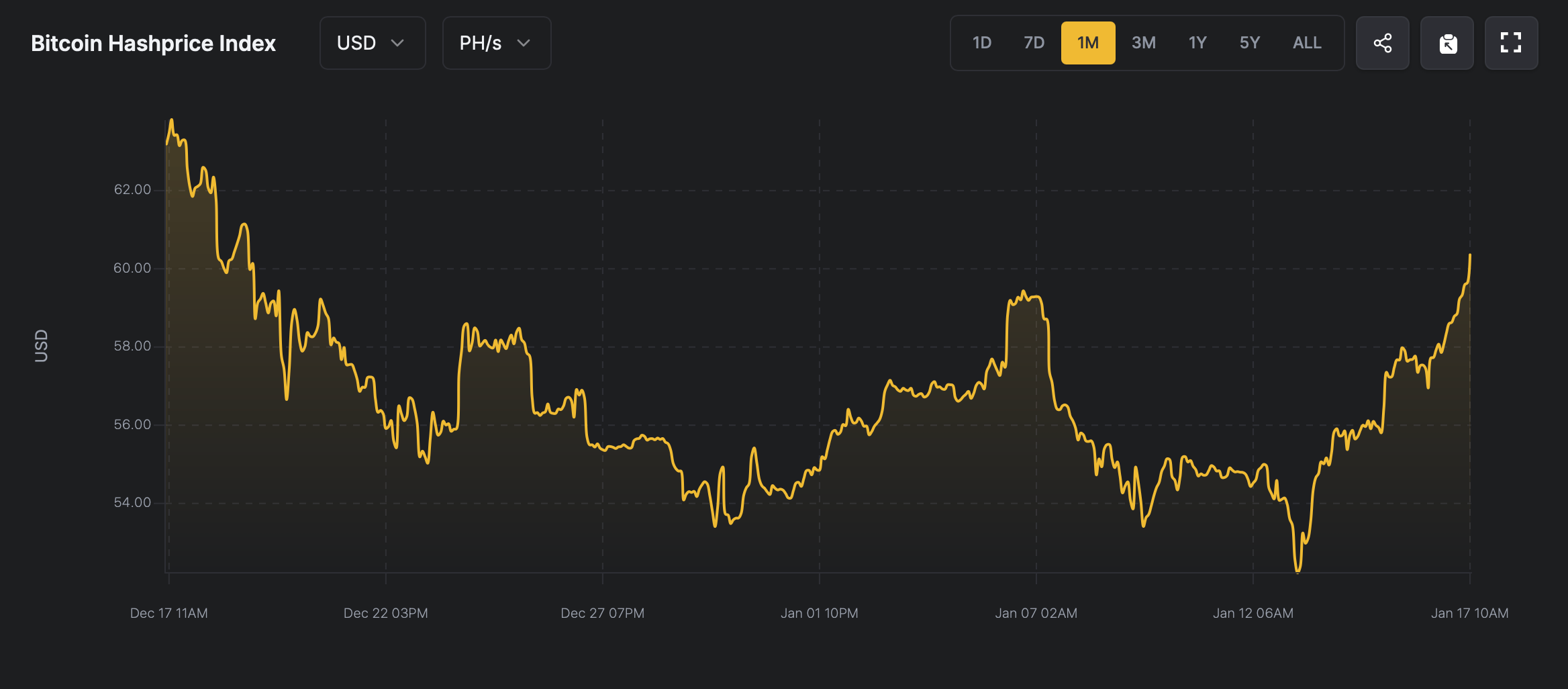

Miners have seen a marked increase in profitability as BTC exceeded the $105,000 threshold on Fri. On Jan. 13, hashprice descended to its lowest level within the past 30 days, with the valuation of 1 PH/s estimated at $52.22, per data from hashrateindex.com. By today, this figure has climbed to $60.85 per petahash, reflecting a 16.53% increase since Mon.

Source: hashrateindex.com

Despite this improvement, current hashprice remains below the 30-day peak of $63.81 per petahash, observed on Dec. 17—a date closely aligned with BTC’s ascent to $108,364 per coin, an all-time high. Meanwhile, transaction fees have marginally increased from Jan. 12, when the average fee stood at $1.217. Presently, fees amount to 0.000019 BTC or approximately $1.95, corresponding to 7.4–9 satoshis per virtual byte (sat/vB).

The network’s hashrate, however, remains below its Jan. 6 peak of 824 exahashes per second (EH/s), now registering at 788.62 EH/s. Slower block intervals suggest a potential downward adjustment in mining difficulty, anticipated to occur on Jan. 27. According to projections from hashrateindex.com, the adjustment could result in a 3.06% decline, though this estimation may shift as the week progresses.

As of today, Foundry commands the largest share of the network’s computational resources, contributing 33.23% of the total hashrate, equivalent to 260 EH/s. Antpool ranks second, managing 138 EH/s, which constitutes 17.62% of the total, while Viabtc follows with 106 EH/s, or 13.6%. Altogether, 69 distinct entities are allocating hashrate to the Bitcoin blockchain as of Jan. 17.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。