Compiled by: Jerry, ChainCatcher

Performance of Crypto Spot ETFs Last Week

US Bitcoin Spot ETF Net Outflow of $552 Million

Last week, the US Bitcoin spot ETFs experienced a net outflow for four consecutive days, totaling $552 million, with a total net asset value of $110.8 billion.

Ten ETFs were in a net outflow state last week, with outflows primarily from FBTC, ARKB, and BITB, which saw outflows of $153 million, $107 million, and $105 million, respectively.

Additionally, only VanEck HODL was in a net inflow state.

Data Source: Farside Investors

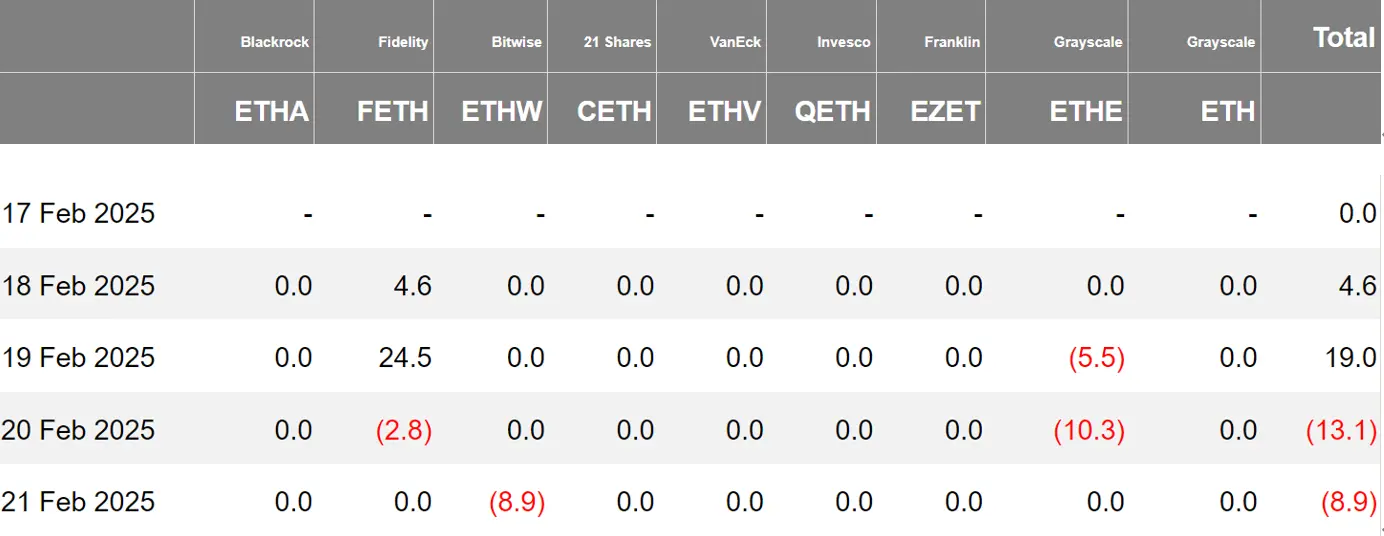

US Ethereum Spot ETF Net Inflow of $1.6 Million

Last week, the US Ethereum spot ETFs had a net outflow of $1.6 million, with a total net asset value of $9.98 billion and an average daily trading volume of $346 million.

The outflow last week primarily came from Grayscale ETHE, which had a net outflow of $15.8 million. A total of six Ethereum spot ETFs had no fund movement.

Data Source: Farside Investors

Hong Kong Bitcoin Spot ETF Net Outflow of 30.19 Bitcoins

Last week, the Hong Kong Bitcoin spot ETFs had a net outflow of 19.03 Bitcoins, with a net asset value of $421 million. The issuer, Harvest Bitcoin, increased its holdings to 357 Bitcoins, while Huaxia held 2,320 Bitcoins.

The Hong Kong Ethereum spot ETFs had a net outflow of 401 ETH, with a net asset value of $55.29 million.

Data Source: SoSoValue

Performance of Crypto Spot ETF Options

As of February 20, the nominal total trading volume of US Bitcoin spot ETF options was $577 million, with a nominal total long-short ratio of 1.88. As of February 13, the nominal total open interest of US Bitcoin spot ETF options reached $13.45 billion, with a nominal total open interest long-short ratio of 1.98. The market's short-term trading activity for Bitcoin spot ETF options has decreased, but overall sentiment remains bullish.

Additionally, the implied volatility is at 53.28%.

Data Source: SoSoValue

Overview of Crypto ETF Developments Last Week

Canary Litecoin Spot ETF Listed on DTCC Website, Code LTCC

According to the DTCC website, the Canary Litecoin spot ETF has been listed with the code LTCC, and the creation/redemption section shows D. Although this does not indicate that the ETF has received any regulatory approval or any explicit approval process results, listing on the DTCC website is a "standard procedure" for launching new ETFs.

US SEC Confirms Receipt of Bitwise's Spot XRP ETF Application

The US Securities and Exchange Commission (SEC) confirmed on Tuesday that the Cboe BZX Exchange, a subsidiary of the Chicago Board Options Exchange, submitted an application for the listing and trading of Bitwise's XRP spot ETF. In a document confirming the proposal, the SEC requested comments to be submitted within 21 days from the date of publication in the Federal Register. After that, the agency may decide to approve, disapprove, or "initiate proceedings."

The 19b-4 filing is the second step in the two-step process for proposing a crypto ETF to the SEC. Once confirmed, the document will be published in the Federal Register, thereby initiating the SEC's approval process. The SEC has previously confirmed the XRP spot ETF applications submitted by 21Shares and Grayscale but has not yet confirmed the applications from Canary Capital and WisdomTree.

According to Bloomberg ETF analysts James Seyffart and Eric Balchunas, the likelihood of an XRP-based ETF being approved is 65%.

SEC Seeks Public Comments on Approving Grayscale and Bitwise Ethereum ETF Options Trading

The SEC is seeking public comments on the approval of options trading for Grayscale and Bitwise Ethereum ETFs. In a document submitted on Tuesday, the SEC accepted the application from the Chicago Board Options Exchange regarding options trading for the Grayscale Ethereum Trust ETF, Grayscale Ethereum Mini Trust ETF, and Bitwise Ethereum ETF.

The SEC requested relevant comments to be submitted within 21 days after publication in the Federal Register. The agency may decide to approve, deny, or "initiate further review procedures."

Hashdex Approved to Launch the World's First XRP Spot ETF in Brazil

The Brazilian Securities Commission (CVM) has approved Hashdex to launch the world's first XRP-based spot ETF—HASHDEX NASDAQ XRP INDEX FUND.

Currently, the ETF is in the pre-operational phase, managed by Genial Investimentos, with the official listing date yet to be announced.

Grayscale's Spot XRP ETF Officially Submitted to the Federal Register, Resolution Deadline October 18

Grayscale's Spot XRP ETF (19b-4 application) has been officially submitted to the Federal Register, meaning that the SEC will begin its review and must decide whether to approve or deny the application by October 18.

The 19b-4 application is the formal document submitted by Grayscale to the SEC to apply for the launch of an XRP-based exchange-traded fund (ETF). This document has been officially published in the Federal Register, marking the formal start of the review process.

According to regulations, the SEC must make a decision by October 18. During this period, the SEC may communicate with Grayscale to request additional information or clarify related issues.

Franklin Templeton Submits S-1 Filing for Spot Solana ETF to the US SEC

XRP ETF and Solana ETF Applications Officially Recorded in the US SEC Federal Register, Awaiting Further Approval

Australian ETF Operator BetaShares Launches BTC ETF

US Exchange MEMX Applies to SEC for Approval of Its 21Shares XRP ETF Listing

US SEC Confirms Receipt of 21Shares Proposal for Staking Ethereum ETF

US SEC Seeks Public Comments on WisdomTree XRP ETF Proposal

Market News: US SEC Confirms COINSHARES SPOT XRP ETF Application Has Been Submitted

US SEC Confirms Receipt of CoinShares' Litecoin Spot ETF Application

Views and Analysis on Crypto ETFs

According to Bloomberg ETF analyst Eric Balchunas, while the listing of the LTC ETF on DTCC does not mean that the product has been approved or is about to start trading, it shows that the issuer is preparing for trading after future approval, and the current probability of approval remains at 90%.

Bloomberg Analyst: PlanB Moving Bitcoin to ETF Demonstrates the Convenience It Offers

Bloomberg senior ETF analyst Eric Balchunas commented on X platform about "PlanB moving Bitcoin to ETF," stating: "If this news is true, then as a major influencer with 2 million followers, PlanB's actions are enough to demonstrate how powerful the convenience offered by exchange-traded funds is, and there is no need to worry about being robbed at gunpoint. On the other hand, it is understandable that those who want to control and hold their keys indeed want to control their keys themselves."

The president of The ETF Store, Nate Geraci, stated on social media that the fund giant Charles Schwab has established a digital asset chief position and is expected to offer crypto spot trading services. The company is currently one of the largest brokerage firms in the US.

According to Bloomberg senior ETF analyst Eric Balchunas, the asset holding ratio of 13F reporting institutions in most Bitcoin ETFs has reached 25-30%, and it is expected to ultimately reach a level similar to that of gold ETFs (GLD) at 40%, indicating that there is still 10-15% growth potential.

Luca Sorlini, the product head of virtual asset service provider Northstake, stated that he believes once the XRP ETF is approved, the reasonable range for inflows in the first week will be between $400 million and $800 million.

Luca Sorlini added that his prediction will depend on various factors, including overall market conditions, the number of competing ETFs that may launch simultaneously if approved, and, more importantly, institutional interest in this issuance.

However, Bloomberg senior ETF analysts James Seyffart and Eric Balchunas currently believe that the likelihood of the XRP ETF being approved is 65%. This is because the classification of the token as a security or a commodity remains an unresolved issue.

Crypto analyst Miles Deutscher pointed out that since the election frenzy, the inflow rate into Bitcoin and Ethereum ETFs has significantly slowed. As the market is forward-looking, most ETF buyers have already positioned themselves in anticipation of the favorable factors that may arise from Trump's potential return to office. With this demand being pre-absorbed, the market is now waiting for the next catalyst that could drive prices up.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。