Green Week for Digital Assets Despite Trade Tariffs and Deepseek Volatility

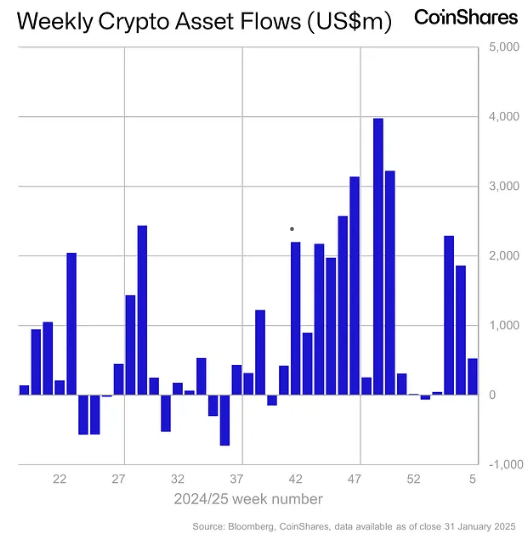

Digital asset investment products recorded $527 million in inflows last week, despite investor uncertainty driven by macroeconomic factors such as U.S. trade tariffs and China’s Deepseek developments.

Bitcoin remained the dominant asset, attracting $486 million in inflows, while short bitcoin products saw a second consecutive week of inflows totaling $3.7 million. XRP emerged as the second-best performing altcoin with $15 million in inflows last week and $105 million year-to-date (YTD).

However, the week started on a bearish note with Deepseek-related concerns triggering $530 million in outflows on Monday. The market quickly rebounded, closing the week with over $1 billion in inflows, highlighting ongoing investor confidence despite volatility.

Regionally, the U.S. led inflows with $474 million last week and $5 billion YTD. Europe followed, recording $78 million in inflows and $93 million YTD while Canada faced $43 million in outflows, likely influenced by U.S. trade tariffs.

Ether ended the week with neutral flows, reflecting its exposure to technology sector risks and global economic uncertainty. Meanwhile, blockchain equities have accumulated $160 million YTD, as investors view market corrections as buying opportunities.

Despite short-term volatility, the crypto market continues to attract institutional and retail capital, signaling long-term optimism in the digital asset space.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。