Cryptocurrency exchange Coinbase (Nasdaq: COIN) beat analyst estimates by an eyepopping 109% when it revealed its Q4 earnings report on Thursday.

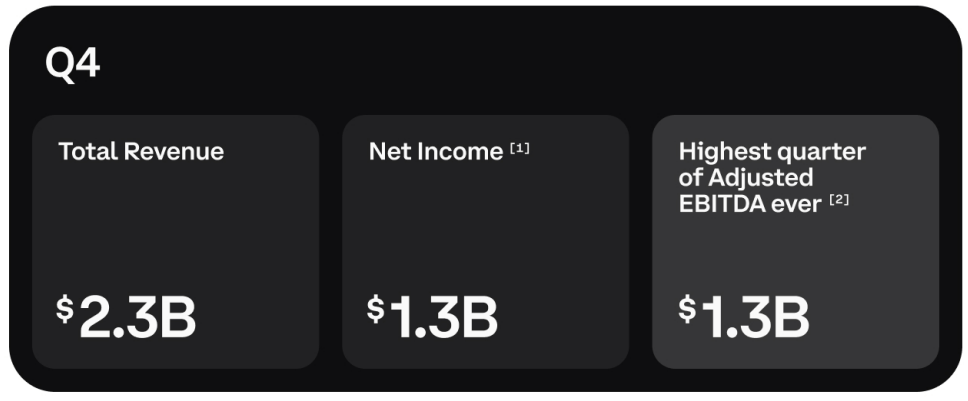

The firm raked in $6.6 billion in 2024 of which $2.6 billion was pure profit, and capped off 2024 with $2.3 billion in quarterly revenue and a Q4 net income of $1.3 billion.

(Coinbase Q4 revenue figures / Coinbase shareholder letter)

The stellar performance, according to Coinbase’s shareholder letter, was a result of higher crypto prices and revenue from services such as staking, custody, and the exchange’s flagship subscription product Coinbase One.

But after twenty-three analysts predicted the exchange would only produce net income of $2.16 for each of their 286.5 million outstanding shares, Coinbase blew past those estimates and brought in a whopping $1.3 billion in Q4, exactly half of the entire year’s net income, producing an EPS of $4.51 which is more than double of what Wall Street pundits expected.

“Coinbase had an amazing 2024,” said CEO Brian Armstrong during the firm’s earnings call on Thursday evening. “I’m very optimistic on these next few years.”

The launch of spot bitcoin (BTC) exchange-traded funds (ETFs) in January and Donald Trump’s decisive victory in November’s presidential election were pivotal to Coinbase’s financial success, according to the letter.

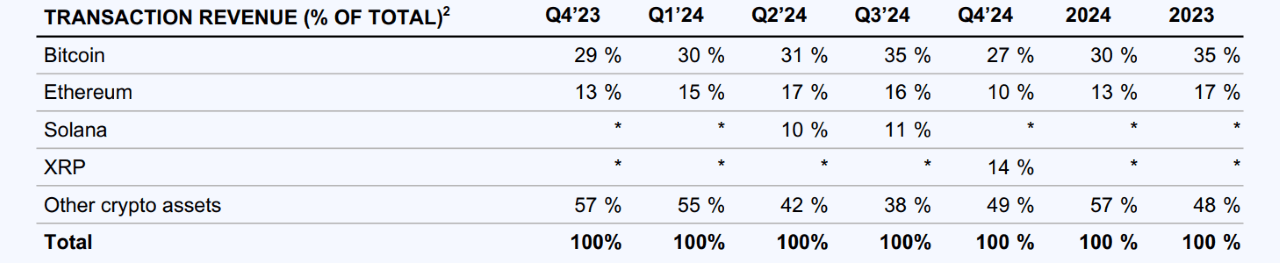

Bitcoin dominated trading and transaction volume, accounting for 32% of all trading volume in 2024 and 27% of trading volume in Q4. Similarly, the dominant cryptocurrency was responsible for 30% of transaction revenue for the year and 27% for the quarter.

(Source of transaction revenue / Coinbase shareholder letter)

“BTC inflows were the largest driver of native unit growth, driven by our role as primary custodian for the vast majority of ETFs,” the letter says. “We ended Q4 with $220 billion in assets under custody.”

Coinbase spent $363 million on general and administrative expenses in Q4. The category includes legal expenses. The firm has been a leader in lobbying the government to provide regulatory clarity and those efforts paid off handsomely when crypto-friendly Trump clinched the presidential nomination in November.

“Crypto’s voice was heard loud and clear in this recent U.S. election and it’s the dawn of a new era,” Armstrong said. “President Trump is moving fast to fulfill his promise of making the U.S. the crypto capital of the planet.”

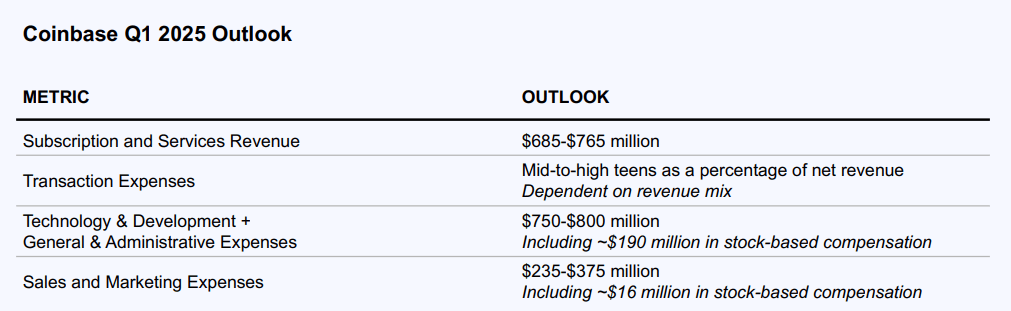

So far, Coinbase has already generated roughly $750 million in transaction revenue and expects its other services to bring in up to $765 million for Q1 2025.

(Q1 2025 outlook / Coinbase shareholder letter)

“The most pro-crypto Congress we’ve ever seen is now leading the charge on stablecoin and market structure legislation,” Armstrong said. “It’s hard to overstate the significance of this change that’s happened in the last few months.”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。