Circle 在支付网络、银行牌照申请、机构合作等多个领域积极布局,同时正逐步逼近市场领头羊 Tether。

撰文:Prathik Desai, Nameet Potnis, Thejaswini M A

编译:Block unicorn

前言

尽管美国总统唐纳德·特朗普的关税政策引发市场动荡,使 Circle 的上市计划一度暂停,但其正以闪电般的速度推进其预期的 IPO。

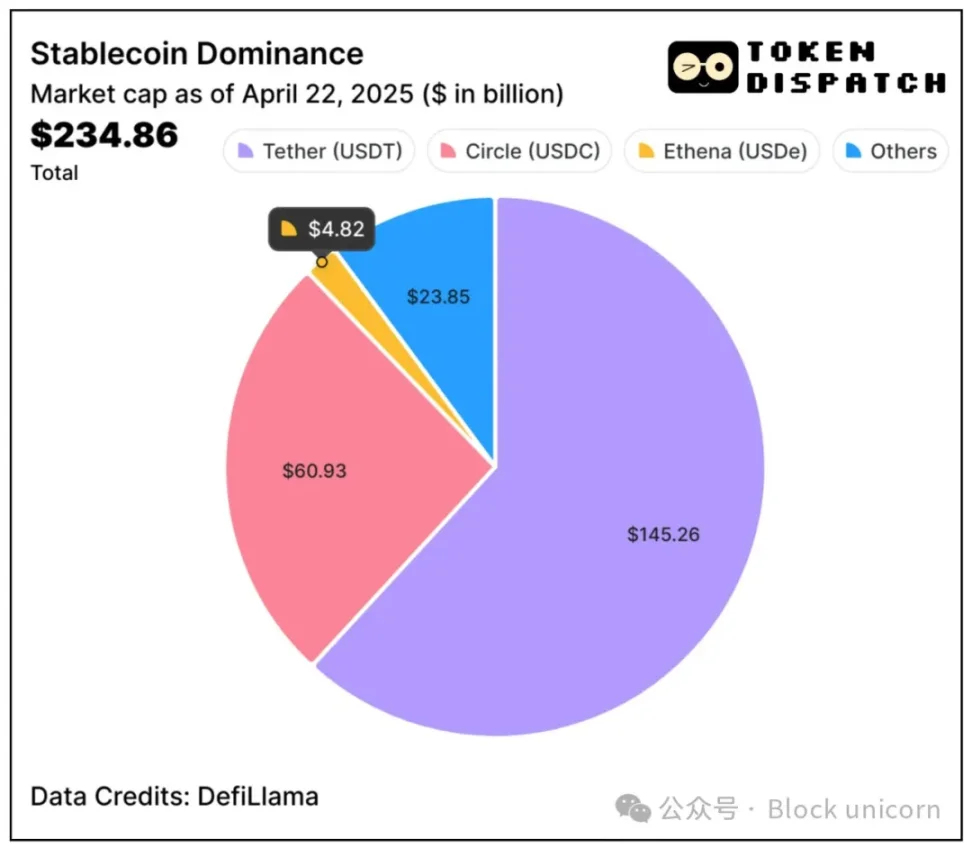

Circle 在多个领域积极布局——支付网络、银行牌照申请、机构合作,同时正逐步逼近市场领头羊 Tether。以数据为例,USDC 发行方已将其与 Tether 的市场份额差距从 50 个百分点缩小至仅 35 个百分点。

在今天的文章中,我们将探讨:

- USDC 加速增长,缩小与 Tether 的差距

- Circle 的新支付网络如何取代过时的跨境系统

- 为何 Circle 和其他加密公司突然竞相申请银行牌照

- 传统银行如何准备对稳定币的反攻

让我们先来探讨一下,除了加密货币泡沫之外,稳定币的竞争为何如此重要。

2 万亿美元的稳定币竞赛

稳定币的竞争日趋激烈。随着监管明朗化,传统金融巨头正准备采取行动,这可能会打破目前 Tether 和 Circle 占据的双寡头格局。

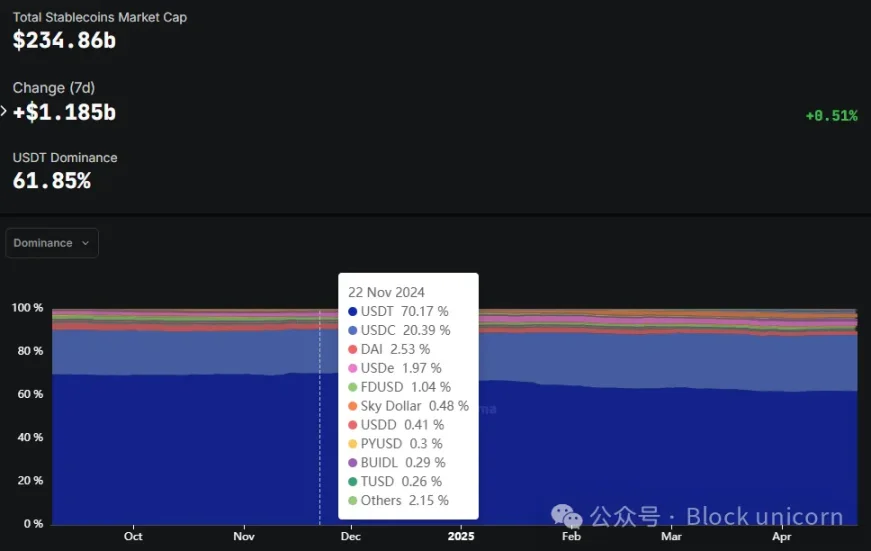

过去五个月,两大稳定币合计市场份额下降了 4 个百分点。

Fireblocks 支付高级副总裁 Ran Goldi 在接受 Coindesk 采访时表示:「我们将看到银行发行稳定币,因为它们符合 MiCA 要求。到今年底,你可能会看到 50 多种新稳定币。」

渣打银行的一份报告显示,到 2028 年底,稳定币市场规模可能飙升至惊人的 2 万亿美元,几乎是目前 2350 亿美元总供应量的十倍。

数十家银行正在私下起草稳定币计划的战略规划,预计大多数银行将在本季度末最终确定其方案。 Goldi 指出:「看看银行是自行开发,还是利用纽约梅隆银行等服务银行的平台,或者像 Fireblocks 这样的供应商,这将会很有趣。」

这一迫在眉睫的竞争威胁解释了 Circle 为何在多个领域如此急切的行动。随着传统金融机构准备入场,巩固市场地位的窗口正在迅速关闭。

稳定币竞赛升温

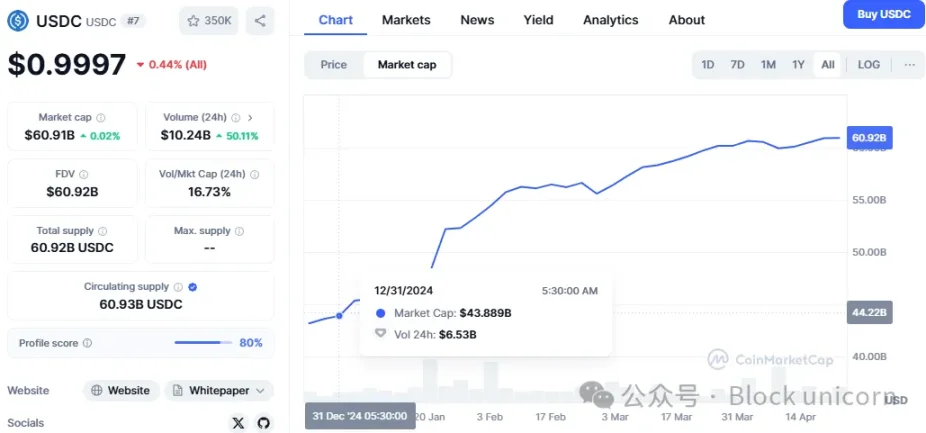

USDC 的意图和快速动作显而易见:截至 4 月 19 日,其市值攀升至超过 600 亿美元,较年初的 440 亿美元增长了 170 亿美元,增幅约 40%。

相比之下,Tether 的 USDT 同期市值仅增长 8%。尽管 Tether 以近 2.5 倍于 USDC 的市值保持主导地位,但增长差距正在迅速缩小。

USDT 的市场份额主导地位在过去五个月下降近 10 个百分点至 61.85%,而 Circle 则上升约 6 个百分点。

数据显示,两种稳定币之间的偏好差距正在扩大。受监管实体和 DeFi 协议更青睐 USDC,因为 Circle 的监管体系清晰透明。

其优势在欧洲最为明显。USDC 获得了 MiCA 的许可,使其能够覆盖 27 个欧盟国家,覆盖总人口达 4.5 亿的地区。相比之下,USDT 则没有。

监管机构并非 Tether 持续主导的唯一障碍。

Coinbase 首席执行官布莱恩·阿姆斯特朗最近表示,该交易所的新「远大目标」是取代 Tether 的 USDT,成为全球「第一美元稳定币」。

Kraken 和 Crypto.com 等其他交易所也在欧洲市场下架了 USDT。

打破银行轨道

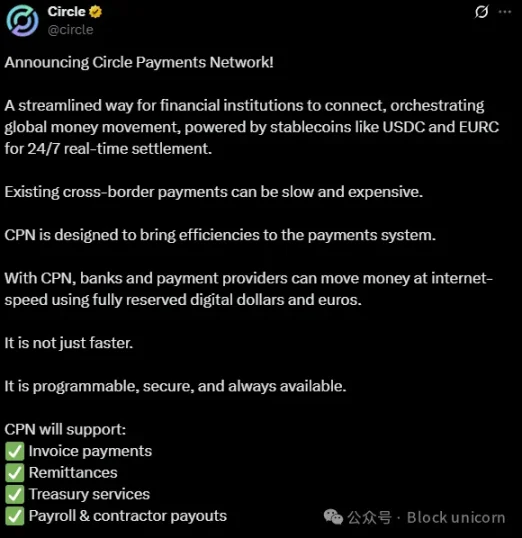

周二,Circle 推出了一款产品,旨在降低跨境资金转移的成本和延迟。Circle 支付网络 (CPN) 旨在利用稳定币作为桥梁,拆除全球金融老旧的基础设施。

Circle 在 X 上发帖称:「我们不仅仅在打造稳定币,我们还在构建全球支付的现代化基础设施。」

众所周知,国际银行结算速度缓慢、成本高昂,并且受到传统系统的限制,这些系统经常在夜间和周末关闭。Circle 的替代方案承诺使用全额储备的数字美元 (USDC) 和欧元 (EURC) 进行全天候即时转账。

Circle 已引入 20 多家设计合作伙伴,其中包括 dLocal、WorldRemit、BVNK、Yellow Card 和 Coins.ph。

这一合作伙伴阵容表明,其明确聚焦于新兴市场和高流量汇款通道的机构——传统银行业在这些领域表现尤为不足。

Circle 的网络举措有着简单而根本的理由——将稳定币发行商转变为大规模移动这些资产的关键金融基础设施提供者。

一位知情人士表示:「Circle 正在推出一个支付网络,最初目标是汇款,但最终目标是与 Mastercard 和 Visa 竞争。」

银行布局

在推出支付网络的同时,据《华尔街日报》报道,Circle 正准备跨越监管难关,申请美国银行牌照或执照。

然而,Circle 并非孤军奋战。特朗普家族稳定币 USD1 的托管机构 BitGo,以及 Coinbase 和 Paxos,也在走同样的道路。时机恰逢美国稳定币法规的不断演变,这些法规可能很快会要求稳定币发行者获得牌照。

为何现在追求银行牌照?

银行牌照将允许 Circle 像传统银行一样运营,可能包括接受存款和发放贷款。

但这也伴随着高昂的成本。据报道,加密公司 Anchorage Digital 在获得联邦牌照后花费了数百万美元以符合监管要求。

但回报可能是丰厚的——即获得美联储主账户的权限,这是 Custodia 等加密原生银行多年来未能实现的「圣杯」。这种权限将为 Circle 提供金融机构所能获得的最接近美国货币供应的渠道。

我们的观点

Circle 的多管齐下战略表明,其准备的不仅是 IPO 前的定位,而是一种深层次的尝试,旨在弥合传统金融与加密领域之间的鸿沟,这是其他稳定币发行方尚未成功跨越的。

Circle 的机构级支付网络、银行牌照雄心以及 USDC 的受监管地位,共同构筑了抵御 Tether 和即将进入的传统金融竞争者的前所未有的护城河。Circle 在多元化领域奠定坚实基础,以构建与竞争对手的显著差异化。

值得注意的是 Circle 对新兴市场和汇款通道的关注。当竞争对手在成熟的西方市场争夺主导地位时,Circle 也在悄然扩展,建设金融包容性仍难以企及的地区的基础设施。

其合作伙伴名单——dLocal(南美)、WorldRemit(非洲和亚洲汇款)、Yellow Card(非洲)、Coins.ph(菲律宾)——宛如下一代汇款市场的路线图。

相对于 Tether,MiCA 的牌照优势或许是 Circle 最被低估的资产。通过监管合规接触 4.5 亿欧洲用户,无疑是一个赢家通吃的局面。

Circle 的战略表明了他们理解一个基本事实——稳定币战争的胜利不仅取决于市场份额,还依赖于基础设施、监管定位和机构整合。

Circle 深知自己无法在短期内超越 Tether 的市值,因此它正在构建一个完全不同的领域,而 Tether 尽管规模庞大,但凭借其现有能力却无法与之竞争。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。