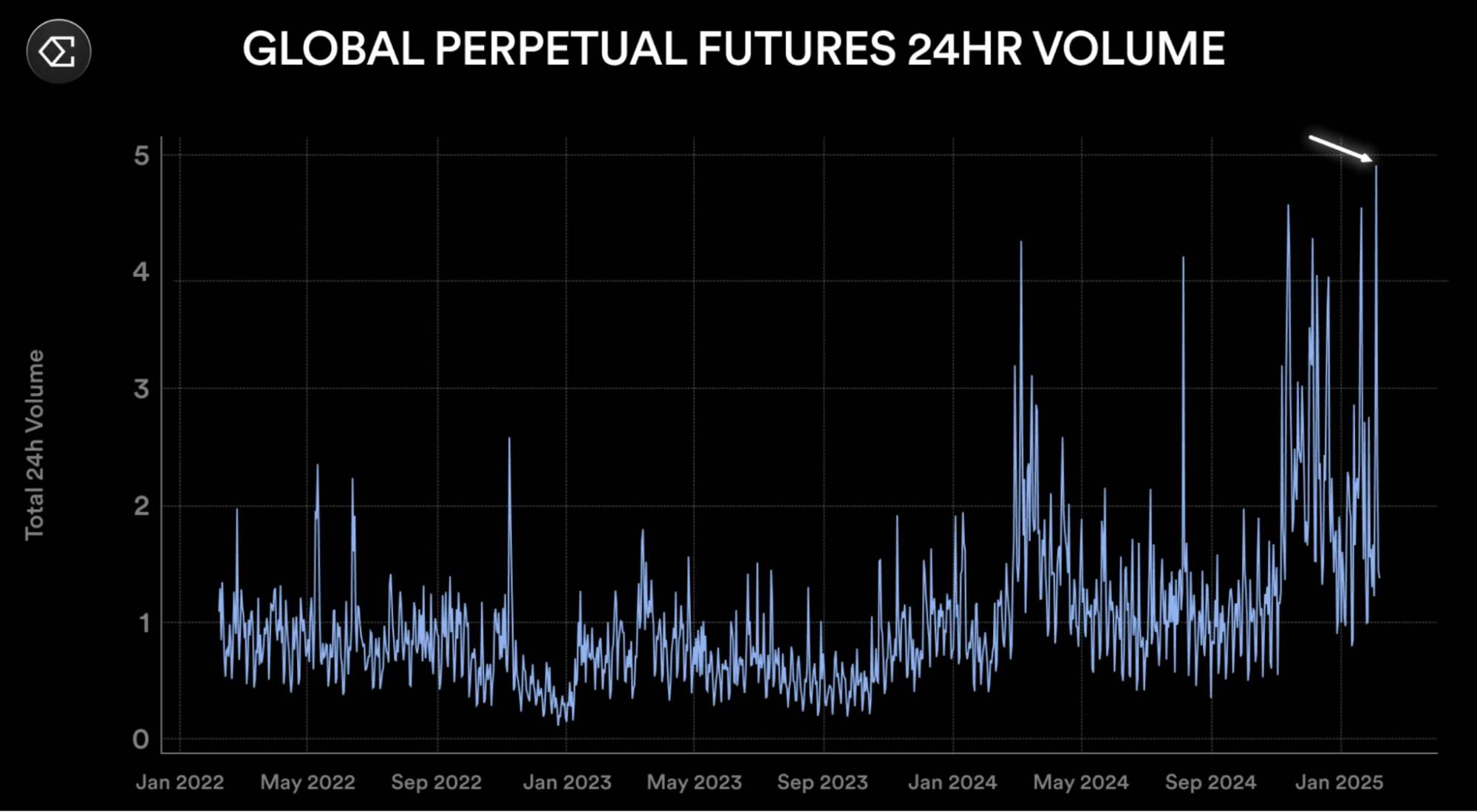

The stress test of the cryptocurrency derivatives market came unexpectedly. Last week's black swan-level liquidation event once again brought the fragility of the derivatives market to the forefront:

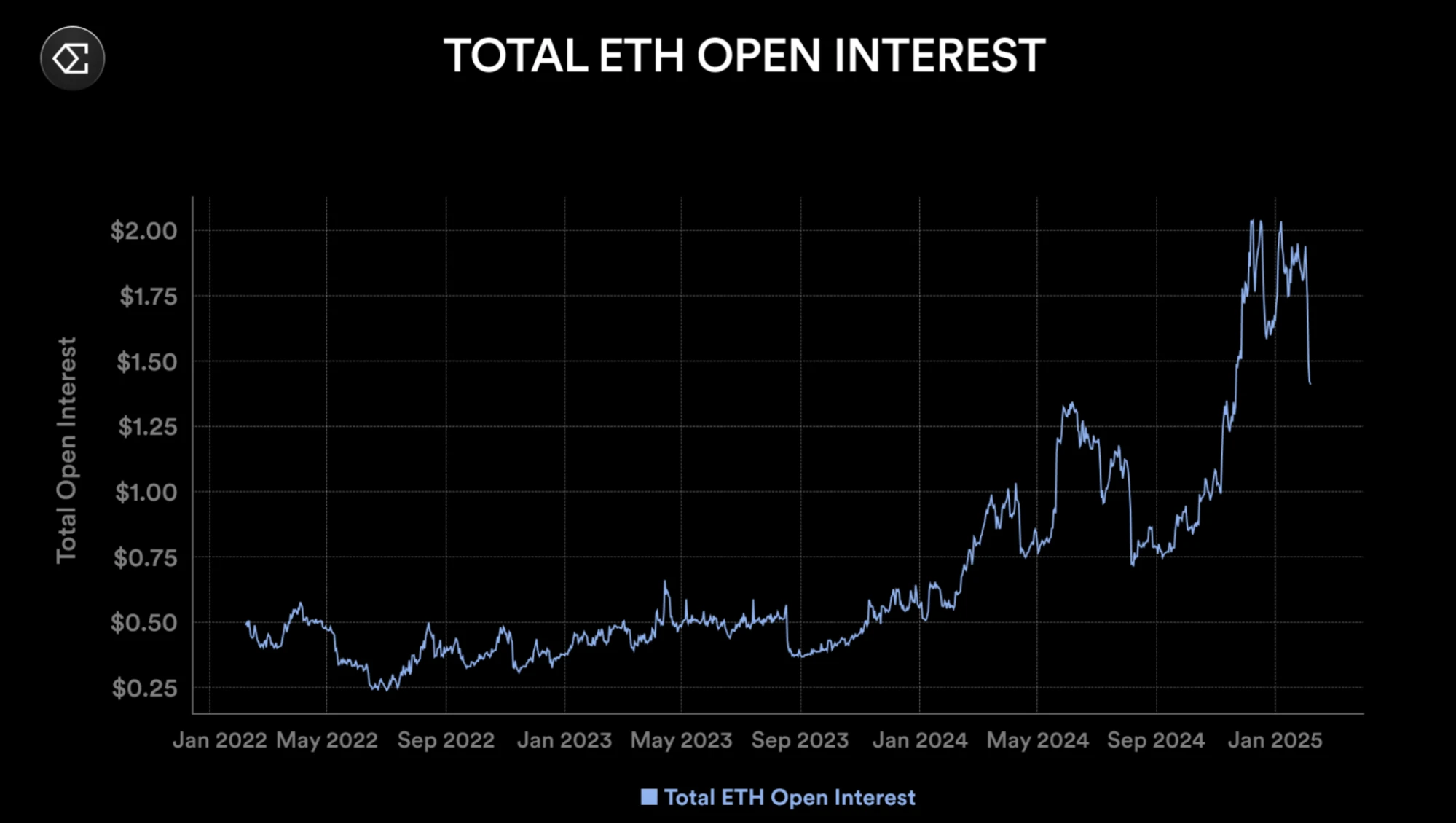

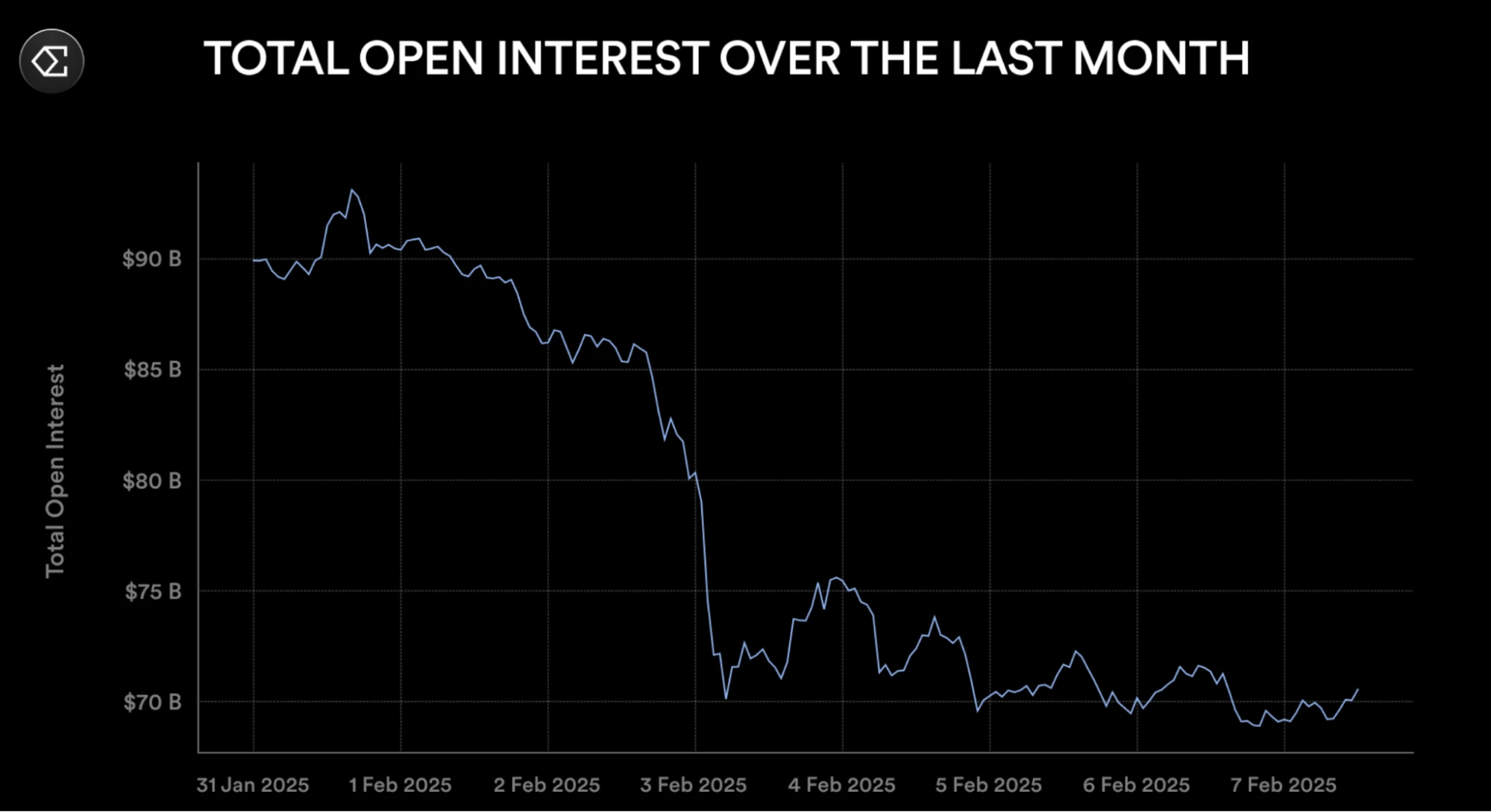

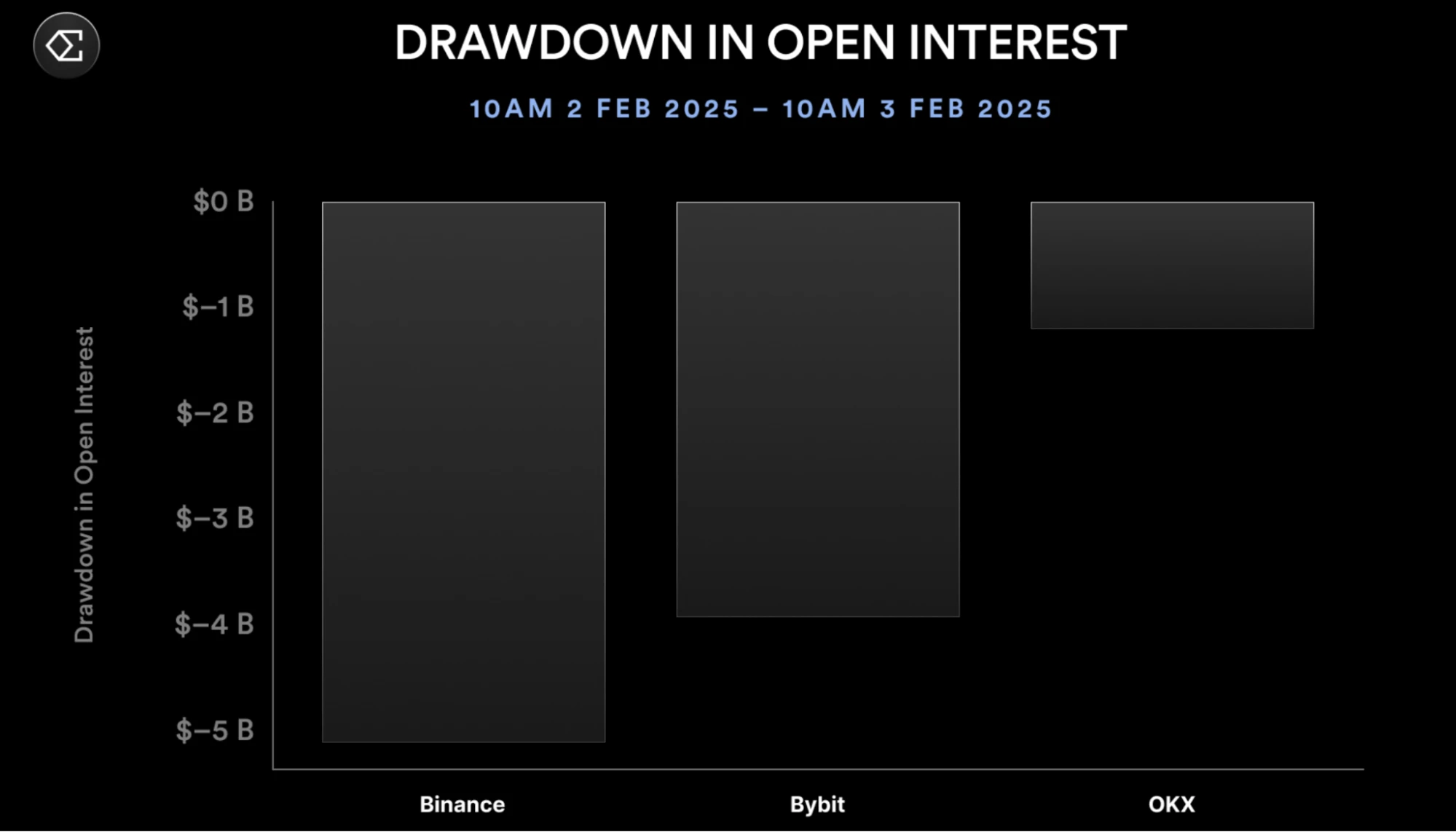

The open interest in ETH contracts plummeted by $2.3 billion in a single day, with the total contract positions across the network evaporating by over $14 billion, marking the largest single-day decline in history.

This extreme market condition unexpectedly became the best experimental ground for testing the hedging model of stablecoins.

Market Circuit Break: ETH Contracts at the Eye of the Storm

This liquidation event exhibited distinct structural characteristics: although the market size of BTC contracts is twice that of ETH, the open interest in ETH saw a weekly decline of 25% (a reduction of $5 billion), far exceeding the loss ratio of BTC. From February 2 to 3 alone, the ETH contract positions decreased by $2.3 billion in a single day, accounting for 16.4% of the total network decline. On-chain data indicates that this asymmetric selling pressure may stem from concentrated liquidations of nested leverage within the Ethereum ecosystem (such as LST re-staking, margin positions in DeFi protocols, etc.).

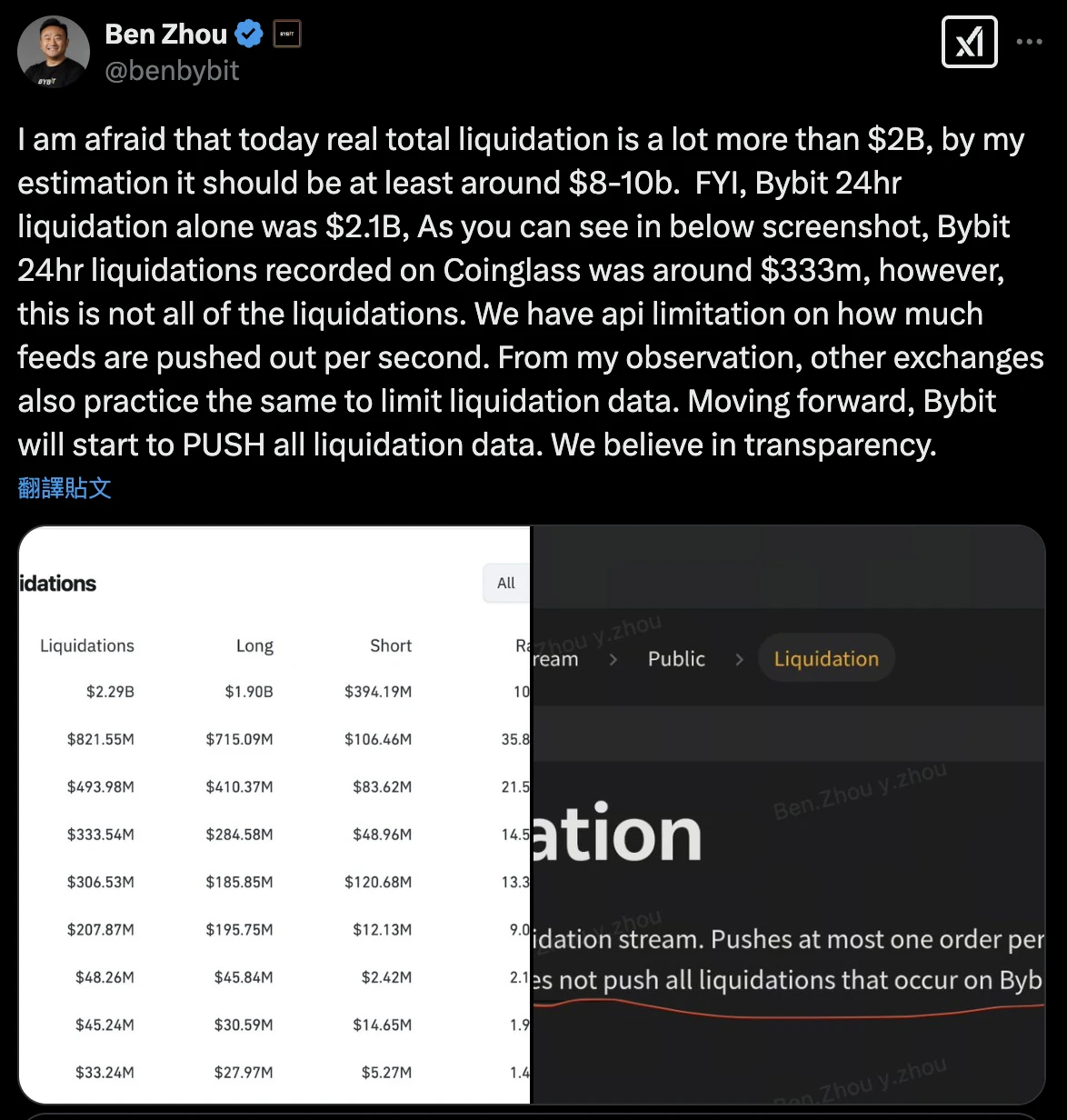

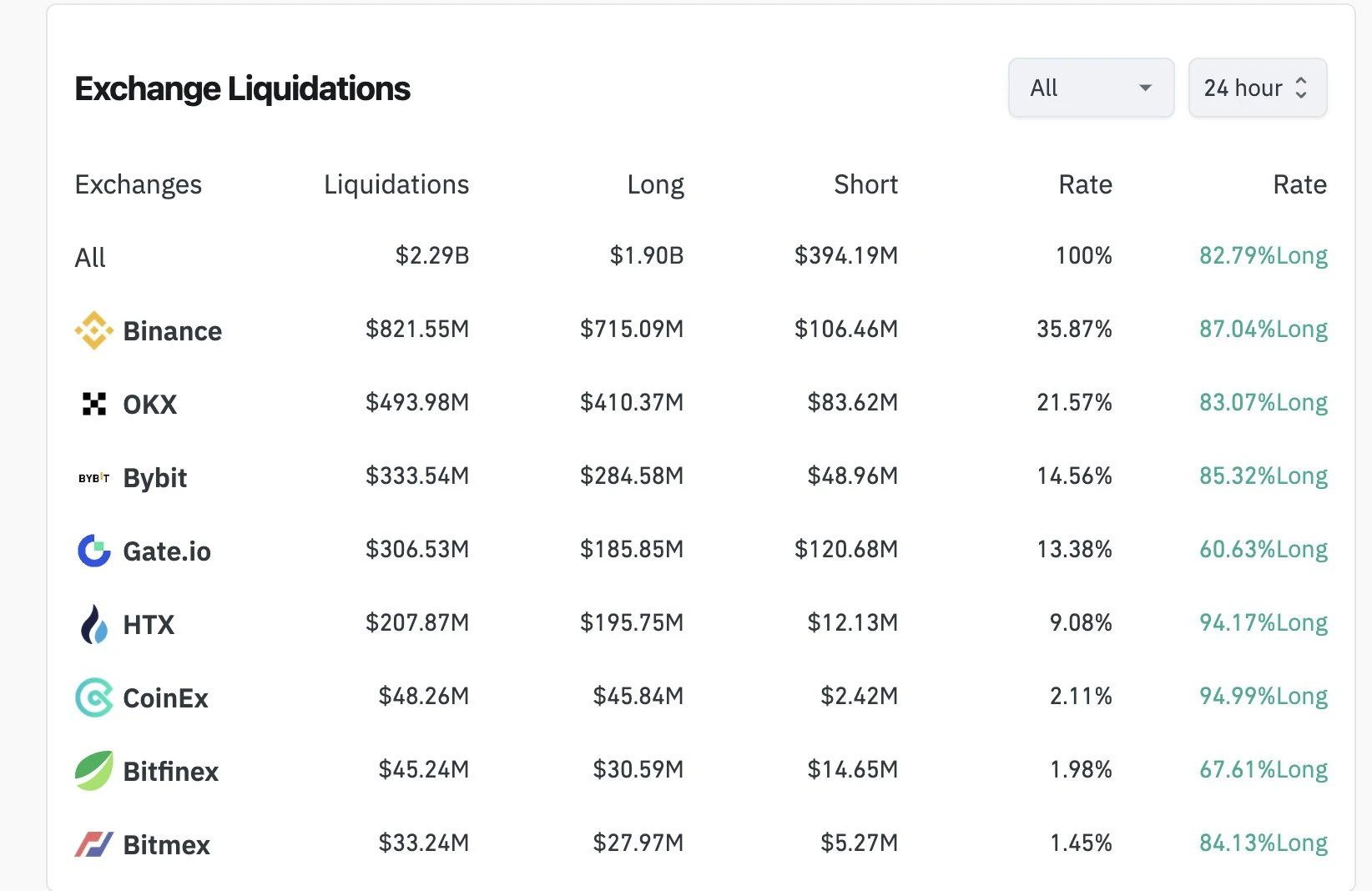

Exchange data shows that there is a significant statistical bias in the scale of this round of liquidations. Third-party platforms like Coinglass reported a liquidation amount of only $2.3 billion, but founders of leading exchanges estimated that the actual losses could reach $8-10 billion based on internal data. This discrepancy may arise from limitations in the data push from exchange APIs, leading to some liquidations not being captured in real-time. For example, Bybit's officially disclosed liquidation amount ($2.1 billion) far exceeds the $333 million recorded by Coinglass. If calculated based on this logic, this event may represent the largest actual liquidation scale in cryptocurrency history.

The Anchoring Characteristics of Stablecoins: Mechanism or Luck?

In the context of a sharp contraction in market liquidity, users had to turn their attention to the anchoring performance of stablecoin protocols. What surprised me was that some protocols managed to gain additional profits during the market sell-off through clever strategies. While most leveraged players fell during the liquidation wave, Ethena's synthetic dollar stablecoin USDe executed a counter-trend operation: its 24-hour redemption volume reached $50 million, with secondary market trading exceeding $350 million, and the price difference with USDT remained anchored within a ±0.1% range. Price curves show that USDe's movements were highly synchronized with fiat stablecoins like USDC and DAI, with the collaboration between CEX market makers and on-chain arbitrageurs effectively offsetting short-term liquidity shocks.

USDe Price Compared to USDC (Red) and DAI (Purple)

From a theoretical perspective, when the price of ETH perpetual contracts is deeply discounted compared to spot (with the maximum discount for Binance contracts being 5.8% this time), the unrealized profits generated by short positions create a natural buffer. The protocol converts part of these profits into realized gains through an automatic liquidation mechanism, thereby providing additional APY boosts for holders. Ethena is one such case: data shows that last week it captured $500,000 in profits through this strategy, contributing a 50 basis point weekly APY increase for sUSDe holders.

The core mechanism supporting this stability lies in its unique "spot + perpetual contract short" hedging combination.

The Double-Edged Sword Effect of Perpetual Contract Strategies

Reviewing this event reveals the key bottleneck of perpetual contract strategies: when the funding rate for ETH continues to decline (at times lower than that of BTC contracts), the profit model relying solely on funding rates faces challenges.

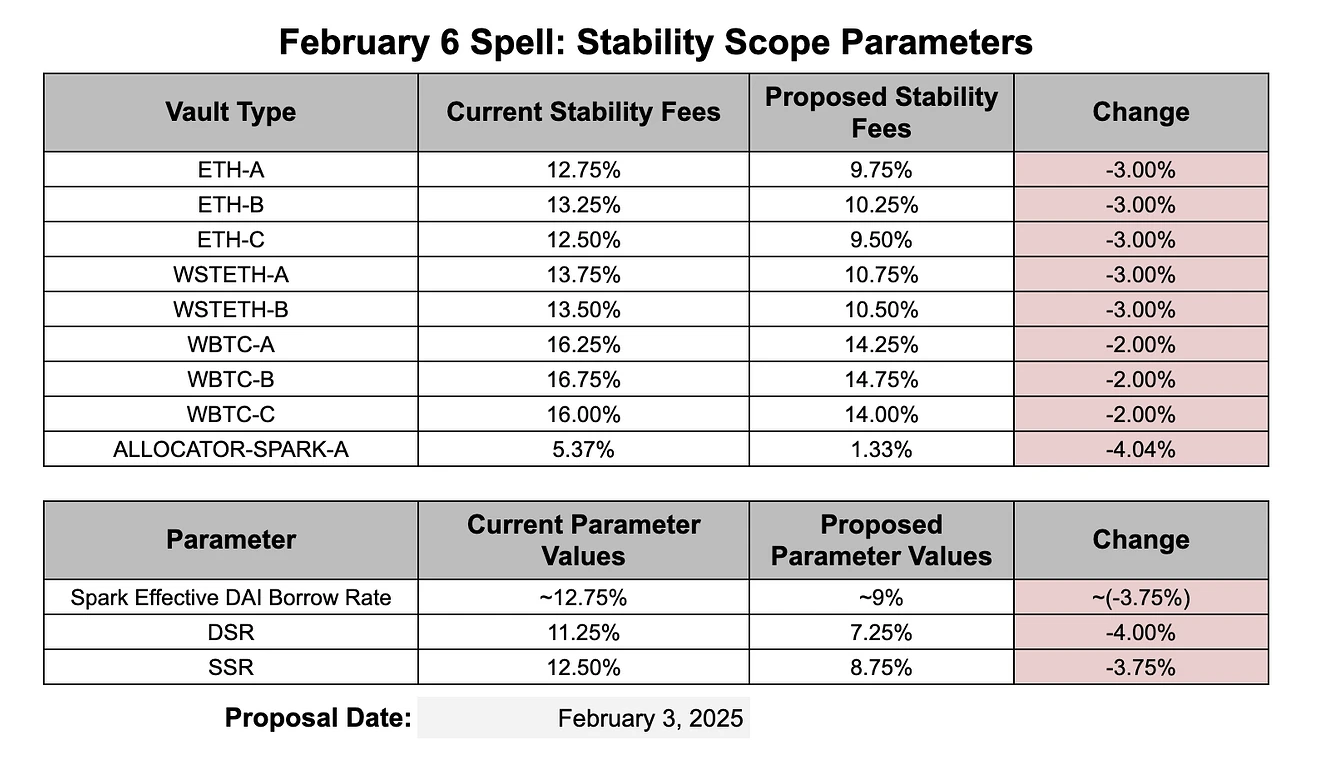

In response, Ethena's solution is to initiate dynamic rebalancing, shifting over $1 billion in collateral from perpetual contracts to on-chain stablecoin yield markets like Morpho and Aave (with some pools offering annualized returns of up to 8.75%). This "yield radar" model allows it to maintain a basic yield even during periods of low funding rates. However, the sustainability of this strategy still needs to be observed. When the market enters a deep bear phase, stablecoin yields may shrink with declining borrowing demand, while the negative funding rate losses of perpetual contracts may exacerbate. At that point, how will the protocol maintain yield attractiveness?

Another point of contention is the execution risk across exchanges. The discount on Binance's ETH contracts (5.8%) far exceeds that of platforms like Bybit and OKX (around 1%), leading to Ethena's short profits being highly concentrated on a single exchange. Although its automated system claims to capture cross-platform price differences, issues such as API rate limits and withdrawal delays during extreme market conditions may still erode arbitrage opportunities.

The "Impossible Triangle" of Derivative Stablecoins?

Regardless, Ethena's experiment provides new insights for the algorithmic stablecoin sector: hedging spot volatility through perpetual contracts may create a more capital-efficient anchoring mechanism than over-collateralization; while the design of a dynamic collateral pool attempts to find a balance between yield, liquidity, and security.

However, this stress test also reveals potential risks:

Liquidity coupling risk: When multiple exchanges experience deep discounts simultaneously, the concentration of short position liquidations may exacerbate price fluctuations;

Dependence on yield sources: Current yields come from the price differences of perpetual contracts and on-chain stablecoin yields, both of which are positively correlated with market risk appetite;

Black swan tolerance: If there is a liquidity drain across exchanges and asset classes (like the crash in March 2020), the hedging combination may face the risk of collateral cross-contamination.

A Test Without an Endgame

In this historic liquidation event, stablecoins like USDe demonstrated unexpected stability, but their true test may not have arrived yet. Once the market falls into a long-term death spiral of low volatility and negative funding rates, can this model relying on derivatives for hedging continue to generate returns? The answer may need to wait for the next crypto winter to arrive.

At the very least, this test proves one thing: in the valley of algorithmic stablecoins, what may traverse the bull and bear markets is not the most perfect design, but the most adaptive survival strategy.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。