Bitcoin.com News recently reported that Bitcoin’s transaction queue emptied for the first time in over two years. This marks a sharp contrast with the backlog in 2023, when the queue climbed to a record peak exceeding 600,000 unconfirmed transfers, and even in 2024 when most of the year witnessed between 150,000 and 250,000 unconfirmed transactions awaiting processing. As of Sunday, Feb. 2, 2025, mempool.space indicates there are only 5,988 transfers in the queue, and there have been several instances where blocks scarcely fill.

A wide array of impassioned and divergent viewpoints circulate regarding the empty mempool.

This development has ignited a flurry of discourse on social media platforms such as X and forums like Reddit. “Fair metric for the health of the project, and it’s not good,” James O’Beirne, commonly known as “Jamesob,” stated on X. Reddit forum moderator Bashco from r/bitcoin replied to Jamesob’s assertion. “It’s not necessarily ‘bad’ either,” Bashco said. “It does give credence to the idea that the block size should be reduced though. And the good news is that the recent spam attacks were ultimately costly failures. Transactional value is what matters.”

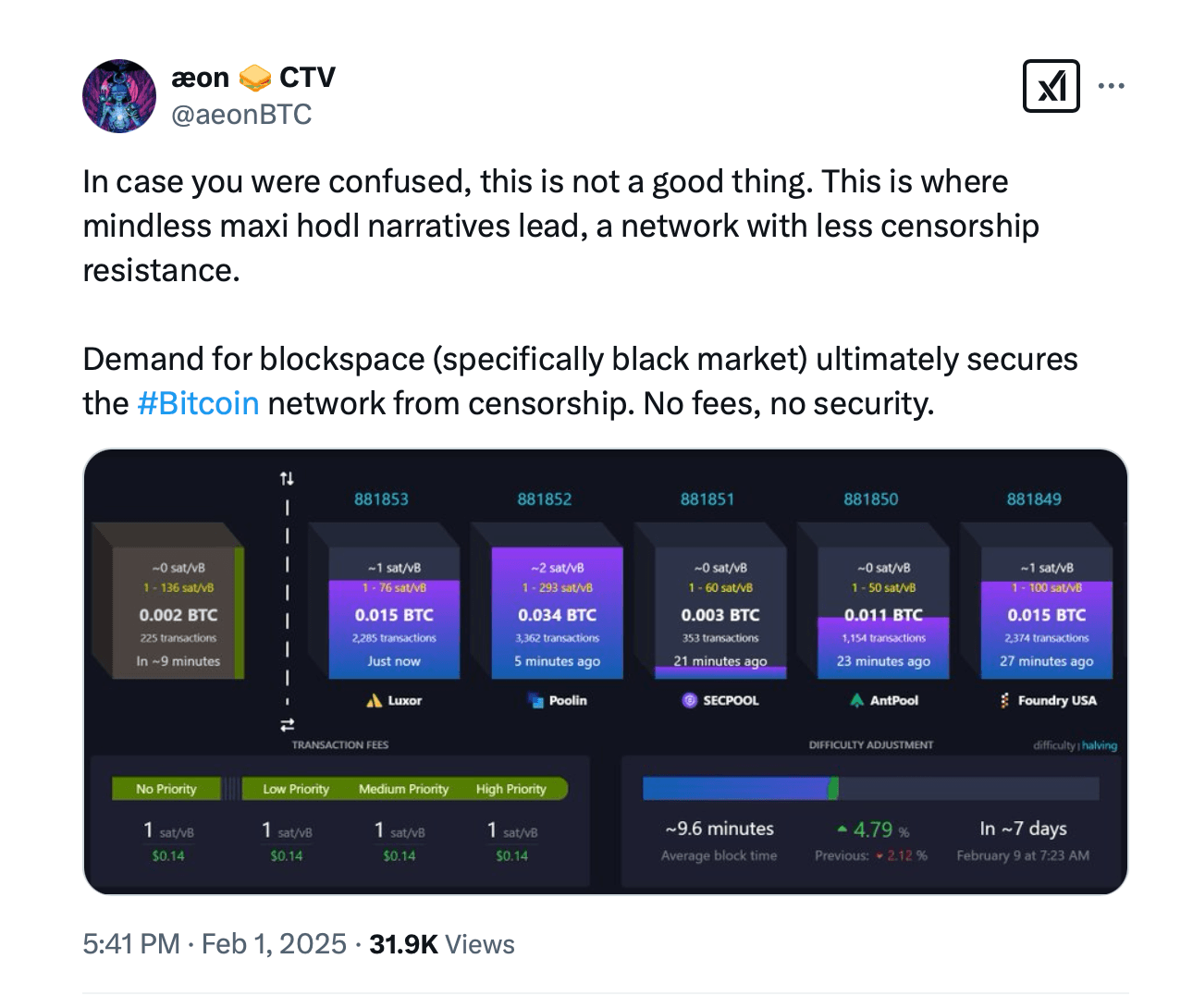

Jamesob responded. “This is a very tired narrative,” he wrote to Bashco. “No traffic on the chain means no usage outside of third party custodians. If things were going well and people were actually making firsthand usage of Bitcoin, the chain would be bustling continuously. We have created yet another stock ticker, congrats,” he added. Opinions on the matter remain split, as numerous individuals—Bashco among them—assert that an empty mempool is a positive development. “Bitcoin’s mempool is totally clear,” Joe Consorti wrote. “Four of the last five blocks were not filled, and transaction fees are ~1 sat/vB or less.”

Consorti added:

24/7, cheap, instant, global, final settlement.

Some believe the lack of activity on Bitcoin’s layer one (L1)—its base blockchain—could undermine the very foundations of the network over time, potentially leading to its decline. Bitcoin’s security model relies heavily on miners being incentivized to validate transactions and secure the blockchain through block rewards and transaction fees. As Bitcoin approaches its final halvings, block rewards will diminish, leaving transaction fees as the primary compensation for miners.

People also contend that BTC fees should remain low, yet this principle applies to millions—or even billions—of people worldwide using Bitcoin as a peer-to-peer electronic cash system. When billions of individuals employ BTC, fees prove negligible; however, that is not the case when barely 400,000 transfers occur each day. Should both fees and transfer activity stay minimal and continue to decline, a precarious cycle may unfold: fewer miners would participate, diminishing the network’s hashrate and rendering it more susceptible to attacks.

“Bitcoiners celebrating that the mempool cleared is one of the most retarded things I’ve seen in a while,” the X account Bart Mol wrote. “The digital gold narrative is slowly destroying the foundation of Bitcoin, like wood rot in the foundation of a house.”

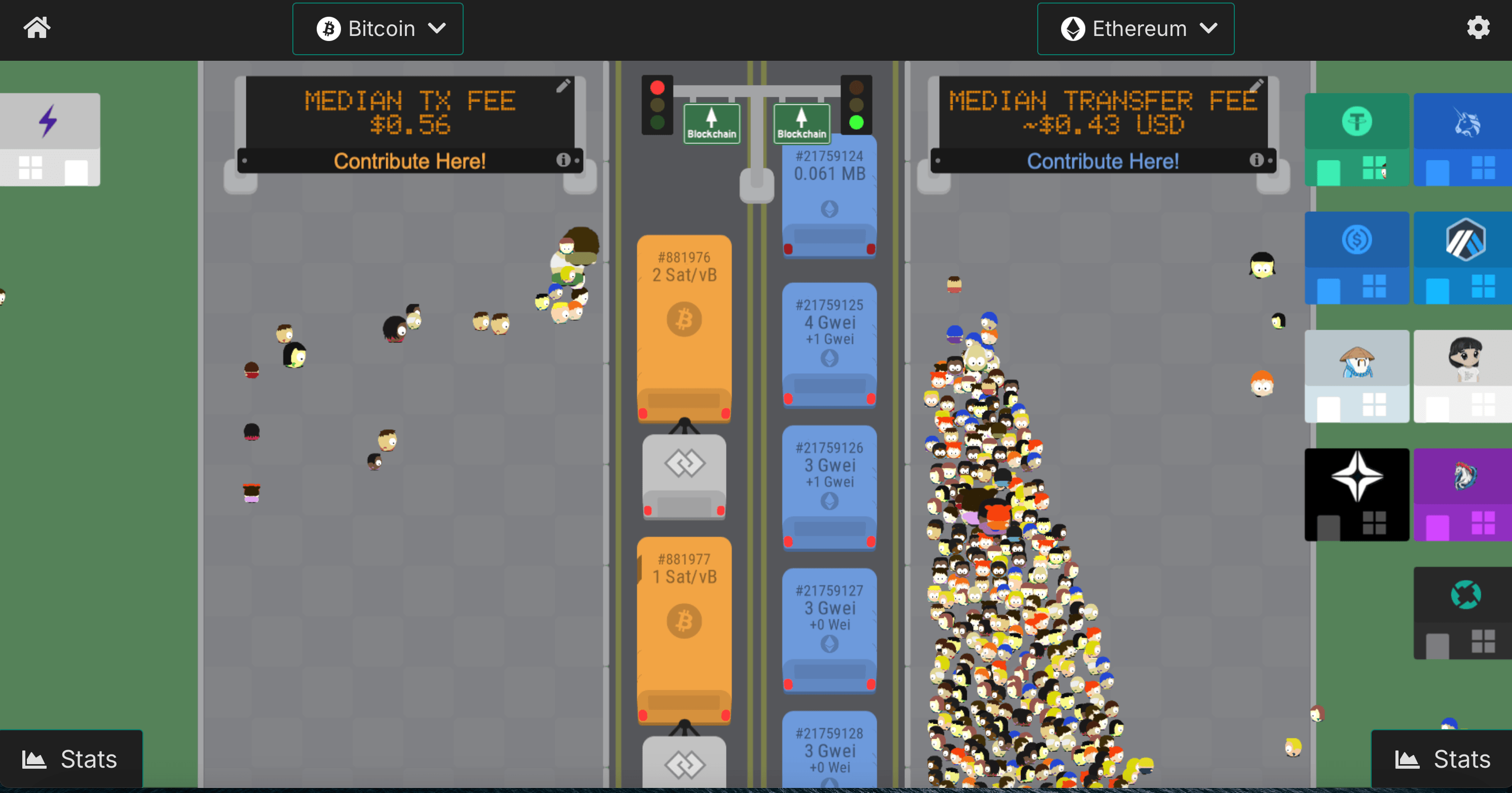

A visual of txcity.io showing Bitcoin vs. Ethereum in terms of real-time transactions at 8:30 a.m. Eastern Time on Sunday, Feb. 2, 2025.

However, not everyone is alarmed by the empty mempool and many have mentioned the backlog fluctuates as transaction demand rises and falls, reflecting natural shifts in network usage rather than inherent flaws. Congestion phases incentivize fee competition, reinforcing miner incentives and security, while quieter periods indicate smooth processing or temporary lulls. These cycles are fundamental to Bitcoin’s decentralized fee market, balancing scarcity and adaptability without signaling failure.

“The mempool clearing isn’t a good or a bad thing,” Marty Bent explained on X. “It just ‘is.’ People fear mongering and trying to cast current or past mempool states onto the future (whether it’s completely flooded or completely empty) are short sighted. Usage will ebb and flow and so too will mempools,” Bent added.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。