Following a multi-week acquisition spree of bitcoin (BTC), Microstrategy (Nasdaq: MSTR) entered a strategic hiatus this week, halting its accumulation of the leading cryptocurrency, as noted in a social media post by Saylor. “Last week, Microstrategy did not sell any shares of class A common stock under its at-the-market equity offering program, and did not purchase any bitcoin,” Saylor posted to X. “As of 2/2/2025, we hodl 471,107 BTC acquired for ~$30.4 billion at ~$64,511 per bitcoin.”

The revelation arrives as bitcoin weathers a tempest of external pressures, reportedly precipitated by recent tariff policies linked to Trump. The digital currency tumbled to a Sunday low of $91,530 per unit on Bitstamp, its lowest intraday valuation in recent weeks. Notwithstanding this depreciation, Microstrategy’s trove of BTC still retains a 47% appreciation, per data from blockchaincenter.net.

The same analytical tool—which humorously speculates how the firm might fare had it opted for ethereum (ETH)—concludes such a pivot would have yielded negligible returns. In aggregate, Microstrategy’s bitcoin portfolio commands an unrealized valuation of $14.281 billion.

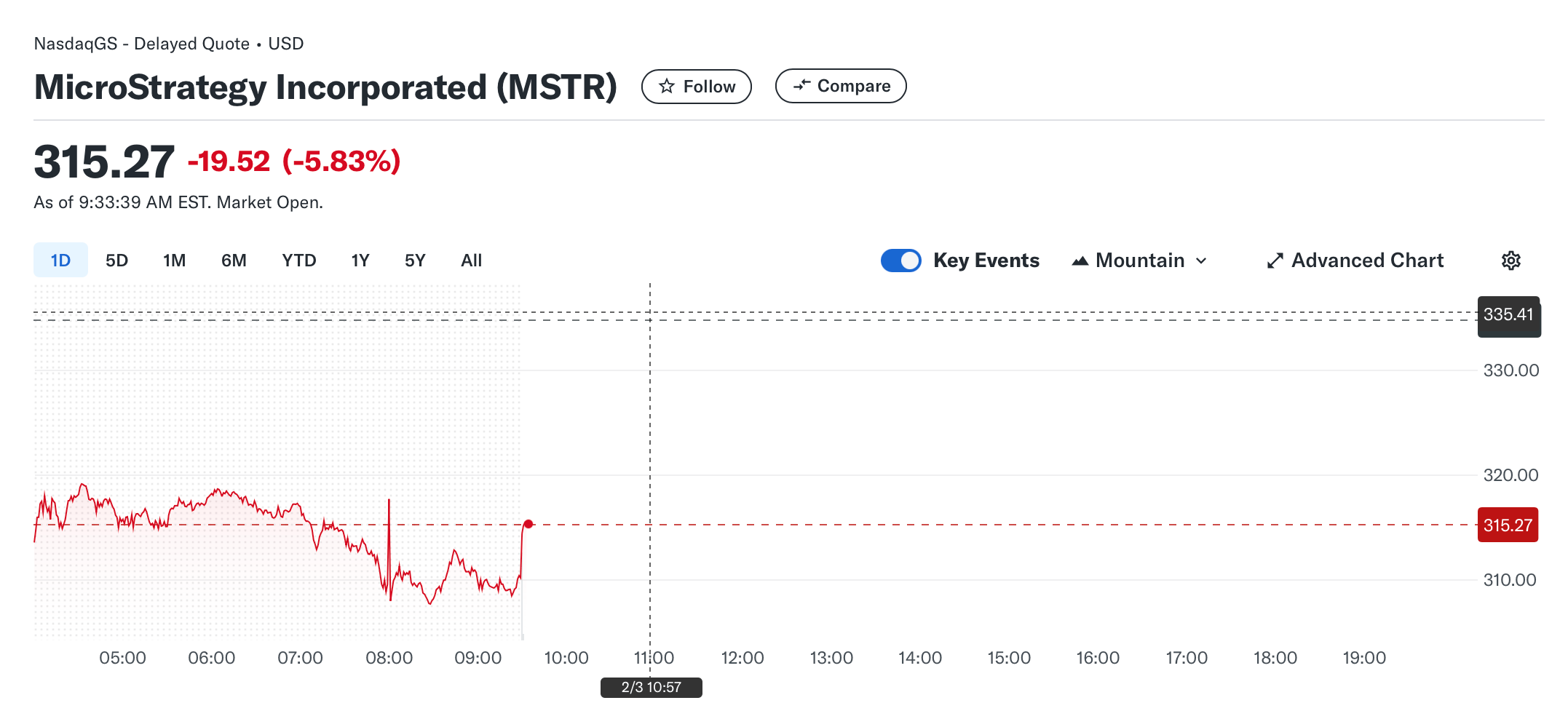

MSTR equity, meanwhile, exhibited relative stability ahead of recent market tremors, ceding a modest 1.68% across the previous five sessions. While the stock has soared 125% since September, its year-to-date trajectory reflects a tempered 11% climb against the greenback. As soon as the opening bell on Monday started on Wall Street, MSTR was down 5.83% against the U.S. dollar to start the day. Fifteen minutes later it had improved with MSTR only down 3.5% at 9:45 a.m. Eastern Time on Feb. 3.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。