Tether Gold's market capitalization surpasses $700 million, benefiting from rising gold prices.

Author: OurNetwork

Translation: Shenchao TechFlow

BUIDL | Tether Gold | Franklin Templeton | Maple Finance | Superstate

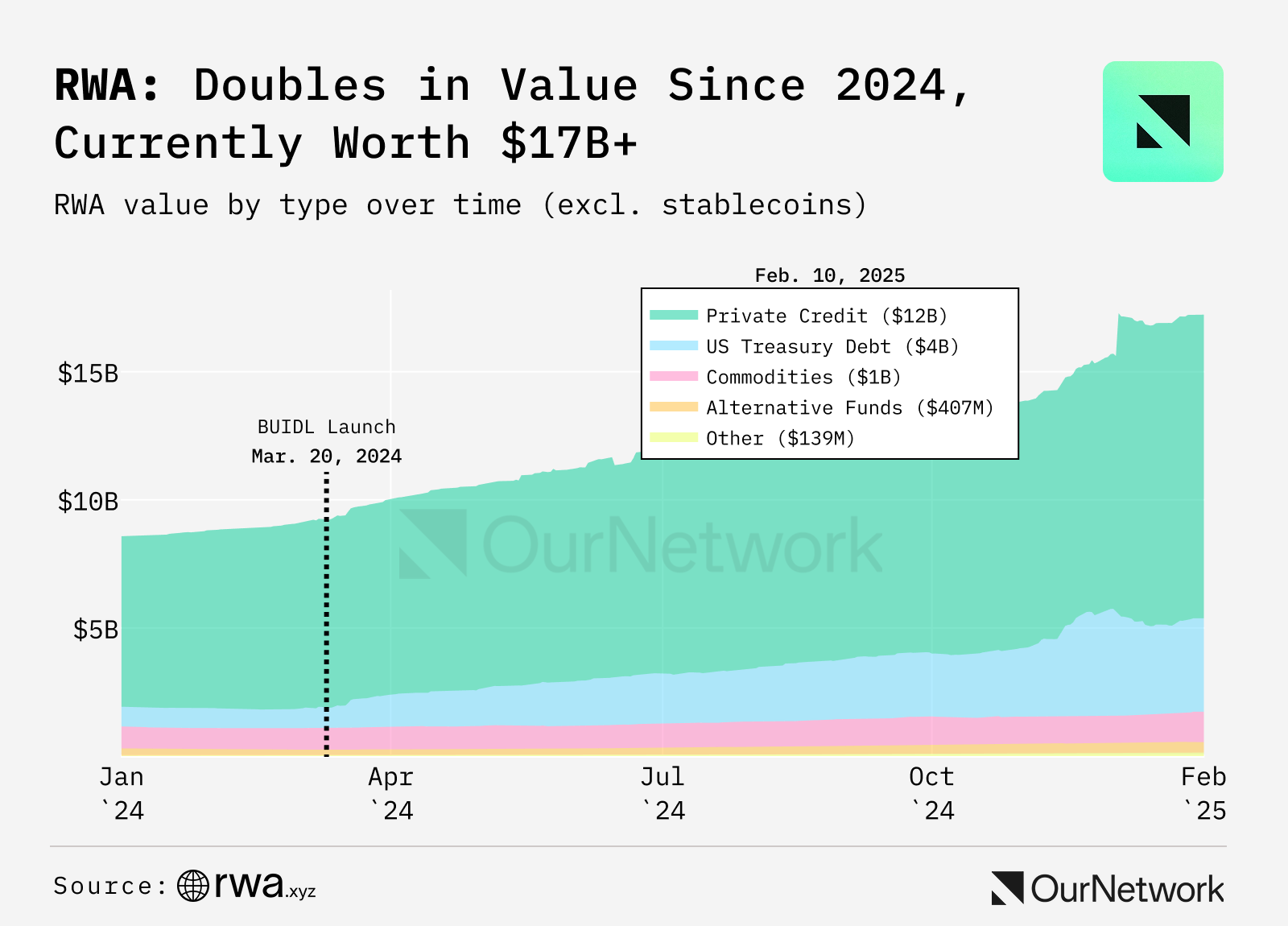

Tokenized RWAs – Excluding Stablecoins – On-chain scale surpasses $17.2 billion

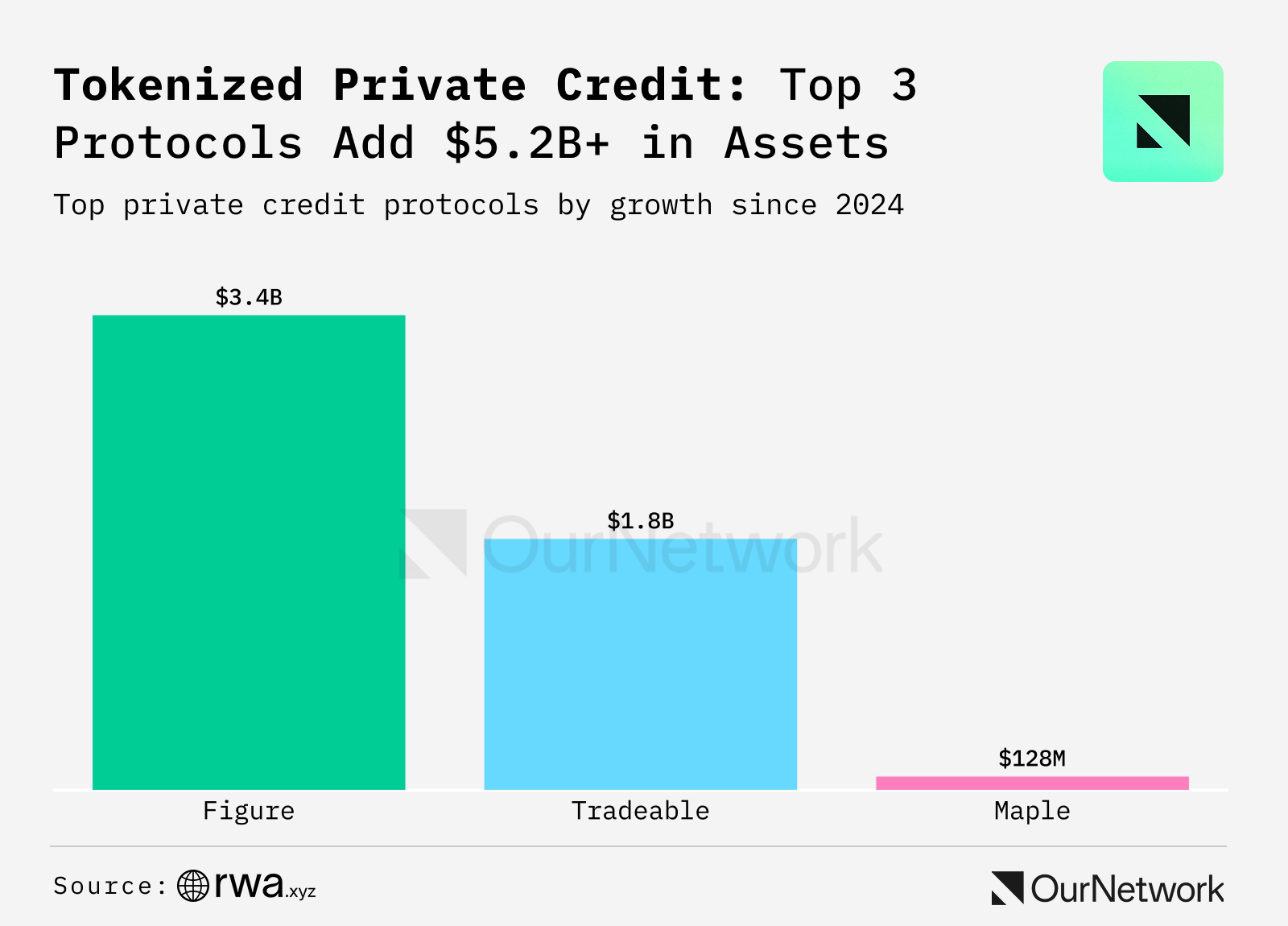

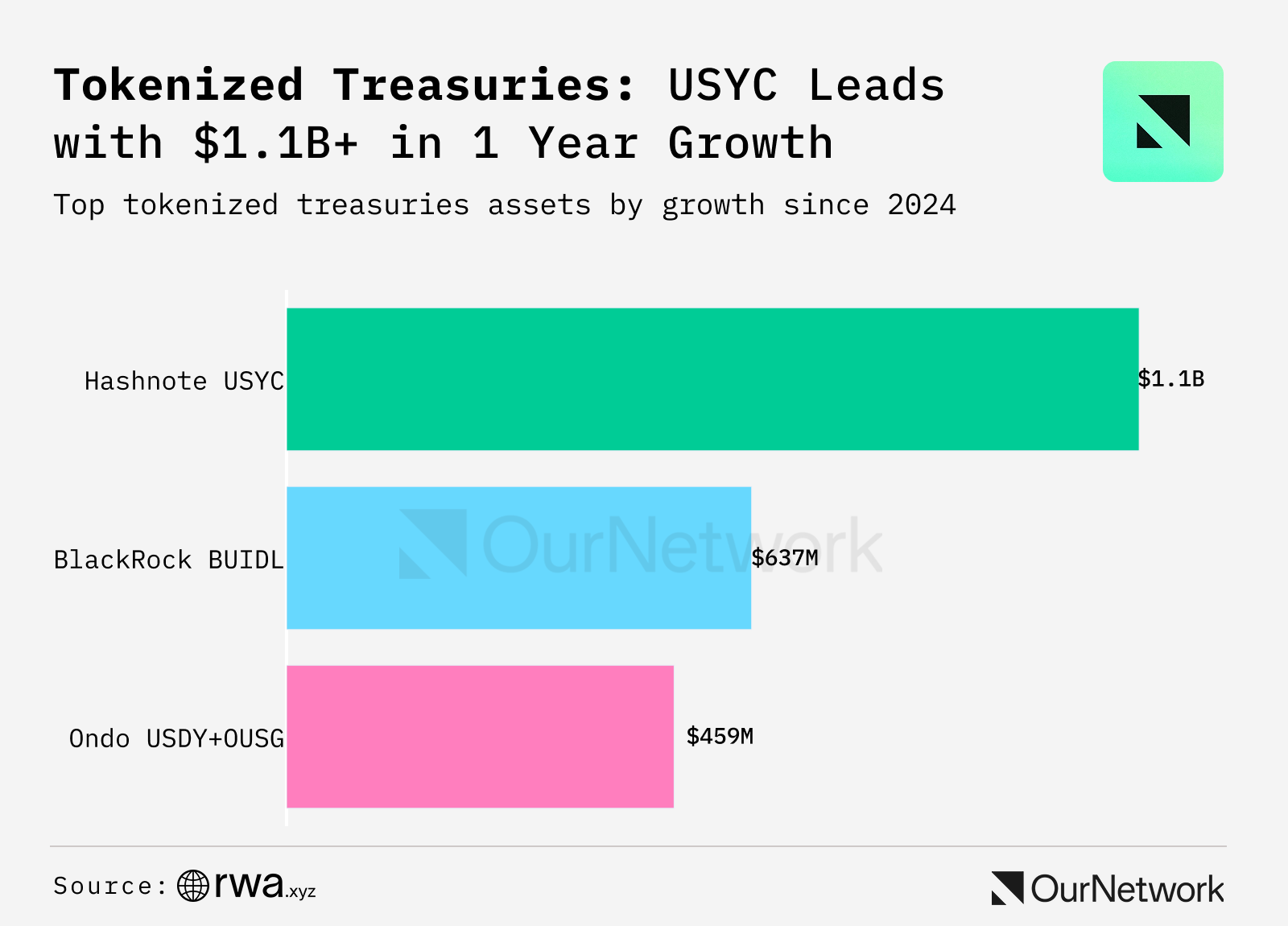

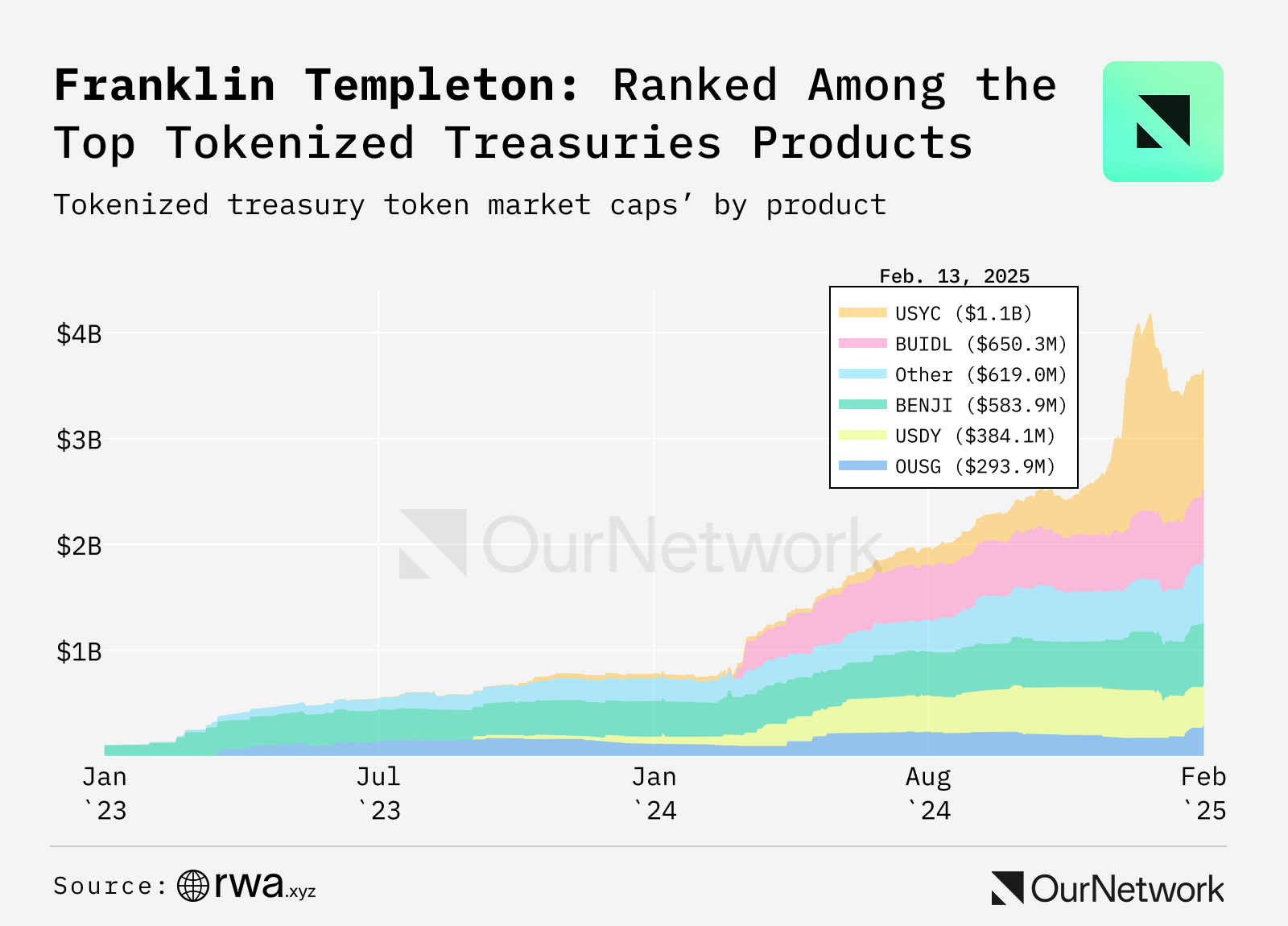

- Since 2024, the scale of the tokenized real-world assets (RWAs) sector has doubled to $17.2 billion, driven mainly by private credit and tokenized government bonds. The growth in private credit primarily comes from Figure's consumer finance products and Tradable's institutional platform. Tradable has partnered with asset management firm Victory Park Capital, which focuses on private asset-backed credit, to tokenize $1.7 billion in assets. Meanwhile, tokenized government bonds have grown from $800 million to $3.6 billion, with Hashnote's USYC, BlackRock's BUIDL, and Ondo's related products performing prominently in this area. Although early users preferred traditional blockchain networks, institutional investors are gradually shifting towards Ethereum and other emerging networks.

- In the private credit sector, Figure has launched tokenized products based on home equity lines of credit (HELOCs) through Provenance Blockchain, becoming a leader in this field. In January 2025, Tradable partnered with Victory Park to launch $1.7 billion in institutional-grade private credit assets on the Layer 2 network ZKsync Er. Additionally, Maple Finance has further expanded the application of tokenized private credit through its decentralized lending platform.

- In the field of tokenized U.S. Treasury bonds, Hashnote's USYC product, along with its integration with Usual Protocol's yield-bearing stablecoin USD0, has become a significant driver of market growth. Meanwhile, BlackRock's BUIDL and Ondo's USDY/OUSG products provide institutional-grade solutions and infrastructure for yield generation and treasury management.

- Transaction Spotlight: On-chain data shows that the stablecoin USD0 launched by Usual Protocol is backed by Hashnote's USYC Token. Users can directly redeem USD0 through the protocol and receive assets in the form of USYC. Additionally, on-chain records indicate that Usual Protocol's treasury wallet is the largest holder of USYC.

BUIDL

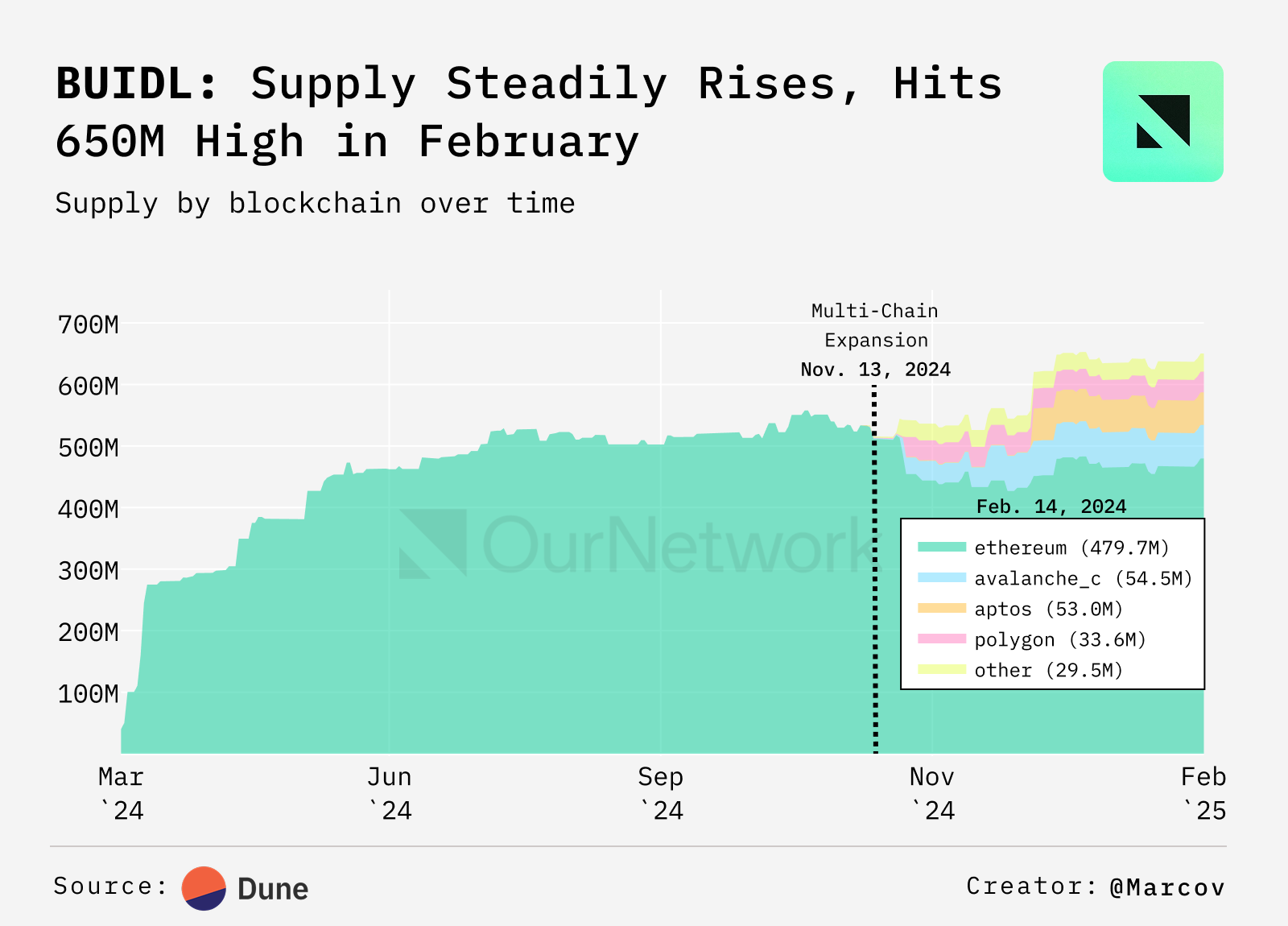

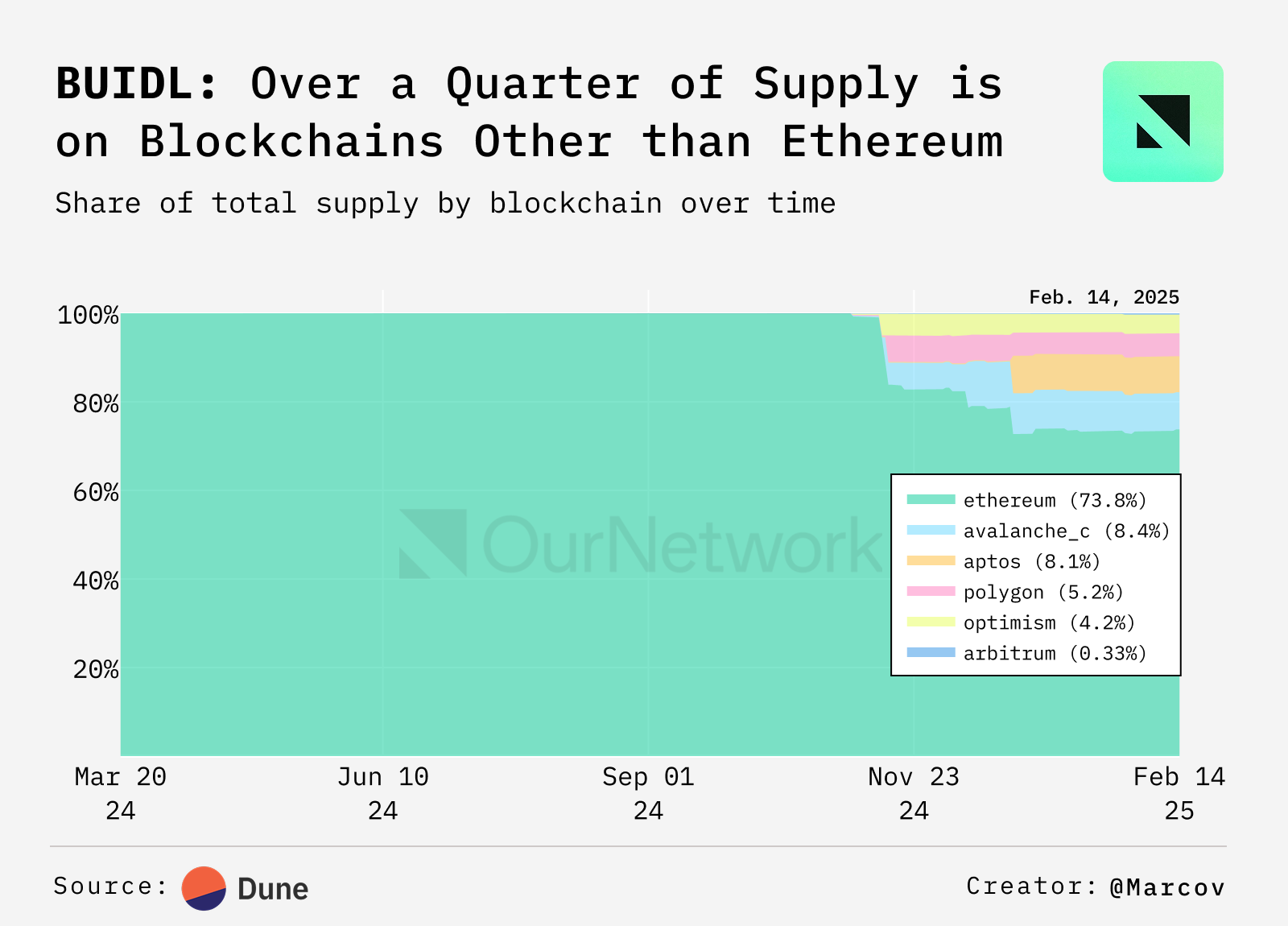

Over 25% of BUIDL fund assets have migrated to blockchains outside of Ethereum

The BUIDL fund managed by Blackrock and Securitize has maintained a stable supply over the past few months, slightly decreasing to $625 million at the end of January. Recently, the total supply has rebounded to $650 million at the beginning of the year.

- Since achieving multi-chain support in November 2024, the assets of the BUIDL fund have gradually shifted to blockchains outside of Ethereum. Currently, over 26% of the assets are distributed across Arbitrum, Optimism, Polygon, Aptos, and Avalanche.

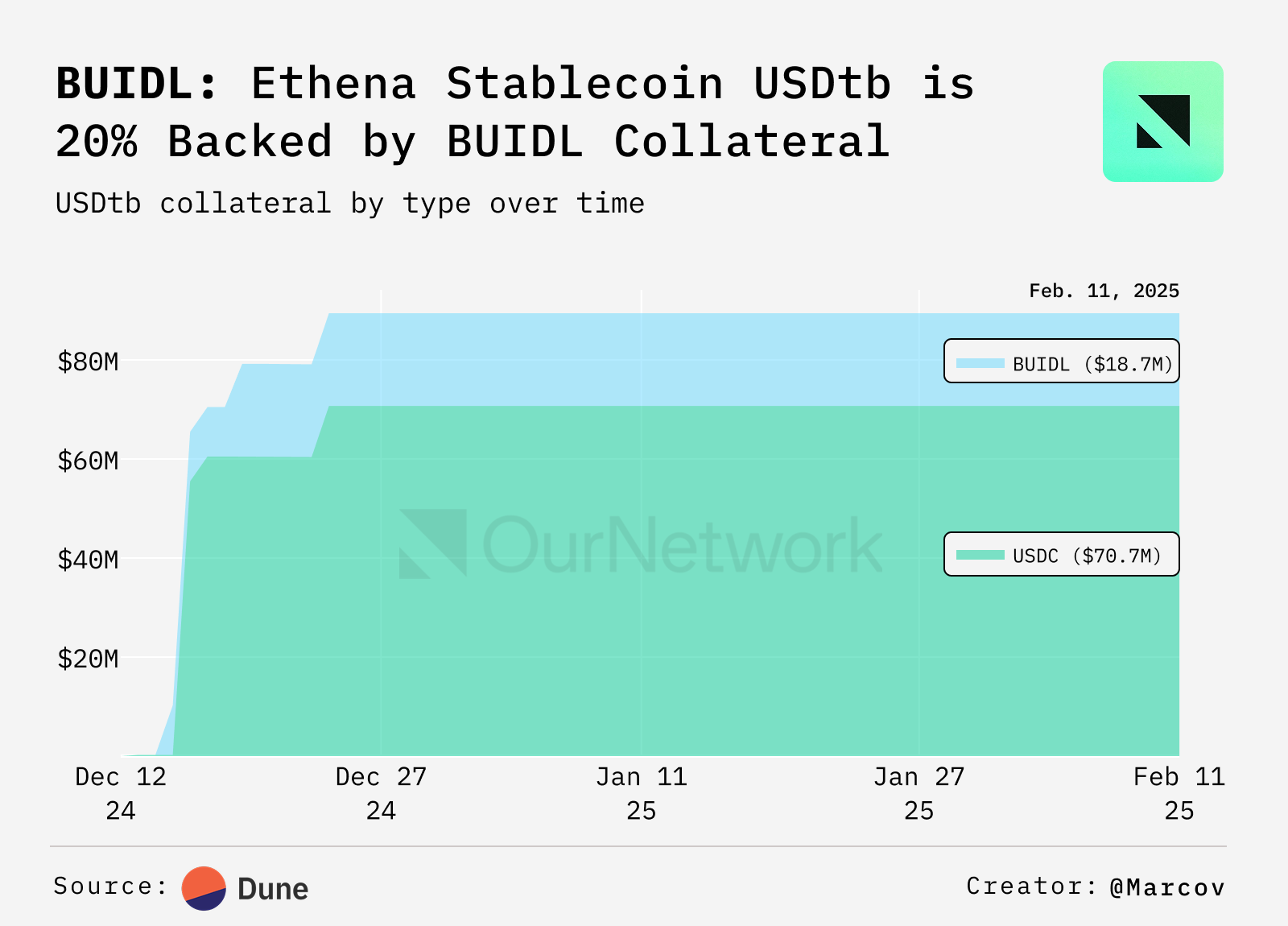

- Notably, the synthetic dollar protocol Ethena has launched a stablecoin USDtb supported by the BUIDL fund, making liquidity more widely accessible. As of now, the supply of USDtb is $89 million, with $18.7 million supported by the BUIDL fund, and further growth is expected in the future.

Tether Gold (XAUt)

Tharanga Gamage | Website | Dashboard

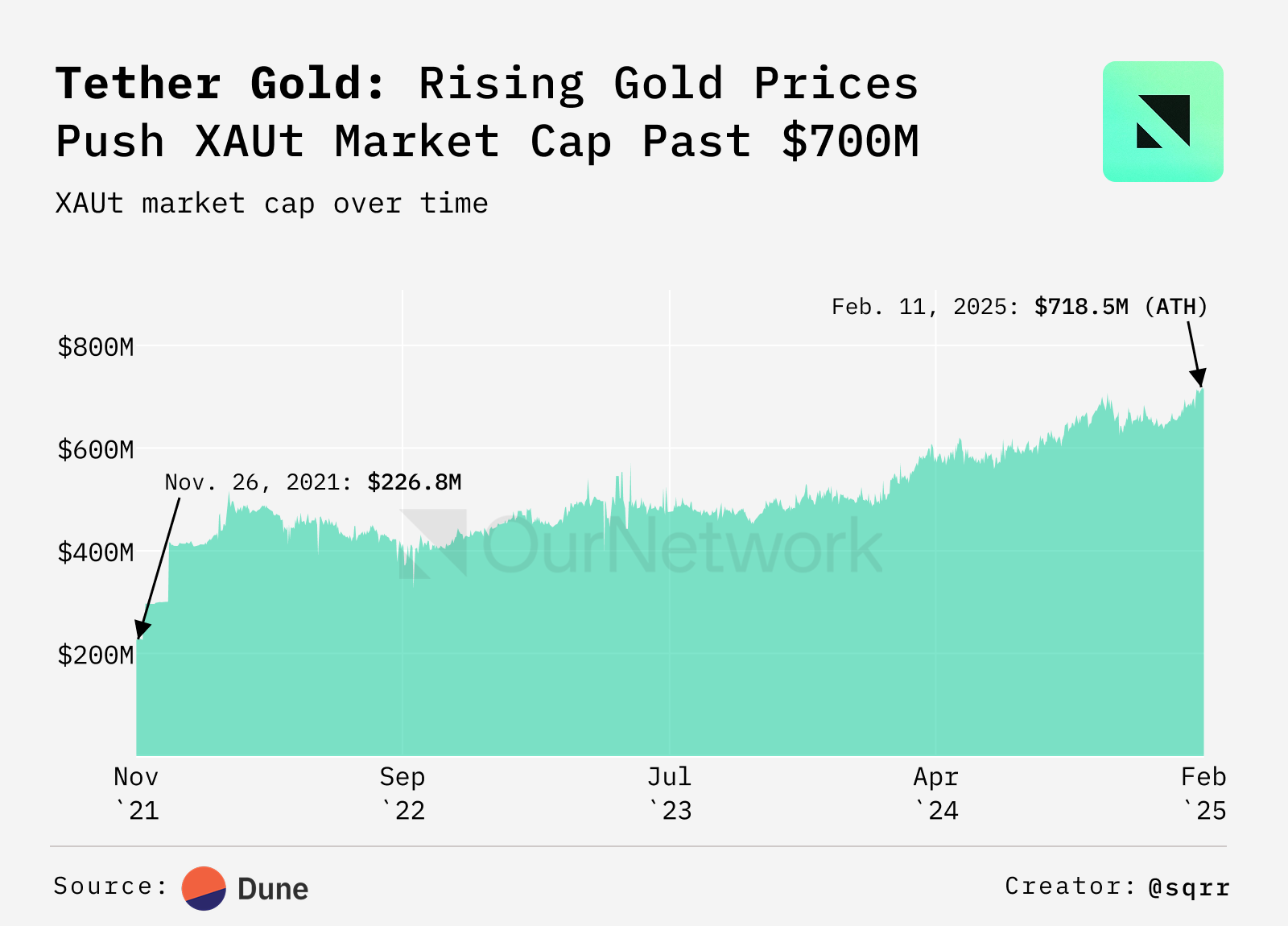

Tether Gold's Market Capitalization Surpasses $700 Million, Benefiting from Rising Gold Prices

As the largest tokenized gold asset currently, Tether Gold (XAUt) has seen its market capitalization exceed $700 million due to the recent rise in gold prices. XAUt is a token that grants holders ownership of physical gold, with a minimum purchase of 50 XAUt required for each verified buyer (approximately $146,608 as of February 14, 2025). Currently, XAUt accounts for 41% of the total market capitalization of tokenized gold.

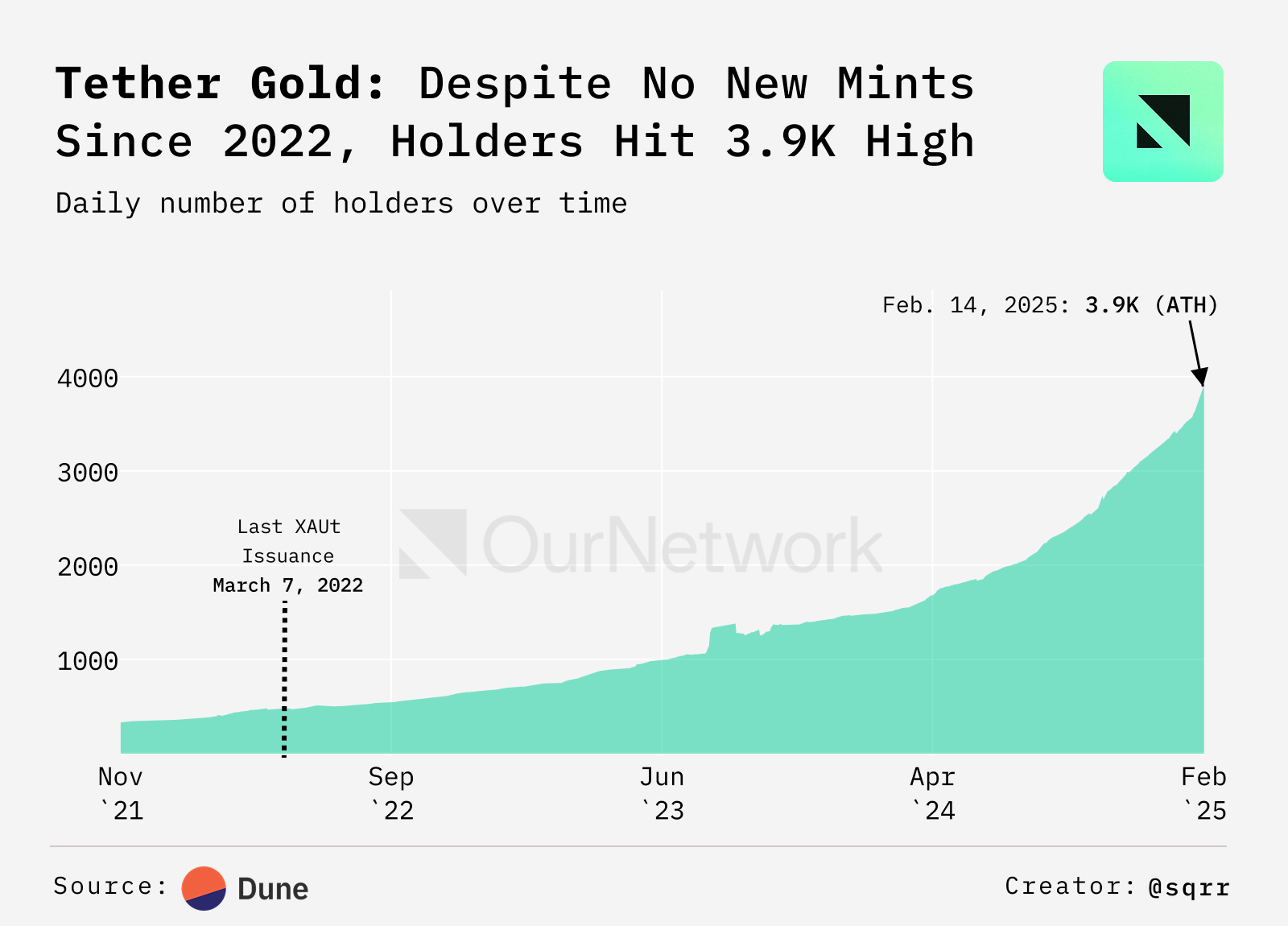

- A total of 246,500 XAUt tokens have been issued on Ethereum, with each token corresponding to 1 ounce of custodial gold. However, 24.7% of the tokens remain stored in Tether's treasury. The last on-chain issuance of XAUt tokens occurred on March 7, 2022. Currently, the number of addresses holding XAUt has grown to 3,888.

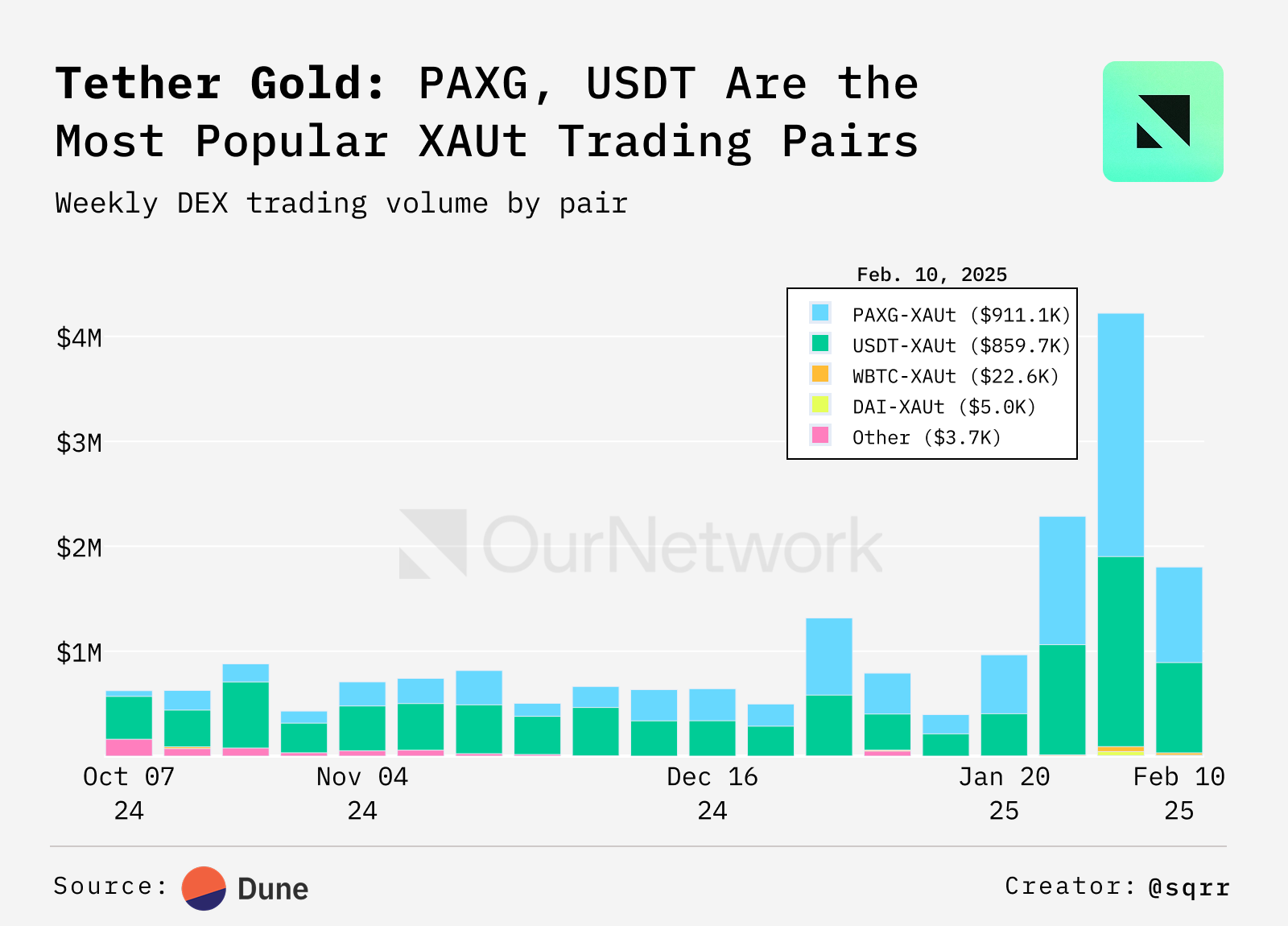

- On decentralized exchanges (DEX), the cumulative trading volume of XAUt has exceeded $237 million, with the most active trading pairs being PAXG and USDT. As gold prices reach historic highs, decentralized trading activity has significantly increased since the end of January 2025. Meanwhile, based on positions from centralized exchanges (CEX), the trading volume of XAUt may be even higher.

Franklin Templeton

Biff Buster | Website | Dashboard

Franklin Templeton's On-chain U.S. Government Money Fund (FBOXX) Asset Management Scale Approaches $600 Million

Since 2021, Franklin Templeton has quietly established the largest tokenized U.S. money market fund to date. FBOXX is its on-chain U.S. government money fund, currently approaching an asset management scale of $600 million. This indicates an increasing acceptance of blockchain-based financial products among institutional investors. FBOXX provides a regulated blockchain tool that allows investors to hold U.S. government bonds while maintaining a stable net asset value (NAV) of $1.

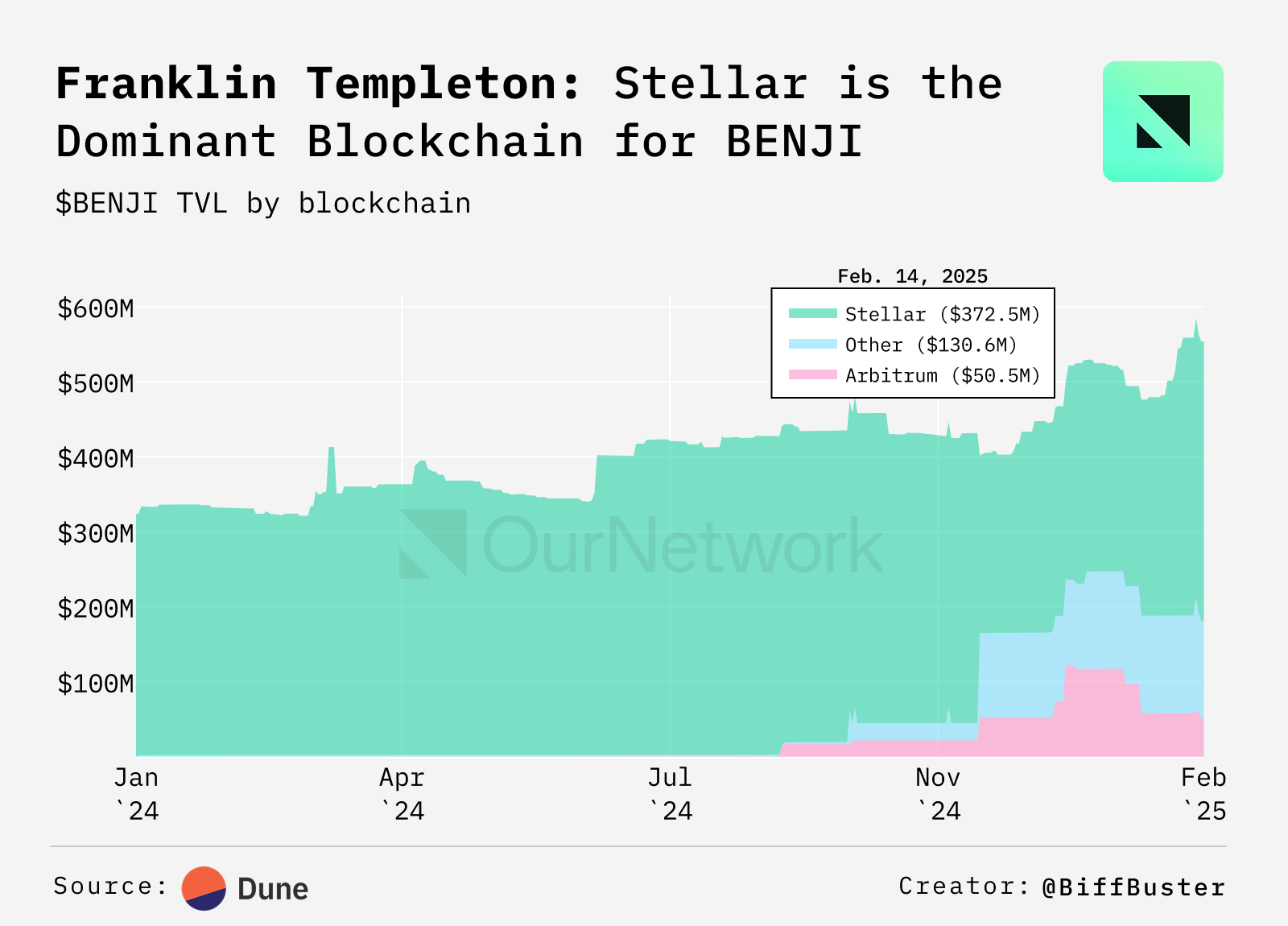

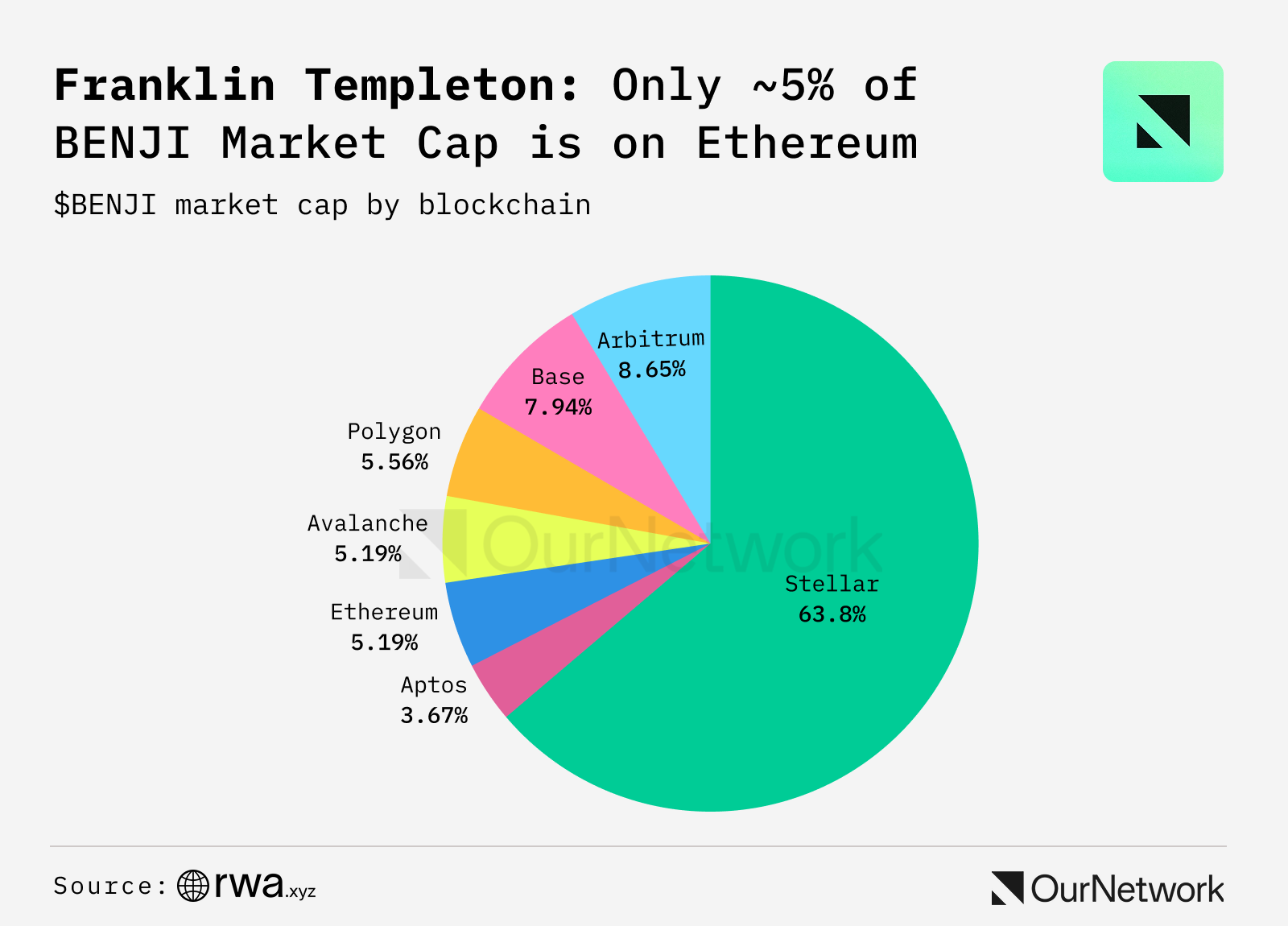

- BENJI is the on-chain tokenized representation of FBOXX, allowing investors to transfer tokenized shares across multiple blockchains. The fund currently has 553 holders, offering an annualized yield (APY) of 4.55% and charging a management fee of 0.15%.

- While Ethereum remains the primary blockchain for tokenized real-world assets, with a total market capitalization of $2.5 billion, Franklin Templeton's early success on Stellar indicates that low-cost alternatives are significant for tokenized government bonds.

- Transaction Spotlight: Whenever BENJI is launched on a new blockchain, it typically sees a significant influx of funds the following day. For example, the BENJI money market fund on Aptos received $21 million in new deposits, increasing its asset management scale by approximately 5%. With the Benji investment platform now launched on Solana, and Solana having advantages in low-cost, high-volume blockchains, significant growth in asset management scale is expected in the next three months.

Maple Finance

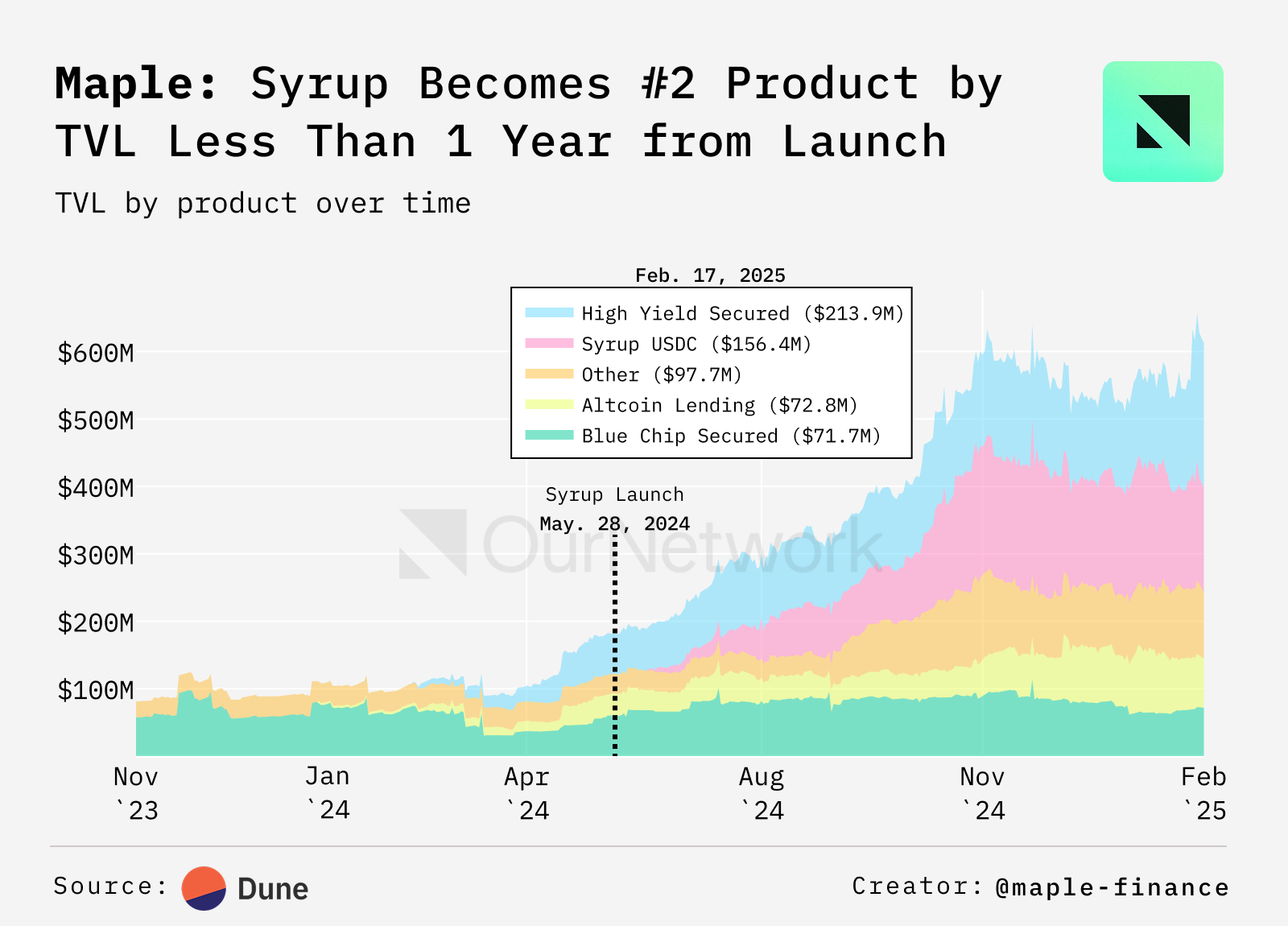

Maple Finance's Total Value Locked (TVL) Surpasses $600 Million at the Beginning of 2025

Maple Finance provides high-quality yields to borrowers by offering loans collateralized by BTC, ETH, and SOL. Since August 2024, the platform's total value locked has more than doubled, with both Maple and Syrup products experiencing significant growth. Protocol revenue has also shown a similar trend, reaching an all-time high in January 2025.

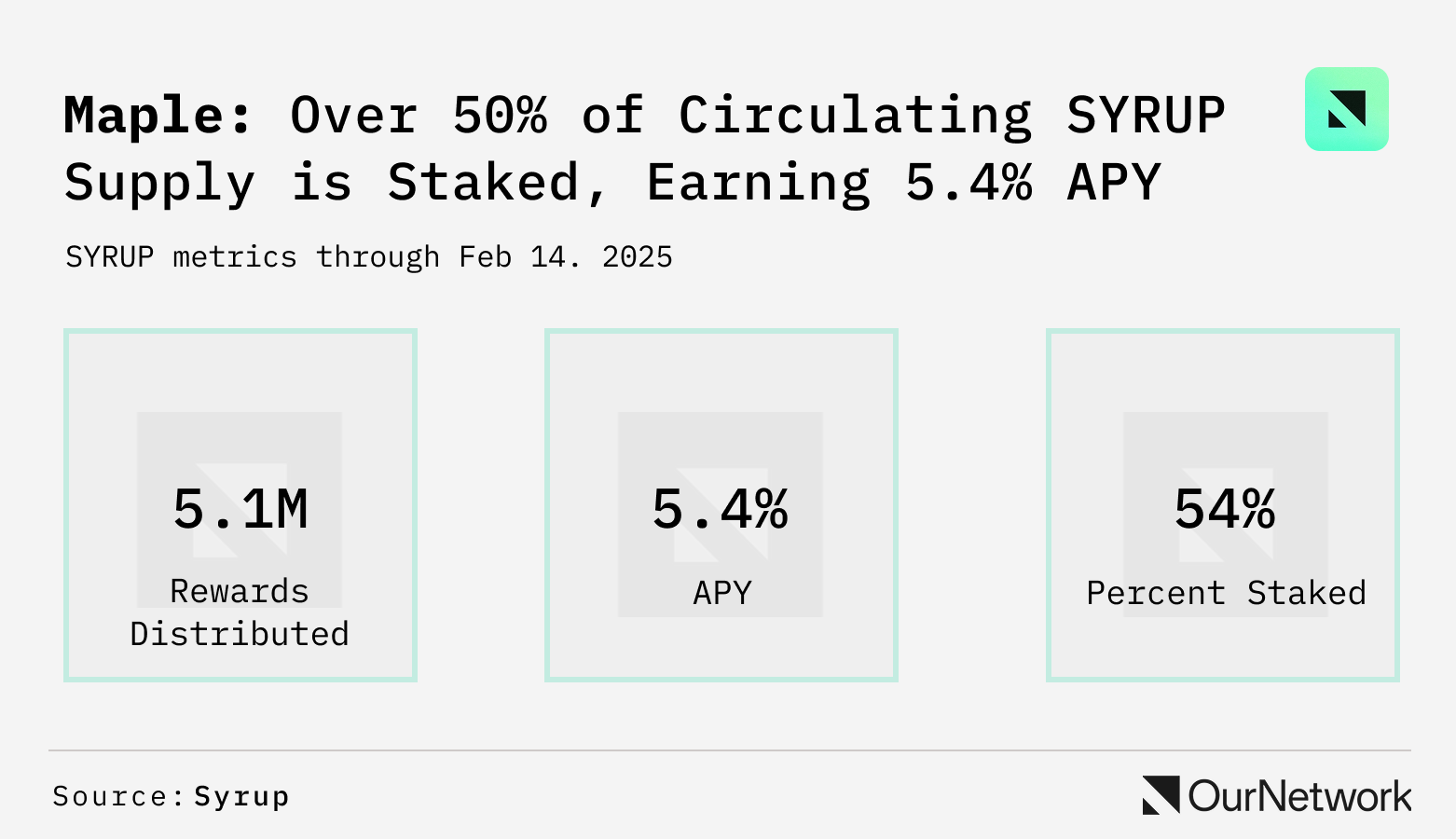

- In November 2024, the migration of MPL to SYRUP was initiated, along with the reintroduction of staking features, allowing users to share in the growth of the leading institutional lending platform in DeFi. To date, over 50% of the circulating supply of SYRUP has been staked, and 20% of January's revenue has been used to repurchase SYRUP.

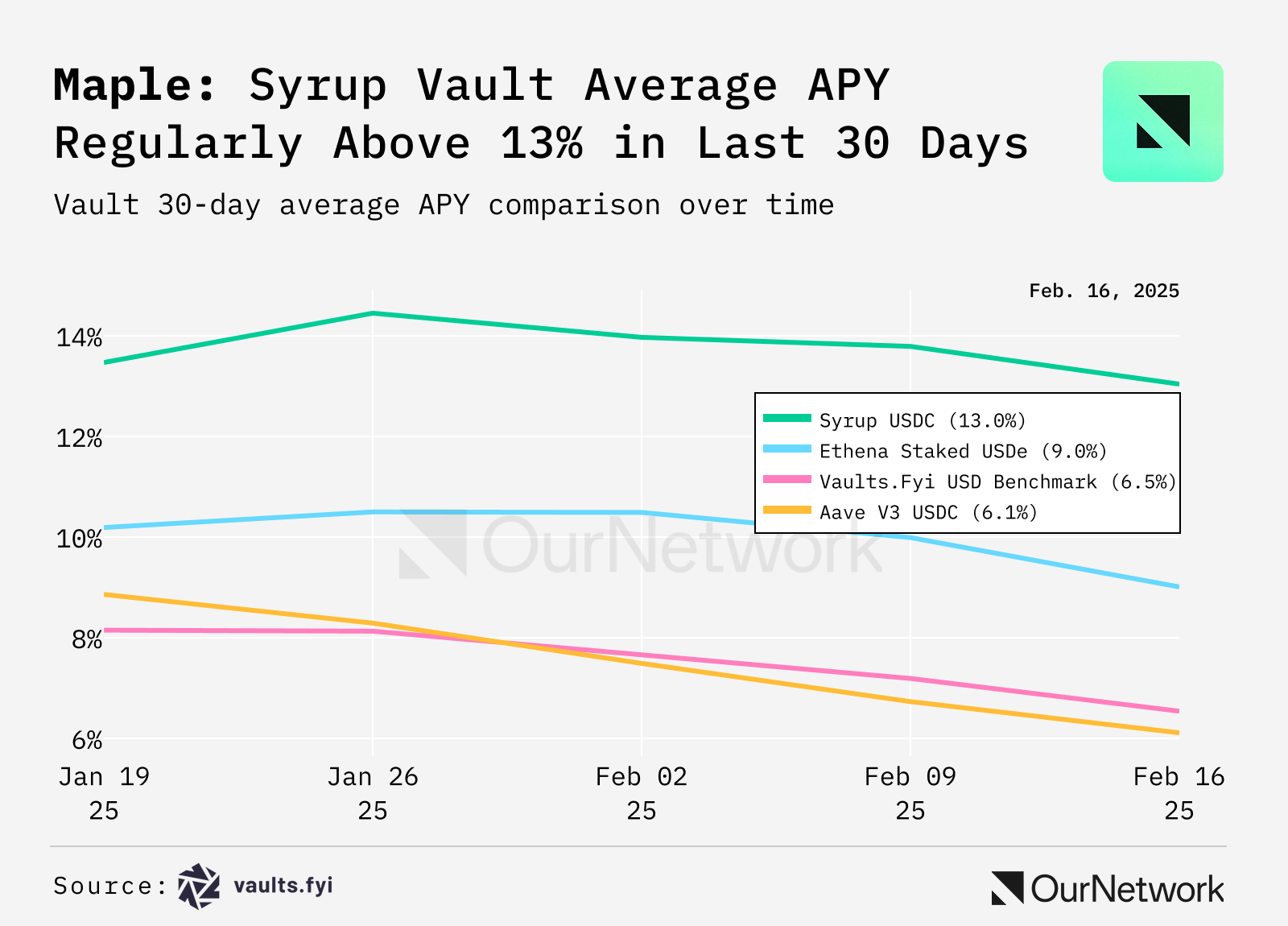

- In the context of generally compressed DeFi yields, Syrup's performance has significantly outperformed major competitors. Over the past 30 days, Syrup's net yield has exceeded Aave by more than double, and is 50% higher than Ethena's sUSDE, while maintaining an average collateralization ratio of over 165% in its loan book.

- Transaction Spotlight: Despite market volatility at the beginning of February leading to record liquidation volumes, Maple and Syrup actually attracted nearly $40 million in new deposits. Many large holders are reallocating funds from protocols like Aave to Syrup in search of higher stablecoin yields.

Superstate

Emily Coleman | Website | Dashboard

Superstate Achieves Multi-Chain Expansion, Tokenized Fund Asset Management Scale Surpasses $300 Million

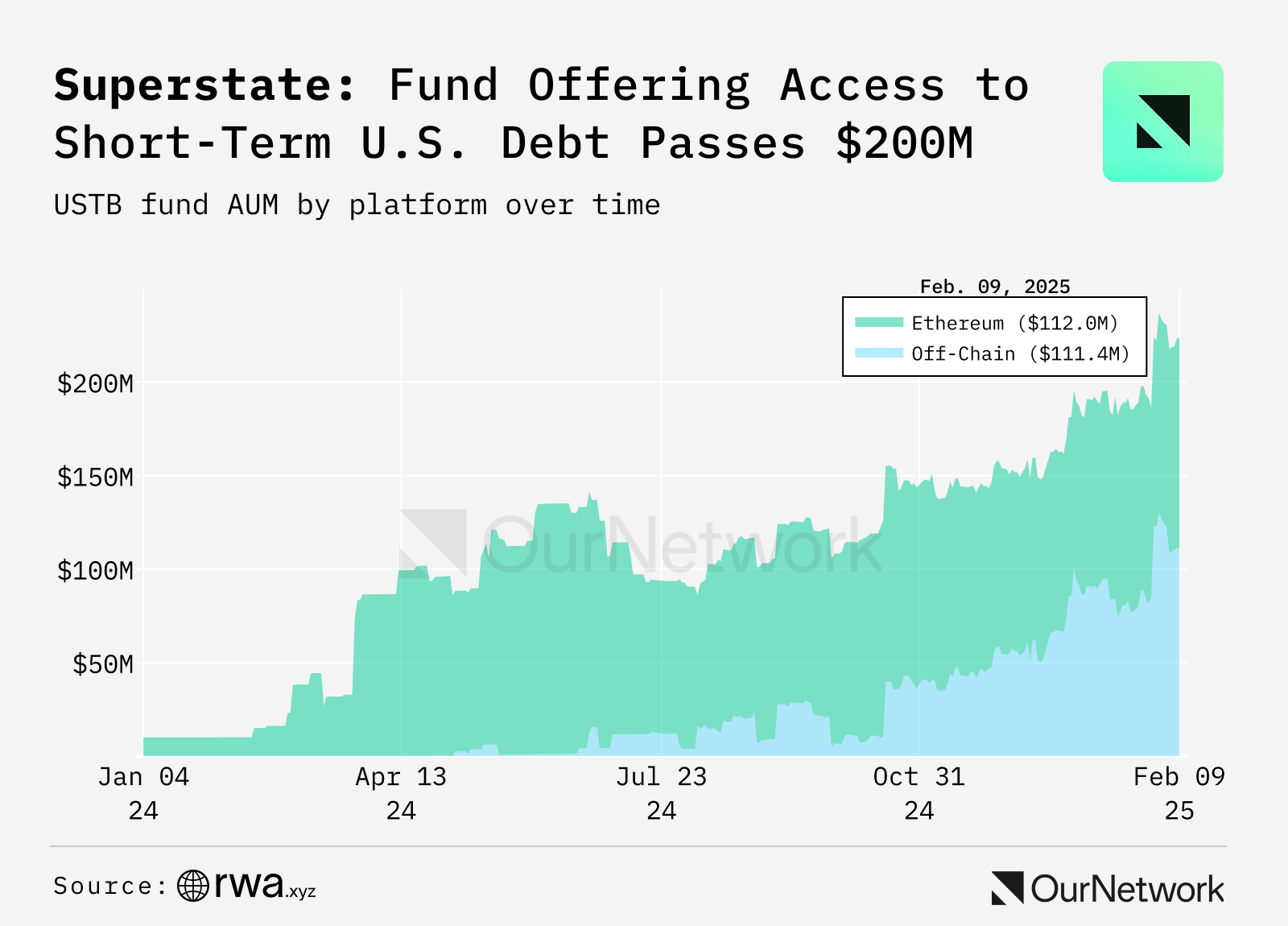

- U.S.-based asset management company Superstate announced that its tokenized funds collectively surpassed $300 million in assets under management in January 2025, further indicating an increasing acceptance of on-chain finance among institutional investors. Superstate's USTB fund focuses on short-term U.S. Treasury bills and institutional securities, with assets under management exceeding $200 million. To this end, the fund has introduced a management fee of 15 basis points while continuing to provide investment opportunities in traditional financial assets through tokenized infrastructure.

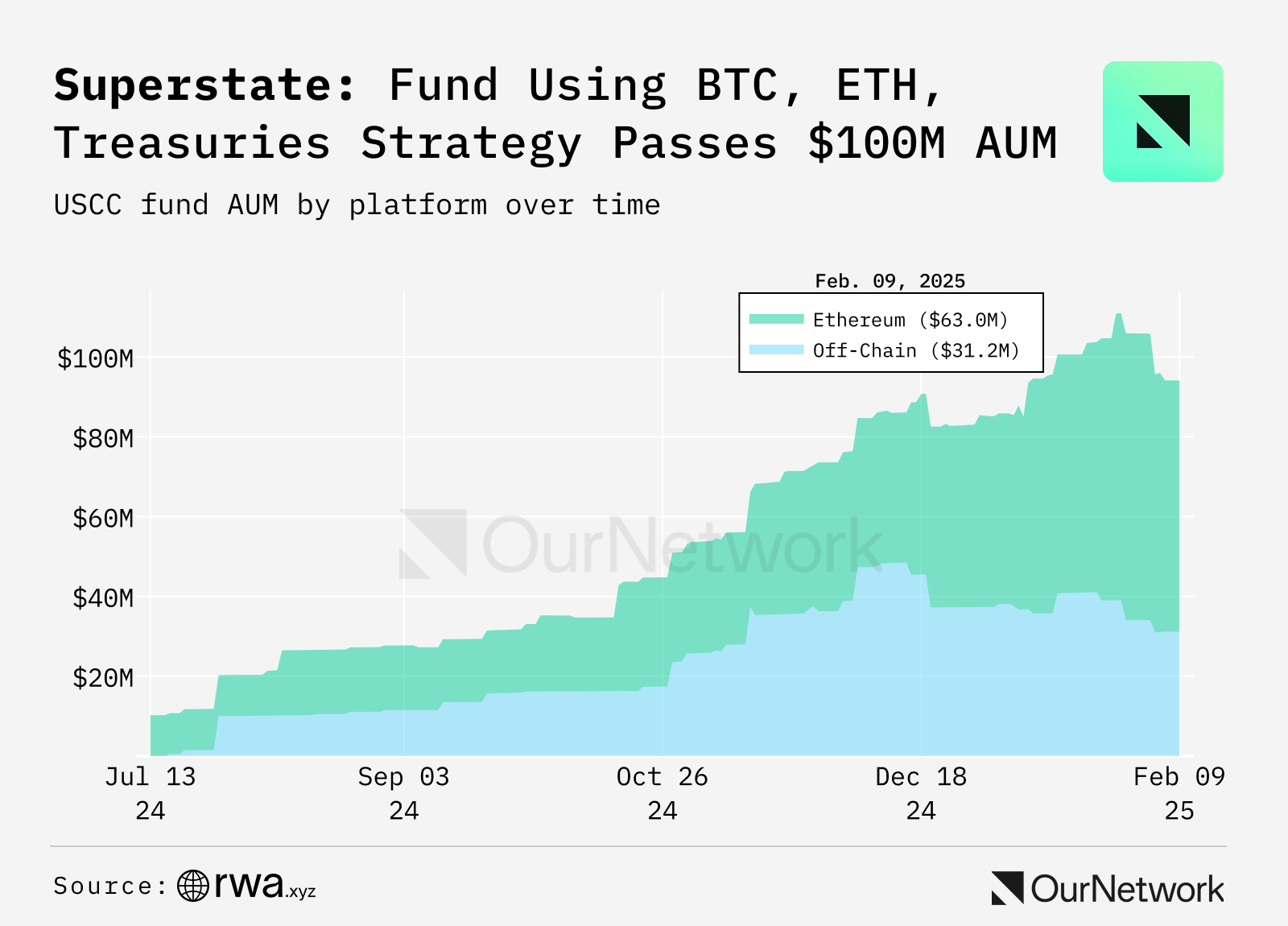

- Additionally, Superstate's Crypto Carry Fund (USCC) has also surpassed $100 million in assets under management, with investors allocating funds to crypto strategies covering BTC, ETH (including staked ETH), and U.S. Treasury bonds. Both funds support on-chain trading on Ethereum as well as off-chain trading via bookkeeping, and plan to expand to the Plume blockchain, a network designed specifically for tokenized real-world assets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。