Author: insights4.vc

Compiled by: Felix, PANews

Thanks to key milestones such as the launch of the spot Bitcoin ETF in January 2024 and the election of a pro-crypto U.S. president and Congress in November, the crypto market experienced significant growth in 2024. The market capitalization of liquid cryptocurrencies surged by $1.6 trillion (an 88% year-on-year increase), reaching $3.4 trillion by the end of the year, with Bitcoin's market cap growing by nearly $1 trillion, approaching $2 trillion by year-end. Bitcoin's rise accounted for 62% of the total market increase, while the surge in memecoins and AI tokens also contributed to Bitcoin's ascent, dominating on-chain activity, particularly on Solana.

Despite the market recovery, the crypto venture capital space remains challenging. The investment opportunities provided by major trends such as Bitcoin, memecoins, and AI agent tokens are limited, as they primarily leverage existing on-chain infrastructure. Once-popular sectors like DeFi, gaming, the metaverse, and NFTs have failed to attract significant new attention or capital. With expectations that the new U.S. government will introduce regulatory reforms, established infrastructure companies are facing increasingly fierce competition from traditional financial service intermediaries.

Emerging trends such as stablecoins, tokenization, DeFi-TradFi integration, and the intersection of crypto AI show promise but are still in their infancy. Meanwhile, macroeconomic pressures, including high interest rates, have hindered high-risk allocations, disproportionately affecting the crypto venture capital industry. Following the highly publicized crypto market crash in 2022, comprehensive VC firms have largely remained cautious and distanced themselves from the crypto market.

According to Galaxy Research data, venture capitalists invested $3.5 billion in crypto and blockchain-focused startups in Q4 2024, a 46% quarter-on-quarter increase. However, the number of deals decreased by 13% to 416.

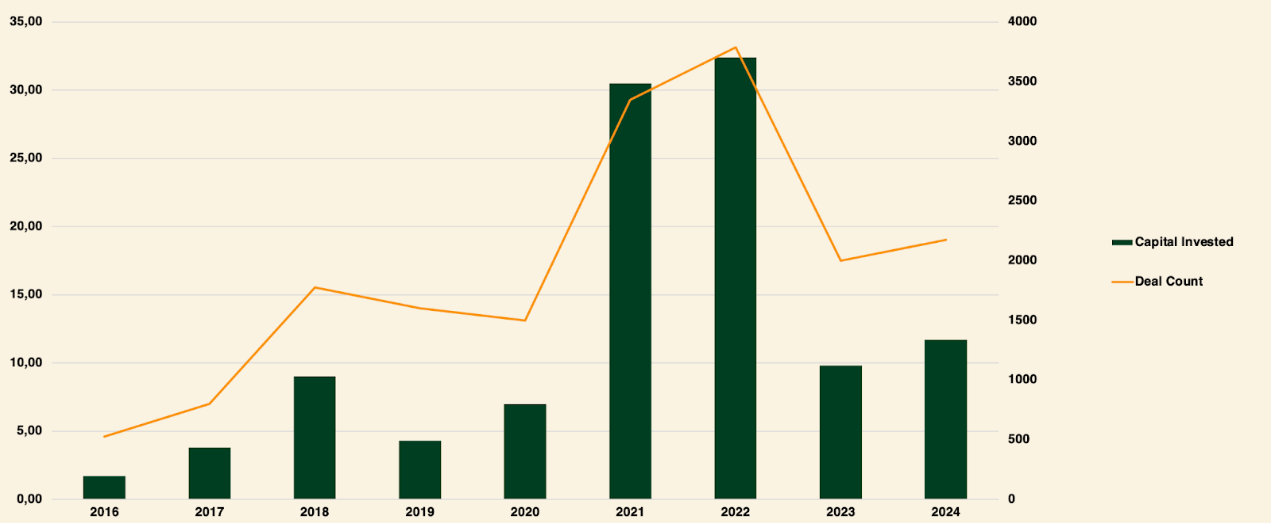

Annual Breakdown of Crypto Venture Capital (2016-2024)

Throughout 2024, the total investment from venture capital in crypto and blockchain startups amounted to $11.5 billion, with a total of 2,153 deals.

According to PitchBook's "2025 Corporate Technology Outlook," senior analyst Robert Le predicts that by 2025, annual investments in the crypto market will exceed $18 billion, with multiple quarters surpassing $5 billion. This represents a significant increase compared to 2024, but remains markedly lower than the levels seen in 2021 and 2022.

The increasing institutionalization of Bitcoin, the rise of stablecoins, and potential regulatory progress on DeFi-TradFi integration are key areas for future innovation. These factors, combined with emerging trends, could facilitate a revival in venture capital activity.

Capital Investment and Bitcoin Prices

Historically, there has been a strong correlation between Bitcoin prices and the amount of capital invested in crypto startups. However, since January 2023, this correlation has noticeably weakened. Bitcoin reached an all-time high, while venture capital activity struggled to keep pace with Bitcoin's momentum.

Possible Explanations:

- Diminished allocation interest: Institutional investors may hesitate due to regulatory uncertainty and market volatility.

- Shift in market narrative: The current market narrative favors Bitcoin, potentially overshadowing other crypto investment opportunities.

- Venture capital outlook: The broader venture capital market is experiencing a downturn, impacting crypto investments.

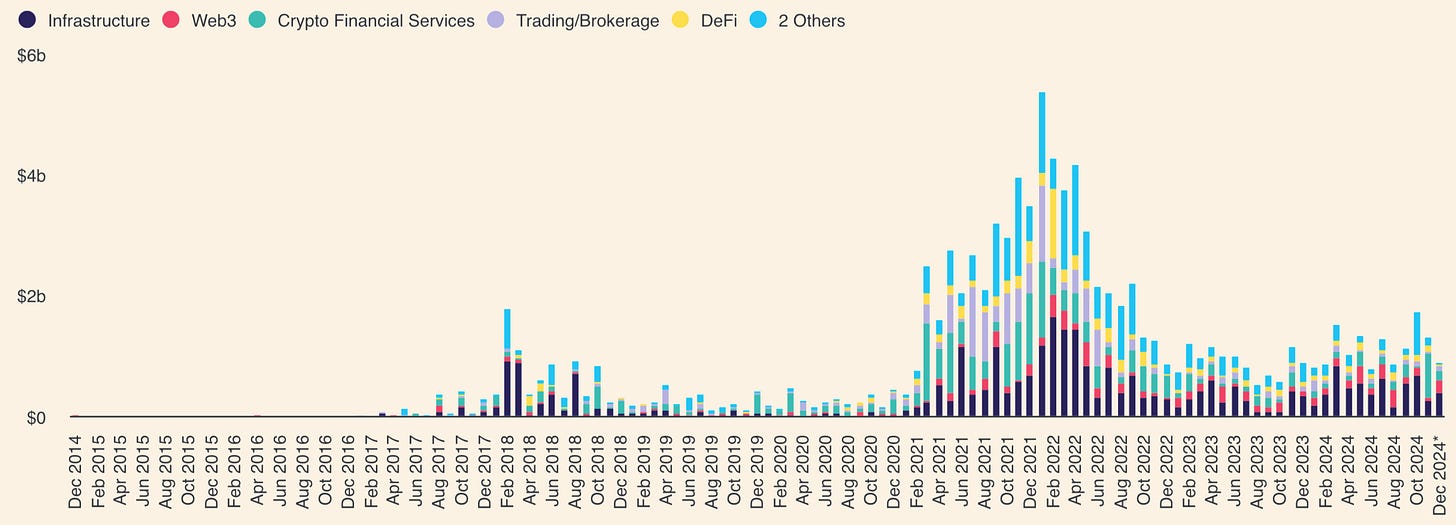

Infrastructure Track Dominates Crypto Venture Capital

Total Financing by Track in 2024 (USD)

According to The Block data, in 2024, infrastructure dominated crypto venture capital, attracting over 610 deals and reaching $5.5 billion, a 57% year-on-year increase. The investment focus was on expanding blockchain networks through L2 solutions to improve speed, reduce costs, and enhance scalability. Modular technologies, including data availability and shared sequencers, received significant funding, while liquid staking protocols and developer tools remained key priorities.

NFT and gaming startups raised $2.5 billion, slightly above the $2.2 billion raised in 2023. Despite stable funding, NFT market activity declined as memecoins gained traction. Although trading activity has matured since the peak of 936 deals in 2022, NFTs and gaming remain focal points, with over 610 deals. Corporate blockchain financing saw a significant decline, down 69% year-on-year, from $536 million in 2023 to $164 million.

Web3 financing showed some resilience, raising $3.3 billion over the past two years, close to the $3.4 billion raised in 2021-2022. Growth was driven by emerging trends such as SocialFi, crypto AI, and DePIN. DePIN emerged as a rapidly growing vertical, attracting over 260 deals and nearly $1 billion in funding.

DeFi experienced a strong recovery in 2024, achieving over 530 financings (an 85% year-on-year increase) compared to 287 financings in 2023. Bitcoin-based DeFi use cases, including stablecoins, lending protocols, and perpetual protocols, were key drivers of this growth.

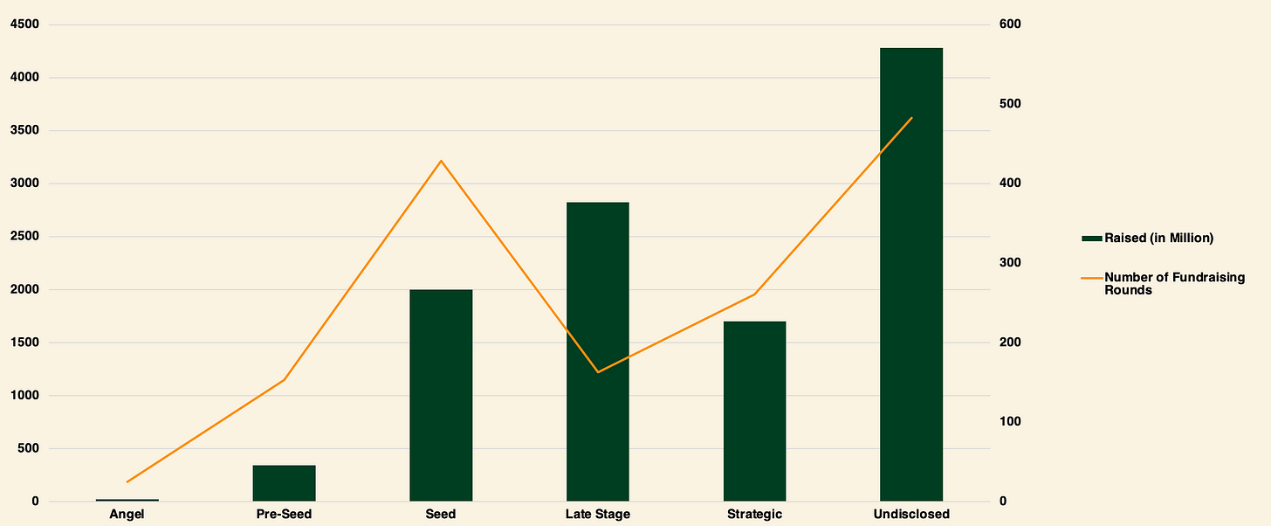

Breakdown of Crypto Venture Capital Investment by Type

The above chart indicates that, excluding undisclosed rounds, the crypto industry remains highly concentrated in early-stage financing. Early-stage deals attracted the majority of capital investment, accounting for 60%, while later-stage financing accounted for 40% of total capital, a significant increase from 15% in the third quarter.

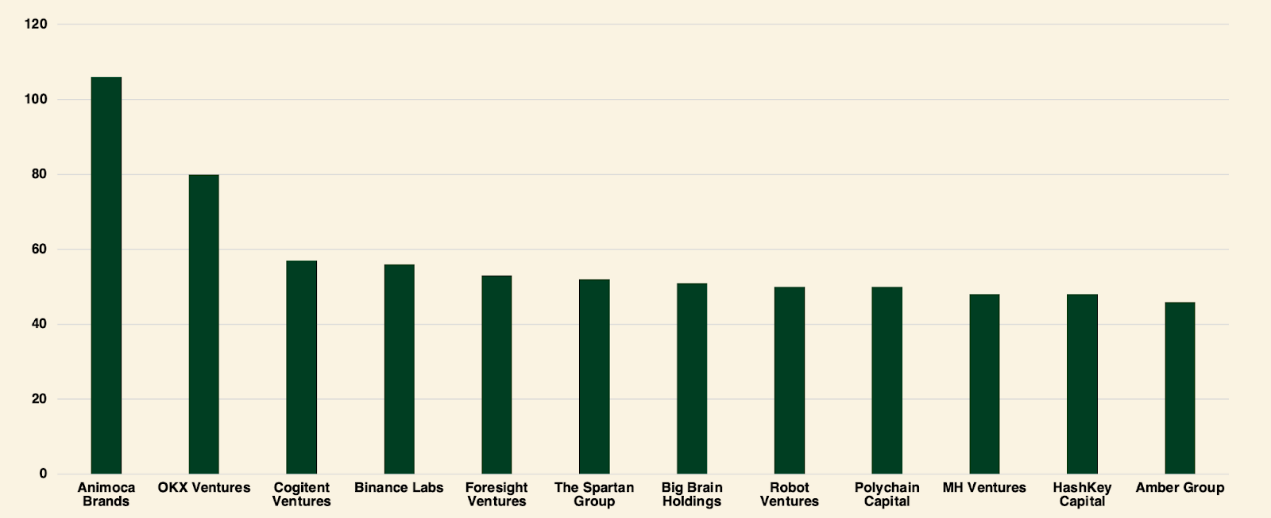

Most Active Investors

In 2024, Animoca Brands led venture capital activity with over 100 investments, followed by OKX Ventures with over 80 investments; Cogigent Ventures, Binance Labs, and Foresight Ventures each completed around 60 investments; while The Spartan Group, Big Brain Holdings, and Robot Ventures completed over 50 investments; major players like Polychain Capital and Amber Group maintained over 40 investment activities.

Venture Capital Funds

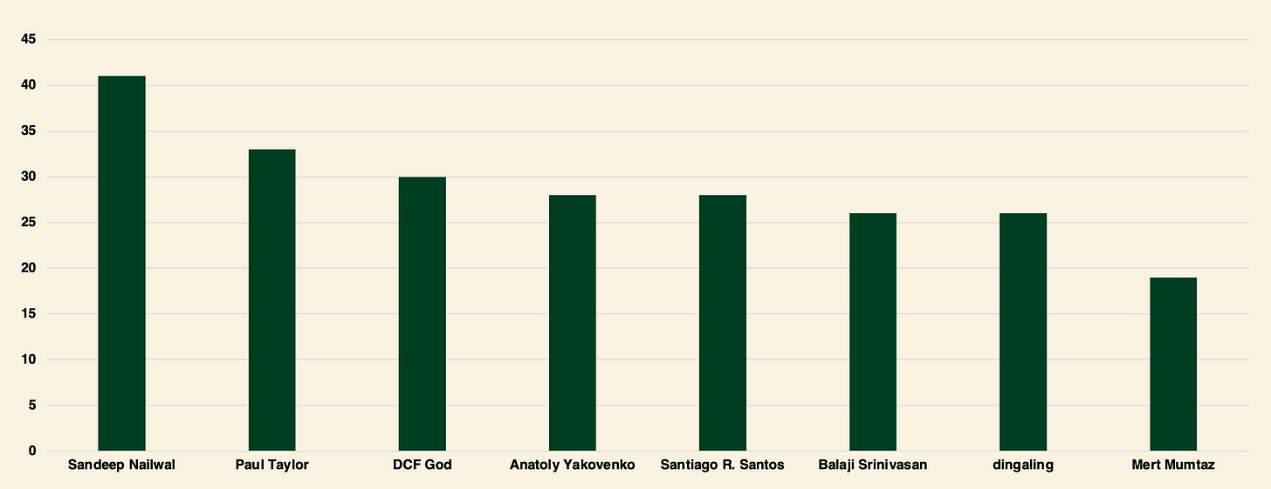

Among angel investors, the most active was Sandeep Nailwal (founder of Polygon), participating in over 40 investments; followed by Paul Taylor and DCF God, each participating in over 30; Anatoly Yakovenko (founder of Solana); Santiago R. Santos and Balaji Srinivasan were also significant participants, completing over 25 investments; Mert Mumtaz was slightly behind but still active.

Angel Investors

Crypto Venture Financing

According to the Venture Capital Journal, the fundraising amount for venture capital funds in 2024 fell to its lowest level in six years, with 865 funds raising a total of $104.7 billion, a significant 18% decrease from the $128 billion raised by 1,029 funds in 2023.

Affected by macroeconomic factors and the ongoing market volatility of 2022-2023, crypto venture financing continues to face pressure. Allocators have reduced their commitments to crypto venture capital funds, reflecting a shift from the bullish sentiment seen in early 2021 and 2022. Although interest rate cuts are expected in 2024, meaningful reductions are not anticipated until the second half of the year, and capital allocation for venture funds has continued to decline quarter by quarter since Q3 2023.

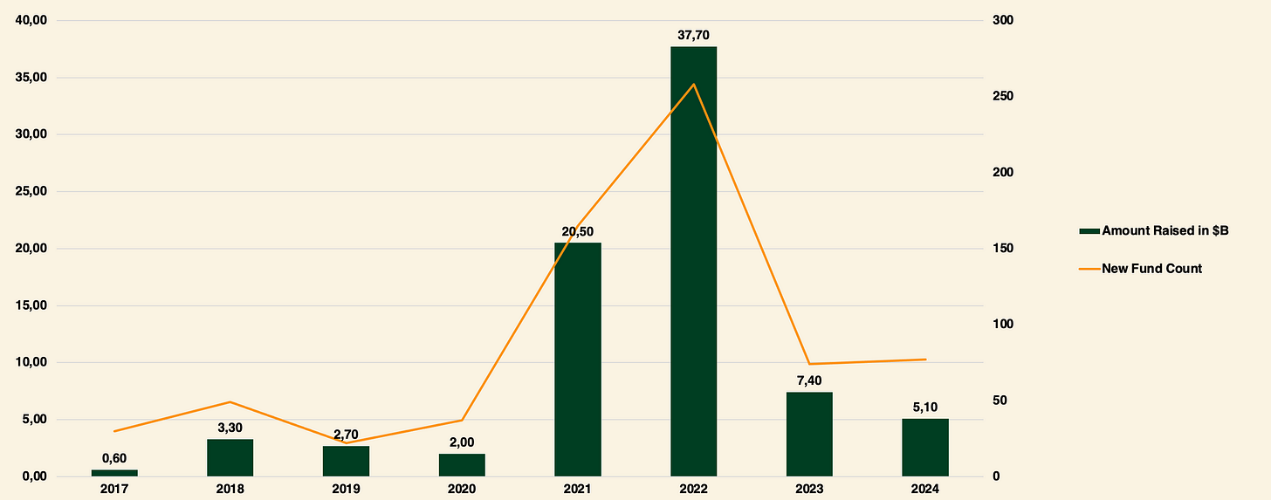

Crypto Venture Financing from 2017-2024

The financing situation for crypto venture capital funds in 2024 was notably weak, with 79 new funds raising $5.1 billion, marking the lowest annual total since 2020. Despite a slight year-on-year increase in the number of new funds, the reduced interest from allocators led to a significant shrinkage in fund sizes. The median and average fund sizes in 2024 both fell to their lowest levels since 2017, highlighting the increasingly challenging fundraising environment.

Shift to Medium-Sized Funds

Historically, small funds (under $100 million) have dominated crypto venture capital fundraising, reflecting the early stage of the crypto industry. However, since 2018, there has been a noticeable shift towards medium-sized funds ($100 million to $500 million).

While large funds (over $1 billion) experienced rapid growth from 2019 to 2022, they have not emerged in 2023 and 2024 due to the following challenges:

- Deployment difficulties: A limited number of startups require substantial funding.

- Valuation risks: Large investments inflate valuations, increasing risks.

Despite this, well-known funds such as Pantera Capital and Standard Crypto ($500 million) remain active, expanding their business scope to include areas beyond cryptocurrency, such as AI. Notably, Pantera Fund V is the successor to Pantera Blockchain Fund IV and is set to launch its first fundraising round on July 1, 2025, with a target of $1 billion.

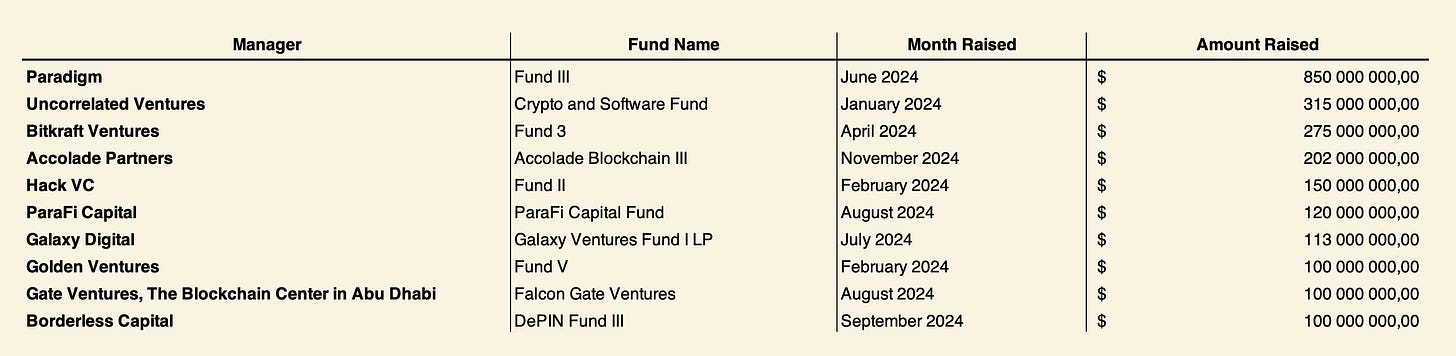

The table below summarizes the 10 funds that raised over $100 million in 2024. The largest closed-end fund in 2024 is Fund III managed by Paradigm.

Crypto Venture Capital Funds Raising Over $100 Million in 2024

Notable Investments in 2024

Top 10 Venture Capital Projects of 2024

Monad: An EVM-compatible L1 blockchain that achieves a throughput of 10,000 transactions per second, with a 1-second block time and single-slot finality. Its parallel transaction execution architecture ensures efficiency, making it a preferred choice for developers seeking speed and scalability.

Farcaster: A social network that supports user control over their data. Its "fully decentralized" design allows for interactions without network-wide approval, using a non-custodial social graph secured by Ethereum. The flagship application Warpcast highlights its potential to redefine social media.

Berachain's Proof of Liquidity (PoL) consensus links network security with liquidity provision, allowing validators to stake liquidity assets to enhance security while earning rewards. EVM compatibility simplifies the deployment of DeFi applications, solidifying Berachain's role in the DeFi ecosystem.

Story Protocol: Transforming intellectual property management through on-chain registration, automated licensing, and monetization via token-bound accounts supporting ERC-6551. Utilizing the Ethereum Virtual Machine and Cosmos SDK, it provides creators with control and fosters innovation.

0G Labs: Combining blockchain scalability with AI-driven processes, featuring a robust data availability layer and a decentralized AI operating system (dAIOS). Its $250 million funding leads the project financing record for 2024, surpassing Monad and solidifying its dominance in the AI-blockchain space.

Polymarket: A decentralized prediction market that gained significant attention during the 2024 U.S. presidential election, showcasing the potential for rapid adoption of Web3 despite declining post-event metrics.

Blockchain Infrastructure

- EigenLayer: Introducing a re-staking market to maximize the utility of staked assets on Ethereum, enhancing security and validator income.

- Babylon: Combining Bitcoin's proof of work with proof of stake blockchains to provide tamper-proof security and cross-chain interoperability.

Blockchain Services

- Sentient: Achieving decentralized AI applications through scalable and private AI computing by leveraging blockchain's distributed network.

- Zama: Implementing homomorphic encryption for secure data processing on the blockchain, ensuring privacy without sacrificing functionality.

Key Trends for 2024 and Beyond

AI integration, DeFi on Bitcoin, and dedicated blockchains dominate the blockchain space. Projects like 0G Labs and Sentient are leading in the AI field, while Babylon strengthens Bitcoin's role in DeFi. In the near future, Monad, Berachain, and Story Protocol are expected to launch their mainnets.

Conclusion

The landscape of crypto venture capital in 2024 exhibits a cautiously optimistic attitude, characterized by a rebound in fundraising activity and growing institutional interest. The shift towards medium-sized funds and the continued dominance of emerging funds indicate that the industry is maturing and adapting to changing market dynamics. Despite a short-term decline in venture capital and extended fundraising cycles, the ongoing focus on early-stage venture capital and emerging trends like AI integration highlight a resilient ecosystem poised for future growth. Overall, the crypto industry demonstrates potential strength, suggesting that new momentum may be on the horizon.

Related Reading: 2024 Financing Report: 1,259 Fundings, $9.615 Billion, Overall Market Trends Similar to Last Year

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。