Written by: Jimmy

Summary: Bitcoin Thunderbolt, like Bitcoin Lightning, was created to solve the confirmation acceleration problem of the Bitcoin network. The difference is that Bitcoin Lightning does not support programming, only payments, and has high setup costs, while Bitcoin Thunderbolt, as planned by Nubit, supports programming and more Turing-complete complex operations, improving liquidity issues and compensating for the lack of deployment capabilities in DeFi applications, enabling a true "super evolution" of Bitcoin.

The story of Bitcoin is always about time.

Time has made it indestructible, and time has allowed it to grow under extreme conditions.

Its security is built on time: 10 minutes per block, a stable supply of 21,000,000, longest chain consensus…

Its challenges also come from time: a throughput of 7 transactions per second, which is even less than an Ethereum L2.

If Bitcoin wants to become a true global currency and global computing network, it must become faster, stronger, and more scalable—yet the fundamental security of Bitcoin does not allow it to change the underlying rules at will.

Undoubtedly, Bitcoin is the world's most secure decentralized financial network, but at the same time, it has also become one of the "slowest" public chains.

Bitcoin is secure enough, but not fast enough.

Bitcoin is reliable enough, but not flexible enough.

In this dilemma, the Bitcoin community has embarked on a difficult path of technological evolution.

Lightning Network: An Unfinished Dream

How to accelerate Bitcoin?

This question has been attempted to be answered by the Bitcoin community for the past decade.

As early as 2015, Bitcoin's first "acceleration plan" was born. It was called the Bitcoin Lightning Network.

At that time, the debate over Bitcoin's scalability had already begun to emerge. The SegWit soft fork had not yet been proposed, and on-chain scaling solutions and sidechain solutions were fiercely competing. The community was embroiled in disputes over block size, transaction throughput, and other issues, trying to find a way for Bitcoin to be as convenient as credit card payments without compromising its decentralized nature.

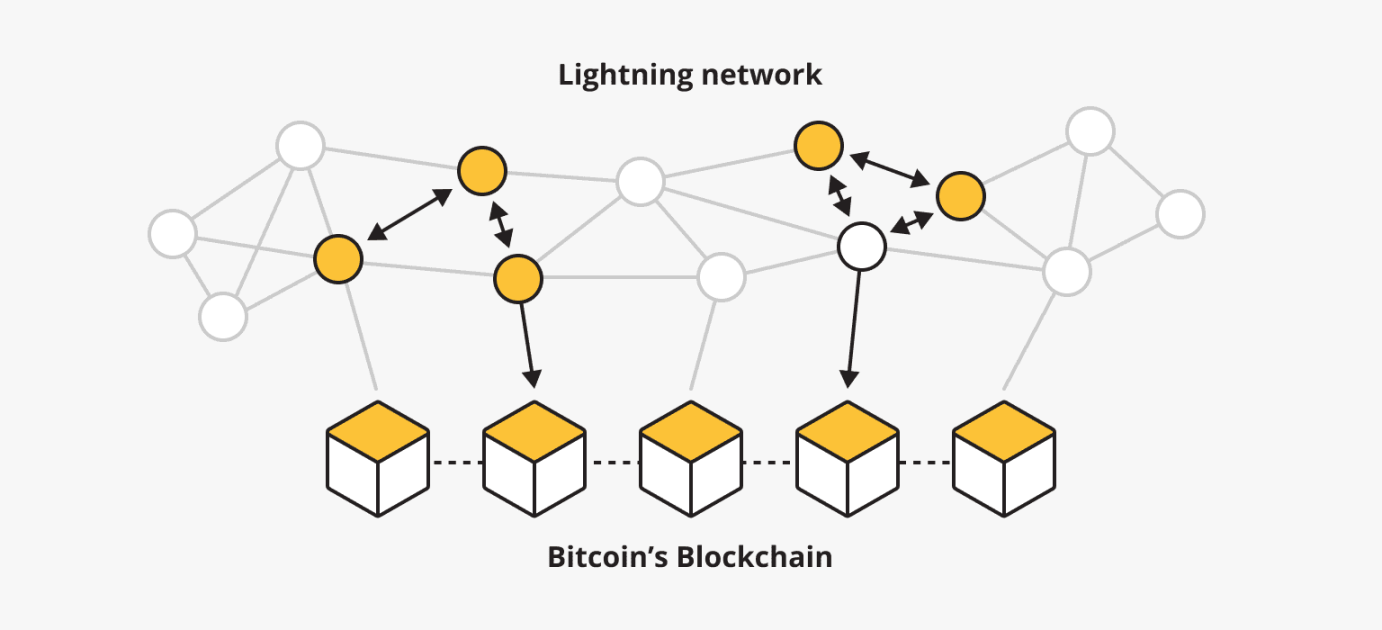

In February 2015, Joseph Poon and Thaddeus Dryja proposed the concept of the Lightning Network in a paper, hoping to make Bitcoin transactions faster and cheaper through State Channels.

The idea behind the Lightning Network is: if all transactions are submitted to the Bitcoin mainnet, the efficiency will definitely lag behind, so why not keep small transactions off-chain and only write them to the blockchain at final settlement?

This idea has indeed worked. To date, the Lightning Network has been adopted by multiple Bitcoin wallets and payment service providers globally, becoming one of the important infrastructures of the Bitcoin ecosystem. But strangely, it has never truly gained widespread adoption.

It is undeniable that the Lightning Network has made Bitcoin transactions faster and cheaper. However, if we return to Bitcoin's core vision of "decentralization, verifiability, and security," it is easy to see that the Lightning Network still has several key issues that remain unresolved:

1. Liquidity Issue: It is still a "channel network."

Lightning requires users to deposit BTC in advance to open payment channels, which means users' funds are locked, and liquidity is limited. Once the BTC in the channel runs out, the transaction will fail, requiring a reroute, increasing transaction costs and uncertainty.

In other words, it is not suitable for large-scale, broader financial applications.

2. Intelligence Issue: It cannot achieve DeFi on Bitcoin.

The changes in the Bitcoin ecosystem have far exceeded the scope of payments.

From Ordinals to BRC-20, from Runes to BitVM, the asset layer of Bitcoin is undergoing constant revolution. But the Lightning Network still only supports basic payment logic and cannot run complex contracts, financial protocols, or asset transactions.

In other words, it cannot meet the needs of rich DeFi applications and products.

3. Centralization Issue: Its degree of decentralization is decreasing.

In theory, the Lightning Network is a decentralized payment network. However, in reality, most liquidity is concentrated in a few "super nodes" (large payment providers), and users often need to transact through these nodes, which undermines the concept of decentralized finance in Bitcoin and also affects security.

In simple terms, if Bitcoin is to become a true global financial infrastructure, it needs far more than just a simple payment network.

It needs an acceleration layer that can execute complex logic.

Bitcoin needs not just to be "faster," but also "smarter."

Bitcoin Thunderbolt: Bitcoin "Lightning Network"?

Ten years after the Lightning Network, an unexpected tweet may be the answer.

On February 21, 2025, Hanzhi, a CS PhD student at UCSB and co-founder of Nubit, updated a tweet on his X personal account, sparking a lot of discussion and dissemination in a short time. In the tweet, Hanzhi publicly announced a Bitcoin acceleration plan—Bitcoin Thunderbolt, the Bitcoin "Lightning Network."

From the name, Bitcoin Thunderbolt directly points to the acceleration and programmability of Bitcoin transactions, suggesting that this technical solution may fill the capabilities that the Lightning Network currently cannot achieve.

Currently, Nubit has not disclosed complete technical details, but from the information revealed so far, Bitcoin Thunderbolt may have the following core features:

1. No channels, no locked funds required.

Unlike the Lightning Network, which requires establishing payment channels, Thunderbolt may not rely on a centralized liquidity network but instead be based on a native solution of the Bitcoin mainnet.

2. Fully Bitcoin-native (100% Bitcoin-native).

All transactions and computations are built on Bitcoin, without relying on additional L2 networks or centralized indexers, fully inheriting Bitcoin's native security.

3. Smart programmability, supporting smart contracts on Bitcoin.

Thunderbolt may bring true smart contract execution capabilities to Bitcoin, compatible with BRC-20, Runes, Ordinals, and even allowing for the implementation of decentralized finance (BTCFi).

This means that Bitcoin can not only be used for payments but can also become a decentralized financial network, supporting automated asset issuance, decentralized trading, and even more complex contract execution.

If these assumptions hold true, Bitcoin Thunderbolt may not only be an "accelerator" for Bitcoin but also a "Layer 1.5"—achieving intelligence, scalability, and transaction acceleration without changing Bitcoin's underlying consensus.

This new architecture raises the question:

Could Bitcoin Thunderbolt be the key to making Bitcoin "smarter and faster"? How will it be realized?

The Values of Bitcoin: Things More Important than Speed

Returning to Bitcoin itself, what are we talking about when we talk about Bitcoin?

The Bitcoin ecosystem has always been a slow and cautious evolutionary process.

For the Bitcoin community, "speed" does not mean everything; "decentralization and security" are the core values of Bitcoin.

This is also why Bitcoin's technological evolution is much slower than Ethereum's—every upgrade must undergo strict scrutiny and consensus.

So, will Bitcoin Thunderbolt really be accepted by the Bitcoin community?

Currently, it at least possesses several characteristics that align with Bitcoin's philosophy:

Does not change Bitcoin's underlying consensus: Thunderbolt does not require a hard fork but operates based on the existing Bitcoin protocol.

Decentralized secure execution method: If BitVM is its core technology, then it will have decentralized computing capabilities rather than relying on centralized nodes.

Enhances the use of BTC as a financial asset: Through programmability, Thunderbolt may allow BTC to have richer financial application scenarios, not just as a store of value.

Whether it can gain acceptance from Bitcoin OGs may be one of the future challenges for Bitcoin Thunderbolt.

However, as the lightning strikes, the thunder follows.

After ten years of silence, today the wind sounds.

In the 16 years of Bitcoin's development, 2015 Lightning, 2017 SegWit, 2021 Taproot, 2023 BitVM, each innovation has been a confrontation between new and old factions, a fierce clash between decentralization and scalability, and intense competition among solutions.

Bitcoin Lightning has been in operation for ten years, yet has not achieved its full potential; Bitcoin Thunderbolt rises with the momentum and should be the orthodox solution.

Though the process is arduous, the gold emerges after the storm.

Will Bitcoin Thunderbolt become the next key chapter in Bitcoin's history?

Nubit co-founder Hanzhi revealed that the technical details of Bitcoin Thunderbolt will be announced at the ETH Denver conference at the end of February 2025, and BitVM founder Robin will also participate in the discussion, at which point more exciting details may be revealed.

We look forward to it.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。