deUSD has become the only entry point that allows institutional asset holders to directly integrate into DeFi.

Author: Elixir

Compiled by: Deep Tide TechFlow

Institutional investors are entering.

Although traditional financial (TradFi) companies have launched tokenized money market funds and other real-world assets (RWA), there is almost no interoperability between these assets and DeFi, and they remain isolated in their respective domains.

Currently, there is no solution that allows RWA holders to directly enter the crypto economy or use these assets in DeFi.

Until the emergence of deUSD, which has become the only entry point that allows institutional asset holders to directly integrate into DeFi.

Elixir will soon announce partnerships with several traditional financial firms managing over $10 trillion in assets, making deUSD the native channel for these tokenized funds to enter DeFi.

With the support of issuers, RWA holders will be able to directly enter DeFi through deUSD from their portal. Users receive dollars at a 1:1 ratio while maintaining independent RWA backing.

deUSD has already made BlackRock's BUIDL and Hamilton Lane's SCOPE default to DeFi native assets and is collaborating with issuers to support the minting of deUSD through independent assets. Elixir's partnership with Securitize (bringing its tokenized RWA into DeFi) is just the beginning.

As cheap capital enters DeFi, deUSD will lower the stablecoin lending rates in the sector. RWA holders can provide liquidity in dollars and use it as collateral for borrowing, participate in AMM liquidity pools, serve as trading collateral, or engage in re-staking, among other operations.

Any individually supported liquidation can be achieved through Circle's atomic redemption mechanism, which can quickly convert top RWA assets into USDC. If a holder's deUSD leaves their wallet or is staked, this redemption process will be triggered. In other cases, holders will continue to independently hold the risk exposure of the initial RWA.

Trustless, Transparent, Decentralized

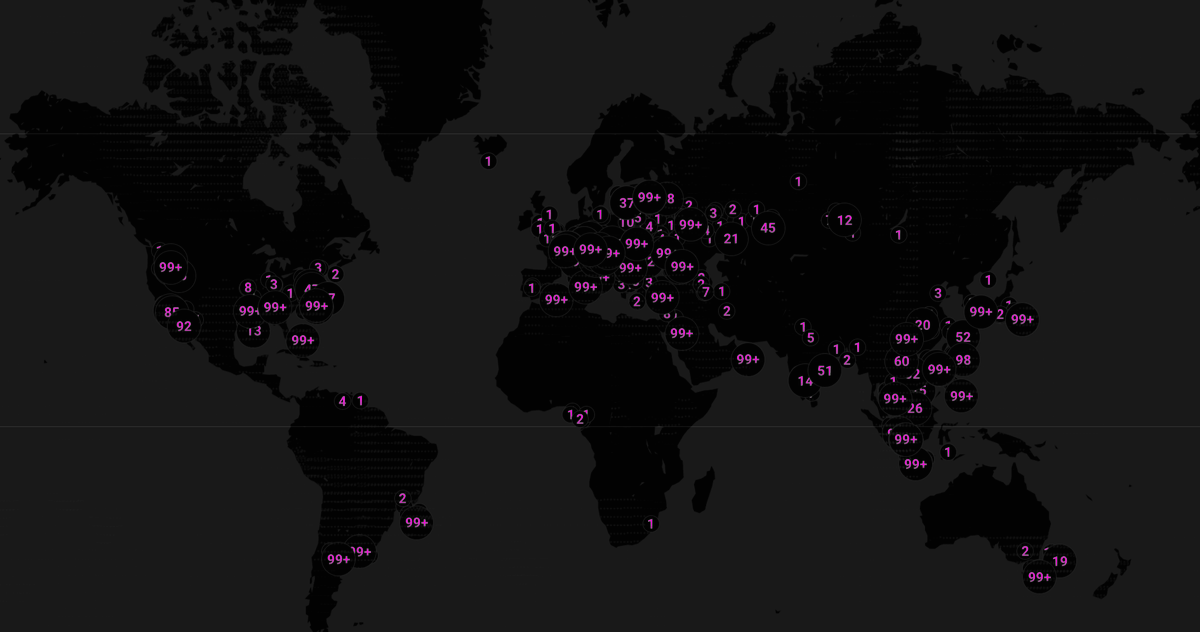

Elixir is a modular network designed for this purpose, utilizing a delegated proof-of-stake (DPoS) system to achieve consensus. After years of development, the network is currently operated by 31 institutional genesis validator nodes and over 40,000 global validator nodes (which will support the network at the upcoming public mainnet launch).

This makes deUSD possible: Elixir's network can compute and execute high-throughput data, thereby supporting trustless settlement.

Elixir's genesis validator nodes include institutions such as OKX, Anchorage, P2P, Securitize, Luganodes, Republic Crypto, and more. You can read our latest Mirror blog post for more details on the first phase of the Elixir mainnet.

The public mainnet launch is coming soon. Shortly thereafter, anyone will be able to run or participate in protecting the Elixir network.

Q5 has arrived, Elixio.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。