Schiff, whose disdain for bitcoin is well-documented, framed the moment as a poetic rebuttal to its proponents, blending dry wit with economic forewarning as markets absorbed the shift. The economist remains dubious toward bitcoin, deeming it a speculative venture devoid of inherent worth—a stance eclipsed only by his universally recognized advocacy for gold, which he champions as a superior bastion of enduring value.

This perspective has endured as a hallmark of his financial philosophy. Day after day, his X feed amplifies this conviction through a perpetual stream of cautionary insights into macroeconomic pitfalls and speculative hazards to shun bitcoin investments entirely.

“Today, [Saylor] bragged about his leveraged bitcoin buys generating a BTC yield of 6.9% so far in 2025. However, the share price of MSTR is down 6% in 2025, while massive dilution has destroyed shareholder value, causing the premium to its bitcoin holdings to collapse by 85%,” Schiff wrote on X.

In another X post, Schiff said:

Gold closed at yet another record high today, above $2,954. [Gold] also closed at a record high, up 11% YTD. In contrast, ETFs that invest in fool’s gold, aka bitcoin, are down 3.5% YTD. Instead of 2025 beginning a golden age for bitcoin, it looks like it will just be a golden age.

Beyond bitcoin, Schiff has trained his rhetorical sights on Strategy (formally Microstrategy). Schiff explained earlier in the day that Strategy’s shares have tumbled since cresting their November price peak. He claimed the firm’s $33 billion bet on bitcoin now carries an elevated per-unit outlay of $66,400, while gold—its gilded rival—has glittered 9% brighter.

Should bitcoin’s valuation breach this precarious cost threshold, and Strategy’s equity persist at a depressed multiple relative to its crypto cache, the company risks plunging into an existential “death spiral,” Schiff stated. While further adding, “The more bitcoin ‘succeeds’ the more damage it does to the U.S. economy. So the sooner it fails the less damage it will do.”

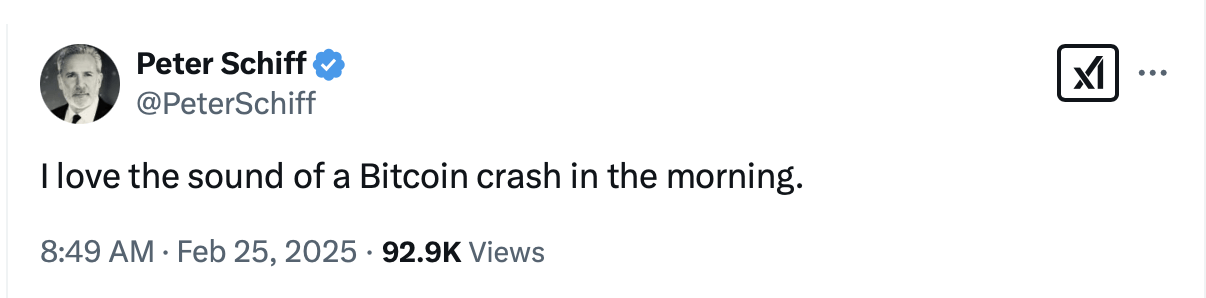

After BTC broke below the $90,000 zone on Tuesday during the early morning trading sessions, Schiff remarked:

When MSTR trades at a discount to its bitcoin holdings, in theory [Saylor] could sell bitcoin and buy back shares to close the discount. But since doing so would crash bitcoin and the MSTR share price, he won’t. So the discount will keep widening until bankruptcy forces the sale.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。