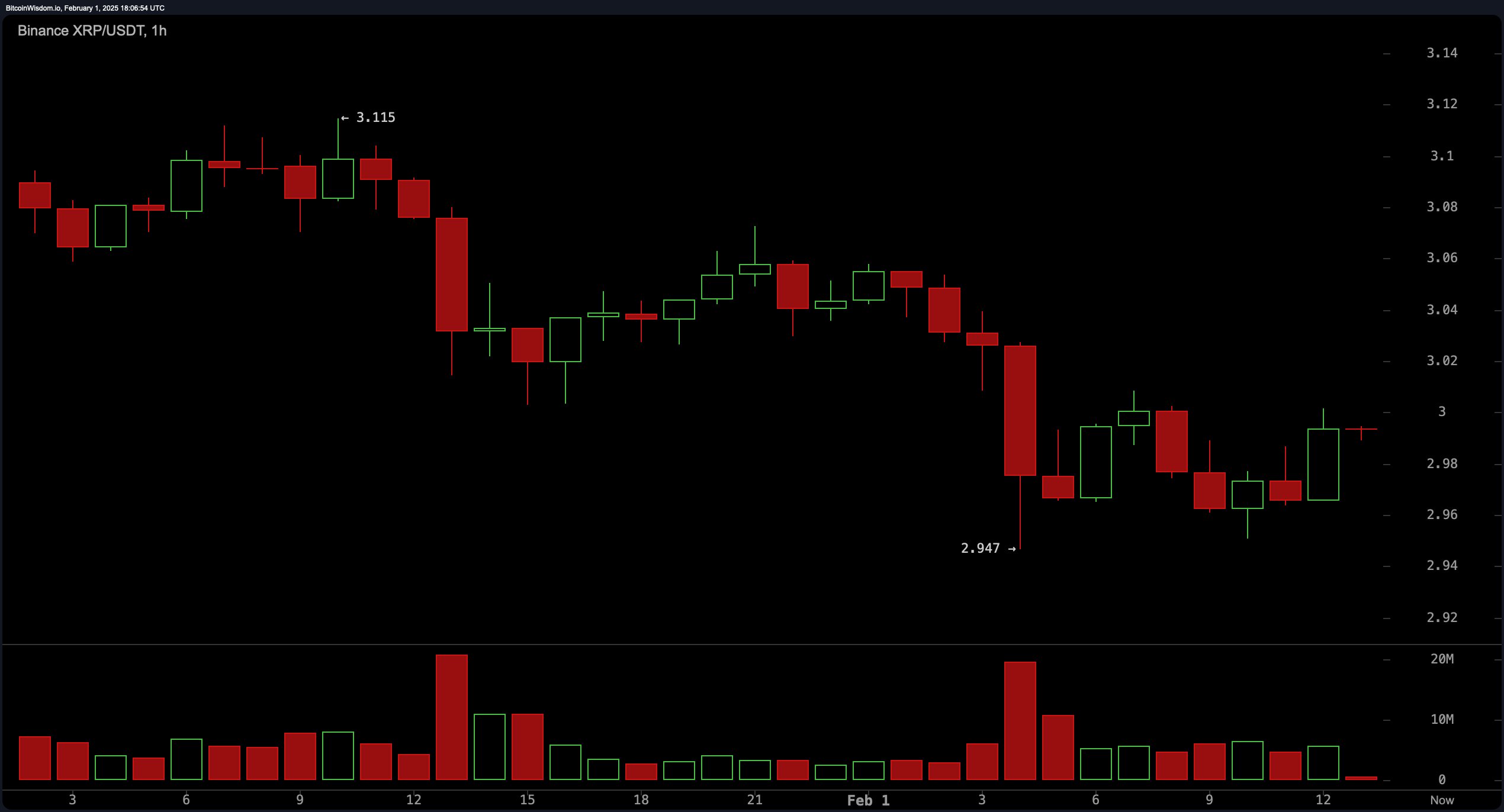

XRP’s one-hour price snapshot reveals a bearish trajectory crystallizing after XRP was rebuffed near $3.115, forging successive lower peaks and amplifying downward velocity. Escalating seller activity has nudged the asset toward the $2.95 foothold, a zone where buyer resurgence could materialize. Should this threshold falter, descent toward $2.75 becomes plausible. Conversely, heightened demand might spark a rally toward the $3.10 resistance.

XRP/USDT 1H chart via Binance on Feb. 1, 2025.

The four-hour chart echoes this dominant downward arc, with XRP unable to carve higher troughs since cresting at $3.40. Descending peaks fortify the corrective narrative, while evolving volume patterns tilt advantage toward pessimists unless $3.10 is decisively breached. Sustained elevation above this barrier would herald revived optimism; stagnation might precipitate a slide toward $2.65-$2.75 range.

XRP/USDT 4H chart via Binance on Feb. 1, 2025.

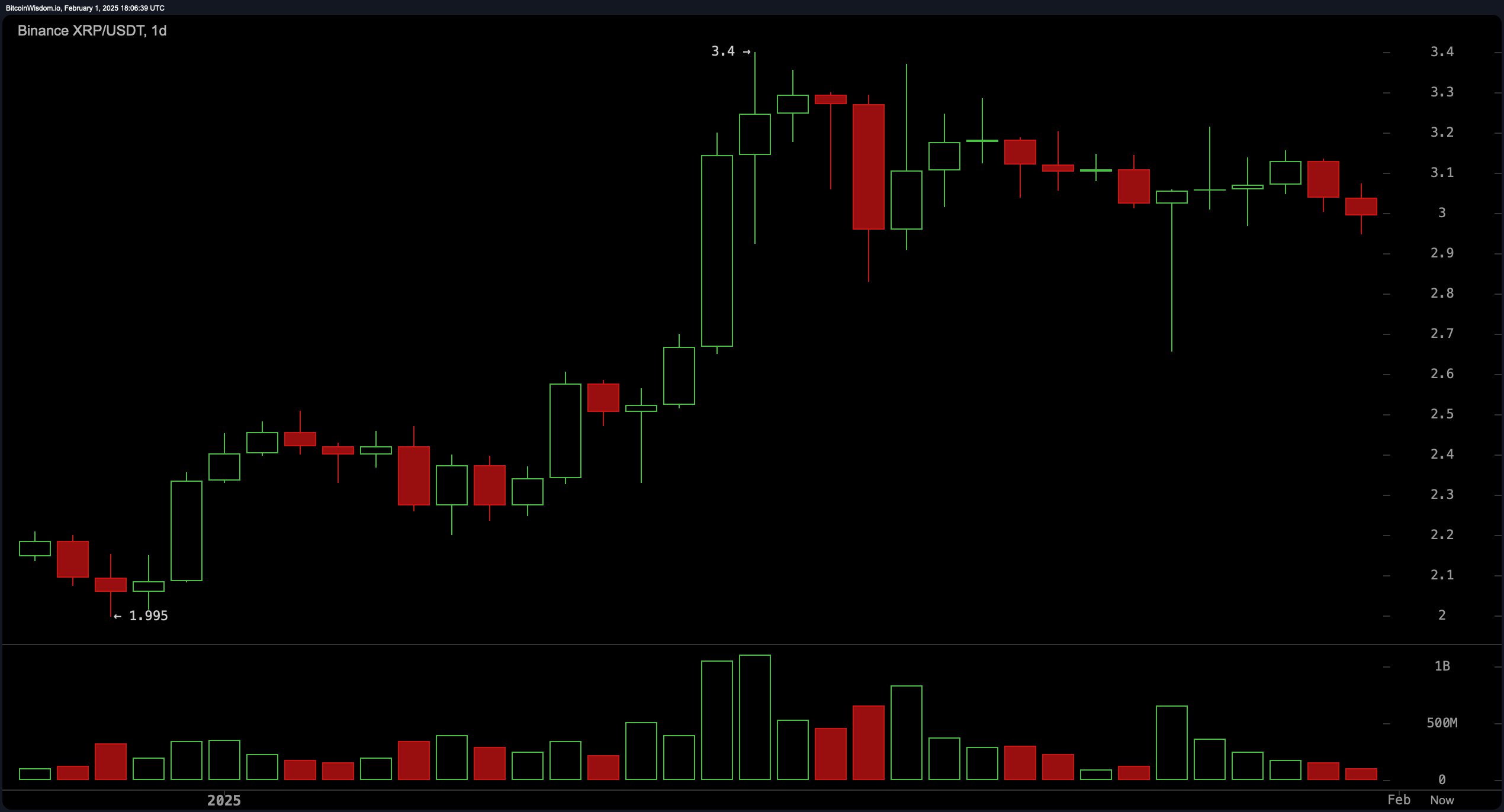

Daily metrics illustrate XRP grappling with downward forces post-recent highs, its struggle to reclaim $3.10 as support affirming seller dominance. Yet the broader bullish foundation endures provided $2.95 holds firm. Stabilization here could ignite a measured climb toward $3.30-$3.40. Conversely, slipping below $2.90 might accelerate retreats toward $2.75.

XRP/USDT 1D chart via Binance on Feb. 1, 2025.

Oscillators weave a nuanced narrative: The RSI at 54.95 reflects equilibrium, while the Stochastic (56.05) and CCI (-21.26) mirror ambivalence in market sentiment. An ADX of 16.92 confirms trend ambiguity, yet the AO’s 0.31 flashes a tentative green light. Counterbalancing this, momentum (-0.18) and MACD (0.14) tilt toward caution.

Moving averages (MAs) deliver a split verdict. Short-term EMAs (10 at 3.05) and SMAs (10 at 3.07) advise caution, while the EMA 20 at 2.97 whispers optimism. This aligns with extended averages—EMA 30 (2.86), EMA 50 (2.63), EMA 100 (2.13)—buttressing the case for enduring bullish potential. The 200-period averages further cement this outlook, amplifying $2.95’s significance as a linchpin for sustained upward trajectories.

Bull Verdict:

The enduring alignment of long-term moving averages—EMA 30 ($2.86), EMA 50 ($2.63), and EMA 100 ($2.13)—coupled with the 200-period averages’ unwavering upward bias, paints a resilient foundation for XRP. Should the $2.95 bastion hold firm, historical patterns and structural support suggest a revival toward $3.30-$3.40 remains plausible. The awesome oscillator’s nascent buy signal and the broader bullish architecture hint at latent strength, positioning patient bulls to capitalize on a potential resurgence once near-term turbulence subsides.

Bear Verdict:

Dominance by sellers in the immediate term, evidenced by cascading lower highs, weakening momentum indicators, and short-term moving averages flashing sell signals, tilts the scales toward caution. Failure to defend $2.95 risks triggering a cascading retreat toward $2.75 or lower, amplified by the asset’s inability to reclaim $3.10 as support. With oscillators reflecting indecision and the ADX confirming trend ambiguity, bears may exploit this fragility to extend the corrective phase unless a decisive catalyst—like a volume-backed breakout above $3.10—shifts the narrative.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。