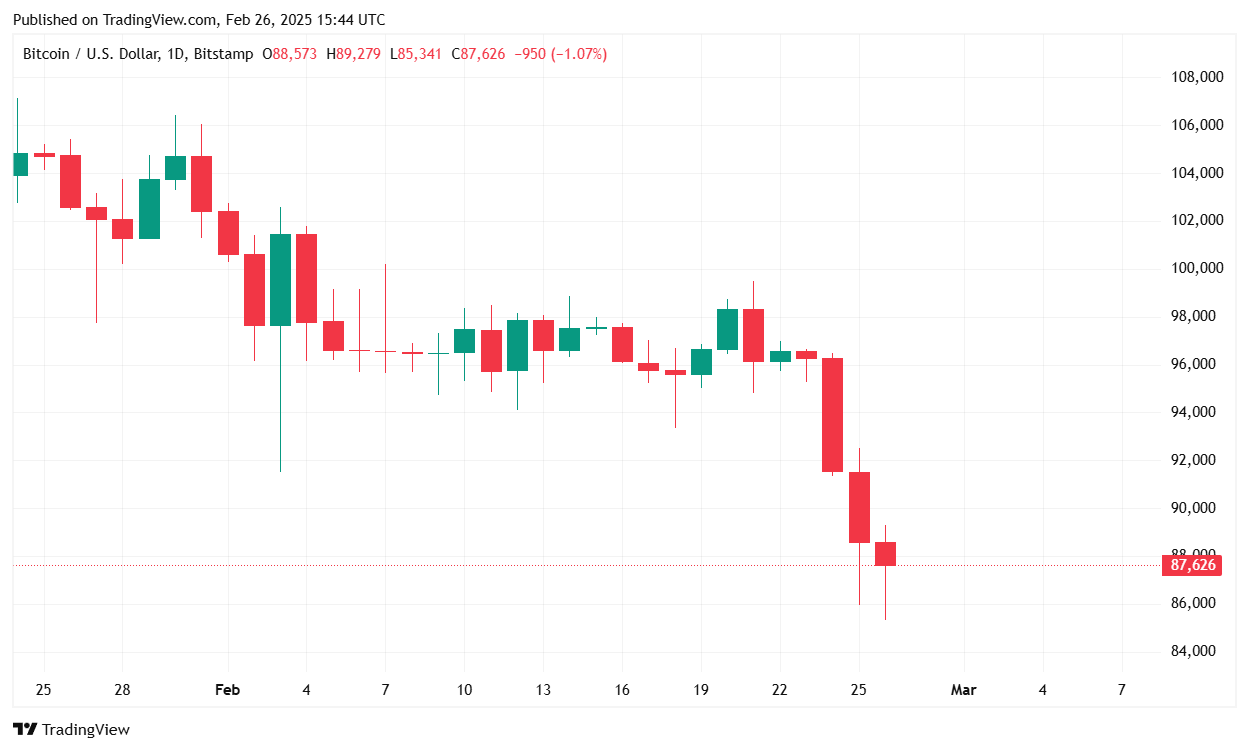

Bitcoin fell to a 3-month low over the last day, and to add insult to injury, spot bitcoin exchange-traded funds (ETFs) registered a record $1 billion in outflows, resulting in continued downward pressure on the price of the largest digital asset. Earlier today at 10:44 a.m. ET, bitcoin was trading at $87,670, reflecting a 0.77% decline since yesterday and a significant 9.10% drop over the past seven days, according to Coin Market Cap data. By 2:30 in the afternoon, BTC had sunk even lower.

(BTC price / Tradingview at 10:44 a.m. ET)

- 24-Hour Price Range: Bitcoin has fluctuated between $83,365 and $89,351.20, indicating persistent volatility but a slight recovery from its daily low.

- Trading Volume: The 24-hour trading volume sits at $56.38 billion, marking a steep 31.70% drop from yesterday’s aggressive sell-off. This decline suggests that traders are showing signs of exhaustion following recent market turmoil.

- Market Capitalization: BTC’s total market cap is currently at $1.73 trillion, mostly flat from yesterday but up marginally by 0.12%.

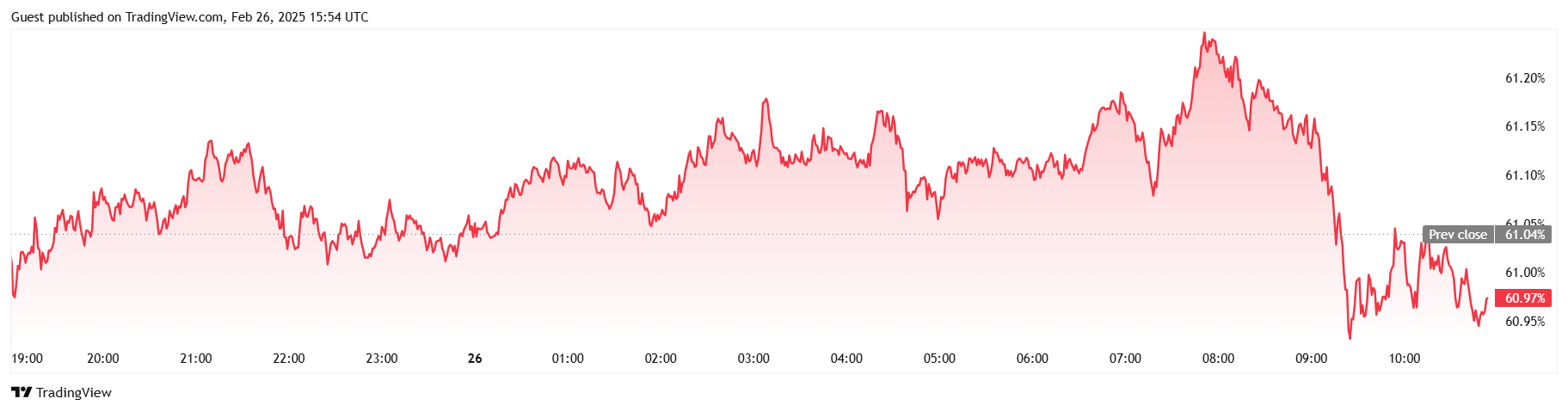

- BTC Dominance: Bitcoin dominance has edged lower to 60.98%, down 0.21% in the last 24 hours, as altcoins attempt to recapture lost ground.

(BTC dominance / Trading View)

- Futures Market: Total BTC futures open interest has declined by 1.24% to $56.42 billion, reflecting a reduction in leveraged positions as market uncertainty persists.

- Liquidations: Over the past 24 hours, total liquidations amounted to $151.84 million, with long positions bearing the brunt at $99.28 million, while short liquidations totaled $52.55 million

Yesterday’s record ETF outflows were a key driver of bitcoin’s lackluster price action today. Capital flight hints at a shift in investor sentiment towards bitcoin, although it’s too early to tell how permanent that shift will be. Ether ETFs also recorded a net outflow of $50 million, contributing to the overall bearish sentiment in the crypto space.

Bitcoin’s ability to hold above the $80,000 level will be crucial in the coming days. The recent drop in futures open interest and trading volume suggests that traders are adopting a more cautious stance, waiting for clearer market signals before making big moves.

If BTC manages to reclaim the $90,000 mark, it could signal a short-term relief rally, potentially targeting $92,500 as the next resistance level. However, if selling pressure intensifies and BTC falls below $83,000, further downside could open the door for a retest of the $82,000 to $80,000 support zone.

With ETF outflows still weighing on sentiment and market participants closely watching macroeconomic developments, bitcoin’s price remains in a fragile state. Investors will likely be monitoring trading volume, derivatives positioning, and institutional activity for signs of a potential trend reversal in the days ahead. Just before 3 p.m. (ET) on Wednesday, BTC was exchanging hands for $83,827 per coin.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。