Over the past six months, shares of the business intelligence firm Microstrategy (Nasdaq: MSTR) have appreciated by an extraordinary 152% when measured against the U.S. dollar. Over the preceding five days alone, the company’s stock has advanced by 27.92%.

Complementing this impressive performance, Microstrategy’s strategic investment in bitcoin (BTC) has also yielded exceptional returns during the same period. Data indicates that since initiating its bitcoin (BTC) acquisition strategy in 2020, Microstrategy has accumulated an extraordinary total of 450,000 bitcoins.

Michael Saylor’s X statement on Sunday.

The firm has allocated $28.179 billion toward these acquisitions, employing leveraged debt as part of its financing approach. Notably, as reported by Bitcoin.com News just yesterday, the company was exploring another share expansion model to generate additional capital for further bitcoin purchases.

By Monday, Microstrategy’s holdings could potentially increase, as Michael Saylor hinted on Sunday with a cryptic statement: “Things will be different tomorrow,” accompanied by an image of the firm’s portfolio tracker. Historically, such statements from Saylor have preceded announcements of new bitcoin acquisitions.

To date, after methodically dollar-cost averaging into BTC and expending $28.179 billion, the company’s bitcoin position has appreciated by a staggering $19.055 billion. As of Jan. 19, 2025, Microstrategy’s BTC holdings are valued at $47.234 billion.

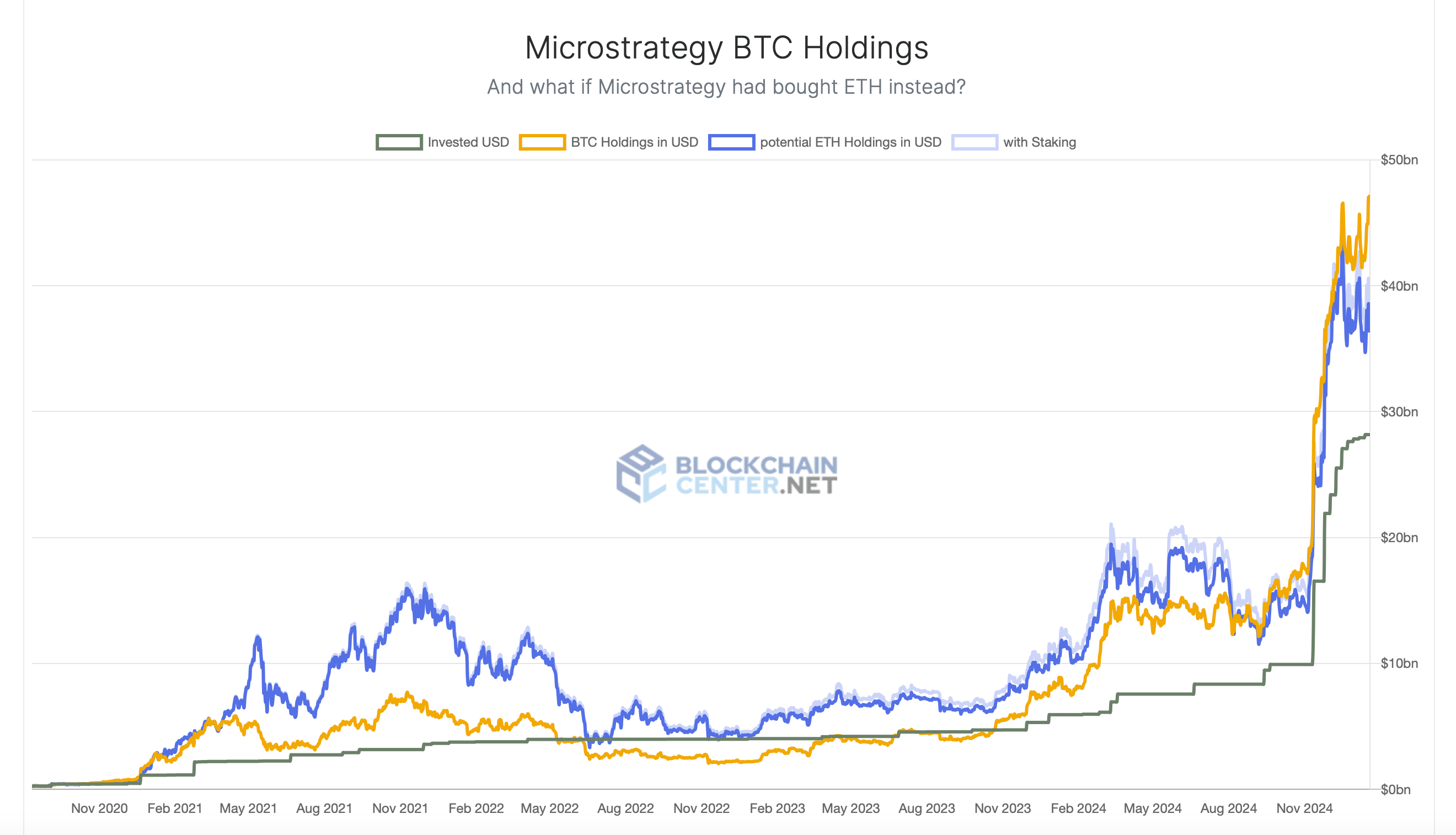

“There Is No Second Best” tracker via blockchaincenter.net.

According to the “There Is No Second Best” tracker hosted by blockchaincenter.net, had Saylor and his firm opted to acquire ether (ETH) instead, their investment would have yielded only a 33% gain, as opposed to the current 68%.

In that hypothetical scenario, Microstrategy’s holdings would amount to $37.504 billion, falling significantly short of its current $47.234 billion valuation for its bitcoin reserves. Microstrategy’s unwavering commitment to bitcoin reflects a bold conviction in its long-term potential, with the firm’s strategy serving as a high-stakes bet on the digital asset’s supremacy over alternatives like ether.

By coupling financial innovation with a calculated investment approach, Microstrategy has, at least so far, positioned itself not only as a corporate trailblazer, but also as a case study in the intersection of finance and digital transformation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。