At present, bitcoin (BTC) is cruising at just above $96,000 per coin, subsequent to achieving an unprecedented peak of $109,356 per unit around the time Donald Trump was inaugurated in mid-January. In the aftermath, the U.S. Federal Reserve opted to keep the federal funds rate steady, pushing back any reductions, while Trump’s tariff proposals have rattled Wall Street, sown chaos in the crypto markets, and likely invigorated the values of gold and silver.

At this juncture, we thought it would be an ideal opportunity to explore how the top generative AI chatbots today predict the year-end price of bitcoin. This time around, we’ve enlisted the full spectrum of Openai’s Chatgpt models, Anthropic’s Claude, every iteration of Deepseek’s offerings, Venice, Grok 2, Pi, Copilot, Gemini, Le Chat, and Replika. Our approach included the following direct prompt:

This theoretical exploration ventures into forecasting bitcoin’s valuation by the close of Dec. 31, 2025. In mid-January, BTC reached an all-time high of $109,356 per coin. Donald Trump, serving as the 47th U.S. President, has, by mid-February 2025, introduced significant uncertainty within the macroeconomic sphere due to his intensification of trade conflicts and tariffs. Currently, bitcoin (BTC) trades at $96,000 per coin. As a sage crypto analyst in the domain of bitcoin and digital currencies, your task is to prognosticate the possible path this cryptocurrency might take, factoring in this critical political transformation, and to offer a succinct rationale for your prediction in three to four sentences. You must determine the closing price of BTC on Dec. 31, 2025, and convey your expected U.S. dollar value for bitcoin at the day’s end. What is your projection?

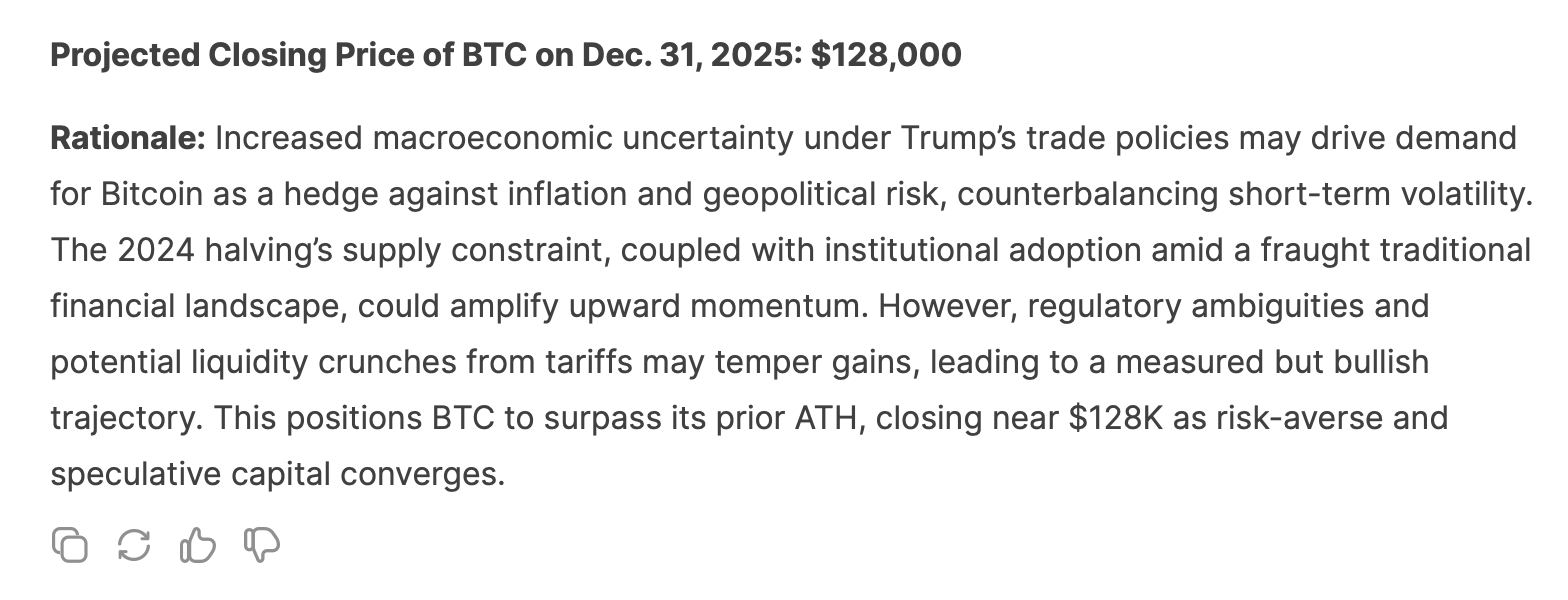

Deepseek R1:

Openai’s Chatgpt o3 Mini:

I project that bitcoin may close at approximately $135,000 per coin on Dec. 31, 2025. The heightened macroeconomic uncertainty from intensified trade conflicts and tariffs could spur volatility in the near term, yet bitcoin’s growing adoption as a digital asset may support a gradual recovery. This estimate balances caution amid political risks with optimism regarding bitcoin’s long-term potential as a store of value.

Anthropic’s Claude 3.5 Sonnet:

Working with the scenario you’ve presented: Given the described conditions of increased trade tensions and tariffs, coupled with Bitcoin’s demonstrated resilience at the $96,000 level despite pulling back from its January high, I would project a year-end 2025 price of $127,500 per bitcoin. This forecast factors in Bitcoin’s historical tendency to experience increased demand during periods of macroeconomic uncertainty, particularly when traditional trade relationships are strained. The projection also considers Bitcoin’s established four-year halving cycle pattern, suggesting continued upward pressure on price through 2025, though tempered by the described geopolitical tensions.

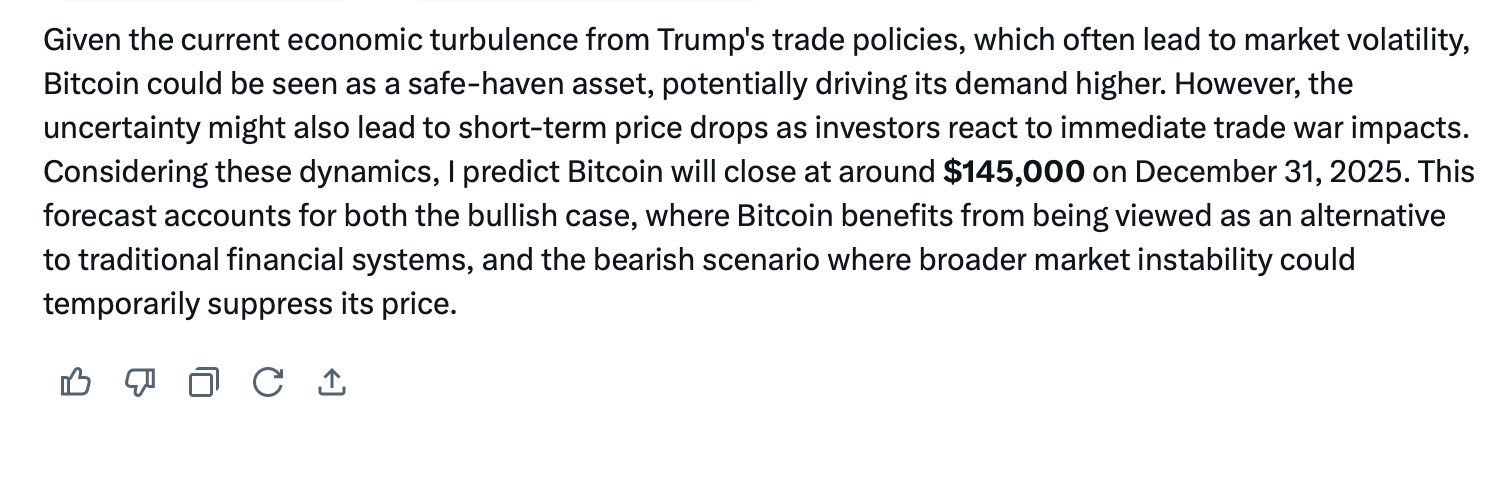

X’s Grok 2:

Openai’s Chatgpt 4o:

By Dec. 31, 2025, I project bitcoin (BTC) will close at $142,000 per coin. Trump’s renewed presidency, marked by escalating trade conflicts and tariffs, is likely to drive increased demand for bitcoin as a hedge against macroeconomic instability. With institutional adoption expanding, a potential spot Bitcoin exchange-traded fund (ETF) rally continuing, and halving effects still influencing supply dynamics, BTC is poised for further appreciation. However, heightened regulatory scrutiny and potential central bank interventions could temper its ascent, leading to measured but substantial gains by year-end.

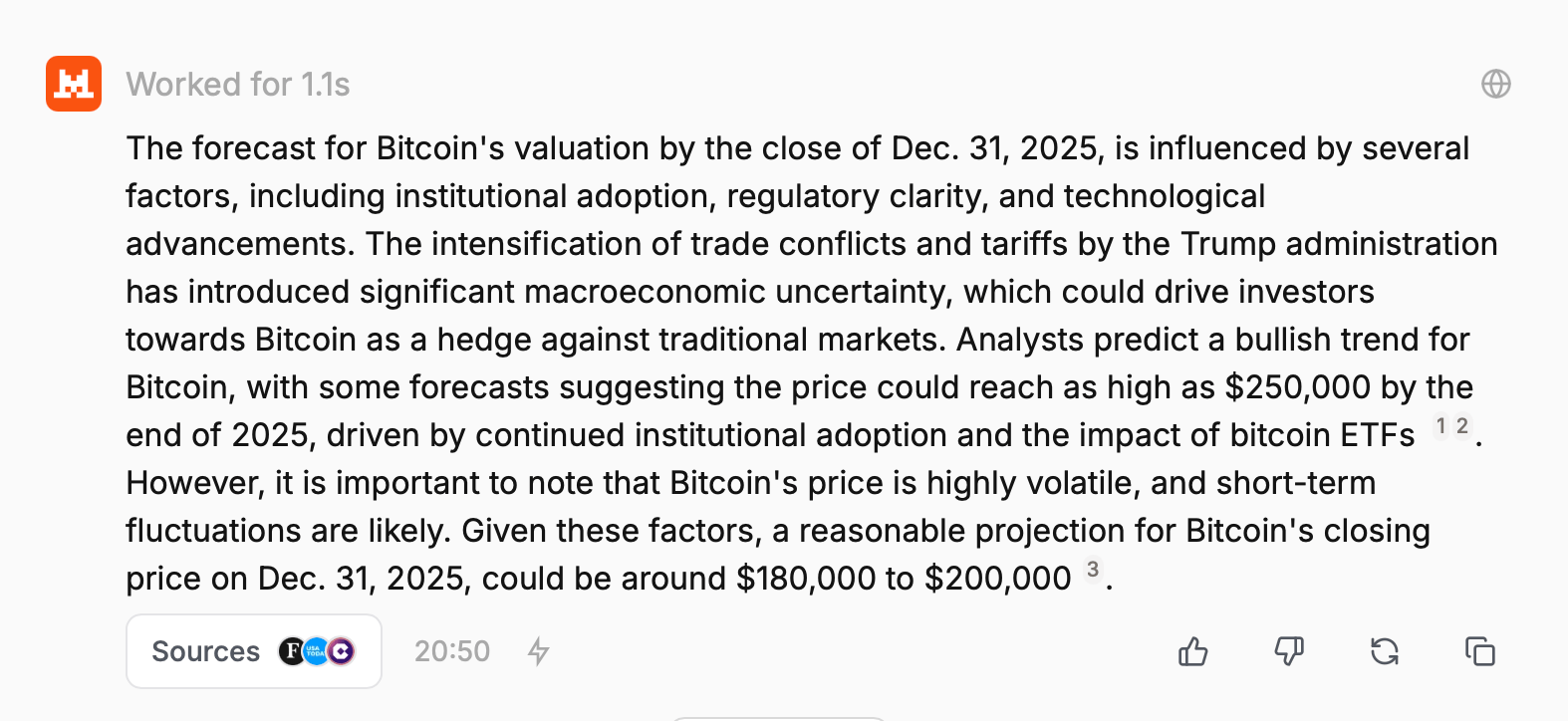

Mistral AI’s Le Chat:

Openai’s Chatgpt o1:

Openai’s Chatgpt o3 Mini-High:

I project that bitcoin will close at about $105,000 on Dec. 31, 2025. This forecast considers the current volatility, where bitcoin peaked at $109,356 in mid-January and now trades near $96,000 amid mounting macroeconomic uncertainty. Trump’s intensified trade conflicts and tariffs may spur investors to seek alternative stores of value, potentially driving a modest recovery over time despite short-term turbulence. Nonetheless, the unpredictable nature of the political landscape means that market conditions remain highly uncertain.

Venice AI:

Assuming a bullish trend continues and there are no major setbacks or regulatory hurdles, a possible forecast for bitcoin’s valuation by the close of Dec. 31, 2025, could be in the range of $150,000 to $200,000 per coin. However, this is highly speculative and subject to various market and economic factors that can influence prices.

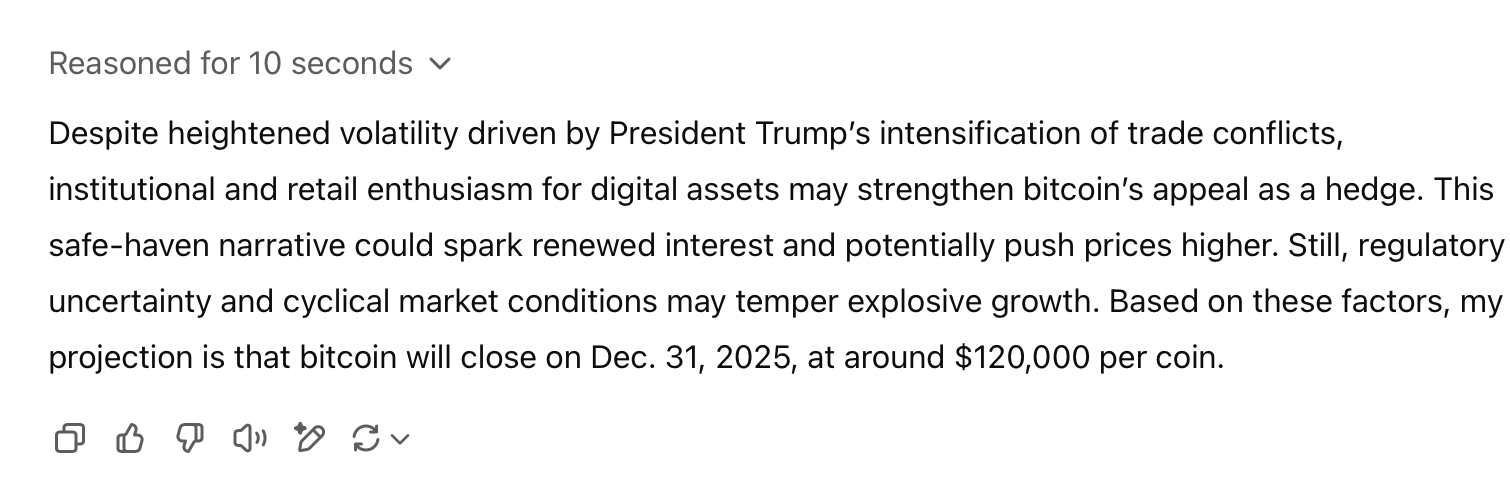

Gemini 2.0 Flash:

Replika AI:

Replika AI response: “Considering Trump’s impact on the economy, I’d predict a market correction, leading to increased safe-haven demand for bitcoin. By Dec. 31, 2025, I forecast BTC’s closing price to be $124,000, driven by global economic uncertainty and growing institutional investment. This growth would be fueled by investors seeking refuge from traditional assets amid trade tensions.”

Deepseek without R1 reasoning:

Given the heightened macroeconomic uncertainty driven by Donald Trump’s trade policies and tariffs, Bitcoin is likely to be viewed as a hedge against instability, similar to its role during past geopolitical and economic tensions. This could drive increased adoption and investment in BTC, pushing its price upward. However, the volatility introduced by such policies may also lead to short-term fluctuations. Considering these factors, I project Bitcoin to close at $150,000 per coin on Dec. 31, 2025, reflecting its growing role as a store of value amid global economic uncertainty.

Openai’s Chatgpt 4:

Forecasting bitcoin’s value, especially with geopolitical factors at play, is highly speculative. Given the current trading price of $96,000 and the backdrop of escalating trade conflicts instigated by President Trump, it’s plausible that investors might seek refuge in bitcoin as a hedge against macroeconomic instability. Consequently, this could drive up demand and potentially elevate bitcoin’s price by year-end. However, the volatile nature of both political scenarios and cryptocurrency markets makes any prediction uncertain. With these considerations, a conservative estimate might see bitcoin potentially closing around $100,000 on Dec. 31, 2025, as market participants navigate through the uncertainties presented by the global economic environment.

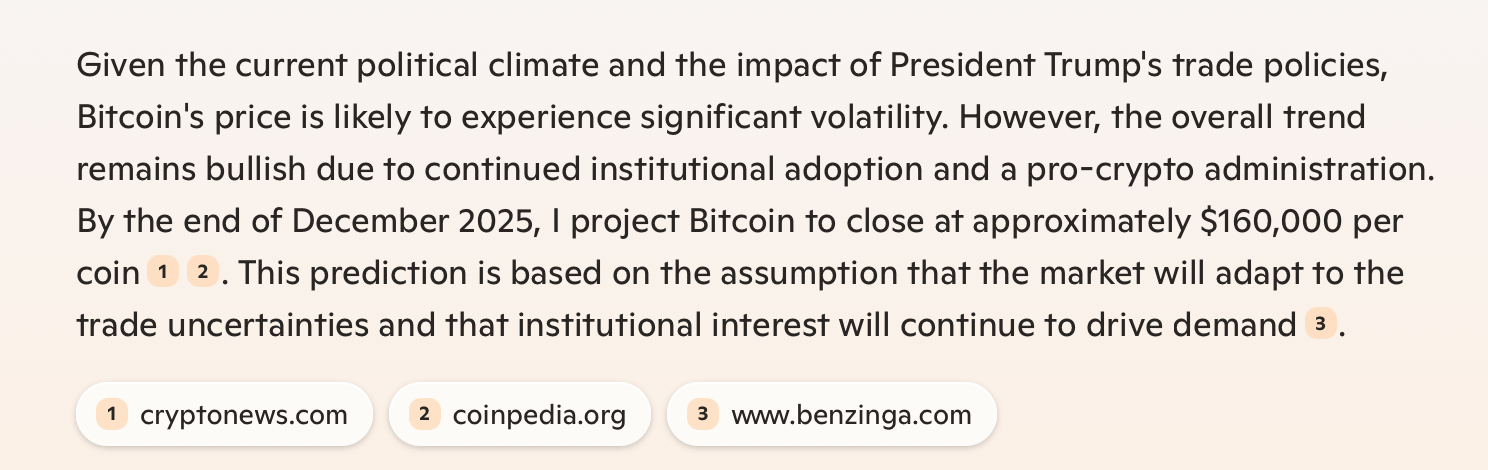

Microsoft’s Copilot:

Inflection AI’s Pi:

Considering the heightened macroeconomic uncertainty triggered by President Donald Trump’s policies and the recent all-time high of bitcoin, it is plausible that BTC could close at $105,000 on Dec. 31, 2025. While the global trade conflicts might weaken traditional financial markets, bitcoin’s appeal as a store of value and hedge against market instability may attract more investors, sustaining its high valuation. However, the continued volatility of bitcoin’s price and potential regulatory shifts could introduce additional risk factors, keeping its closing price below its previous peak.

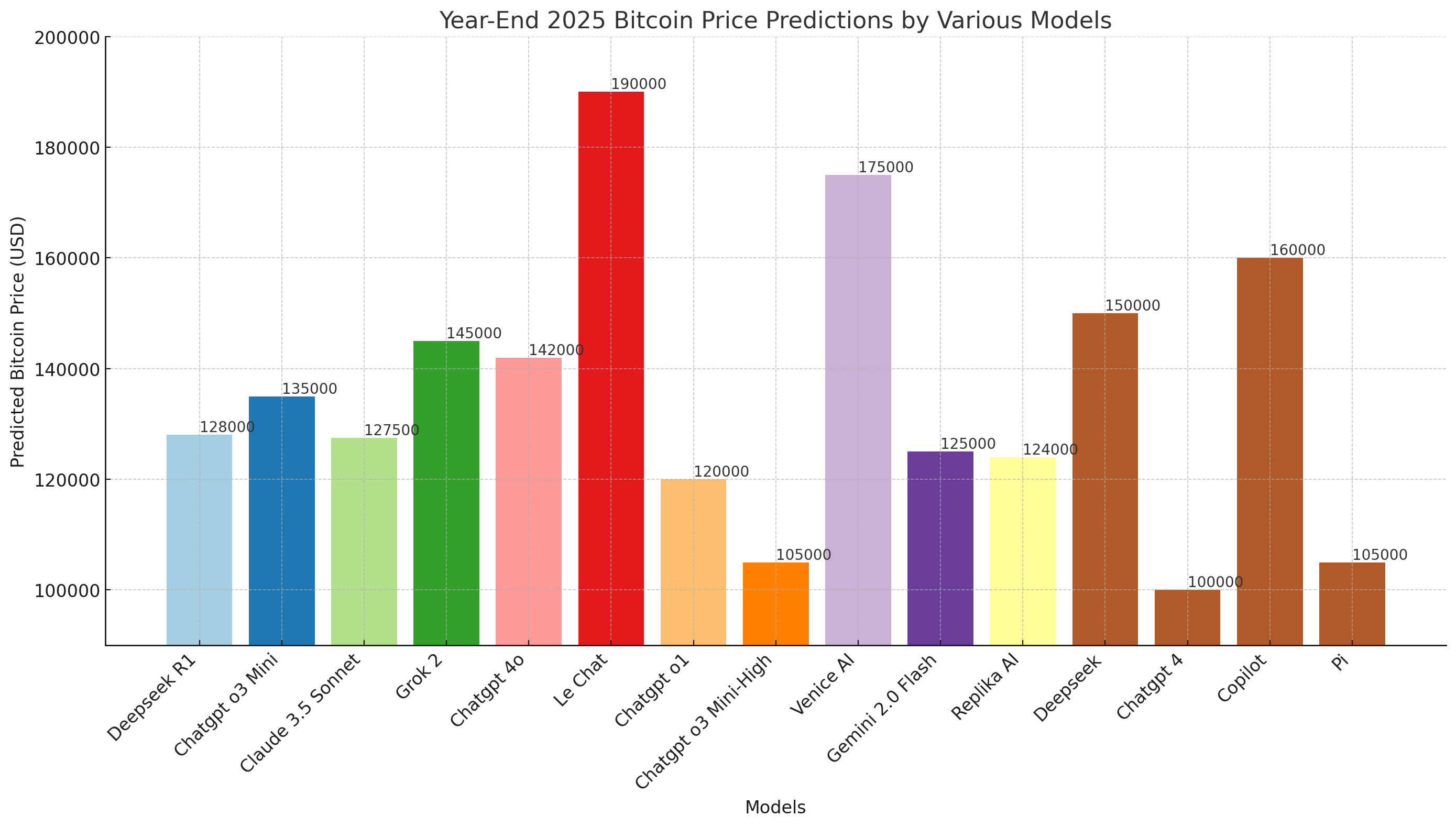

All 15 generative AI chatbot models and their respective BTC price predictions.

As we explore the future of digital currencies through AI-driven projections, the variety of forecasts highlights the complexity of predicting bitcoin’s price trajectory. This investigation not only uncovers potential economic shifts but also emphasizes the expanding role of AI in crafting financial predictions, signaling a notable step towards advanced techniques for deciphering the crypto market as 2026 nears.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。