原创|Odaily星球日报(@OdailyChina)

作者|Wenser(@wenser2010)

近日,主打“PayFi 网络协议”概念的 Huma.Finance 因团队成员与KOL之间的争论颇受市场关注,甚至再度掀起了“加密领域学历是否重要”这一话题的热烈讨论。结合其于4月10日在 Solana 网络推出的 Huma 2.0 系统以及特朗普政府掀起的关税贸易战,PayFi 赛道热度再起。

有鉴于此,Odaily星球日报将于本文对 Huma 进行简要介绍,并对其是否存在以往 P2P 项目的暴雷风险予以探讨。

初探 Huma:Solana生态 PayFi 新星

值得一提的是,Huma 并非Solana 生态的“原生项目”,而是于去年11月从以太坊生态扩展至 Solana 网络的。

2023年2月,Huma 完成830万美元融资,由Race Capital和Distributed Global领投,ParaFi、Circle Ventures、Robot Ventures等参投。彼时,其项目定位为 DeFi借贷协议。

2024年9月,继4月完成与跨境支付平台 Arf 的合并之后,Huma 宣布完成 3800 万美元融资(包括 1000 万美元股权投资和 2800 万美元的收益型 RWA),由首轮投资方Distributed Global 领投,Hashkey Capital、Folius Ventures、Stellar Development Foundation 和土耳其最大私人银行İşbank 的风险投资部门 TIBAS Ventures 等机构参投。彼时,其项目定位为 RWA 平台。

直到11月完成生态扩展之后,Huma 才将项目正式定位为“首个 PayFi 网络”。

Huma 官网界面

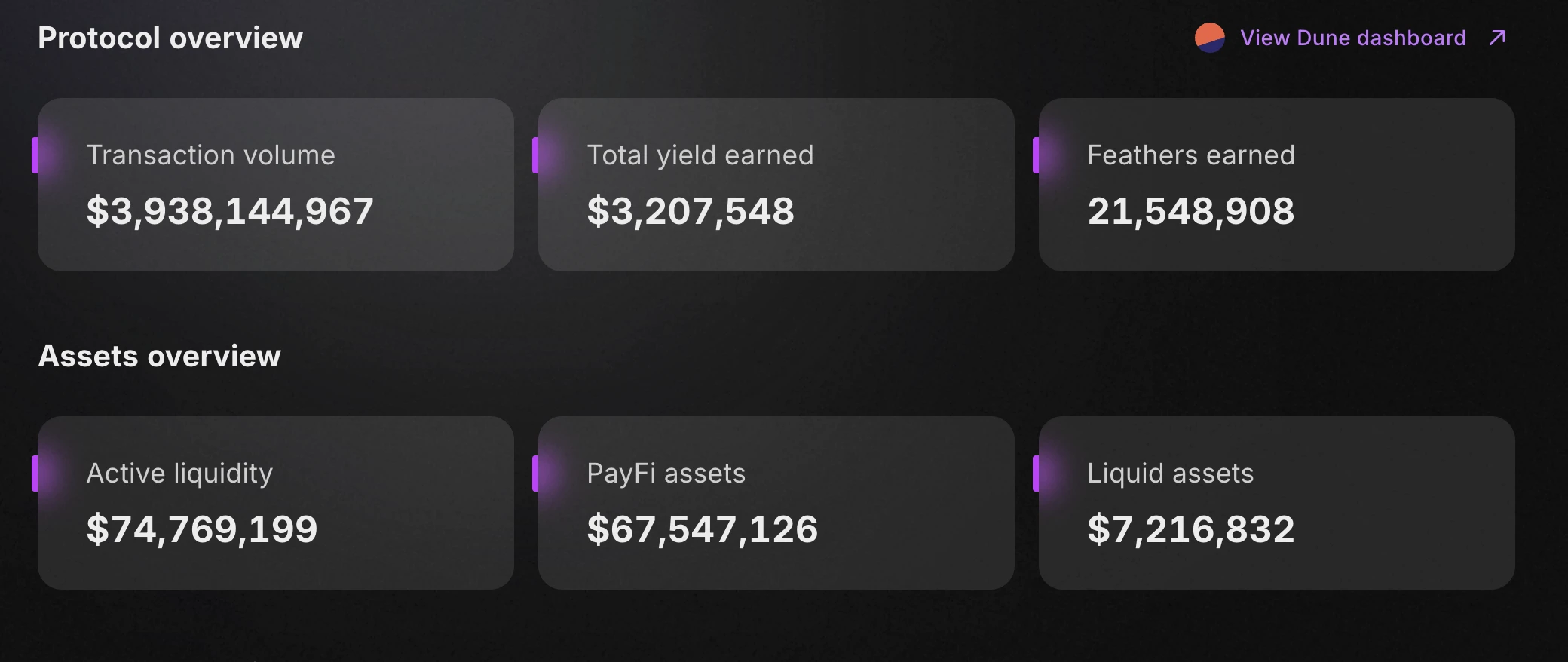

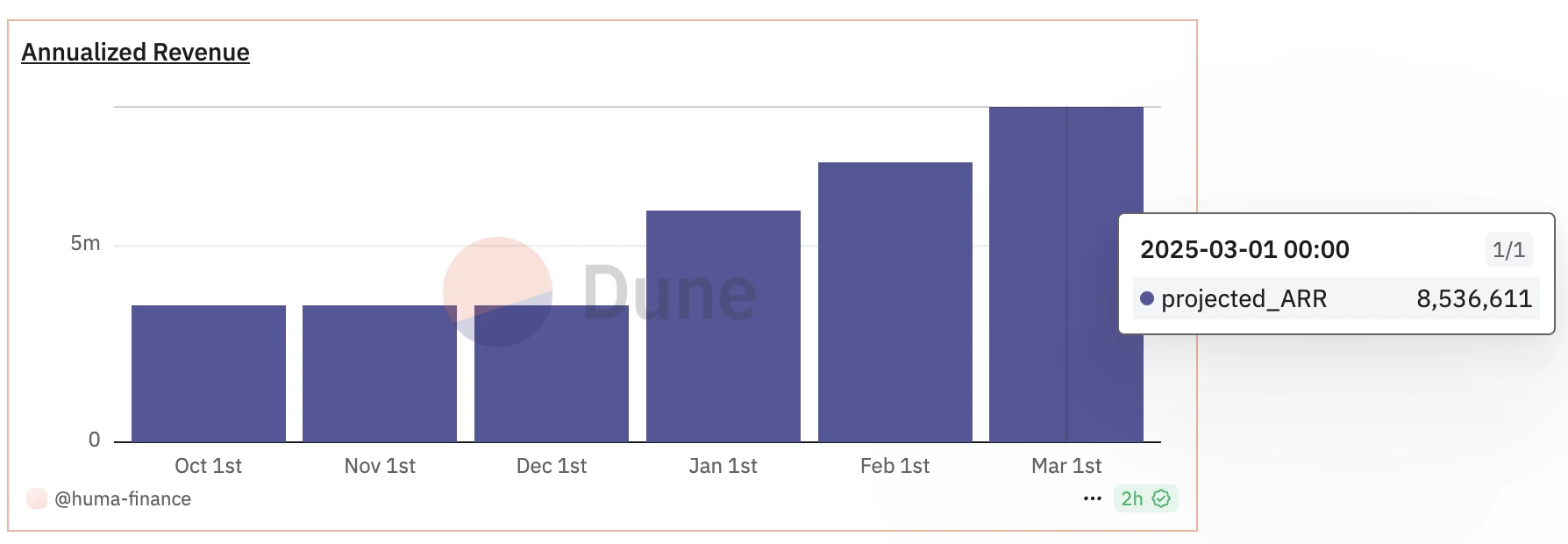

根据 Huma 平台官方数据,目前其总交易量超39亿美元,总收益约320万美元,平台积分 Feather 赚取数量为2154万左右;活跃流动性资产约为7476.9万美元,PayFi 资产约为6754.7万美元;流动性资产约为721.7万美元。另据 Dune 数据,Huma 平台平均年化收益率约为 14.3%,甚至高出官网中给出的 10.5% 的稳定收益率数据;存款人数约为1.5万人左右。

https://app.huma.finance/dataRoom

此外,对于用户最为关心的年化收入,据 Dune 数据,Huma 的平台年化收入自去年10月以来呈逐步增长态势,2025年3月年年化收入高达853.6万美元。而上线不足一周的 Huma 2.0目前累计存款额已突破1221万美元。

据此前媒体信息,Huma 使用区块链技术为汇款、数字资产支持的信用卡、贸易融资、全球支付的 T+0 解决方案和 DePIN 融资等用例提供支付融资(或“按需流动性”),致力于解决传统金融系统中的低效率问题。而这方面的业务主要通过 Arf 进行,截止4月15日,Arf 累计信用额度为19.92亿美元;累计还款金额约为 19.5亿美元;资本周转倍数约为 4.31倍。

据官方提供的机构信息显示,Huma 主要应用于跨境支付融资活动流动性池目前有3个,均已满额,收益率在 11.5%以上。

而在 DePIN 融资方面,Huma 此前曾与 Roam 联合推出 Roam路由器贷款购买计划,用户首付30%,其余资金由Huma 提供贷款,用户将通过后续空投和挖矿奖励偿还贷款,贷款结清后设备收益归用户所有。

2025年1月,据第三方消息,Huma 将在 Jupiter LFG Launchpad 上推出 HUMA 代币,预计投票发布时间为5月。

暂定投票时间为5月

介绍完项目,对于普通用户而言,目前的参与方式主要为通过存款赚取平台收益率回报及 Feather 积分奖励,如果想要最大化后者,可以选择 Huma 2.0 中的 Maxi 模式;两者想要兼顾则可以选择 Classic 模式。邀请链接见此处。

而更多人关心的问题是——Huma 是否存在传统互联网领域 P2P 项目的暴雷风险?

Huma 是否存在 P2P 暴雷风险?是,但又不完全是

根据 Huma 官方提供的 PayFi 策略备忘录文件相关信息来看,Huma 主动披露了一系列的风险因素,其中包括:

信用和违约风险;

PayFi 产品流动性风险;

欺诈和虚假陈述风险;

集中度风险;

担保执行风险;

预融资执行风险;

监管和法律风险;

宏观经济和市场风险;

以及公司运营、技术及区块链层面的相关风险。

Huma 官方文档信息

此外,Huma 官方对用户赎回流程也做出了相关时间及额度的限制说明。

官方对风险的态度如此明确且切割具体,Huma 是否真的会存在暴雷风险呢?目前来看,可能性较低。主要原因如下:

从现有业务模式来看,Huma 的商业模式更偏向于在连接企业和机构投资者及其资金流动性的基础上,向个人开放了无需 KYC/KYB 的代币激励存款功能。

从其基础资产及风控机制来看,Huma 采用 RWA 资产(如Arf Capital 发行的现金抵押债券)而非高风险的P2P个人无担保贷款进行业务结算,Arf 流动性池的分层结构和平台覆盖首次损失的机制也降低了资金出借的违约风险,流动性管理更为灵活(锁定期为活期或3个月、6个月)。

从平台具体功能层面来看,Huma 的 PayFi 网络确实有 P2P 元素,因为其主要通过区块链网络将借款人与投资者联系起来,提供基于未来收入或应收账款的融资;但其重点在于支付融资和 RWA 代币化,涉及机构资本和复杂的金融结构(如 SPV 代币化、结构化融资),与传统 P2P 借贷中的个人对个人模式差异较大。

从信用背书及投资机构来看,Huma 得到了包括 Distributed Global、Hashkey 等一系列知名投资机构及金融机构的支持,也从侧面一定程度上降低了该项目的欺诈可能。值得一提的是,Huma 在部分国家和地区并未开展平台业务(如加密敏感地带的中美两国)。

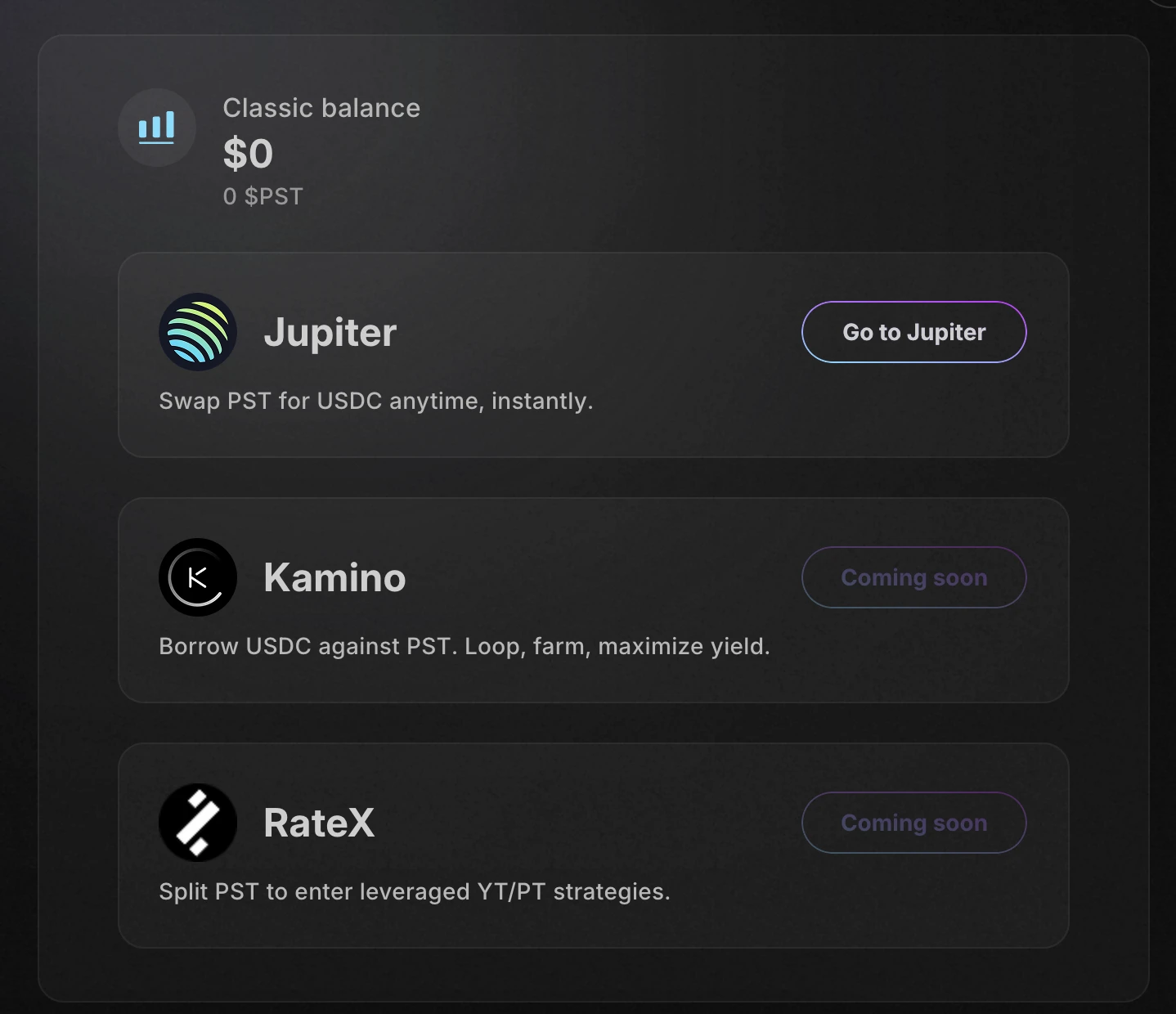

因此,现阶段而言,Huma 更像是一个混合业务模型——其具备一定的 P2P 业务特性,但主要依靠提供跨境支付融资来获取真实收益,并在此基础上开拓 Solana 生态中的 PayFi 版图,引入 Jupiter、Kamino、RateX 等合作伙伴(后两者目前暂未开放)发掘 DeFi 生态系统潜力。

后续,用户应当关注的重点如下:

关注 Arf 流动性池运行状况:https://institutional.huma.finance/

关注 Huma Dune 数据面板相关流动性变化:https://dune.com/huma-finance/huma-overview

关注 Huma 官方关于收益来源透明化的进一步说明——Huma 联创 Richard Liu:https://x.com/DrPayFi

短期来看,Huma 依靠短结转周期及高效率流动性实现了较高的年化收益及协议收入,且有望借助 Arf 这一跨境支付平台实现本年度 100亿美元交易额的目标;长期来看,仍然有赖于 Huma 能否在稳定币结算卡、贸易融资、DEPIN 项目融资以及 RWA 资产代币化方面获得稳定回报。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。