Bitcoin‘s 1-hour chart signals a slight recovery following a local bottom at $82,133, with buyers stepping in to stabilize prices. However, resistance at $86,000 remains a critical barrier, preventing a stronger upward push. If bitcoin holds the $84,000–$85,000 range, a breakout toward $88,000 is possible. A failure to maintain this support level could lead to a retest of $82,000, reinforcing the broader bearish sentiment.

BTC/USD 1H chart via Bitstamp on Feb. 27, 2025.

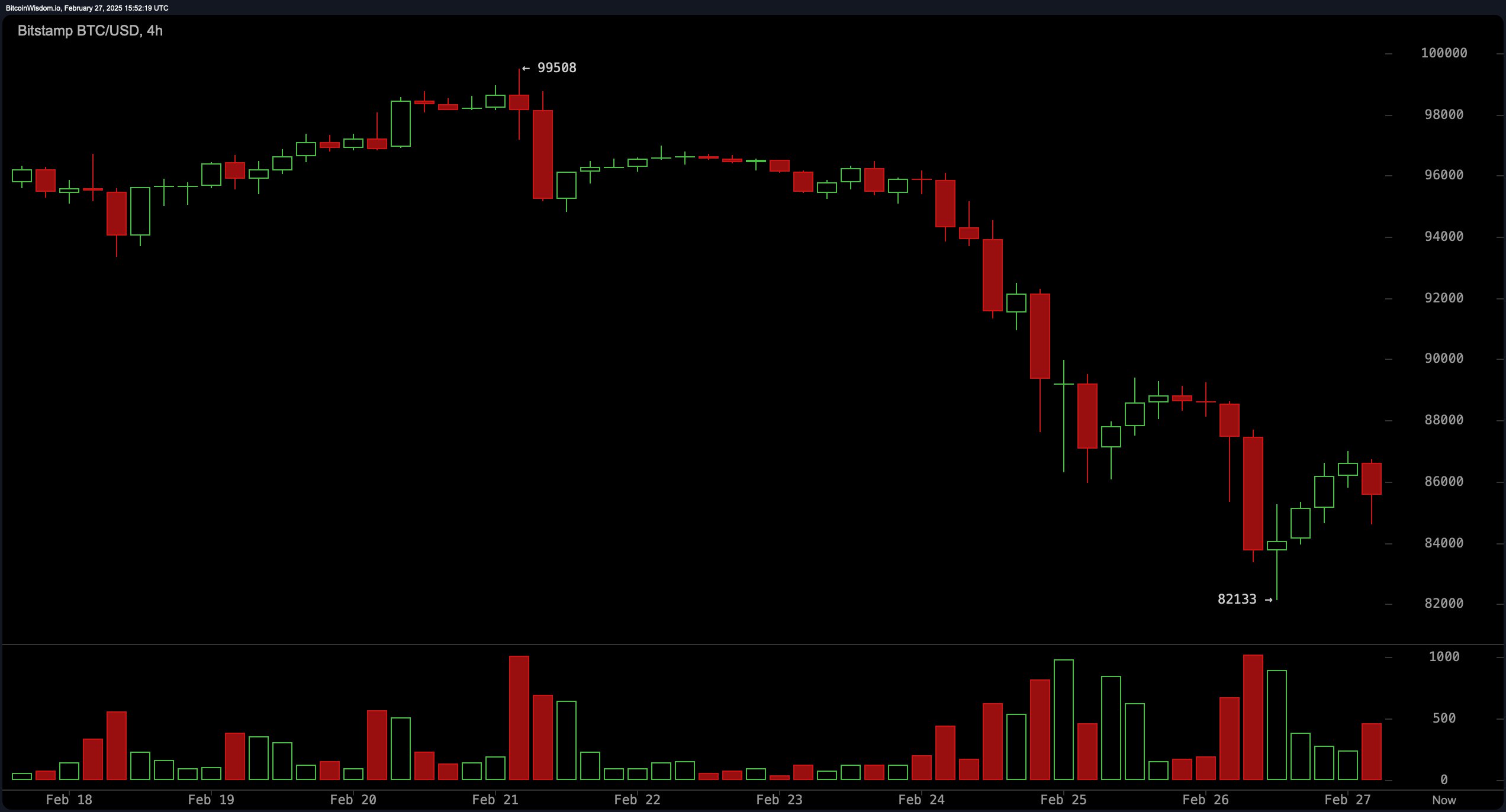

On the 4-hour chart, bitcoin’s price trend remains short-term bearish, though signs of accumulation are emerging. Increased volume on upward movements suggests traders are buying at lower levels. Key resistance lies between $86,000 and $88,000, with a breakout above this zone potentially driving prices toward $90,000. However, failure to surpass this range could signal another leg down toward $82,000 or lower.

BTC/USD 4H chart via Bitstamp on Feb. 27, 2025.

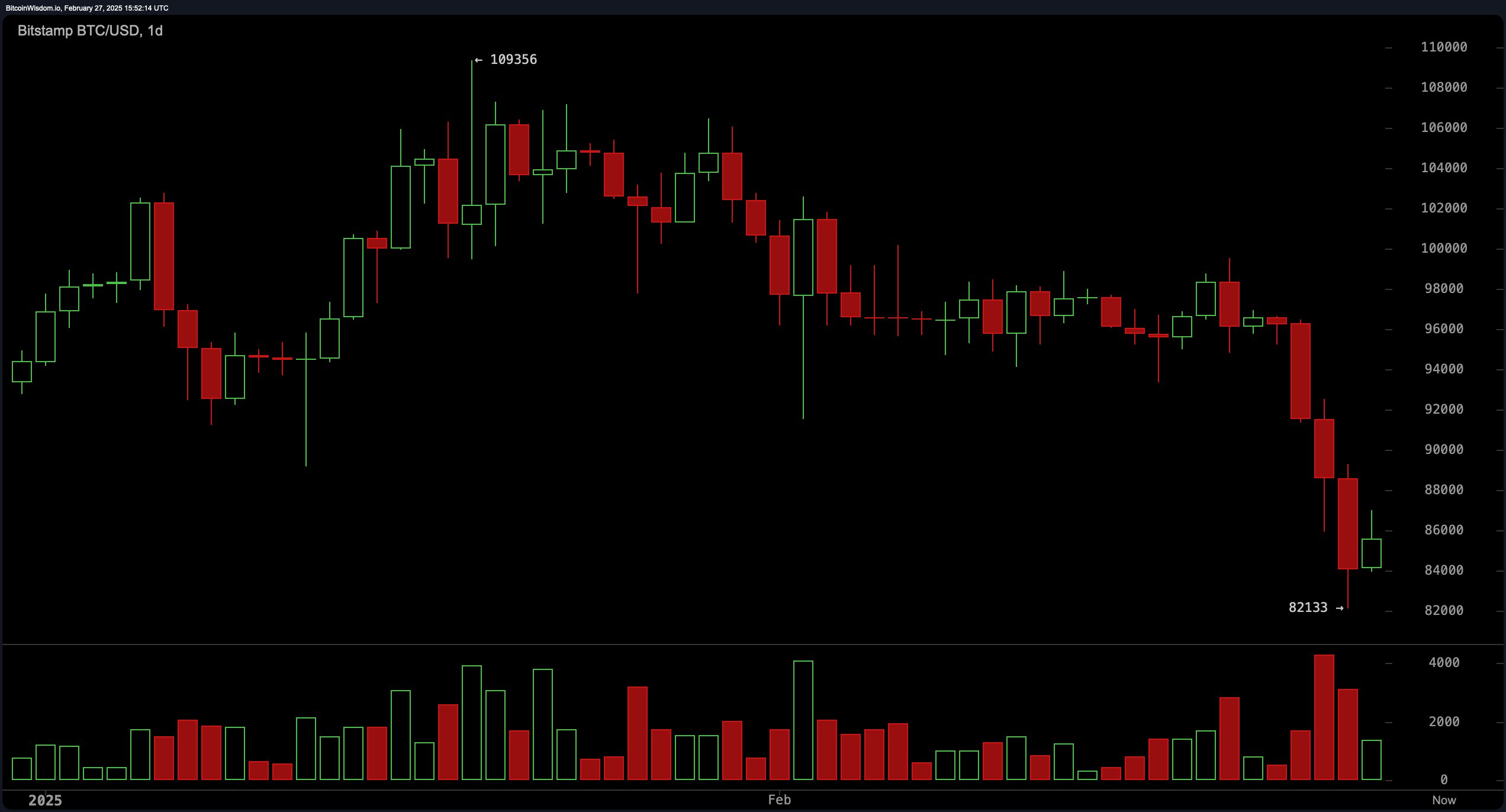

The daily chart confirms the prevailing bearish trend, with strong downward momentum and increasing sell volume. Major resistance sits around $109,356, while support is near $82,133. The price must reclaim $90,000 to disrupt the current downtrend, but if support breaks, bitcoin could see further downside toward $78,000 or even $75,000 in the coming sessions.

BTC/USD 1D chart via Bitstamp on Feb. 27, 2025.

Oscillators present mixed signals, with the relative strength index (RSI) at 30, Stochastic at 17, and momentum at -10,014, all indicating a buying opportunity. Meanwhile, the moving average convergence divergence (MACD) remains negative at -2,818, signaling ongoing bearish momentum.

Moving averages (MAs) continue to reinforce the downtrend, with the exponential moving average (EMA) and simple moving average (SMA) across multiple timeframes—10, 20, 30, 50, and 100—flashing sell signals. The only bullish signs come from the EMA 200 and SMA 200, suggesting long-term support near $85,647 and $81,879, respectively.

In conclusion, bitcoin faces critical resistance at $86,000–$88,000, and a breakout above this level is necessary for a bullish reversal toward $90,000 or higher. Failure to reclaim this range may lead to further declines, with $82,000 as the immediate support level and a potential drop toward $78,000. Traders should closely monitor price action, particularly around key resistance and support zones, as the market remains at a pivotal juncture.

Bull Verdict:

If bitcoin successfully breaks above $88,000 with strong buying volume, it could signal a shift in momentum, allowing the price to reclaim $90,000 and push toward higher resistance levels. A sustained move above this zone may indicate the end of the downtrend and the beginning of a new bullish cycle, targeting $95,000 and beyond.

Bear Verdict:

If bitcoin fails to break above $86,000–$88,000 and instead loses support at $84,000, the market is likely to see further declines. A drop below $82,000 could accelerate selling pressure, pushing prices toward $78,000 or even $75,000, reinforcing the prevailing bearish trend.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。