The leading cryptocurrency’s price declined from the previous day, marking a 24-hour drop of approximately 1.9%, according to the latest BTC price data. This follows a volatile week: Essentially, bitcoin traded near $99,334.93 on February 24 before sliding 11.1% over the last two days. Analysts attribute the swing to intraday trading pressures and macroeconomic headwinds from Trump’s tariff threats.

BTC/USD via Bitstamp 1H chart on Feb. 26, 2025.

Market sentiment remains divided. Some traders advocate holding positions, citing resilience while other reports show bulls targeting $90,000 per bitcoin as a near-term resistance level. However, bearish momentum persists, with significant sell-offs and liquidations noted on Tuesday, Feb. 25. Sleeping bitcoins have also been waking up, like this 185.65 BTC cache from a dormant 2013 wallet that shifted yesterday.

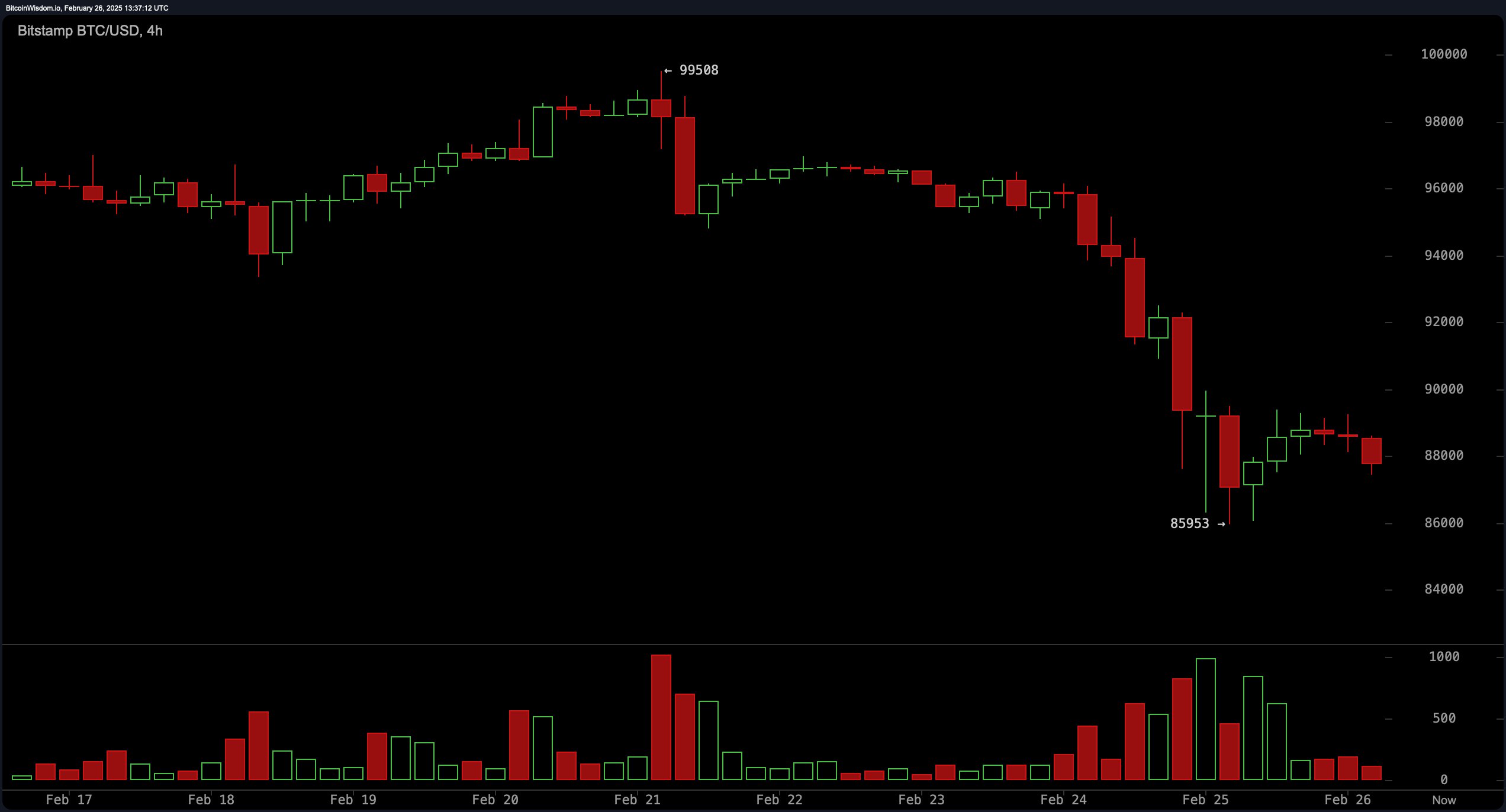

BTC/USD via Bitstamp 4H chart on Feb. 26, 2025.

Broader economic trends compound uncertainty. Recent U.S. tariff proposals and a 0.3% dip in January’s Leading Economic Index have eroded consumer confidence, per Reuters and The Conference Board. Deloitte Insights warns such policies could slow growth, indirectly pressuring bitcoin’s association with risk-on assets like equities.

Historically, bitcoin has thrived or remained resilient during economic instability. Yet its 2025 fluctuations—from the mid-$90K range on Feb. 18 to current lows—showcase sensitivity to macro trends. Investors now weigh short-term volatility against long-term forecasts, including varied 2025 projections of $75,000 to $200,000 per bitcoin.

While traders and analysts monitor recovery signals, February 26’s continued slump highlights bitcoin’s entanglement with global economic shifts. Over the last day, statistics show that over $402 million in derivatives positions have been liquidated, of which $274.74 million were made up of long plays. Traders are advised to track both crypto-specific metrics and macroeconomic indicators for clarity as the week continues.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。