Franklin Templeton filed for an exchange-traded fund on Friday.

The fund will hold Solana as its primary asset, stored securely by Coinbase Custody Trust Company. It will also have a separate custodian for cash holdings.

The ETF’s shares, which represent fractional ownership of its Solana holdings, will be continuously issued and redeemed in large blocks known as Creation Units. These transactions will involve either Solana, cash, or a combination of both.

HOT Stories Samson Mow Insists on Ethereum Rollback After Bybit's $1.4 Billion ETH Hack Bybit CEO Calls Latest Crypto Hack 'Worst in History,' Announces Next Steps Bitcoin (BTC) Surges to $100,000: 3 Key Levels Next, Will XRP Follow Bullish Wave? Dogecoin (DOGE) in Very Difficult Position Ripple CEO Reacts to SEC's Surprising Decision

A key feature of the fund is its potential to stake a portion of its Solana holdings. By doing so, it can earn additional Solana tokens as staking rewards, which may be treated as income for the fund. However, the fund will not claim or hold assets received from blockchain forks or airdrops.

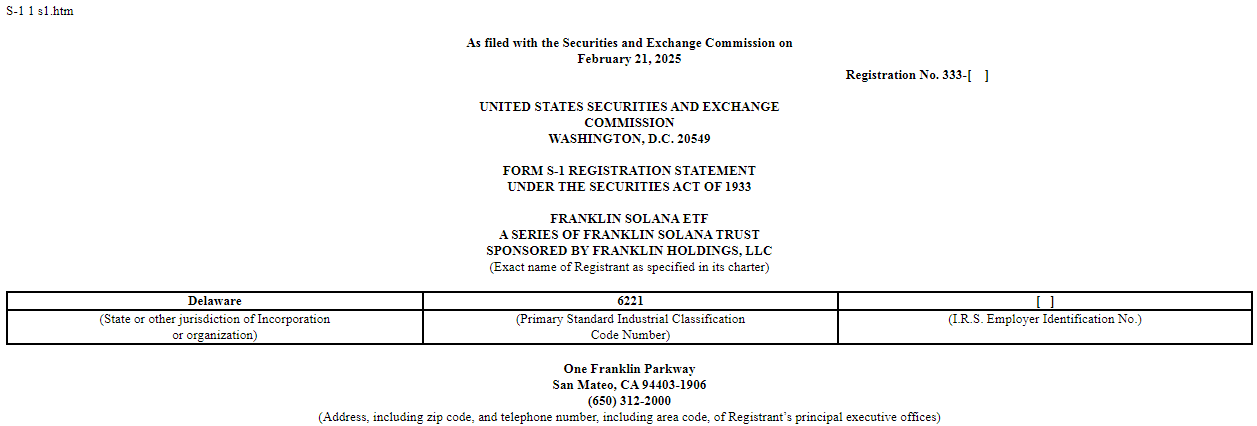

Source: SEC

Shares of the Franklin Solana ETF will be listed on the Cboe BZX Exchange under a yet-to-be-announced ticker symbol. While the fund’s net asset value (NAV) is based on the Solana price, market prices for the shares may fluctuate depending on supply and demand.

Only institutional investors, known as Authorized Participants, will be able to directly buy or redeem Creation Units. However, retail investors can purchase shares through the exchange, similar to traditional stocks or ETFs.

Franklin Templeton’s move follows the broader trend of crypto ETFs gaining traction in traditional finance. With Solana’s growing presence in the blockchain ecosystem, this ETF could provide investors with an easier way to gain exposure to the digital asset while benefiting from the security and liquidity of a regulated exchange.

Related

Tue, 02/11/2025 - 18:27 SEC Acknowledges Solana ETF Filing

Alex Dovbnya

Earlier in February, the SEC acknowledged a recent Solana ETF application proposed by Canary Capital.

As reported by U.Today, VanEck was the first to propose a Solana ETF back in June. Since then, several other issuers have followed suit.

The regulator is also on track to complete the approval of several spot Ethereum ETFs, including the one from VanEck. Earlier this month, VanEck CEO Jan van Eck opined that this marked a historic shift.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。