As of 8 p.m. ET, the cryptocurrency market maintains a valuation of $3.5 trillion, despite a 2.56% decline over the last 24 hours. Bitcoin, which had spent much of the day trading steadily between $104,800 and $105,400, began losing ground at 2 p.m. ET.

BTC/USD via Bitstamp on Jan. 26. 2025.

The leading cryptocurrency now holds a market capitalization of $2.04 trillion, reflecting a 1.7% decrease against the U.S. dollar, with individual coins trading at $102,052. In the past 24 hours, bitcoin recorded a global trading volume of $21.80 billion, with late-afternoon selling pressure fueling a moderate increase in activity.

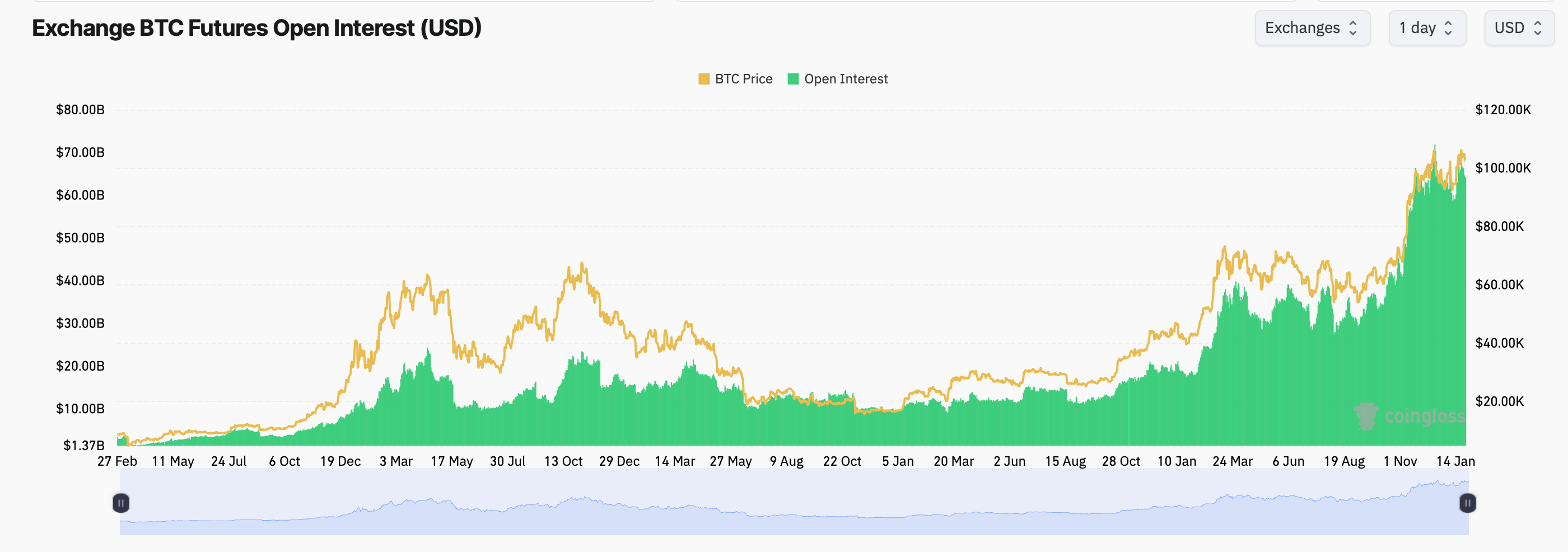

Total liquidations across crypto derivatives markets reached $371.94 million during this time frame, including $132 million in bitcoin long positions, $128 million of which occurred in just four hours. Despite the sell-offs, open interest in bitcoin futures markets remains high, exceeding $64 billion.

BTC futures open interest via coinglass.com

Within the crypto economy’s overall trading volume of $83.94 billion, tether (USDT) dominated with $67 billion, reaffirming its status as the day’s most-traded token. Bitcoin currently commands 57.9% of the crypto market’s aggregate value, while ethereum accounts for 11.1% as of Sunday.

The Crypto Fear and Greed Index, published by Alternative.me, stands at 71, signaling a prevailing sentiment of “greed.” Recent fluctuations in bitcoin’s price highlight the ongoing tug-of-war between bullish optimism and market uncertainty as January nears a close.

While long liquidations and selling pressure highlight investor caution, the sustained high trading volumes and open interest suggest confidence remains a significant force.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。