Original Author: BitMEX

Welcome to our periodic options Alpha series!

Bitcoin has just experienced a significant drop, falling by 10%. Your portfolio is in the red, and you might be wondering, "What should I do next? Panic, double down, or act smartly?"

Options strategies can help manage risk, capitalize on potential rebounds, or generate income. Here are five effective strategies for post-sell-off scenarios, complete with examples, profit and loss analysis, and situational guidance.

(As of the writing of this article, February 26, 2025, 13:06 Hong Kong time, the price of BTC is $88,584.)

1. If you are worried that Bitcoin will continue to fall in March… Action: Buy protective put options (your insurance strategy)

Assume the Bitcoin you hold is priced at $89,000, but you are losing sleep over the possibility of Bitcoin dropping to $75,000 in March. Don’t just sit and wait—hedge yourself! Buy a put option to lock in a floor price.

Example:

● Bitcoin price: $89,000

● Buy an $85,000 put option (expiration date: March 28), with a premium of $3,000.

Why it works:

If Bitcoin plummets to $75,000:

● Your put option pays $10,000 ($85,000 - $75,000).

● After deducting the $3,000 premium, you net $7,000. This money can be used to buy more Bitcoin at a very low price or to offset your portfolio losses.

If Bitcoin rises to $100,000:

● You only lose the $3,000 premium, but your spot position skyrockets. For peace of mind, this small price is worth it.

The worst-case scenario is: If Bitcoin hovers around $89,000 or only rises slightly, the put option will expire worthless, resulting in a loss of the $3,000 premium, but your Bitcoin holdings may have appreciated. For protection and peace of mind, this cost is worth paying.

Summary: This is designed for investors who lean bullish but are concerned about further market declines. You don’t want to sell your Bitcoin, but you need downside protection. Think of it as paying an insurance premium to ensure a good night’s sleep.

2. If you think Bitcoin will remain stable in the coming weeks… Action: Sell covered call options (monetize boredom)

Assume you are stuck with Bitcoin at $89,000 but don’t expect a big move in the short term. Why not let the market pay you while you wait? Sell call options to earn premium income.

Example:

● Bitcoin price: $89,000

● Sell a $95,000 call option (expiration date: March 28), with a premium of $2,600.

Why it works:

If Bitcoin remains at $89,000:

● You earn $2,600. That’s a 3% return for doing nothing over 30 days.

If Bitcoin rises to $100,000:

● You still profit:

○ Sell at $95,000 (gain of $6,000)

○ Keep the $2,600 premium

○ Total profit of +$8,600.

The worst-case scenario is: Missing out on gains above $95,000. But honestly, after experiencing a sell-off, do you really expect a 20% rise in 30 days?

Summary: This is the "I’m willing to collect some free money" strategy. If you are slightly bullish on Bitcoin or just want to reduce costs while holding, this is a perfect choice.

3. If you think Bitcoin will rebound (but not too crazily)… Action: Bull call spread (cheaply participate in the rebound)

You believe Bitcoin has been oversold and expect a 10-20% rebound, but you don’t want to take too much risk by buying call options. Then, a bull call spread is a budget-friendly option.

Example:

● Buy an $85,000 call option for $7,200 (expiration date: March 28).

● Sell a $90,000 call option for $4,000 (expiration date: March 28).

● Net cost: $3,200.

Why it works:

If Bitcoin rises to $90,000:

● Maximum profit is $1,800 ($5,000 spread - $3,200 cost). That’s over 50% return!

If Bitcoin stays below $85,000:

● You lose $3,200. But that’s much less than buying a naked option for $7,200.

The breakeven point is $88,200—an increase of 4.8%.

Summary: This strategy is designed for cautious optimists. You don’t expect Bitcoin to skyrocket, just a small rebound. Lower risk means better sleep.

4. If you are completely uncertain about Bitcoin's direction (but expect significant volatility)… Action: Long straddle (profit from chaos)

After a sell-off, Bitcoin could either rebound sharply or continue to fall. If you are ready to bet on volatility, buying both call and put options simultaneously is an option.

Example:

● Bitcoin price: $89,000

● Buy an $88,000 call option and an $88,000 put option (expiration date: March 28), total cost of $9,000.

Why it works:

If Bitcoin skyrockets to $100,000:

● The call option profits $11,000, netting $2,000 after deducting the $9,000 premium.

If Bitcoin drops to $70,000:

● The put option profits $19,000, netting $10,000 after deducting the $9,000 premium.

Breakeven point: Bitcoin needs to move more than 10%. This is very likely after a sell-off.

Summary: This is the "I don’t care about direction, just volatility" strategy. Is the risk high? Yes. Is the potential reward high? Absolutely—if you guess right.

5. If you think this sell-off is an overreaction… Action: Sell put spreads (bet on stability)

You believe panic has led to this sell-off and that Bitcoin will stabilize or rebound. Sell put spreads to earn premium income while clearly defining your risk.

Example:

● Sell an $85,000 put option, premium of $2,500 (expiration date: March 28).

● Buy an $80,000 put option, premium of $1,500 (expiration date: March 28).

● Net income: $1,000.

Why it works:

If Bitcoin stays above $85,000:

● You keep the $1,000 premium. That’s a 100% return.

If Bitcoin drops to $80,000:

● You lose $5,000 ($85,000 - $80,000), but you keep the $1,000 premium, so your maximum loss is $4,000.

Summary:

This is the "smart contrarian investor" strategy. You earn premium income by betting that the panic is temporary. Just be prepared with cash in case you are forced to buy Bitcoin at $85,000.

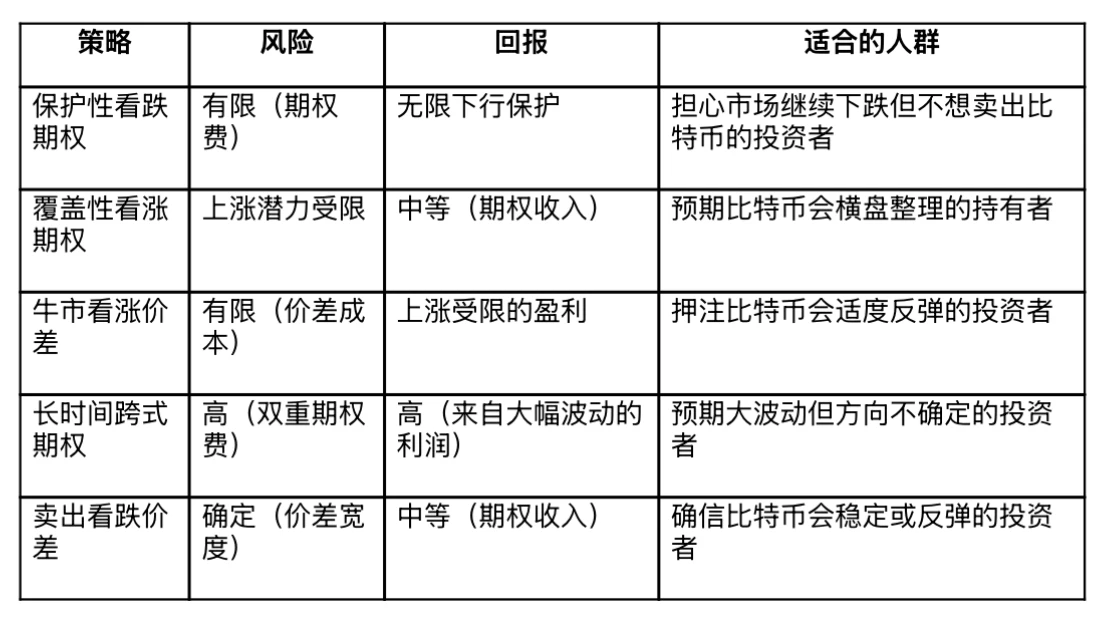

Summary: Overview of Options Strategies After Bitcoin Sell-Off

After Bitcoin experiences a major sell-off, your trading decisions should align with your expectations for future market movements. Here’s a quick summary of the options strategies we mentioned, including their risk/reward profiles and applicable scenarios:

Final Summary:

After a sell-off, emotions run high, but smart traders can turn uncertainty into opportunity. The key is to assess your risk tolerance, market outlook, and time frame, then choose the appropriate options strategy. Here’s how to think:

● If you are worried about another drop, buy protective put options.

● If you think Bitcoin will trade sideways, sell covered call options.

● If you expect a rebound, choose a bull call spread.

● If you anticipate significant volatility, choose a long straddle.

● If you think the market is overreacting, choose to sell put spreads.

No strategy is foolproof, so always manage your risk and position size. If uncertain, start small, hedge well, and let the market validate your judgment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。