Legacy wallets, many untouched for nearly a decade, are reawakening as BTC comfortably trades several thousand dollars above six figures. On Saturday, for instance, bitcoin exchanged hands within the range of $102,214 to $104,839 per coin.

On Friday, a wallet originally established on April 13, 2015, executed its first transaction in nearly nine years and nine months, transferring 77.99 BTC—valued at over $8 million. Shortly thereafter, btcparser.com detected movement from another address, created on Jan. 5, 2014, which transferred 39.07 BTC at block height 879,669.

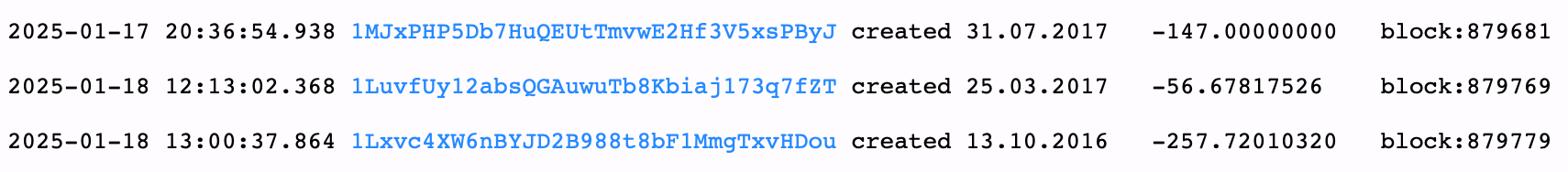

A larger transaction soon followed at block 879,681, where an address originating on July 31, 2017, transferred 147 BTC, valued at approximately $15.2 million. In subsequent activity today, a wallet dating back to March 25, 2017, moved 56.67 BTC, while another from April 29, 2013, shifted 40.01 BTC.

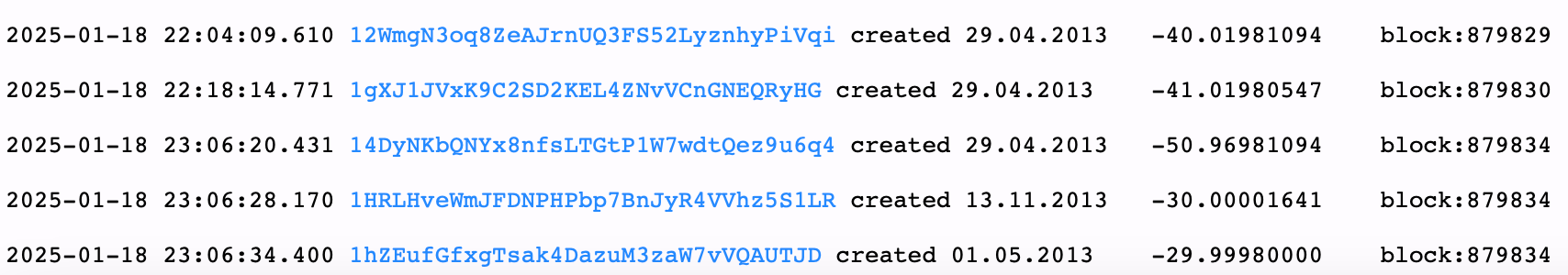

Interestingly, a second wallet from the same day in 2013 transferred 41.01 BTC in the following block, strongly suggesting that the two addresses may share a common owner. These two transactions were succeeded by three additional legacy wallets, collectively transferring 110.95 BTC. Notably, each of these addresses originated in 2013 as well.

Sleeping bitcoin spent from wallets created in 2017 and 2016.

The most substantial movement occurred at block 879,779, where a wallet created on Oct. 13, 2016, transferred an impressive 257.72 BTC—worth an estimated $26.8 million—marking its first recorded activity since inception.

According to Blockchair.com’s transaction privacy tool, the transfer scored a “low” 15 out of 100 due to address reuse. Of the total sum, 50 BTC was directed to a native SegWit address, while the remaining 207.72 BTC was sent to a legacy wallet. This resurgence of once-dormant wallets coincides with bitcoin’s elevated valuation, prompting speculation regarding the motives behind these movements.

Sleeping bitcoin spent from wallets created in 2013.

While some of these coins appear to be heading to centralized exchanges—likely for liquidation—others are simply being redistributed to new wallets. One certainty remains: these holdings have appreciated dramatically since their acquisition, offering their owners an opportunity to cash in, pursue new investments, or fulfill long-deferred aspirations.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。