Centralized crypto exchange Cryptomus promises “one account, endless possibilities” thanks to its large active user base, high liquidity and array of features.

With fees that decrease as trading volumes rise, Cryptomus currently supports 18 major digital assets including Bitcoin, Ethereum, Solana and TON.

The ecosystem claims to serve more than 400,000 customers, whose funds are secured through anti-money laundering and know your customer checks, along with two-factor authentication. Emphasizing its “high level of security,” Cryptomus has also undergone an audit from blockchain security firm CertiK.

Unique matching mechanism

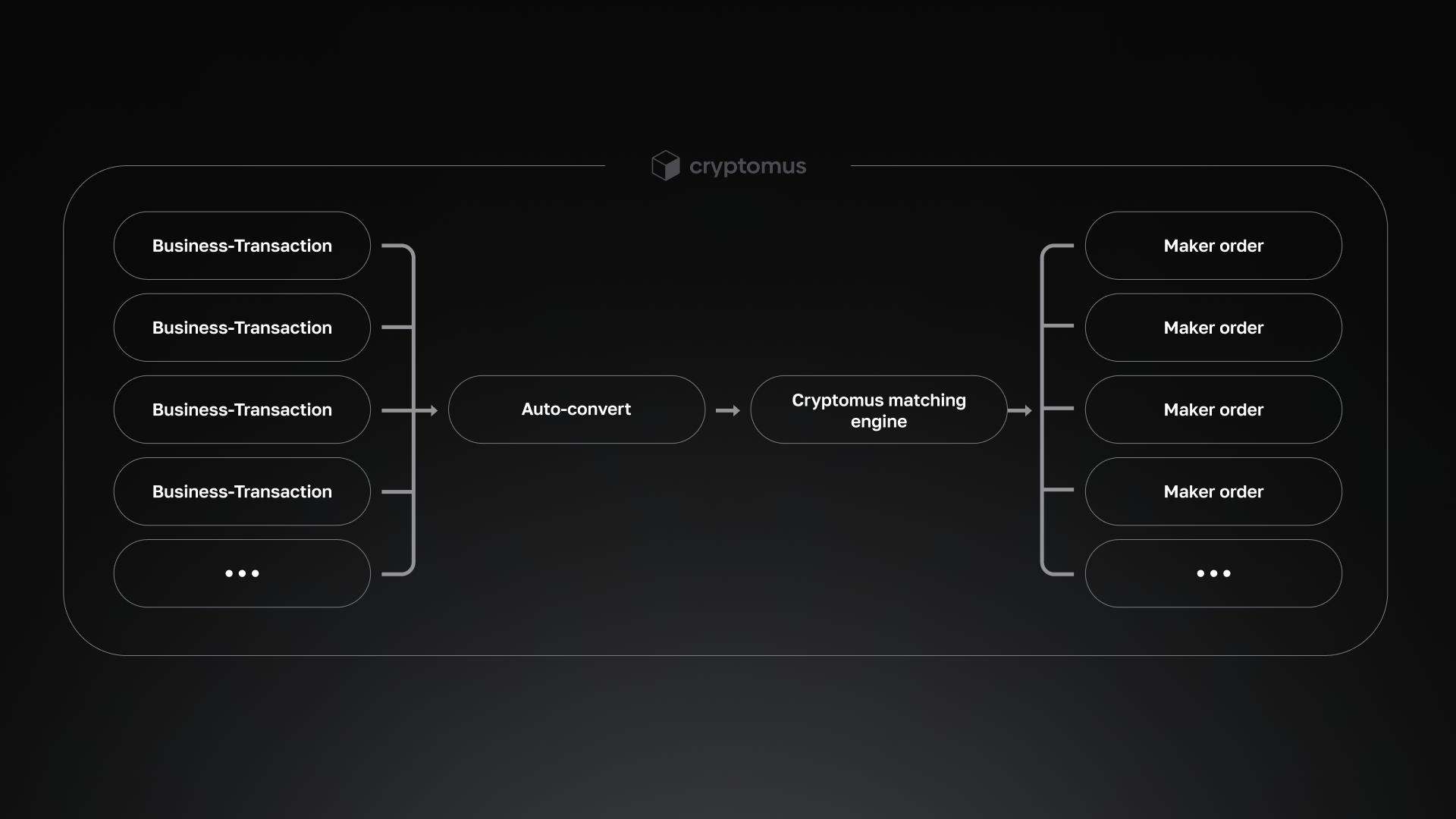

Cryptomus offers a “unique matching mechanism” that aims to deliver better conditions for market traders by strengthening liquidity and narrowing the bid-ask spread.

Cryptocurrency from business transactions converts to stablecoins, and are placed as maker orders instead of market orders—and figures from this trading platform suggest it's used by more than 100,000 institutional clients.

Cryptomus Matching Mechanism. Image: Cryptomus

This, coupled with programs that reduce latency, aims to deliver an optimal environment for high-frequency traders as they seek to capitalize on minute-by-minute movements in the markets.

Cryptomus says it's driven to deliver a fast trading API so orders can be executed quickly, with consistent liquidity adding another layer of speed and convenience.

The exchange also offers a range of partnership programs. Those who refer new users can receive 30% of their fees, with further incentives available for market makers who offer their liquidity, affiliates, and brokers.

As adoption continues to grow internationally, especially in emerging markets, the exchange offers support in 18 languages—complemented by 24/7 support, so customers can get in touch via email and live chat whenever needed.

Other services within the Cryptomus ecosystem include staking, offering daily payouts with a minimum lock-up period of just three days, and yields ranging between 3% and 20% APR across cryptocurrencies including ETH, BNB, DAI and TRX.

An “innovative” peer-to-peer exchange means that users can trade directly with one another, while a blockchain explorer enables transactions to be tracked in one place.

The Cryptomus app, available on iOS and Android, is designed to serve as a one-stop-shop for customers. As well as facilitating the seamless transfer of funds between wallets, cryptocurrencies can be received, withdrawn and converted directly from smartphones, with support for trading set to be added in a coming update.

Tackling crypto's pain points

Cryptomus says every aspect of its ecosystem has been designed with the end user in mind.

A spokesperson for the exchange emphasized that new tokens are “thoroughly verified” before listing, so as to ensure that “there will be no pump and dump schemes on our platform.”

Meanwhile, thoughtful security features—such as a block on withdrawals when passwords are changed immediately after a login—help keep assets safe. Cryptomus added that its focus on liquidity avoids sudden fluctuations in quoted prices.

Another pain point facing this industry more widely lies in how it can be difficult for businesses to accept digital assets as a payment method. Responding to this need, Cryptomus has launched a Payment Gateway for merchants, and says commission fees as low as 0.4% are available. The platform also offers a white-label Payment Gateway solution, alongside fiat deposits for crypto purchases and mass payouts.

Amid growing demand for digital assets, Cryptomus says that its large base of active users, high liquidity and expansive feature set delivers the services that consumers, institutions and merchants need.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。