Bitcoin Drops Below $90,000, Triggers $200 Million in Liquidations

QCP Insights’ latest report analyzed the effect of bitcoin dipping below $90,000 for the first time in a month and triggering over $200 million in liquidations within hours. The move comes amid broader market uncertainty following President Trump’s decision to proceed with tariffs on Canada and Mexico while restricting Chinese investment.

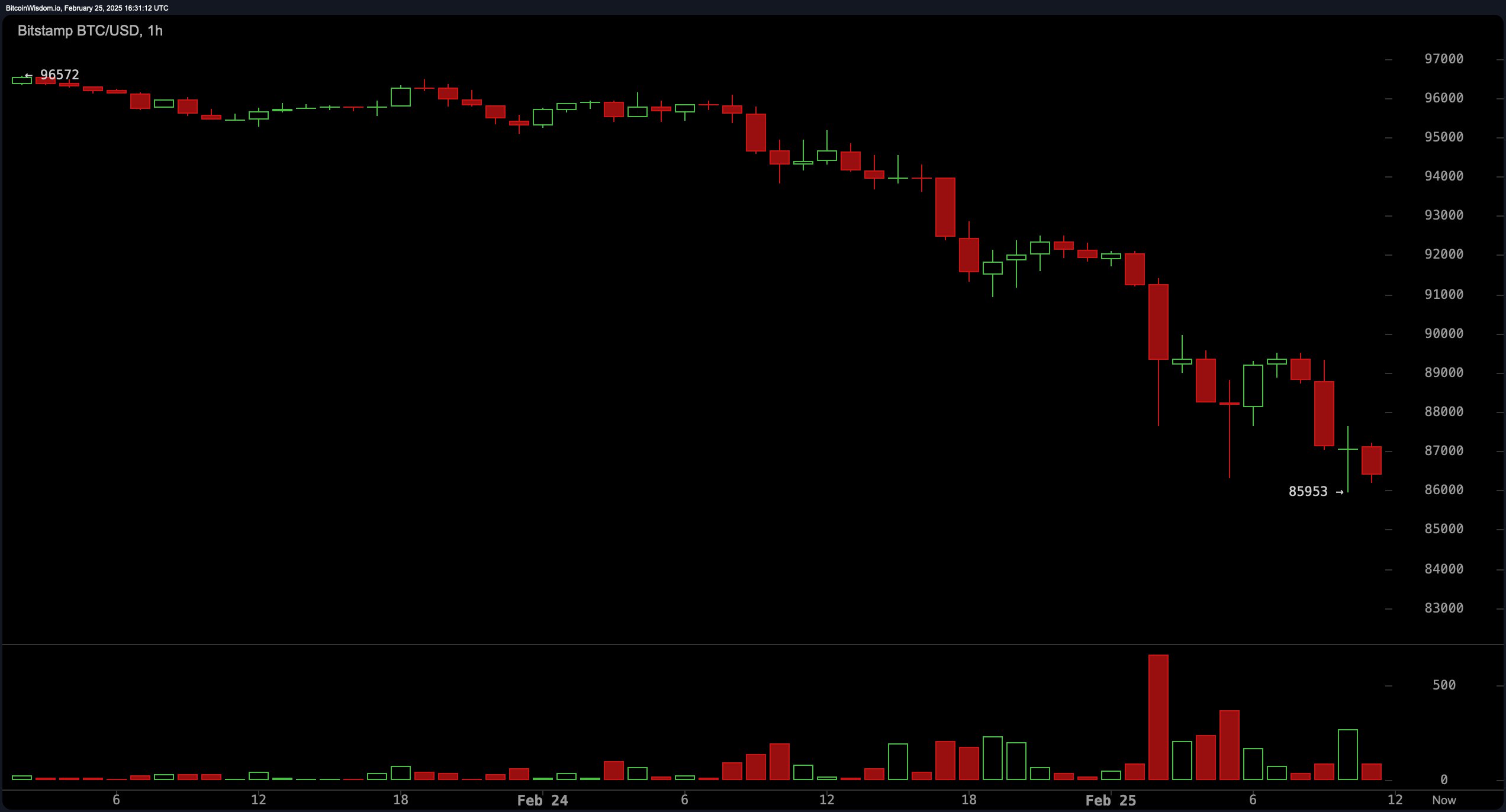

BTC/USD on Feb. 25, 2025.

Despite BTC’s decline, implied volatility (IV) remains relatively stable, with 1-month IV hovering around 50%. Meanwhile, altcoins continue to struggle as BTC dominance rises, suggesting that new capital inflows are concentrated in bitcoin while altcoin bulls may be fully positioned.

Zooming out, traditional markets like equities, fixed income, and gold have largely brushed off macroeconomic concerns, while BTC remains flat, highlighting a potential decoupling from broader risk assets.

Another concern is institutional BTC demand, which has been fueled largely by corporate issuances from firms like Strategy. As Bitcoin hovers near critical support levels, market participants are watching closely to see if institutional buyers step in or if BTC faces further downside pressure.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。