The $1.8 trillion Norwegian Government Pension Fund Global (GPFG) increased its indirect bitcoin (BTC) exposure by 153% in 2024, according to crypto research firm K33 Research.

GPFG is Norway’s sovereign wealth fund, managed by Norges Bank Investment Management (NBIM), a division within the country’s central bank. It is the largest sovereign wealth fund in the world, according to the Sovereign Wealth Fund Institute, and invests in nearly 9,000 companies. Some of these—like Microstrategy (MSTR) hold bitcoin, providing indirect BTC exposure to the fund.

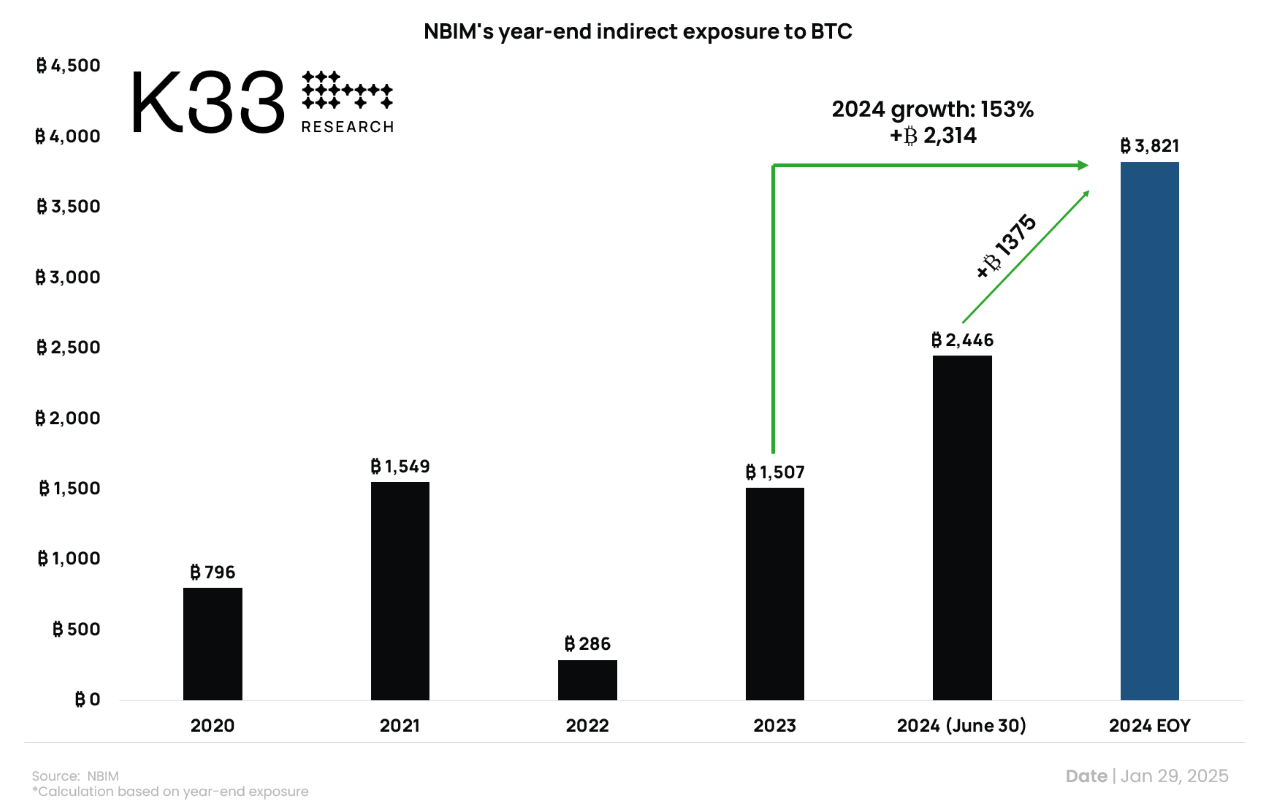

At the end of 2023, the fund’s indirect exposure was at 1,507 BTC, and by the end of 2024, that figure had ramped up to 3,821 BTC, a 153% jump in one calendar year. The change expressed in U.S. dollars (USD) is even more dramatic given bitcoin’s price appreciation – a sharp increase from $64 million to $357 million during the same period.

(2023-2024 increase in indirect BTC exposure for Norway’s Government Pension Fund Global / K33 Research)

“This exposure likely derives from rule-based sector weighting rather than a deliberate choice to prioritize BTC exposure,” said Vetle Lunde, head of research at K33. “The growth is a testament to the market maturing, and BTC ending up in any well-diversified portfolio, intended or not,” he added.

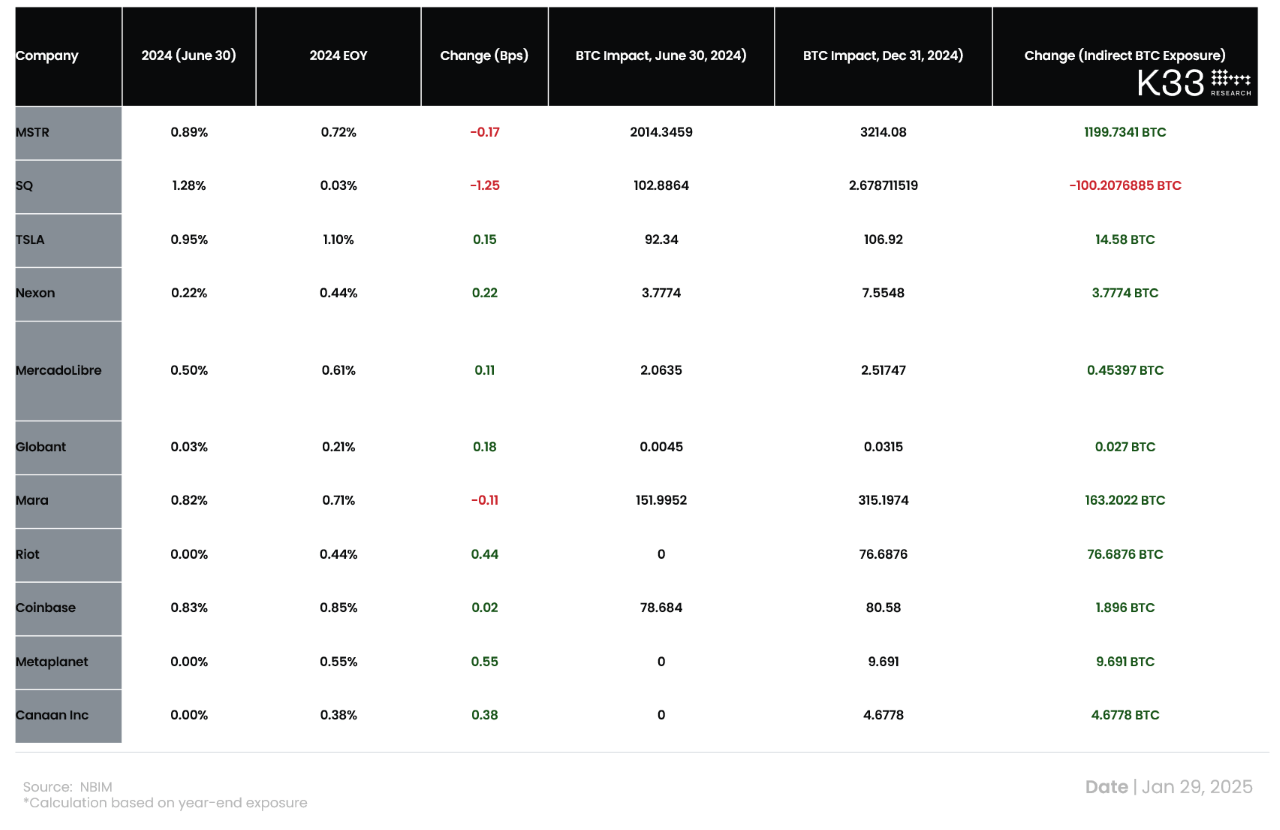

The fund has stakes in at least eleven companies with BTC holdings, the most notable being a $500 million position in Microstrategy stock, which accounts for roughly 1,200 BTC or 31% of GPFG’s total indirect bitcoin exposure. Other firms, such as bitcoin mining companies Riot Platforms (RIOT) and Marathon Digital Holdings (MARA), and cryptocurrency exchange Coinbase (COIN), also contributed to the total exposure.

(Companies with BTC treasuries held by Norway’s Government Pension Fund Global)

“Thanks to corporate BTC treasury strategies, the Norwegian indirect sat per capita exposure stood at 68,837 sats ($64) by the end of 2024,” Lunde said.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。