The growth of the stablecoin economy shows no signs of slowing down, with its total market valuation reaching an impressive $215.647 billion as of Saturday, Jan. 25. The $215 billion threshold was crossed on Friday, marking a $6.383 billion increase over the past week. While some stablecoins faced declines—such as usual usd’s (USD0) 15.78% drop—Tether’s USDT climbed by 0.93%, Circle’s USDC expanded by more than 10%, and Sky’s USDS advanced by 8.60%.

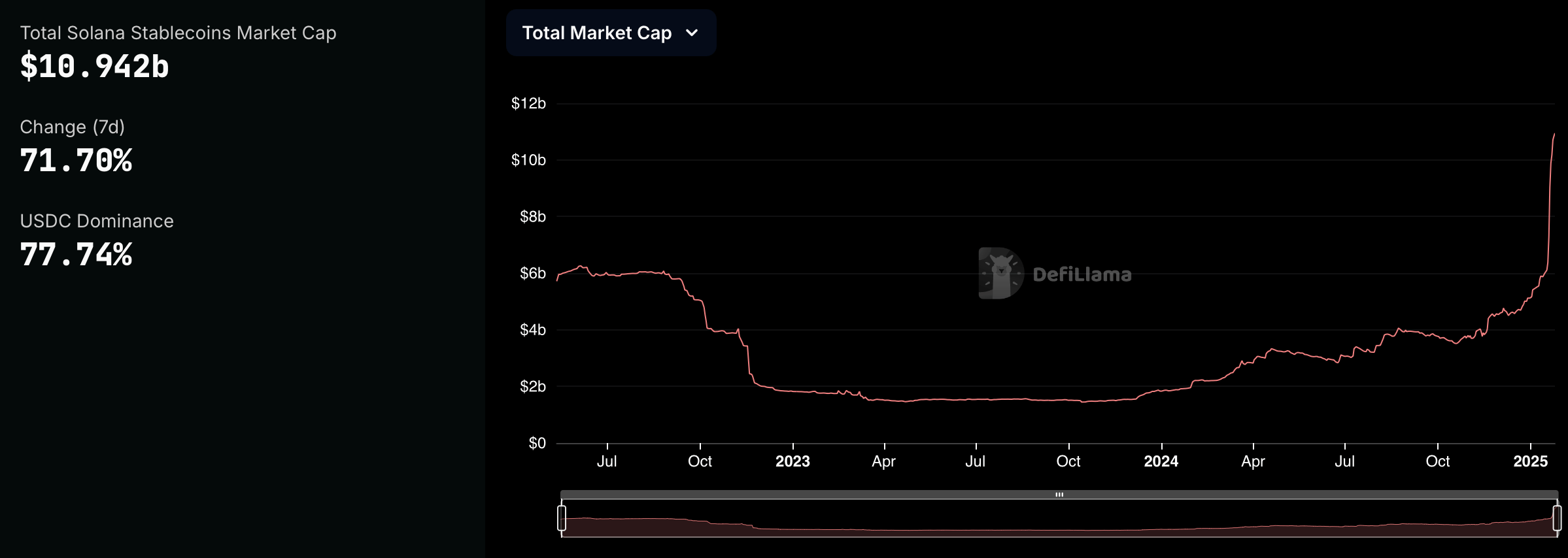

In addition to USDM’s 12.13% increase, USDC led the pack over the past seven days, claiming the top spot for growth among the 40 largest stablecoins. The real buzz, however, revolves around the expansion of stablecoins on the Solana blockchain, which now accounts for nearly $11 billion, or $10.942 billion, based on Defillama’s figures. Over the past week, stablecoin activity on Solana has surged by an impressive 71.70%, with USDC driving most of this growth.

Solana stablecoin cap according to Defillama.

As of Jan. 25, Circle‘s USDC issued on Solana stands at $8.507 billion, while Tether’s (USDT) takes second place with $1.968 billion issued. Paypal’s PYUSD rounds out the top three with $142.42 million on Solana. With a total market cap of $52.172 billion, the USDC issued on Solana represents 16.31% of its overall market valuation. Notably, Artemis Terminal data shows that $43.88 billion in USDT was transferred in the last day alone.

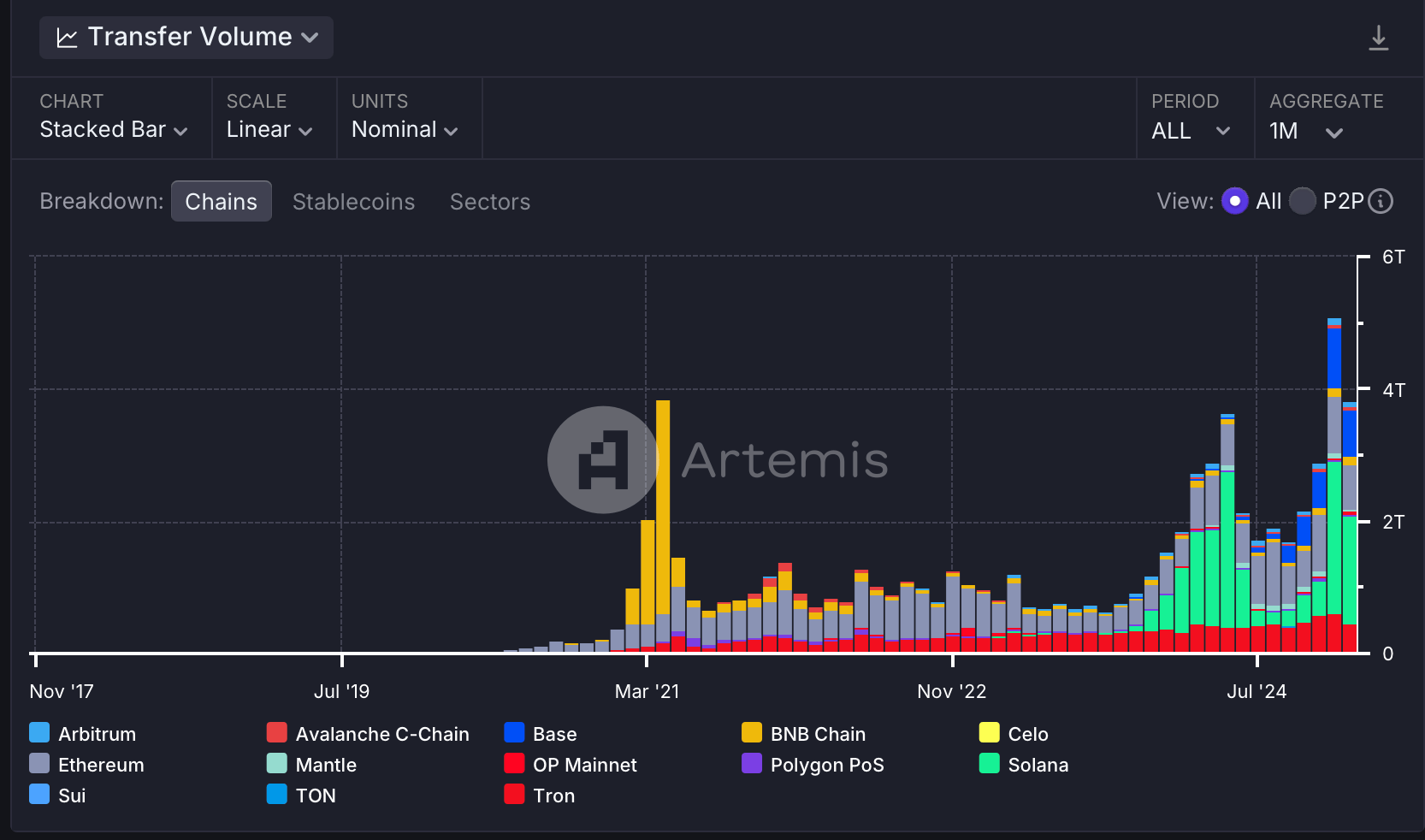

During the same period, $65.39 billion in USDC was moved. According to Artemis Terminal, Solana has already processed $1.6 trillion in stablecoin transfers this month, surpassing Ethereum’s $607 billion and Base’s $664 billion. For comparison, Solana closed out December with $2.3 trillion in stablecoin transactions.

Stablecoin transfer volume via Artemis Terminal on Jan. 25, 2025.

Solana’s growing dominance in the stablecoin sector highlights its increasing appeal as a high-performance blockchain for digital asset transactions. With billions flowing across its network and a sharp rise in stablecoin activity, Solana is carving a significant role in the evolving financial ecosystem. This momentum suggests a future where Solana becomes a cornerstone of global stablecoin infrastructure.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。