The crypto market in 2025 is evolving rapidly. Bitcoin recently surged past $109,000 before correcting to $100,500, demonstrating the ongoing volatility in the sector. Ethereum staking inflows reached a record $2.2 billion, reflecting strong institutional interest, while Bitcoin ETFs have now surpassed gold ETFs in total assets under management.

Meanwhile, the rise and fall of $TRUMP, a memecoin that reached $15 billion in market cap in just two days before dropping 33% overnight, served as another reminder of how unpredictable certain crypto assets can be. With market swings like these, many investors are turning to stable, high-yield alternatives for long-term growth and risk management.

This is where Coinhold by EMCD comes in—a solution designed for those who want consistent, high-yield returns on their crypto without the stress of daily price swings. Let’s explore how it works and whether it’s the right fit for your portfolio.

Coinhold is a crypto savings wallet from EMCD, a global fintech platform based on one of the top 10 BTC pools in the world. It allows users to earn passive income on Bitcoin, Ethereum, and stablecoins through fixed or flexible savings plans. With interest rates of up to 14% APY on stablecoins and 8% on BTC and ETH, Coinhold provides a low-risk, high-reward alternative to staking, lending, or holding assets in a standard wallet.

Coinhold isn’t the only crypto savings wallet on the market, but it’s the one with some of the highest rates out there, beating even Binance’s max stablecoin return of about 10% with Coinhold’s 14% APY. And, of course, these yields are playing in a different league than conventional fiat savings accounts.

Coinhold’s growth reflects this demand. The number of active users has increased by 85%, while deposits have grown by 93%. Most users opt to accumulate BTC and USDT, drawn to Coinhold’s market-leading 14% stablecoin yield. This surge indicates a clear shift toward stable, high-yield crypto savings solutions in an unpredictable market.

Coinhold works similarly to a crypto savings account, offering predictable returns on digital assets. Here’s how it works:

- Pick a savings plan: Choose between fixed (30–360 days) or flexible options.

- Deposit crypto: BTC, ETH, LTC, BCH, USDT, and USDC are supported.

- Earn daily interest: Interest accrues and compounds over time.

- Withdraw anytime: Flexible plans allow for instant access, while fixed plans offer higher returns for longer commitments.

Fixed vs. Flexible Coinhold Wallets

Coinhold offers two types of savings plans:

- Fixed Coinhold: Best suited for long-term investors. A 360-day fixed-term deposit in stablecoins can earn up to 14% APY, while Bitcoin and Ethereum deposits can generate 8% annually.

- Flexible Coinhold: A solution for those who need liquidity while still earning a competitive yield. Users can earn up to 10% APY on stablecoins and 6-7% on BTC and ETH, with the option to withdraw at any time.

With Coinhold’s maximum rate of 14%, your initial investment will almost double over 5 years even if you don’t top it up with a single extra dollar. Time and re-investments make all the difference, and even modest initial investments are still worthwhile.

If you re-invest just 2% of your initial investment every month, your earned interest will be larger than your initial investment in just 5 years even at the more modest 12% rate. And if you decide to open a savings wallet with no starting capital, but contribute the same amount every month, in 5 years earned interest will make up a whopping 25% of your total Coinhold balance. Even if you go for a flexible savings wallet that keeps your funds liquid with returns at 10% and monthly top it up with just 1% of your initial investment, almost a third of your total balance will consist of earned interest.

And if you invest Bitcoin or Ethereum at the maximum 8% rate available for these coins, you’ll gain 50% more in BTC over the same time period. Of course, it’s impossible to say now how much 0.5 BTC will be worth in 2030, but over the past 5 years the coin’s average annual returns have been around 155%.

Let’s look at some actual numbers for a 5-year-long commitment to a range of Coinhold wallets with their varied rates:

| Initial Investment | Account Type | APY | Re-investments | Total Balance | Principal | Interest |

| 50,000 USDT | 360 days VIP | 14% | 0 USDT | 96,270 USDT | 50,000 USDT | 46,270 USDT |

| 5000 USDT | 360 days | 12% | 100 USDT monthly | 16,845 USDT | 11,000 USDT | 5,845 USDT |

| 1 USDT | 360 days | 12% | 100 USDT monthly | 8,035 USDT | 6,000 USDT | 2,035 USDT |

| 5,000 USDT | Flexible | 10% | 50 USDT monthly | 11,880 UDST | 8,000 USDT | 3,880 USDT |

| 1 BTC | 360 days | 8% | 0 BTC | 1.47 BTC | 1 BTC | 0.47 BTC |

Of course, these are all nominal returns, to calculate your real returns, factor in inflation — usually approximately 3%, depending on where you live — and deduct it from your annual interest rate. For example, if you’re putting 1,000 USDT into a 12% Coinhold for 5 years and adding 100 USDT every month, your real returns would still leave you with the equivalent of over 9,000 USDT.

The crypto market is riddled with high risks, average annual stock market returns even for a great index fund like S&P 500 are around 10% before you account for inflation. Meanwhile, Coinhold offers the low risks of an index fund or fiat savings account with much higher returns.

Coinhold is backed by EMCD, a crypto ecosystem based on a leading mining pool with stable operations since 2017, ensuring a secure financial environment. The platform’s diverse range of products provides additional resilience to market fluctuations, while the in-house CISO takes care of the platform’s safety.

Both the EMCD app and site offer full feature accessibility and a user-friendly interface, giving users easy access to digital asset management. Setting up, topping up, and closing a Coinhold wallet requires just a couple clicks.

Special Benefits for Miners

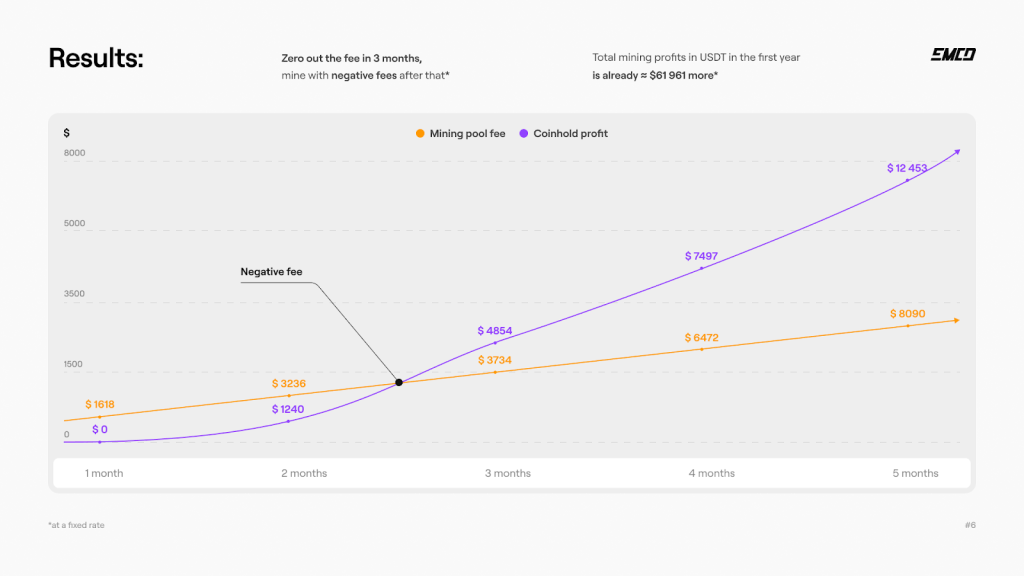

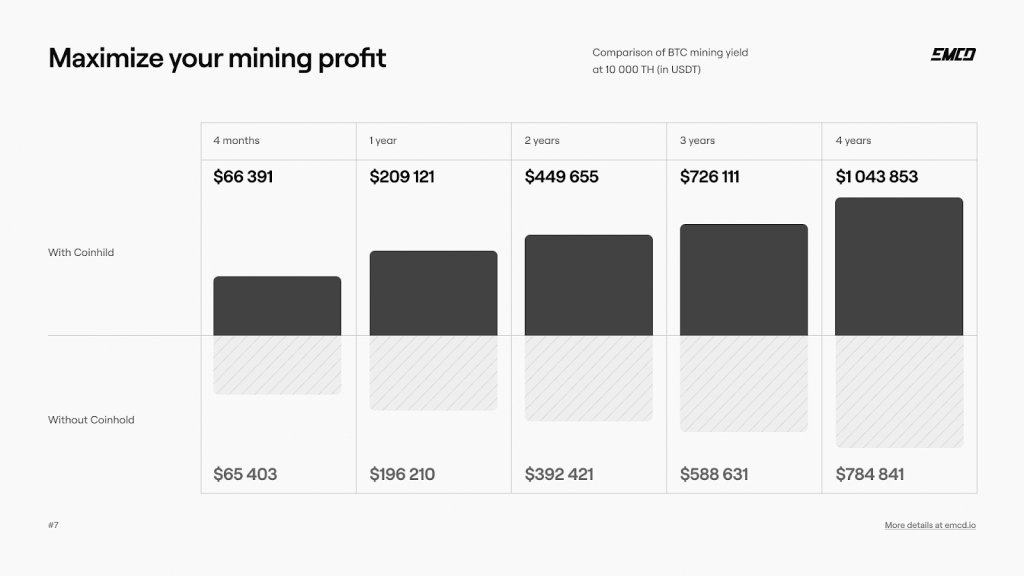

Since EMCD began as a mining pool, Coinhold couldn’t miss the opportunity to offer special perks for miners. It allows miners to deposit mining rewards directly into their Coinhold wallets, helping them earn back their pool fees.

By leveraging compound interest, miners can maximize long-term gains. A well-structured savings plan could result in significantly higher earnings over time, making Coinhold an effective financial tool for crypto miners looking to grow their holdings passively.

Best for:

- Long-term Bitcoin and Ethereum holders seeking passive income.

- Stablecoin investors looking for high-yield, low-risk options.

- Miners wanting to automate earnings growth and reduce costs.

- Risk-conscious investors who prefer steady, predictable returns over speculative strategies.

Not ideal for:

- Short-term traders who thrive on market swings.

- Investors seeking ultra-high DeFi yields above 20%.

- Users unwilling to commit funds for a fixed period.

Getting started with Coinhold is straightforward:

- Sign up on EMCD and create an account.

- Verify your identity and enable two-factor authentication (2FA).

- Choose a savings plan—fixed or flexible.

- Deposit your crypto—BTC, ETH, LTC, BCH, USDT, or USDC.

- Monitor daily accruals and grow your passive earnings.

For investors seeking a stable and secure way to grow their crypto holdings, Coinhold by EMCD offers a compelling alternative to staking, trading, or simply holding assets in a wallet. With competitive interest rates, flexible deposit options, and strong security backing, it provides a reliable solution for passive income generation.

In an unpredictable market, having a stable, high-yield savings strategy can help investors build long-term wealth. Whether you’re a miner, a long-term holder, or simply looking for a low-risk way to earn, Coinhold offers a solution that delivers consistent results.

Ready to start earning? Visit Coinhold by EMCD and set up your savings plan today.

This is a sponsored story. Please conduct your own due diligence and make an informed decision before taking any action. Bitcoin.com accepts no responsibility or liability.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。