Bitcoin ETFs Extend Outflow Streak

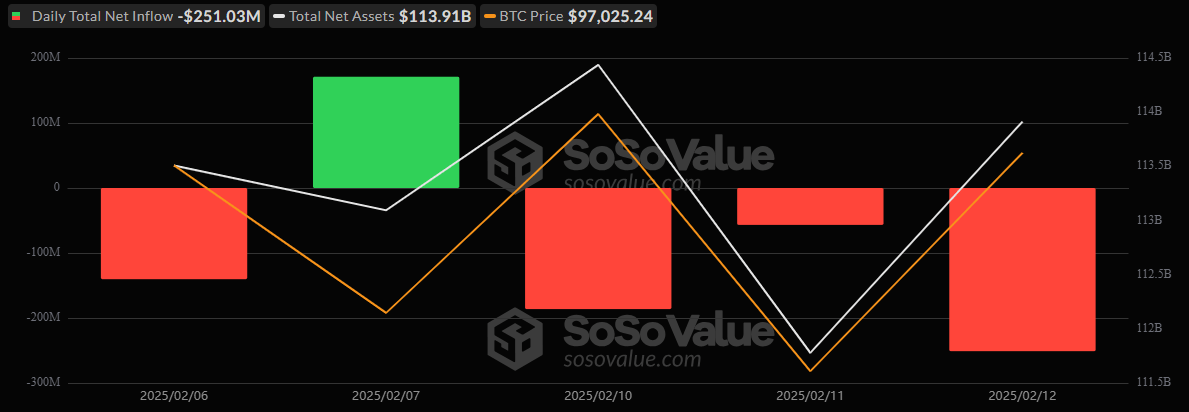

Bitcoin and ether exchange-traded funds (ETFs) faced significant withdrawals on Wednesday, Feb. 12. Bitcoin ETFs recorded their third consecutive day of outflows, totaling $251.03 million.

Notably, Fidelity’s FBTC and Ark 21Shares’ ARKB were the primary contributors, with outflows of $101.97 million and $97.03 million, respectively.

Bitwise’s BITB and Blackrock’s IBIT were not spared the market downturn, with each fund losing $25.94 million and $22.11 million, respectively. The only bright spot was Grayscale’s BTC, which brought in $16.34 million.

Over the past five trading days, bitcoin ETFs have experienced only one day of inflows with the four other days seeing significant outflows.

Ether ETFs were not immune to the downturn, experiencing a net outflow of $40.95 million. Grayscale’w ETHE was the most affected, accounting for $30.23 million of the total outflow. The other loss came on Fidelity’s FETH with a $10.72 million funds exit.

The substantial withdrawals from prominent funds like FBTC, ARKB, BITB, and IBIT highlight a cautious approach among investors during this period.

As of Feb. 13, BTC is trading at approximately $96,000, reflecting a 2% decrease from the previous day. ETH’s price stands at around $2,600, marking a 1.5% decline.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。