AI Agent fatigue, celebrity tokens equating to scams, major narratives on hold.

Since the beginning of this year, the biggest feature of the cryptocurrency market has been the poor sustainability of price increases. This is not only reflected in the altcoins on exchanges but also in the significant decline faced by on-chain tokens that performed well in Q4 2024.

Here are the price changes of major AI Agent tokens in 2025:

Virtual: -79.2%

Ai16z: -85.5%

AIXBT: -68%

Griffain: -80.3%

Buzz: -72.4%

Fartcoin: -67.5%

ARC: -62%

Swarms: -45%

It can be observed that within less than three months, leading projects in the trending narratives have dropped by 80%. While it cannot be directly concluded that this sector is a scam, the loss of attention is an objective fact that cannot be quickly regained.

Next, let's look at the celebrity token narrative, which was initiated by Trump, followed by other celebrities and even countries.

Here are the major celebrity tokens and their decline from their peak:

Trump: -77.1%

Melania: -91%

Vine: -92.7%

jailstool: -93.5%

Jellyjelly: -98%

CAR: -98.5%

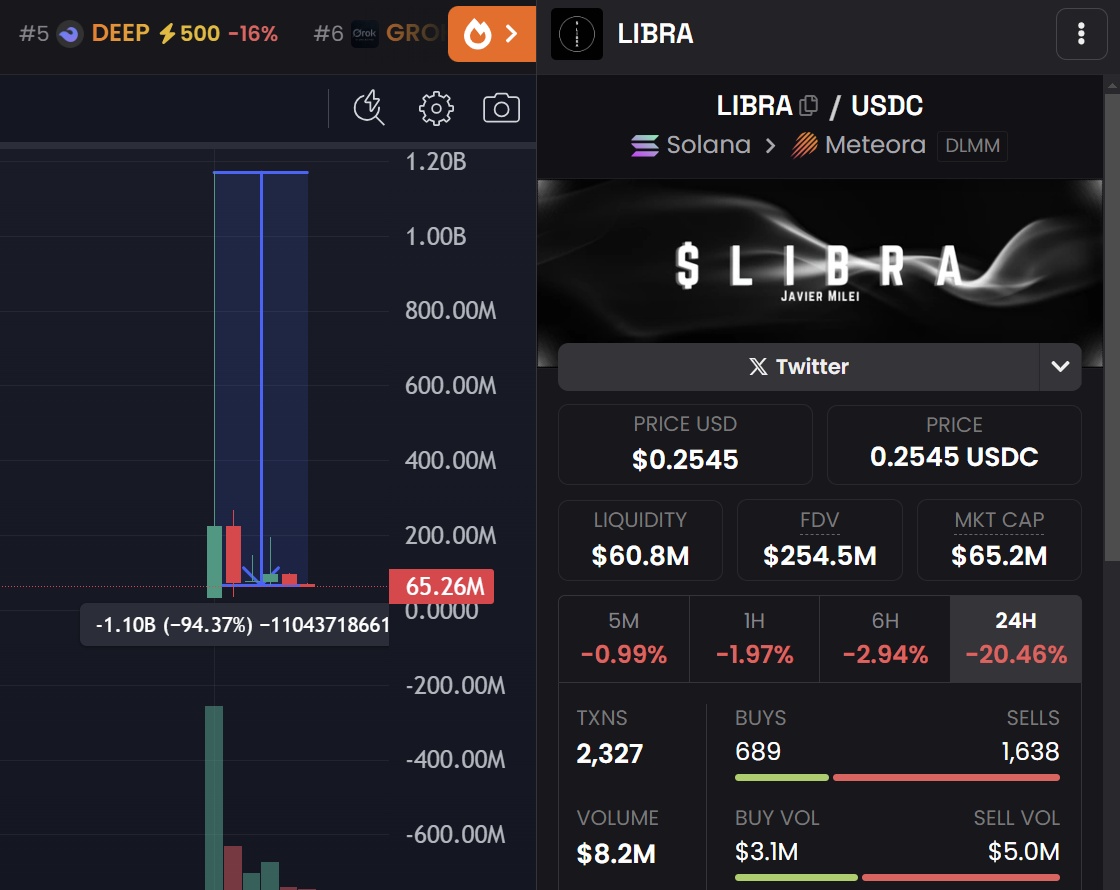

Libra: -94.3%

In the cryptocurrency world, there is a saying: "invest in new, not old," which means that funds are willing to choose newer narratives for speculation. However, compared to AI Agent, the celebrity token sector is evidently more ruthless. What are the current issues in these two sectors? In the current lack of new narratives in the cryptocurrency space, is there still a breakthrough opportunity?

Reference: dexscreener

Current Narrative Dilemma: The Trend of Pure Concept Speculation

In the AI Agent sector, many projects are still stuck in the stages of "concept demonstration" and "future blueprint," lacking practical, scalable products. Even if some operational services are launched in the market, issues such as complex interfaces and poor user experience remain, preventing ordinary investors from developing real engagement. Worse still, project teams often exaggerate narratives to boost prices in order to meet investors' expectations of "AI + blockchain," while the actual application continues to be delayed. Over time, funds lose patience, and attention begins to shift, leading to a significant drop in the prices of related tokens.

In the case of celebrity tokens, although Trump was a highly talked-about start, the issue becomes quite clear when the cryptocurrency market encounters the "celebrity end effect": there may never be another public figure who can surpass Trump in terms of topic and influence. Subsequent attempts by political leaders, internet celebrities, and stars from various countries to follow suit have failed to replicate the initial funding enthusiasm and market sentiment. As market follow-through weakens, the celebrity token sector exhibits a "flash in the pan" phenomenon, with investor confidence rapidly eroding and prices naturally declining.

However, the reason these sectors experience significant volatility lies in a deeper issue: many projects remain at the "concept speculation" level, lacking real and sustainable revenue models. Whether it is AI Agent or celebrity tokens, their core narratives rely on rapid capital and hype entry, but lack incentives for users to participate long-term. When the hype fades, prices struggle to hold up, making it even harder to attract new funds.

Finding Real Revenue Projects

To stand out in the current narrative-weary market, the key is to find products with "real revenue" that are willing to "share with users." "Real revenue" refers not only to the speculative bubble during the listing on exchanges but also to the ability to continuously generate returns through actual business models and trading behaviors, and to provide feedback to token holders or ecosystem participants.

Among them, Hyperliquid fits this model, operating similarly to centralized exchanges, with revenue primarily coming from contract trading fees. However, Hyperliquid uses 100% of the fees to repurchase Hype tokens, and the trading fees are determined by trading volume, thus tightly binding the token price to the product.

According to data from DefiLlama, Hyperliquid handles about 45% of the total 24-hour trading volume of all Perps DEX, currently at $3.78B daily, with daily revenue around $1 million. Even in the current market downturn, it maintains extremely high activity, which is why, during the recent altcoin winter, Hype token prices remain strong.

No matter how hot the narrative is, it will eventually pass. What can endure in the cryptocurrency market are projects with product-market fit (PMF), high user engagement, and real revenue.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。