The latest data illustrates the stablecoin ecosystem has ballooned by a striking $14.429 billion in the past month, reflecting heightened activity in crypto markets. Figures from defillama.com detail a climb in the fiat-anchored digital asset economy from $202.867 billion to $217.296 billion as of Feb. 1, 2025.

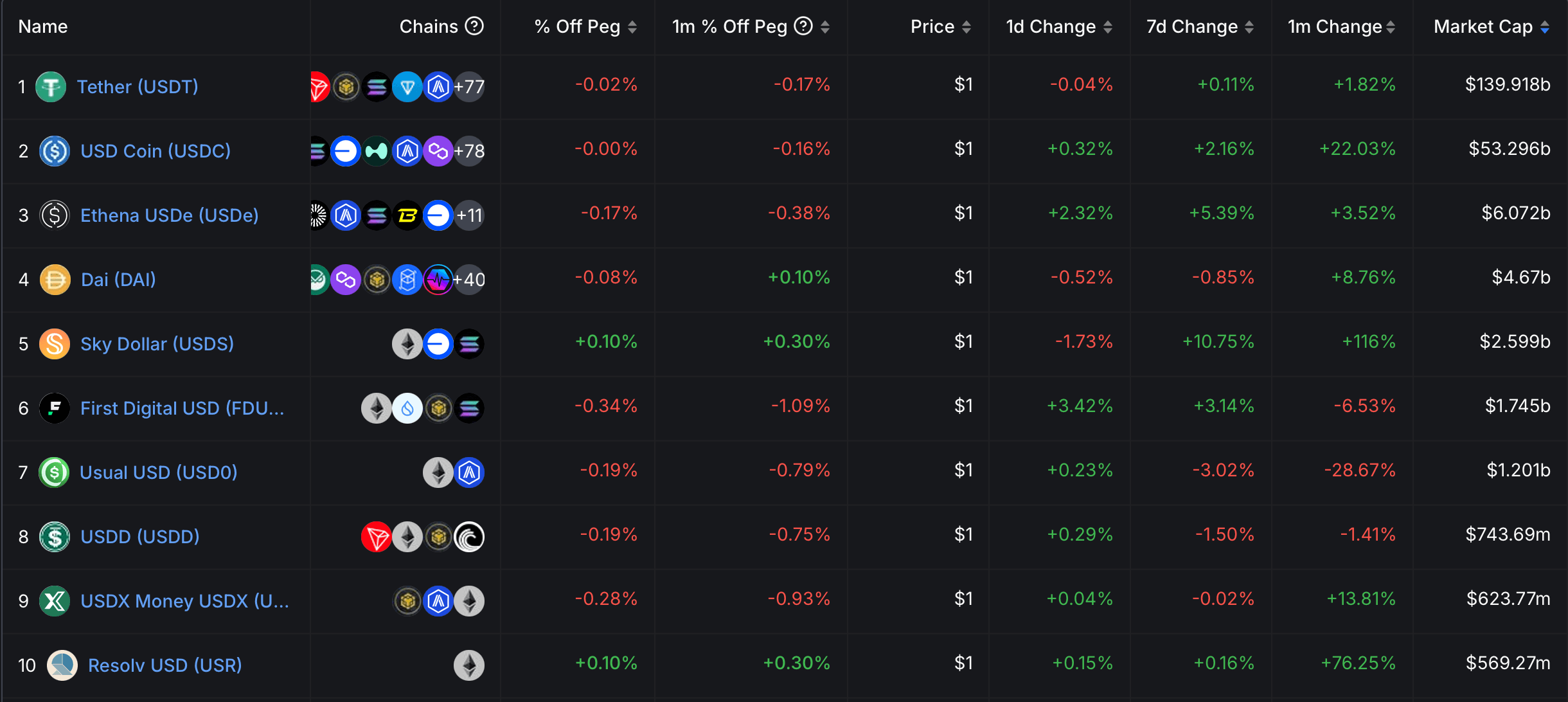

Top ten stablecoins by market cap according to defillama.com.

Seven of the top ten stablecoins recorded supply expansions, with industry titan tether (USDT) inching upward by a modest 1.82%. Dominating the growth charts, Sky’s USDS catapulted 116% in January to $2.599 billion, seizing the spotlight as this month’s unrivaled victor in terms of stablecoin growth.

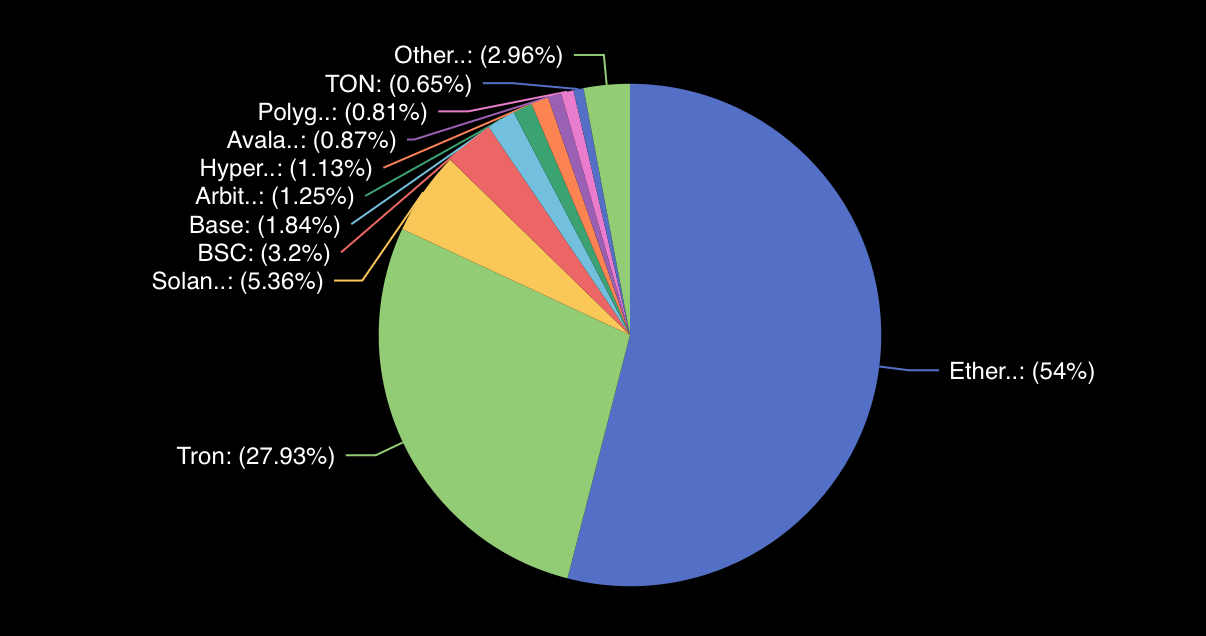

Stablecoin distribution in terms of blockchains via defillama.com data.

Trailing closely, resolv usd (USR)—a protocol collateralized by ethereum (ETH) and hedged by perpetual futures plays—boosted its supply by 76.25%, now totaling $569.27 million. Circle’s USDC claimed third place with a 22.03% uptick since Jan. 1, solidifying its status as the sector’s second-largest asset at $53.296 billion.

Additional notables in the top ten include USDE (+3.52%), DAI (+8.76%), and USDX (+13.81%). As of this weekend, Ethereum anchors $117.327 billion of the total $217.296 billion in circulation, while Tron hosts $60.682 billion.

Solana secures third with $11.654 billion on Feb. 1, followed by Binance Smart Chain (BSC) at $6.961 billion and Base with $3.994 billion. Solana and Base emerged as February’s standout platforms in terms of stablecoin issuance.

January’s expansion signals a maturing digital asset arena, where Ethereum, Tron, and Solana maintain strategic footholds, while Base demonstrates agility in capturing emerging demand. While everyone’s buzzing about how far this bull market might run, folks are also wondering: Just how big could the stablecoin economy get on the ride up?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。