The 1-hour chart indicates that XRP is consolidating within the $2.2 to $2.3 range after finding support at $2.064. Despite weak buying pressure, the short-term trend remains neutral, with resistance forming between $2.3 and $2.35. A breakout above this level could trigger a short-term rally toward $2.4, while failure to hold $2.2 may result in a retest of lower support levels. Trading volume remains weak, suggesting that a decisive move in either direction will require increased market participation.

XRP/USDT via Binance on Feb. 26, 2025, 1 hour chart.

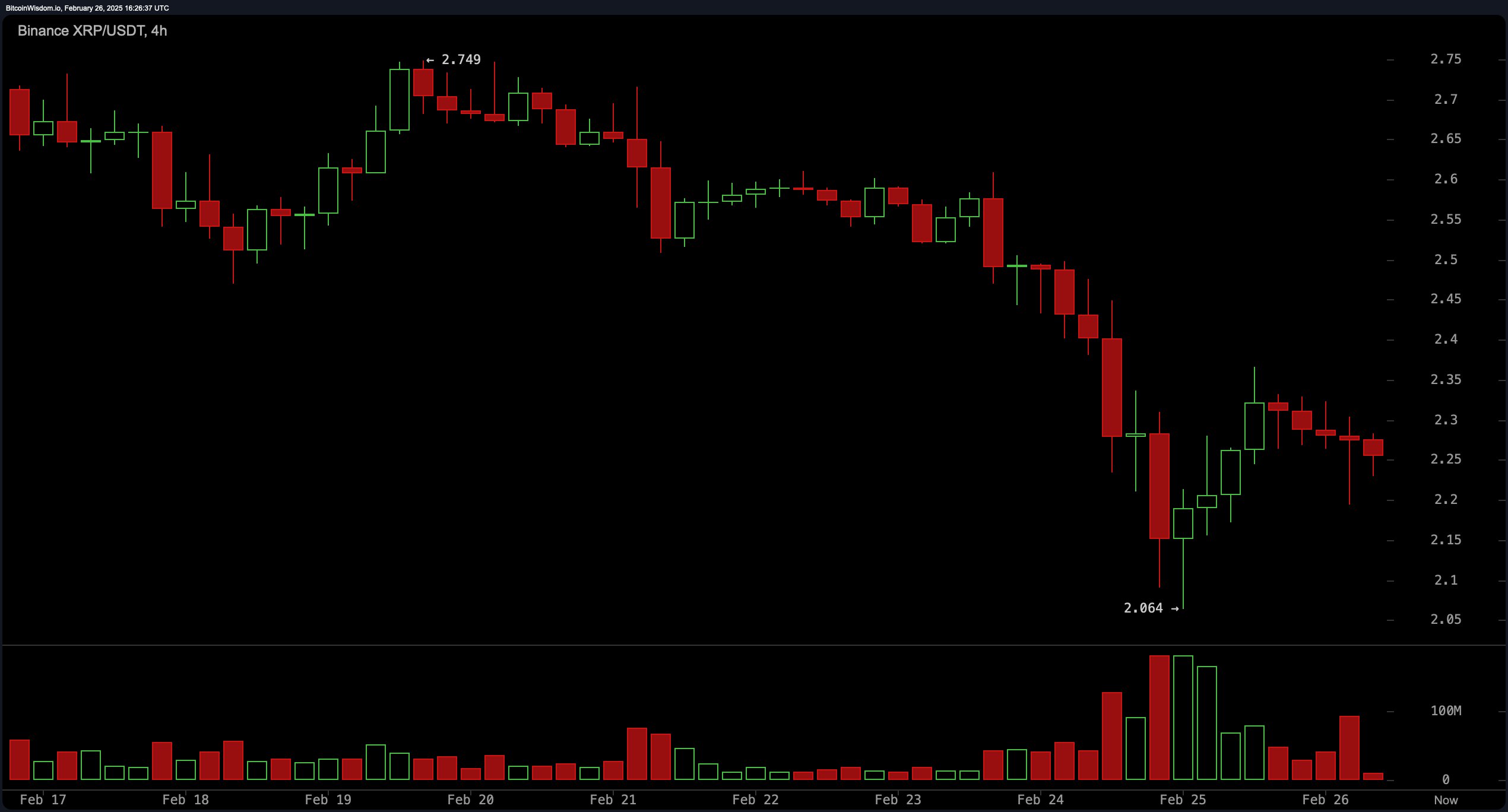

The 4-hour chart highlights a strong downtrend, with XRP experiencing a bounce at $2.064 after failing to sustain levels above $2.75. The market structure suggests a key resistance zone at $2.35 to $2.4, making it a crucial level to watch for potential breakouts. Increased selling pressure followed by a moderate recovery has resulted in a neutral to bearish outlook. Traders should monitor whether XRP can maintain support above $2.2, as a breakdown below this level could lead to further downside movement.

XRP/USDT via Binance on Feb. 26, 2025, 4 hour chart.

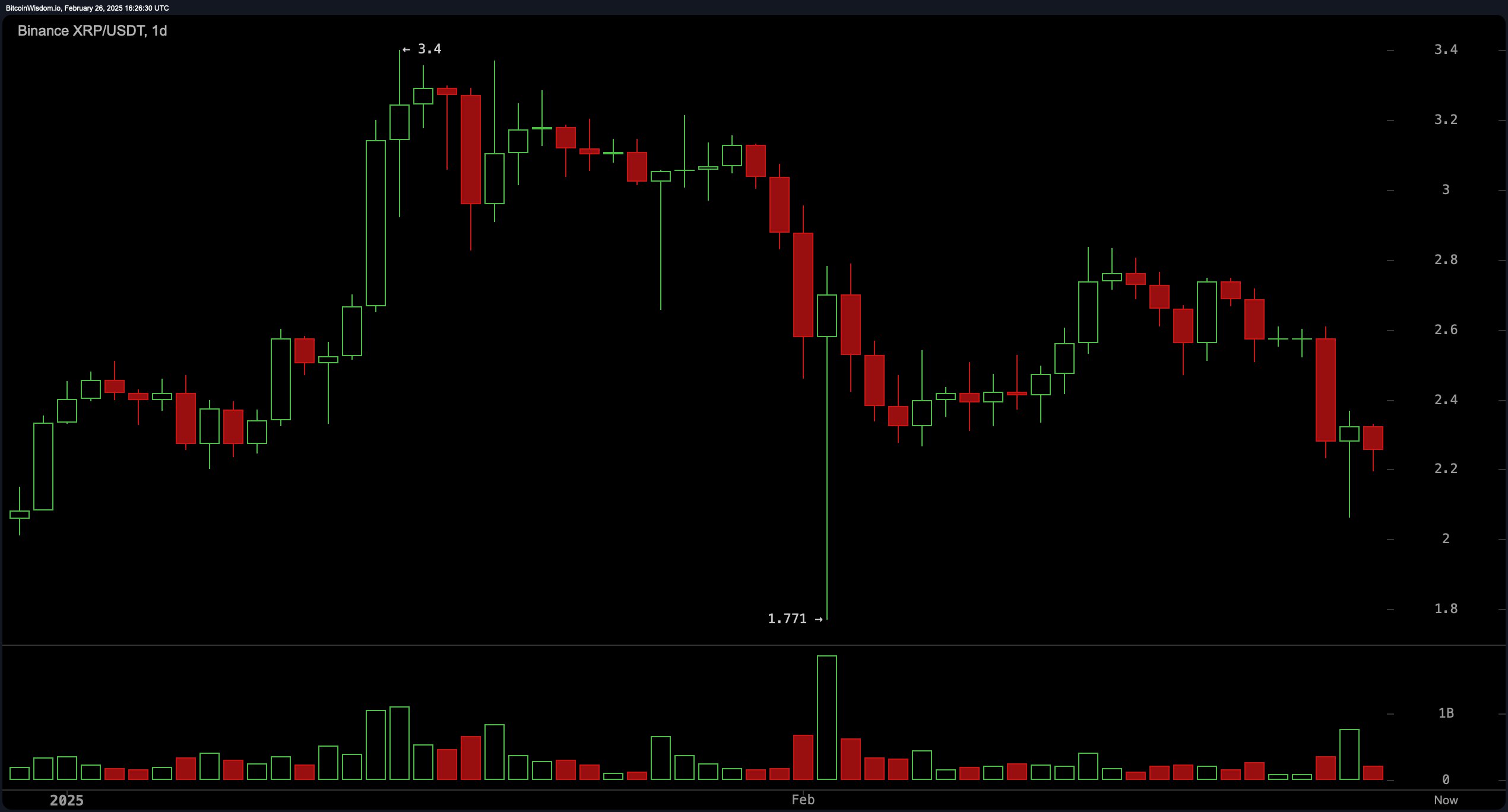

On the daily chart, XRP has been in a clear downtrend after reaching a high of $3.4 before dropping to a low of $1.771. Current support is holding between $2.2 and $2.3, while resistance remains between $2.6 and $2.8. The recent decline in trading volume suggests weakening buying pressure, though stabilization at current levels may indicate a potential shift in momentum. While the broader trend remains bearish, a move above $2.6 could signal a reversal, whereas a drop below $2.2 would reinforce the existing downtrend.

XRP/USDT via Binance on Feb. 26, 2025, 1 day chart.

Oscillator readings present a mixed outlook, with the relative strength index (RSI) at 35.62 in neutral territory, while the Stochastic at 21.07 also signals neutrality. The commodity channel index (CCI) at -133.05 suggests a buying opportunity, whereas the average directional index (ADX) at 33.95 remains neutral. The awesome oscillator is slightly negative at -0.24, reinforcing the indecisive market sentiment. Momentum at -0.48 and the moving average convergence divergence (MACD) level at -0.08 both indicate bearish pressure, suggesting caution for traders considering long positions.

Moving averages (MAs) further confirm the prevailing bearish sentiment, with the exponential moving average (EMA) and simple moving average (SMA) for 10, 20, 30, 50, and 100 periods all generating negative signals. The EMA (10) stands at 2.461 and the SMA (10) at 2.520, both below the current price, reinforcing downward pressure. However, the EMA (200) at 1.791 and the SMA (200) at 1.504 provide a long-term bullish signal, indicating potential support at these levels. Until short-term moving averages show signs of reversal, the bearish outlook remains dominant, with XRP needing a breakout above resistance to establish a more positive trend.

Bull Verdict:

Despite recent bearish pressure, XRP is stabilizing around key support levels, and long-term moving averages suggest strong buying interest at lower prices. If XRP breaks above $2.35 in the short term and clears resistance at $2.6, it could signal a shift in momentum toward a bullish reversal, with potential upside targets at $2.8 and beyond.

Bear Verdict:

XRP remains in a strong downtrend, with key resistance at $2.35 and $2.6 proving difficult to overcome. The majority of oscillators and moving averages indicate bearish momentum, and declining volume suggests weakening buying pressure. If XRP falls below $2.2, a retest of $2.064 or lower levels could be imminent, reinforcing the bearish outlook.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。