Investor sentiment in the crypto market continued to nosedive with both bitcoin and ether exchange-traded funds (ETFs) experiencing significant outflows on Monday, Feb. 24. According to data from Sosovalue, bitcoin ETFs saw a substantial net outflow of $516.41 million, while ether ETFs recorded a net outflow of $78.09 million.

Fidelity’s FBTC bore the brunt of the bitcoin ETF withdrawals, with an outflow of $246.96 million. Blackrock’s IBIT followed closely, losing $158.59 million. Other notable outflows included Grayscale’s GBTC and BTC funds, which saw reductions of $59.5 million and $6.25 million, respectively.

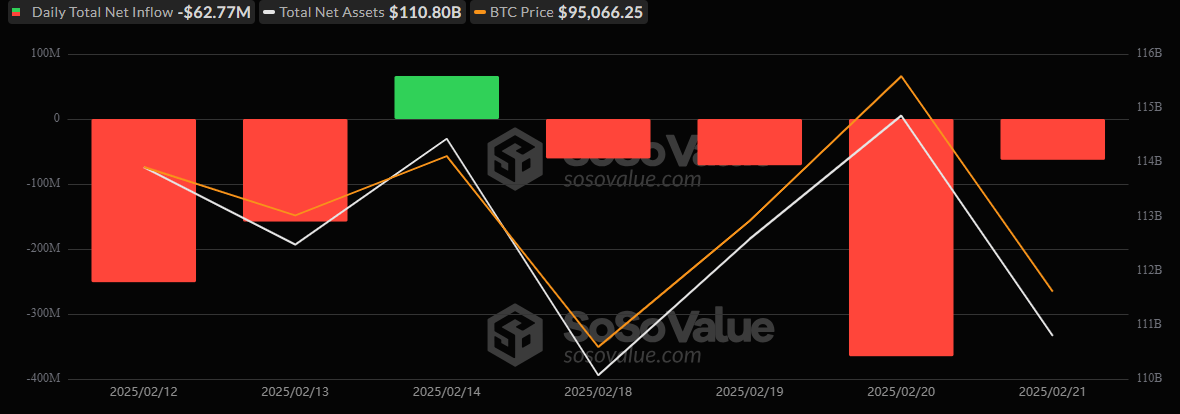

Bitcoin ETF Daily Inflow/Outflow

Invesco’s BTCO and Wisdomtree’s BTCW weren’t spared either, experiencing outflows of $15.02 million and $12.5 million, respectively. Bitwise’s BITB and Vaneck’s HODL also faced withdrawals, shedding $10.26 million and $7.33 million.

Ether ETFs mirrored this trend, albeit on a smaller scale. Blackrock’s ETHA led the outflows with $48.21 million, while Grayscale’s ETHE saw a reduction of $15.45 million. Bitwise’s ETHW and Grayscale’s ETH funds also experienced outflows, losing $9.71 million and $4.73 million, respectively.

The net outflows saw total net assets for bitcoin ETFs dip below $110 billion, standing at $109.26 billion. Similarly, total net assets for ether ETFs stood at $9.94 billion.

These significant outflows suggest a major negative shift in investor confidence, possibly influenced by more market volatility and President Trump‘s definitive stance on the enforcement of tariffs.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。