DeFAI not only enhances the performance of existing DeFi protocols but also opens up new application scenarios, providing long-term development momentum that transcends market cycles.

Part One: Overview of the DeFAI Industry

1.1 Background and Evolution of the DeFAI Industry

Since the rise of DeFi in 2020, the decentralized finance market has gradually evolved from the initial stages of liquidity mining and decentralized exchanges (DEX) to diversified directions such as DAO governance, NFT financialization, and GameFi. However, as the market matures and competition intensifies, DeFi is increasingly facing core issues such as stagnation in user growth, inadequate risk management, and low capital efficiency. At the same time, in recent years, artificial intelligence technology has made breakthrough progress in areas such as generative AI, natural language processing (NLP), and automated decision-making. Especially since 2024, the combination of AI and Web3 technology is seen as a key direction for a new narrative. The integration of DeFi and AI, known as DeFAI (Decentralized Finance + Artificial Intelligence), represents a new path to address the internal competition in the DeFi market, improve user experience, enhance protocol security, and increase asset management efficiency. DeFAI not only enhances the performance of existing DeFi protocols but also opens up new application scenarios, providing long-term development momentum that transcends market cycles.

1.2 Driving Forces Behind the Concept of DeFAI

The core factors driving the emergence of the DeFAI narrative include:

Internal competition and innovation stagnation in the DeFi market: From 2020 to 2022, the DeFi market experienced explosive growth, but starting in 2023, the market growth rate gradually slowed, and user demand shifted from purely high returns to safer and more intelligent financial services.

Rapid advancements in AI technology: Since the emergence of generative AI technologies like ChatGPT, AI has demonstrated tremendous potential in data analysis, risk prediction, and automated execution of smart contracts. Particularly in the fields of automated asset management and intelligent risk control, AI can effectively address the shortcomings of DeFi protocols.

Upgraded user demands: The needs of DeFi users have evolved from simple mining arbitrage to efficient asset management, intelligent risk control, and personalized financial services. The proposal of DeFAI is aimed at meeting this new market demand.

Updates in the Web3 narrative: The demand for new narratives in the market has never ceased, from DeFi to GameFi, SocialFi, and DAOs. The year 2025 may mark the launch of the DeFAI narrative, as new market consensus is forming.

1.3 Evolution of DeFAI

DeFAI will be a key development direction for the future DeFi market. By introducing AI technology, DeFAI will optimize asset management, enhance risk control levels, and promote protocol autonomy, achieving smarter, safer, and more efficient decentralized financial services.

The potential market size of the DeFAI ecosystem is enormous.

According to market forecasts, the potential market size of the DeFAI ecosystem is expected to reach hundreds of billions of dollars within the next five years, especially in the fields of intelligent risk control, automated asset management, and governance optimization.

The application scenarios of DeFAI are extremely broad. From automated investment strategies and credit risk management to the optimization of decentralized autonomous protocols, the application scenarios of DeFAI will cover all aspects of the DeFi ecosystem and even extend to GameFi, SocialFi, and NFT sectors.

The evolution path of the DeFAI narrative is clear. The evolution of the DeFAI narrative will go through early experimental stages, protocol innovation stages, and ecosystem maturity stages, ultimately becoming one of the mainstream narratives in the DeFi market.

Part Two: Core Logic and Technical Architecture of DeFAI

2.1 What is DeFAI?

DeFAI (Decentralized Finance + Artificial Intelligence) is the deep integration of decentralized finance and artificial intelligence, bringing AI's capabilities in data analysis, automated decision-making, and risk control into DeFi protocols to enhance capital efficiency, user experience, and security in DeFi. The core value proposition of DeFAI is to address the pain points faced by traditional DeFi, such as stagnation in user growth, operational complexity, and inadequate risk management, through AI-driven financial intelligence, pushing DeFi into a new stage of automation, personalization, and intelligence. Therefore, DeFAI = AI-empowered decentralized financial protocols.

2.2 Core Value Logic of DeFAI

The core value of DeFAI is reflected in three aspects:

Intelligent asset management: AI automatically optimizes investment strategies based on on-chain data and market dynamics, helping users achieve higher capital utilization.

Real-time risk management: AI predicts market fluctuations and potential risks through machine learning models, triggering automatic liquidation and stop-loss mechanisms in a timely manner to reduce user losses.

Personalized user experience: DeFAI can provide personalized financial product recommendations and automated portfolio management based on user behavior data and preferences.

2.3 Technical Architecture and Implementation Path of DeFAI

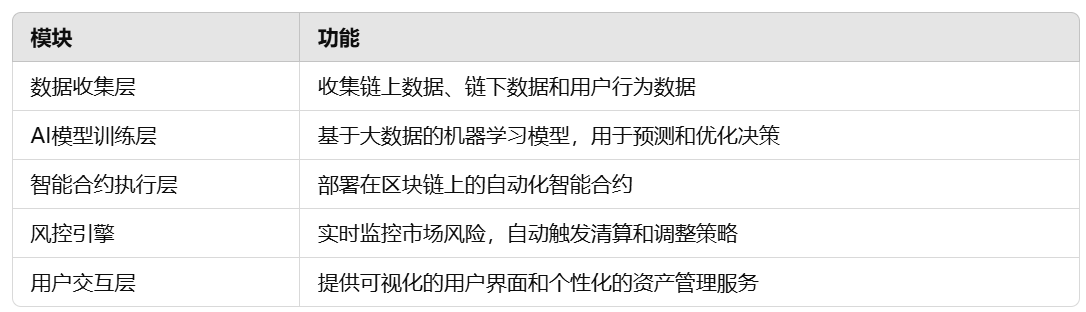

The technical architecture of DeFAI includes the following core modules:

Implementation Path:

Data integration: Obtaining on-chain and off-chain data through decentralized oracles.

AI model training: Training AI models based on historical data to continuously optimize risk prediction and investment strategies.

Smart contract execution: Achieving asset management and risk control without human intervention through automated smart contracts.

User experience optimization: Providing a simple and intuitive user interface to lower the usage threshold for DeFi users.

Part Three: Application Scenarios and Case Analysis of DeFAI

3.1 Intelligent Asset Management: Optimizing Yield Strategies

Case Analysis: YieldBot Protocol

YieldBot is a typical DeFAI project that uses AI algorithms to analyze market dynamics in real-time, automatically seeking the highest-yield liquidity pools for users across different DeFi protocols.

Core Functions:

Cross-protocol yield optimization: AI dynamically adjusts fund allocation based on yield rates and risk levels.

Automatic compounding: Automatically reinvests earnings to maximize long-term returns.

3.2 AI-driven Risk Management and Control Tools

The risk control engine of DeFAI is based on AI models that can monitor market fluctuations and protocol health in real-time, automatically triggering liquidation, stop-loss, and risk alerts.

Application Scenarios:

Decentralized lending platforms: AI models predict the volatility risk of collateral assets, triggering liquidation in advance.

DEX risk control systems: AI analyzes market depth and liquidity conditions, automatically adjusting trading fees to prevent slippage and attacks.

3.3 Intelligent Governance and Autonomy of Decentralized Protocols

DeFAI can enhance the governance efficiency of decentralized autonomous organizations (DAOs):

Intelligent proposal analysis: AI analyzes the potential impact of each governance proposal and provides recommendations.

Voting behavior optimization: AI recommends proposals that align with user interests based on historical voting behavior and preferences.

3.4 Extension of DeFAI in GameFi and SocialFi

DeFAI can assist GameFi and SocialFi protocols in achieving:

User behavior data analysis: Providing personalized game rewards and social recommendations based on user behavior data.

Automated economic model adjustments: AI automatically adjusts game economic models based on market dynamics to maintain token stability.

Part Four: Analysis of the Token Economic Model of DeFAI

The sustainable development of DeFAI projects relies on a well-designed token economic model (Tokenomics), which plays a core role in incentivizing user participation, ensuring protocol security, and promoting protocol governance.

4.1 Design Principles of the DeFAI Token Economic Model

The core of the DeFAI token economic model is to incentivize users to participate in the protocol long-term and achieve decentralized governance. To this end, the design of the token economic model needs to adhere to the following four principles:

Value capture and growth linkage: The tokens of the DeFAI protocol need to have value capture capabilities, meaning that the token value should rise with user growth, total value locked (TVL) increases, and trading volume increases.

Long-term incentives and user stickiness: The DeFAI token economic model needs to design long-term incentive mechanisms to ensure that users not only participate in the protocol in the short term but also maintain long-term locking and activity.

Decentralized governance: The DeFAI protocol needs to achieve decentralized governance through tokens, ensuring that major decisions of the protocol are made collectively by token holders, thus achieving community autonomy.

Dynamic adjustment and economic recession resistance: The DeFAI token economic model should have dynamic adjustment mechanisms to modify incentive strategies based on market changes, avoiding protocol collapse due to market cycle fluctuations.

4.2 Design of the Dual Token System of DeFAI

The DeFAI protocol typically adopts a dual token system, separating the utility token and governance token, each serving different roles.

4.2.1 Utility Token

The utility token is the "fuel" within the DeFAI protocol, used for paying transaction fees, collateral, lending, liquidity mining, and other operations.

Functions: Paying transaction fees, staking mining, unlocking advanced features within the protocol, providing yield rewards.

4.2.2 Governance Token

The governance token is the certificate of governance rights for the DeFAI protocol, allowing holders to participate in protocol governance, including proposals, voting, and decision-making.

Functions: Proposal and voting rights, profit distribution rights, adjusting protocol parameters (e.g., transaction fee rates, staking rewards, etc.).

4.3 Incentive Mechanism Design of DeFAI

To attract user participation and maintain long-term activity of the protocol, DeFAI protocols typically design various incentive mechanisms, including liquidity mining, profit sharing, staking rewards, and behavior mining.

Part Five: Market Prospects and Development Trends of DeFAI

The integration of DeFAI is not just a technological overlay but a profound transformation across multiple fields, including financial infrastructure, data value, and intelligent decision-making. From the early DeFi 1.0 to DeFi 2.0, the market has gradually evolved from simple asset liquidity tools to an ecosystem that includes complex protocols such as lending, staking, and oracles. In the future, the development trend of DeFAI will emphasize intelligence, personalization, and decentralized autonomy, while also welcoming new transformative opportunities in cross-chain interoperability, Web3 identity, and regulatory compliance.

5.1 Trend One: AI-driven Personalized Financial Services

Future DeFAI protocols will not only provide basic financial tools but will also offer personalized financial services through AI algorithms, including automated investment, personalized financial advice, credit scoring, and risk management. DeFAI protocols can provide automated portfolio management services based on users' historical trading data, risk preferences, and market trends.

5.2 Trend Two: Cross-chain Interoperability and Interconnection of DeFAI Ecosystems

With the continuous development of multi-chain ecosystems, DeFAI protocols will gradually evolve from single-chain to cross-chain interoperability protocols, enabling data sharing and asset interchange between different chains. Future DeFAI protocols will require cross-chain bridges and decentralized oracle networks to achieve interconnectivity within the multi-chain ecosystem.

5.3 Trend Three: The Combination of Web3 Identity and Decentralized Autonomous Organizations (DAOs)

The development of Web3 identity (Decentralized Identity, DID) and decentralized autonomous organizations (DAOs) will bring innovations in governance and user identity management to DeFAI protocols. Future DeFAI protocols will integrate users' on-chain identities to achieve more precise user profiling and personalized services.

5.4 Trend Four: Compliance and Decentralized Regulatory Mechanisms

As global regulatory policies become clearer, DeFAI protocols need to find a balance between decentralization and compliance, building decentralized regulatory mechanisms to enhance the compliance and credibility of the protocols. Future DeFAI protocols can achieve self-regulation by introducing AI algorithms to automatically monitor user behavior and transaction data, identifying risks and undesirable behaviors.

5.5 Trend Five: Enhanced Data Privacy and Security

Data privacy and security are critical areas that the DeFAI ecosystem must focus on. In the future, DeFAI protocols will ensure the security and privacy of user data through privacy technologies and data encryption methods. Zero-Knowledge Proof (ZKP) technology will be widely applied in future DeFAI protocols to protect users' transaction privacy.

Part Six: Risk and Challenge Analysis

The innovation of the DeFAI ecosystem brings significant market opportunities but also faces numerous risks and challenges. Financial risks, technical risks, governance risks, compliance risks, and market risks are core issues that DeFAI projects must address during their development.

6.1 Financial Risk Analysis and Response Strategies

Financial risk is one of the core challenges facing the DeFAI ecosystem, including liquidity risk, liquidation risk, and systemic risk. Since DeFAI protocols typically involve complex financial activities such as lending, staking, and profit distribution, financial risk management is particularly important.

Response Strategies:

Multi-asset reserve mechanism: Introduce diversified asset reserves to reduce liquidity pressure on a single asset.

Dynamic fee adjustment: Dynamically adjust the protocol's transaction fee rates based on market conditions to incentivize liquidity providers to increase liquidity during market fluctuations.

Insurance fund: Establish a liquidity insurance fund to provide a buffer for extreme market conditions.

Introduce on-chain oracles: Use high-frequency, low-latency oracles to provide real-time price data, ensuring the accuracy of the liquidation process.

Incentivize liquidators: Design reasonable liquidation reward mechanisms to encourage user participation in liquidation, maintaining market stability.

Set liquidation protection mechanisms: Introduce "flash loan liquidation" and "partial liquidation" strategies to reduce user losses and protocol risks.

Diversified investment portfolio: Spread the protocol's reserve assets across various crypto and traditional assets to mitigate the impact of single market volatility.

Risk hedging tools: Use options, futures, and other tools to hedge market risks and protect protocol assets.

Community governance emergency mechanisms: Establish a community rapid response mechanism to quickly adjust protocol parameters through decentralized voting in the event of systemic risk outbreaks.

6.2 Technical Risk Analysis and Response Strategies

The DeFAI ecosystem heavily relies on smart contracts and AI algorithms, making technical risks a key challenge, including smart contract vulnerabilities, oracle attacks, AI model biases, and data privacy risks.

Response Strategies:

Third-party audits: Regularly invite professional auditing firms to audit smart contracts to promptly identify and fix vulnerabilities.

Bug bounty programs: Encourage white-hat hackers to discover and report protocol vulnerabilities.

Contract upgrade mechanisms: Design upgradable smart contracts to ensure that a fix can be quickly deployed after a vulnerability is discovered.

Multi-oracle redundancy mechanisms: Use multiple oracles to provide data, reducing the risk of a single oracle being attacked.

On-chain verification mechanisms: Ensure the accuracy and reliability of oracle data through on-chain verification technologies.

Flash loan protection: Limit the scale and frequency of flash loan transactions to reduce the likelihood of oracle attacks.

Data transparency: Ensure the training data sources for AI models are transparent to avoid data biases.

Model audits: Regularly audit the decision-making processes of AI models to ensure their fairness and rationality.

Human-machine combined decision-making mechanisms: Introduce human oversight in critical decision-making to avoid biased decisions by AI models.

Zero-Knowledge Proof: Introduce zero-knowledge proof technology to protect user privacy while ensuring the effectiveness of data verification.

Data encryption storage: All user data will be stored encrypted to prevent unauthorized access.

Privacy protocol integration: Integrate with privacy protection protocols (such as Aztec, Tornado Cash) to enhance user privacy protection.

6.3 Governance Risk Analysis and Response Strategies

Governance risks mainly stem from the centralization of protocol governance, community decision-making failures, and governance attacks.

Response Strategies:

Limit the voting weight of a single address, introduce a secondary voting mechanism to enhance the participation of small token holders, and implement token locking mechanisms to prevent short-term speculators from manipulating governance decisions.

Part Seven: Conclusion and Investment Recommendations

The integration of DeFAI brings a new narrative and development path to the crypto industry. Against the backdrop of global economic uncertainty and turbulent macro market conditions, DeFAI represents a long-term narrative logic that transcends market cycles, meeting investors' demands for decentralized finance while aligning with expectations for AI-driven innovation. As AI technology is widely applied in the financial sector, the DeFAI ecosystem will further expand and have a profound impact on traditional finance and Web3.

7.1 Investment Value of DeFAI: A New Narrative that Transcends Market Cycles

7.1.1 Why is DeFAI a Long-term Narrative that Transcends Market Cycles?

In recent years, the crypto market has experienced multiple rounds of bull-bear transitions, with each new cycle accompanied by a new narrative logic. For example:

The ICO boom in 2017 drove the rise of public chains;

The DeFi wave in 2020 led to significant growth in decentralized finance;

The NFT and GameFi boom in 2021 provided new application scenarios for digital assets;

The explosion of AI technology in 2023 became a global focus.

DeFAI is at the core of the next stage narrative, combining the efficiency and transparency of decentralized finance with the intelligent decision-making of artificial intelligence, driving the entire Web3 industry towards intelligent, automated, and personalized services.

The core logic of investing in DeFAI lies in:

AI-driven intelligent financial services: Enhancing the capital efficiency and user experience of DeFi protocols through AI technology.

The evolution of decentralized autonomous organizations (DAOs): AI helps DAOs achieve more efficient governance and automated decision-making.

Cross-chain interoperability: Future DeFAI protocols will become the core infrastructure for asset flow and data sharing in multi-chain ecosystems.

7.1.2 Core Investment Value Points of DeFAI

Intelligent financial services: AI enhances the risk management and yield optimization capabilities of DeFi protocols, enabling automated investment, intelligent risk control, and decentralized credit assessment.

Data value realization: Utilizing AI to analyze on-chain data, uncovering the potential value of user behavior data, data oracles, and decentralized data markets.

Decentralized governance: DAOs introduce AI models to improve the efficiency and fairness of governance decisions, DAO governance tools, and voting incentive protocols.

Personalized financial services: Providing personalized financial advice and loan services based on user profiles and risk preferences, decentralized wealth management protocols, and credit loan protocols.

7.2 Investment Strategies

In the market environment of 2025, short-term investments in DeFAI can focus on infrastructure and popular sectors, seeking innovative projects with growth potential:

Infrastructure projects: Including AI oracles, cross-chain bridges, smart governance tools, etc.

Popular sectors: Such as automated investment protocols, decentralized risk control tools, Web3 identity protocols, etc.

Indicators for identifying short-term opportunities:

Technical team background: Focus on whether the team has deep experience in AI and blockchain technology.

Market demand: Identify whether the protocol addresses current pain points in DeFi.

Partnerships and ecosystem support: Whether the project has received support from mainstream public chains, foundations, and communities.

Long-term investment strategy: In the long run, investing in DeFAI requires attention to the protocol's sustainable development capabilities and user growth, with a focus on projects that have network effects and long-term competitive advantages.

7.3 Recommended Popular DeFAI Sectors and Projects

Based on current market trends and technological developments, here are some noteworthy popular DeFAI sectors and projects:

7.3.1 Automated Investment Protocols

Representative projects: dHEDGE, Enzyme, Yearn Finance

Investment opportunities: Utilizing AI technology to optimize investment portfolios and achieve automated yield management.

7.3.2 Decentralized Credit Scoring Systems

Representative projects: Credmark, ARCx

Investment opportunities: Providing personalized borrowing rates and credit scores for users through AI analysis of on-chain data.

7.3.3 AI-driven Oracle Networks

Representative projects: ChainGPT, Fetch.ai

Investment opportunities: Introducing AI technology to improve the accuracy and timeliness of oracle data.

7.4 Conclusion: Investment Outlook for DeFAI in the Next Five Years

In the long term, DeFAI is expected to become an important component of global financial infrastructure, driving financial markets towards intelligent, decentralized, and personalized development. With continuous technological advancements and growing market demand, DeFAI will continue to attract investor attention and provide significant return opportunities for early investors. DeFAI will lead the wave of intelligent decentralized finance development. AI-driven intelligent decision-making and automated governance will become the core competitive advantages of future DeFi protocols.

Investors should focus on infrastructure projects and long-term value sectors, seeking projects with network effects and competitive barriers. For risk-tolerant investors, the DeFAI sector represents a new narrative that transcends market cycles and is expected to become the next growth engine in the crypto market in the coming years.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。