In the multi-chain "entropy increase" era, the full-chain liquidity infrastructure aimed at the broadest ordinary users may have reached a critical point.

Written by: Web3 Farmer Frank

How did you fare in the latest Plume airdrop?

The answer may be mixed. In fact, under the current stock competition, airdrops are no longer an effective incentive for open-source traffic generation; instead, they have transformed into a financial game for crypto studios and on-chain whales. With the recent launches of new token airdrops like PLUME, a question has become increasingly prominent: How can ordinary users participate more fairly and efficiently in the dividends of emerging ecosystems, rather than just being the companions of whales?

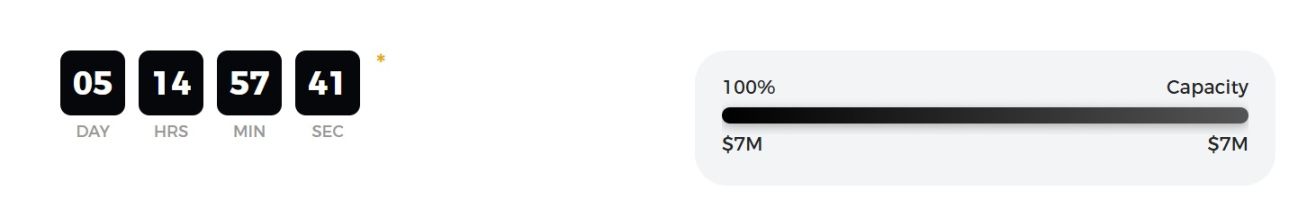

Interestingly, before the Plume airdrop, StakeStone announced the upgrade of its original StakeStone Vault brand to StakeStone LiquidityPad, launching the first project Aria, which reached a purchase cap of $7 million in just 9 minutes.

An interesting analogy is that in today's multi-chain era, each emerging public chain is like a country, possessing unique characteristic industries but urgently needing capital and resources to complete industrialization. In this context, just as the VIE legal structure helps companies in developing countries obtain dollar capital investment and then brings the results back to trade in the U.S. financial market, StakeStone LiquidityPad is essentially playing a similar role:

On one end, it connects to the mature on-chain financial ecosystem of Ethereum, and on the other end, it connects to various emerging public chain ecosystems, helping these emerging public chains raise resources on the Ethereum mainnet and bringing back the excess returns (Alpha) generated from these resources to trade on the financially mature Ethereum mainnet, becoming the largest pipeline infrastructure connecting Ethereum (dollar capital) and emerging public chains (developing countries).

The Prosperous Multi-Chain Era: The Liquidity Dilemma of "Entropy Increase"

Things always tend to move towards increased entropy, and crypto is no exception.

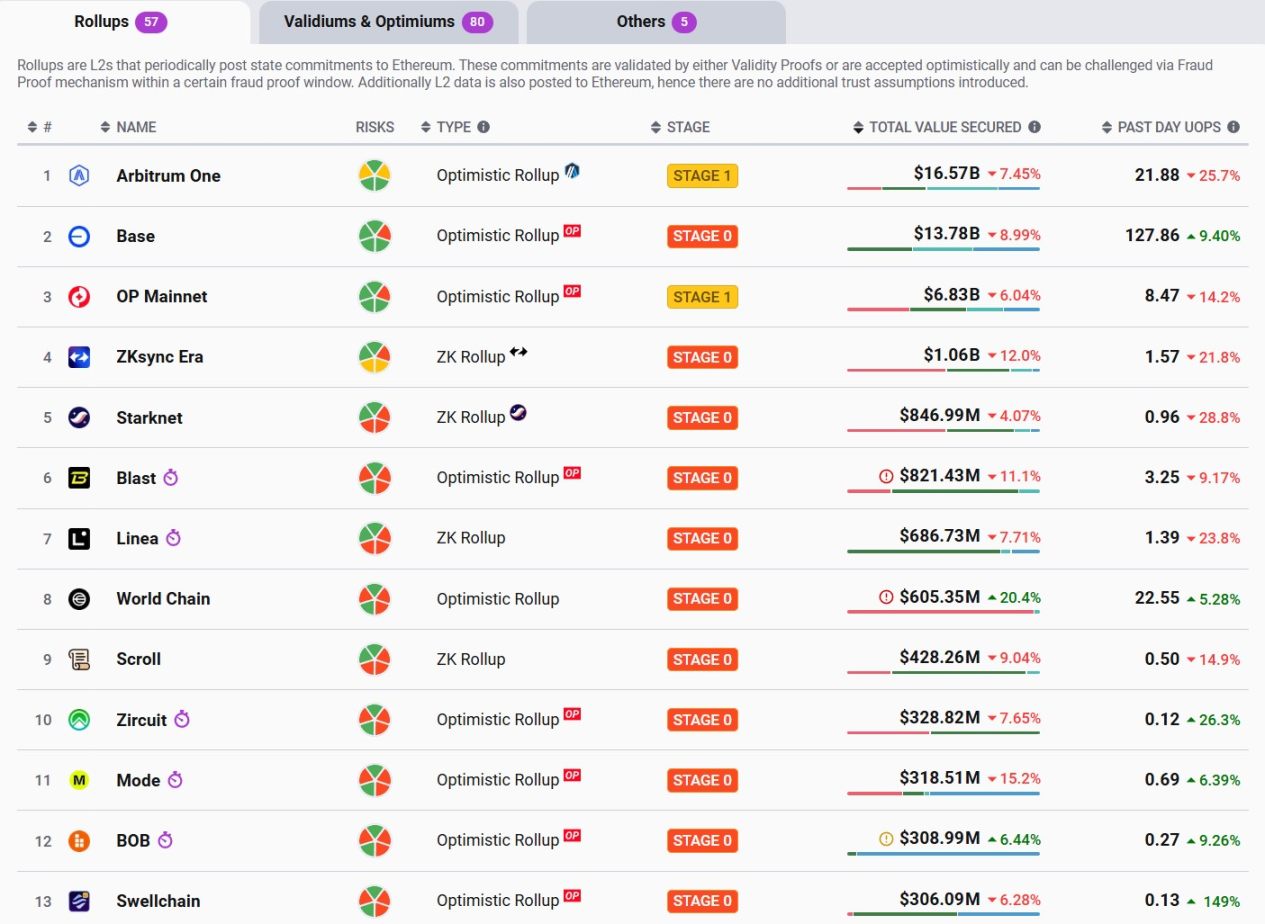

Driven by the modularization wave, from the initial multi-chain concepts of Cosmos and Polkadot to the prosperity of Rollups in the Ethereum L2 era, and now with OP Stack, Arbitrum Nova, Starknet, and other application chains making strides, more and more protocols and applications are beginning to build dedicated chains for specific needs, attempting to find the best balance in performance, cost, and functionality.

According to incomplete statistics from L2BEAT, there are already hundreds of Ethereum L2s in a broad sense. However, while this diversity brings more possibilities to the on-chain ecosystem, it also gives rise to an age-old problem—the extreme fragmentation of liquidity.

Especially starting in 2024, liquidity is not only dispersed on Ethereum and L2s but is also severely isolated within the ecosystems of various emerging public chains/application chains. This fragmentation phenomenon not only complicates user operations and experiences but also greatly limits the further development of DeFi and on-chain applications:

For Ethereum and L2s, liquidity cannot flow freely, capital efficiency decreases, and the potential of on-chain Lego cannot be fully realized; while for emerging public chains like Plume and Berachain, this means high migration costs and entry barriers, making it difficult to break the liquidity island effect from 0 to 1, hindering ecosystem expansion.

In short, the trend of "entropy increase" in the multi-chain era has become the biggest curse of prosperity in the multi-chain era.

In the context of accelerating fragmentation of multi-chain asset liquidity, both users and developers are eager for funds to flow efficiently in any network's DEX, lending, and other on-chain protocols, breaking the barriers of fragmentation and user experience, especially in emerging public chain ecosystems like Plume and Berachain outside of the Ethereum ecosystem:

The yield opportunities in these emerging public chain ecosystems are often highly attractive, and users need to be able to easily migrate assets from Ethereum or other chains into these emerging ecosystems to participate in their DeFi protocols, liquidity mining, or other yield opportunities.

For users, liquidity is key, regardless of how combinable it is. Therefore, objectively speaking, if Ethereum and the multi-chain ecosystem are to continue to scale and prosper, there is an urgent need to efficiently integrate the liquidity resources scattered across multiple chains and platforms.

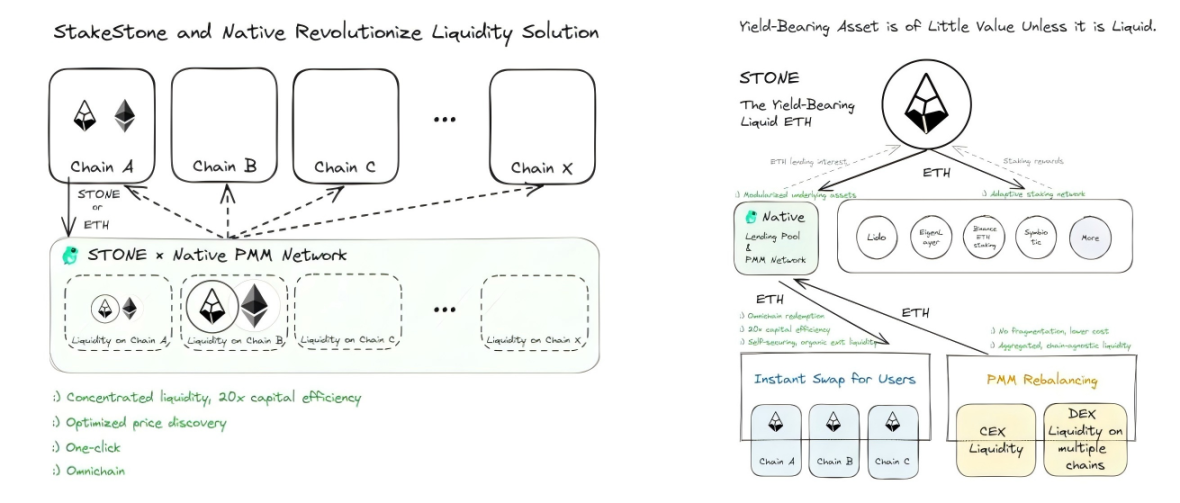

This requires the establishment of a unified technical framework and standards to combat "entropy increase," thereby bringing broader applicability, liquidity, and scalability to the multi-chain ecosystem. This not only further promotes the "unification" process of on-chain liquidity but also drives the multi-chain ecosystem towards maturity.

This demand and vision for "unification" also provide space for full-chain liquidity infrastructures like StakeStone LiquidityPad to showcase their capabilities. As an innovative full-chain liquidity vault product issuance platform, StakeStone LiquidityPad aims to help emerging public chains and application chains efficiently integrate cross-chain liquidity resources through customized liquidity fundraising solutions, breaking liquidity islands and promoting the efficient flow of capital.

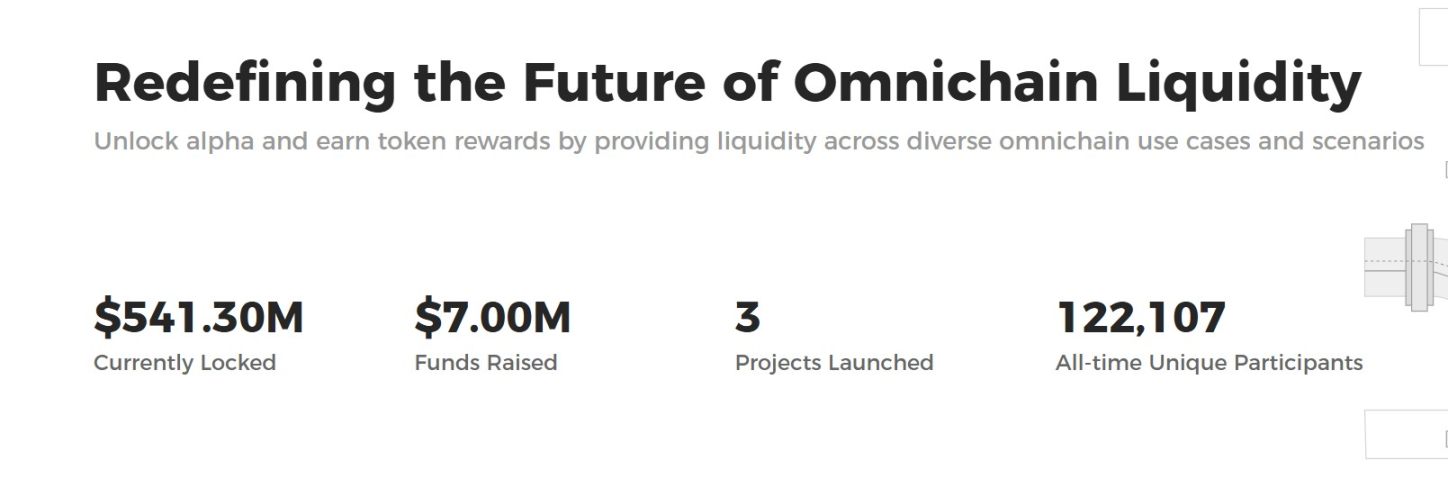

As of the time of writing, StakeStone LiquidityPad has locked over $540 million in funds, with more than 120,000 unique on-chain addresses participating. This data not only proves the market's recognition of StakeStone LiquidityPad but also reflects the strong demand from users for full-chain liquidity solutions.

StakeStone LiquidityPad: "From Point to Plane," Transitioning to a Liquidity Network

Many users may still associate StakeStone with Ethereum Staking/Restaking-related yield protocols, but from the very beginning, StakeStone's product architecture has been aimed at full-chain liquidity infrastructure. Initially, it focused on vault products targeting emerging public chain ecosystems, gradually building the prototype of its liquidity network:

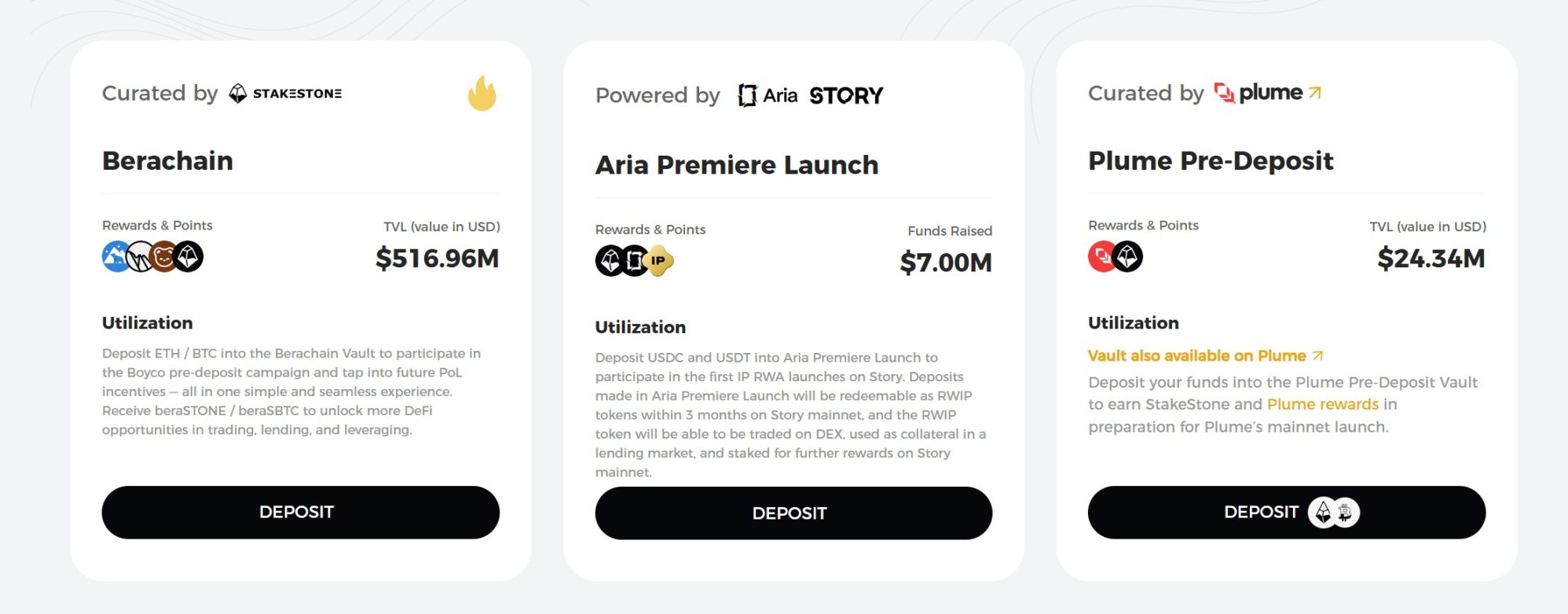

Whether it was the Plume Pre-Deposit Vault launched in collaboration with Plume or the Berachain StakeStone Vault launched in collaboration with Berachain, these were StakeStone's pioneering attempts in different ecological scenarios, not only providing urgently needed liquidity support for emerging public chain ecosystems but also serving as a good model for StakeStone's construction of full-chain liquidity infrastructure.

This also explains why StakeStone decided to further upgrade its product line, rebranding the original Vault brand to StakeStone LiquidityPad—a more comprehensive, flexible, and customized full-chain liquidity fundraising and management platform. This is not only an evolution of product form but also a key step for StakeStone to transition from "point-to-point" liquidity solutions to a "point-to-plane" liquidity network.

In short, as a full-chain liquidity infrastructure, StakeStone is committed to connecting liquidity assets on the Ethereum mainnet with the liquidity needs of emerging public chains and L2 ecosystems.

From this perspective, the rebranded StakeStone LiquidityPad is essentially a customized full-chain liquidity solution aimed at diverse needs, covering the entire lifecycle of liquidity support from cold start to ecosystem expansion.

1. Projects Not Yet Launched on Mainnet: Pre-Deposit Vaults Assist Cold Starts

For public chains or protocols that have not yet launched their mainnet and are still in the cold start phase, StakeStone LiquidityPad supports project parties in raising the liquidity needed for early cold starts by launching pre-deposit (Pre-Deposit) vaults on the Ethereum mainnet, using the funds for the following purposes:

- Liquidity provision for DeFi protocols: Such as Berachain Vault, assisting the Berachain ecosystem in rapidly building core DeFi components;

- Liquidity support for RWA protocols: Such as Plume Vault, providing resources for the on-chainization of real-world assets (RWA);

- Investment in RWA assets: Such as Story Protocol Vault, supporting emerging protocols in bringing on-chain liquidity into real asset scenarios;

2. Projects Already Launched on Mainnet: Customized Vaults for Specific Yield Scenarios Accelerate Ecosystem Growth

For projects that have launched their mainnet and entered a mature operational phase, StakeStone LiquidityPad supports the customization of vaults for specific liquidity yield scenarios to help project ecosystems achieve rapid growth, such as:

- Liquidity provision for DeFi protocols: Such as Solana/SUI Vault, providing liquidity support for DeFi protocols on these public chains, enhancing capital efficiency;

- Liquidity provision for special yield scenarios: Such as BNB Chain Vault, supporting special yield scenarios on BNB Chain, such as liquidity mining, staking rewards, etc., through customized liquidity solutions to meet the high yield demands of specific ecosystems;

Moreover, to meet a broader range of application scenario needs, StakeStone will also expand support for more mainstream assets beyond STONE/SBTC/STONEBTC issued by StakeStone, including but not limited to ETH, WETH, WBTC, cbBTC, BTCB, LBTC, FBTC, USDT, USDC, etc.

From this, it can also be seen that from point to plane, through the upgrade of StakeStone LiquidityPad, StakeStone not only provides more flexible tools for emerging public chains and L2s but is also building a more efficient full-chain liquidity network—whether from cold start to mature stage liquidity support or cross-chain ecosystem resource integration, LiquidityPad aims to become a key link in the cycle of on-chain liquidity.

This not only meets diverse liquidity needs but also efficiently integrates liquidity resources scattered across multiple chains, forming an interconnected liquidity network. Whether it is the cold start needs of emerging public chains or the expansion needs of mature ecosystems, StakeStone LiquidityPad will become their most reliable liquidity partner.

The "Full-Chain Liquidity Flywheel" Behind StakeStone

Incremental growth is the core primitive of Web3.

For StakeStone LiquidityPad, its core value lies not only in solving the liquidity isolation problem of emerging public chains and application chains but also in forming a "full-chain liquidity flywheel" that integrates multiple asset yields and liquidity re-release through its unique mechanism design.

The core of this flywheel effect revolves around the multiple yield and liquidity re-release mechanisms centered on LP Tokens.

First, after users deposit assets into StakeStone LiquidityPad, they will receive LP Tokens (such as beraSTONE). These LP Tokens not only serve as proof of users' rights in the emerging public chain ecosystem but also act as keys to unlock multiple yields.

On one hand, the assets deposited by users will directly participate in the emerging public chain ecosystem, such as liquidity mining rewards in Berachain and governance token airdrops. At the same time, StakeStone's automated strategies help users efficiently capture these local yields without facing complex technical operations, thanks to the automated strategies within the Vault.

This low-threshold participation method allows more users to easily enter the emerging ecosystem and seize early dividends.

On the other hand, the corresponding LP Tokens not only represent users' rights in the emerging public chain ecosystem but also package the yields of the emerging ecosystem into interest-bearing assets, connecting with more mature mainnet infrastructures, thus possessing high financial composability—users can seamlessly access DeFi financial facilities on Ethereum through LP Tokens, further releasing liquidity potential:

- Providing liquidity or trading on DEXs like Uniswap/Curve: Users can use LP Tokens for liquidity mining or trading to earn additional yields;

- Using AAVE/Morpho for collateralized lending: LP Tokens can be used as collateral to participate in the lending market, further enhancing capital utilization;

- Selling yields using Pendle: Users can split or sell the yield rights of LP Tokens through protocols like Pendle, realizing early monetization of yields;

This mechanism not only allows a user's single asset to be reused across multiple ecosystems, maximizing yields, but also significantly lowers the participation threshold for emerging ecosystems, enabling more users to efficiently capture local yields in emerging public chain ecosystems like Berachain.

Thus, under the accumulation of multiple yields, users' investment returns can be maximized, and the acceptance and recognition of emerging ecosystems can quickly open up, forming a positive flywheel effect: more users participate → more liquidity is injected → emerging ecosystems develop faster → the value of yield-packaged assets increases → attracting more users to participate.

Interestingly, as StakeStone LiquidityPad evolves, it also means it can better connect emerging ecosystems like Berachain, which are in the cold start phase, with mature ecosystems across different yield scenarios:

- Helping emerging public chains raise cold start funds: Through StakeStone LiquidityPad, emerging public chains can raise cold start funds on the Ethereum mainnet, obtaining the "from 0 to 1" liquidity support needed for early development;

- Bringing excess yields back to mature markets: With the growth of resources, the excess yields (Alpha) on emerging public chains will be brought back to trade on the financially mature Ethereum mainnet, achieving a complete cycle of resources;

Overall, this dynamically adaptive mechanism enhances the compound ability of asset yields, further strengthening the market adaptability and competitiveness of StakeStone LiquidityPad.

The human demand for new assets is eternal. From this perspective, under the competitive landscape of the multi-chain era, StakeStone LiquidityPad is likely to become a key lever for building liquidity niche assets and prosperous on-chain ecosystems, thanks to its positioning as a full-chain liquidity infrastructure:

By introducing a new yield structure with inherent full-chain liquidity attributes, it can not only stimulate the stagnant on-chain ecosystem but also design products with higher capital efficiency and better yields, as well as composable DeFi scenarios. This meets users' pursuit of diversified yields while providing efficient liquidity solutions for emerging public chains and mature ecosystems.

Conclusion

In the future, as multi-chain ecosystems accelerate their expansion, StakeStone LiquidityPad is expected to become a core hub connecting emerging public chains with mature markets, bringing more efficient and fair liquidity solutions to users and protocol parties.

From the liquidity dilemma of "entropy increase" to the ecological prosperity driven by the "flywheel," redefining the liquidity infrastructure of Web3 is not only an inevitable path for StakeStone to further improve the full-chain liquidity agenda but also the optimal solution to propel multi-chain ecosystems toward maturity.

As for whether it can reach the critical point of transformation by 2025, continuous observation is still needed.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。