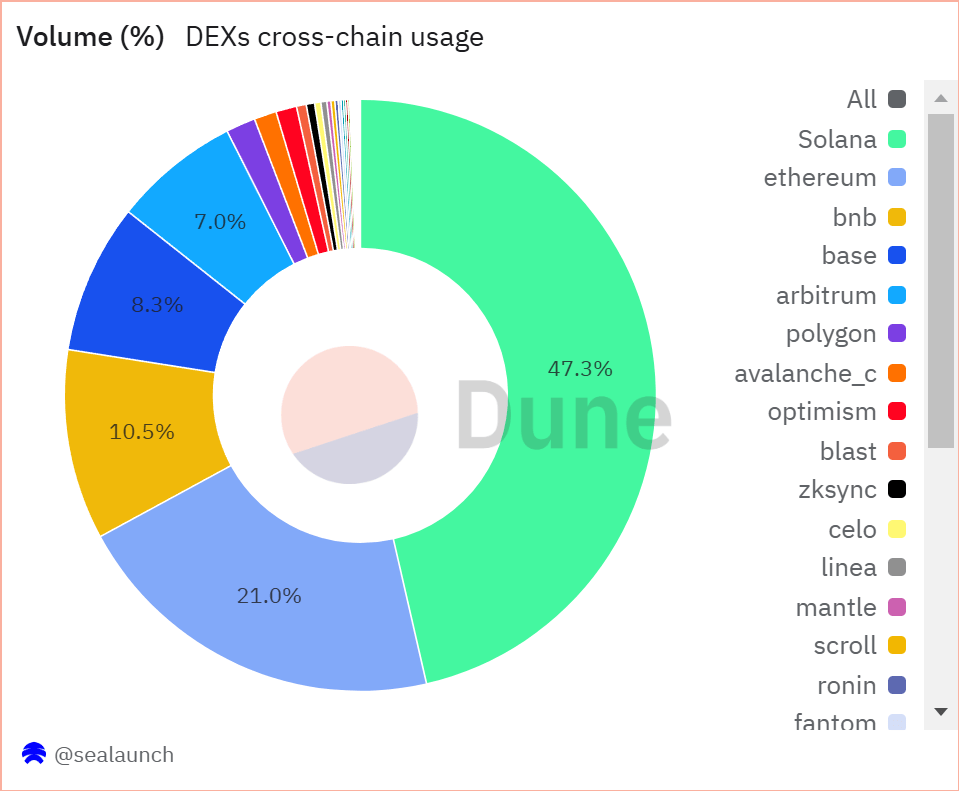

When it comes to dominating volume on decentralized exchanges (DEXs), Solana is eating Ethereum’s lunch – and drinking its milkshake – at least that’s how Seychelles-based cryptocurrency exchange OKX describes the DEX landscape in its 2025 State of DEXs report published on Tuesday.

The proof-of-history blockchain generated 48% of DEX volume in 2024 according to the report. By comparison, Ethereum was responsible for 21%, less than half of Solana – without accounting for volume from Ethereum L2s like Base, Arbitrum, and Polygon.

(Solana DEX volume / Dune Analytics)

The star of Solana’s ecosystem, the platform responsible for generating 60% of the blockchain’s impressive DEX volume, is none other than pumpdotfun, the infamous memecoin launchpad that has minted nearly 7 million tokens according to data from Dune Analytics, and unsurprisingly drawn the ire of many “degens,” even managing to get legal action taken against it.

(Burwick Law legal action alert against pumpdotfun / Burwick Law)

But regardless of pumpdotfun’s questionable reputation, it is now part of a well-oiled machine – together with decentralized exchange Raydium and DEX aggregator Jupiter – that allows users to mint memecoins on pumpdotfun, generate liquidity on Raydium, and obtain efficient price discovery via Jupiter, helping Solana generate more DEX volume than any other layer one blockchain.

“The key player and contributor to Solana’s explosive growth is indisputably Jupiter,” the OKX report states. “But if Jupiter is the king of Solana DEXs, Raydium is the kingmaker.”

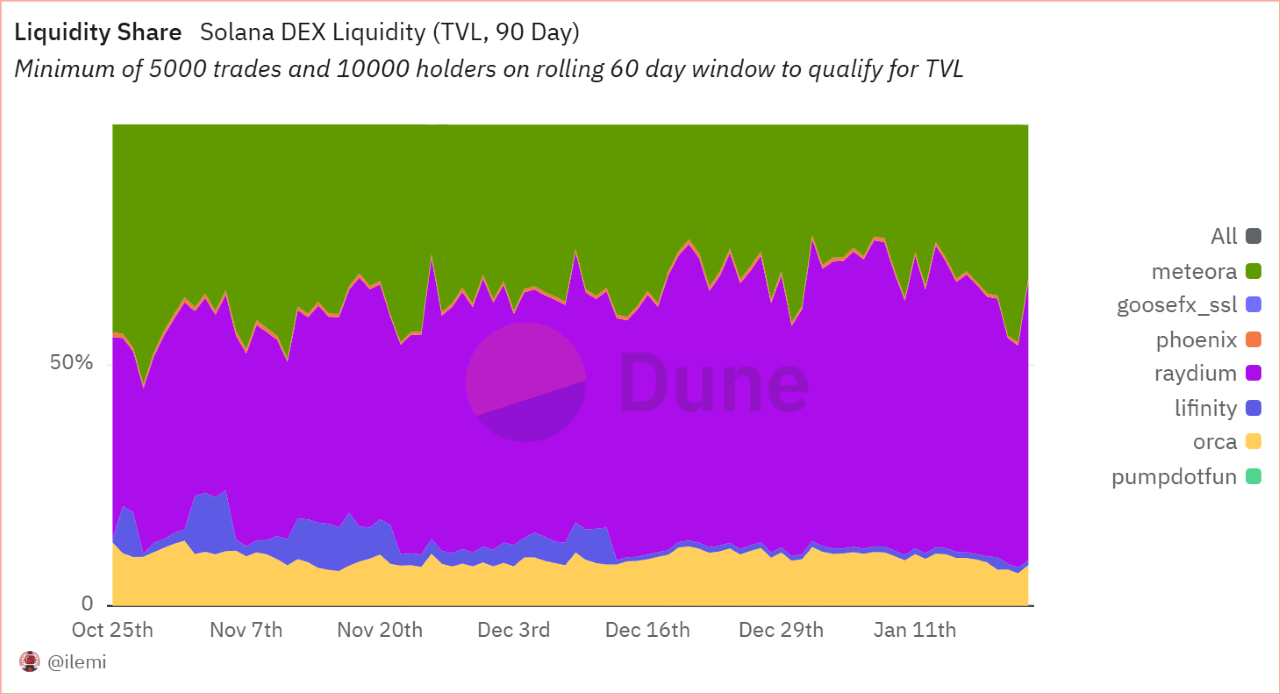

Jupiter is Solana’s most dominant aggregator and is responsible for nearly 70% of the network’s total transaction volume. Raydium is Solana’s top DEX and aside from aggregators like Jupiter, dominates DEX volume – mostly because of pumpdotfun.

(Raydium dominance in Solana DEX liquidity / Dune Analytics)

To understand how aggregators work, we can look to OKX itself, which despite being a centralized exchange (CEX), insists that DEXs are the future, and has built its own DEX aggregator as a result.

“This tool enables builders to deliver swaps with lower slippage, better liquidity, and seamless support for token pairs across multiple chains,” the exchange explains in the report. Adding that its aggregator lays the groundwork for a “more efficient and interconnected decentralized ecosystem.”

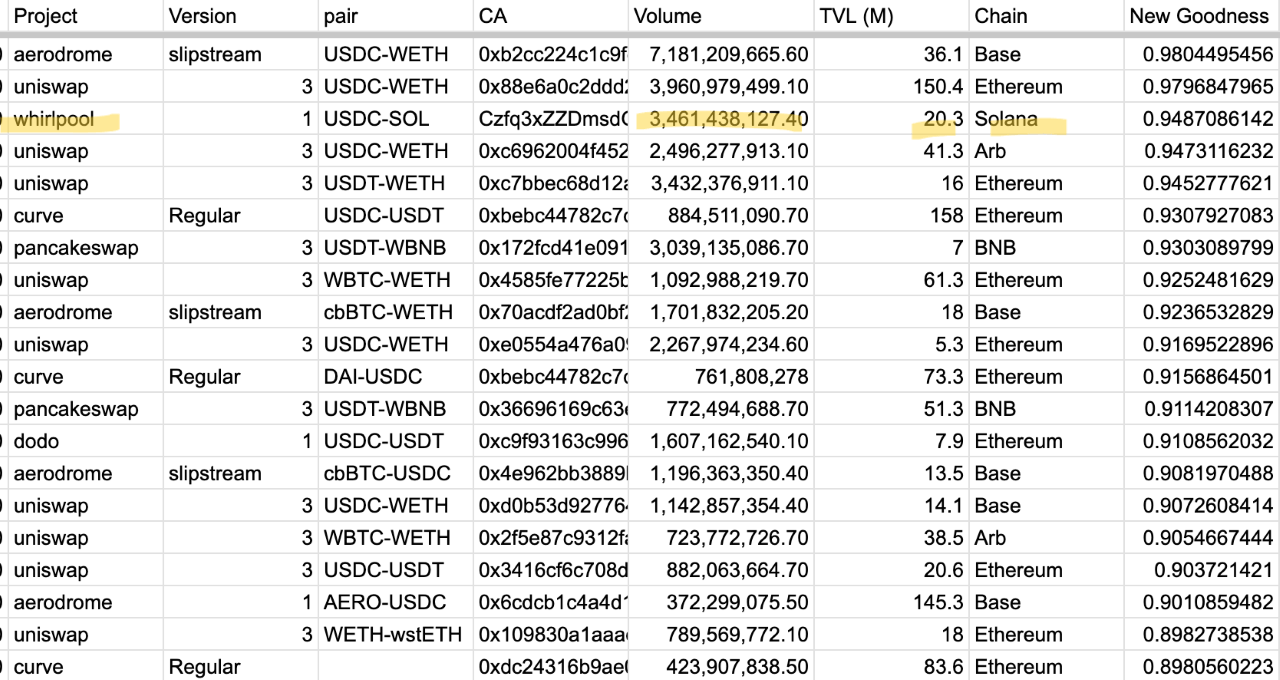

But for all the things Solana’s got going for it, some of its metrics are concerning. Yes, the blockchain sees impressive volume, but liquidity and the quantity of assets staked on Solana or “total value locked” (TVL), are both low – certainly lower than Ethereum’s numbers.

Out of the top twenty liquidity pools, only one – Whirlpool – is on Solana, with a TVL of only $20 million. The rest are on Ethereum or one of its many L2s.

“Whether Solana’s low TVL, high-volume model is a temporary market anomaly or a feature of its ecosystem’s resilience will depend on how it adapts to changing market conditions and continues attracting liquidity and development,” the report says.

(Ethereum liquidity pool dominance vs Solana / @jpn_memelord on X)

The report makes it clear that Ethereum is still the dominant decentralized finance (defi) hub and together with its L2s, is still the go-to platform, even though Solana has higher DEX volume. But Ethereum’s base layer is too slow and expensive, and it must rely on its L2s to stay competitive. Conversely, Solana is cheap and nimble but lacks the depth in liquidity to overthrow the incumbent network, at least for now.

“Time will tell if Ethereum can retain its market share of DEX volumes,” the report says, “But with the proliferation of L2s and innovation of DEX primitives, it suffices to say that Ethereum will not go down without a fight.”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。