The crypto market’s total capitalization fell by more than $100 billion as bitcoin slid below $90,000 to $86,314, marking one of the sharpest single-day declines in 2025. Analysts linked the crash to Trump’s tariffs—a 25% levy on imports from Canada and Mexico and a 10% tariff on Chinese goods—announced earlier in February. The measures sparked fears of inflation and reduced risk appetite among investors, accelerating sell-offs in volatile assets like bitcoin and alternative digital assets.

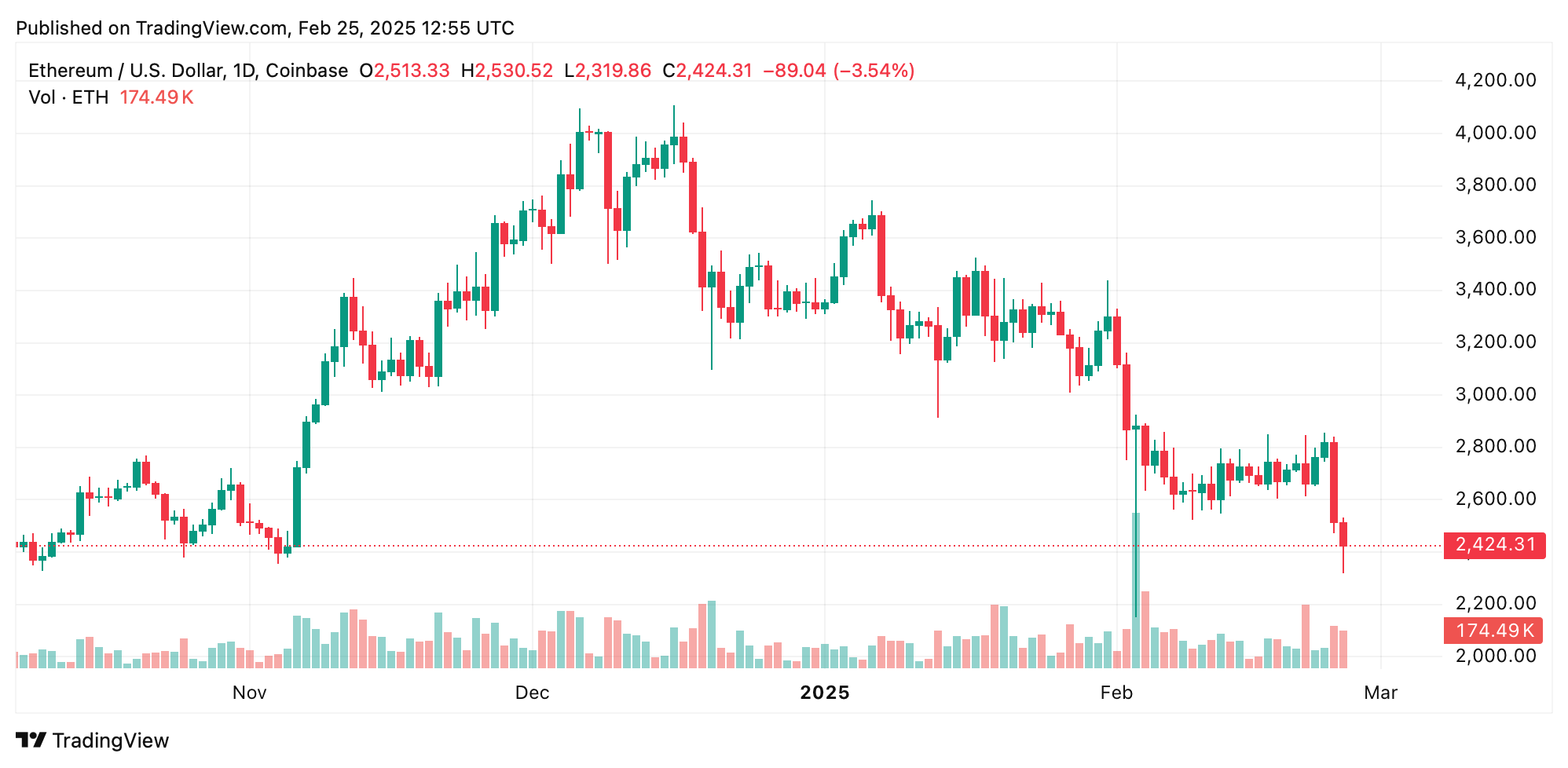

ETH/USD

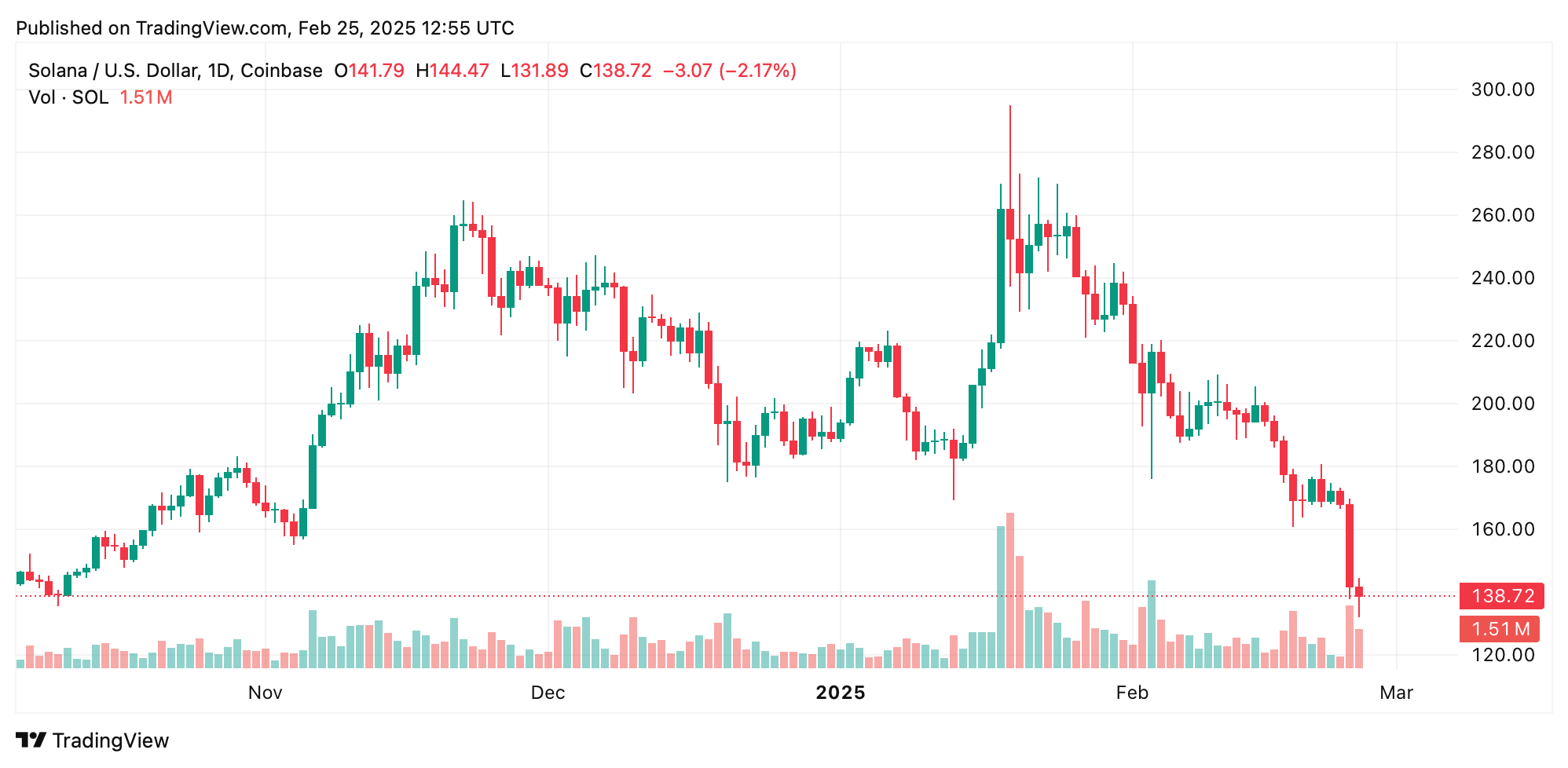

Altcoins, known for their speculative appeal, experienced steeper drops than bitcoin. Ethereum, the second-largest cryptocurrency, fell an estimated 9.7%, struggling to hold key price levels. Solana dropped 12%, with meme coin trading exacerbating its decline. Lower-market-cap assets like cardano and XRP saw losses of 10-15% and 7-10%, respectively, as pressure compounded. The meme coin sector has shed 15% against the U.S. dollar over the last day.

SOL/USD

Many believe the U.S. tariffs will disrupt global trade dynamics, raising costs for businesses and consumers. This uncertainty has prompted investors to flee riskier holdings, including crypto assets and crypto stocks, which historically face sharper corrections during downturns. Analysts noted the crash mirrored past reactions to geopolitical shocks, underscoring crypto’s growing sensitivity to macroeconomic shifts.

“Cryptocurrency markets were in freefall Monday into Tuesday, with a quarter of a trillion dollars wiped out as bitcoin dipped under $90,000 for the first time since last November,” Neil Roarty, a cryptocurrency analyst at Clickout Media told our newsdesk. “The collapse was sparked by weak economic data out of the US, not helped by Donald Trump’s confirmation that planned tariffs on Canada and Mexico would progress as planned.”

Notably, the downturn highlighted an unexpected link between trade policies and digital assets. Cryptocurrencies, often viewed as decentralized and insulated from traditional markets, proved vulnerable to broader economic pressures. Observers cited rising U.S. Treasury yields and fiscal instability as additional factors driving the sell-off.

Overall, this week’s crypto market crash has showcased altcoins’ heightened volatility compared to bitcoin, with losses exceeding 20% in some cases during prior crises. While bitcoin retained relative stability and dominance, its decline still reflected broader market anxiety. This event at the end of February marked a pivotal moment for crypto markets, revealing their deepening ties to global economics.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。