $326.81 million evaporate Thursday, with bullish BTC traders absorbing a $108.96 million blow to longs. A decent 109,359 traders faced liquidations, crowned by a $38 million BTC-USDT wipe-out on HTX (via coinglass.com). Open futures interest stood at 55,100 BTC (11,020 contracts at 5 BTC each).

The Crypto Fear and Greed Index (CFGI) lingered at 10 (“Extreme Fear”) on Wednesday, suggesting either latent bargains or impending declines. Today, it edged to 16 but retained its ominous label. Bitcoin’s weekend trajectory essentially hinges on Friday’s developments, including if and any political tremors from the Trump administration.

Out of BTC’s $143 million in wipe-outs on Thursday, $108.96 million were liquidated longs.

While the $82,000–$89,000 band seems plausible, bearish headlines could deflate prices—or an audacious leap past $90,000 might defy expectations. Currently, BTC trades 22% below its historic peak.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。