DeFi's Difficulty of Use is an Old Topic, with a Penetration Rate of Only 1.4%.

Author: WOO X Research

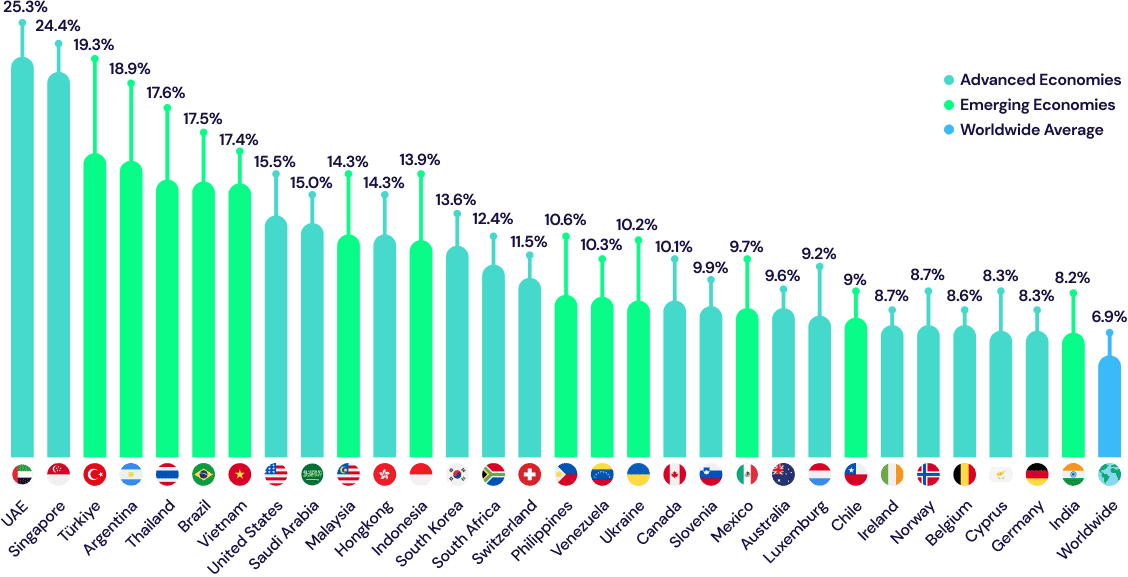

According to a survey by Triple A in 2024 on global cryptocurrency ownership, approximately 6.9% of the global population currently owns cryptocurrency, which equates to about 562 million people.

DeFi has always been seen as the hope for mass adoption, yet its penetration rate is dismal.

How can we estimate the number of DeFi users? We can calculate it from the daily active users of current mainstream public chains/Layer 2, with the daily active address counts of ETH, Base, and Solana totaling around 8 million. This figure does not account for "witch" addresses and multi-chain players, so 8 million is an overestimated number.

8 million / 562 million = 1.4%

This means that the current DeFi penetration rate among all cryptocurrency players is only 1.4%, but in terms of trading volume share, it has seen rapid growth, with DEX accounting for a historical high of 16.7% of CEX trading volume.

This also leads to a fact: the DeFi market is still dominated by a small number of large capital users, with low attractiveness for new users.

The main reasons DeFi struggles to attract new users revolve around high knowledge barriers and poor user experience. Taking the simplest Swap as an example, users must know how to transfer tokens to the chain, reserve Gas Tokens, understand what slippage is, and authorize transactions. This series of complex operations is not as convenient and quick as one-click buying and selling on centralized exchanges.

So, has DeFi inevitably become a zero-sum game, turning into a playground for old users?

The involvement of AI may break through the past dilemmas of DeFi, giving rise to a new narrative - DeFAI.

Reference: https://www.triple-a.io/cryptocurrency-ownership-data

What is DeFAI?

If DeFi represents the innovation of decentralized finance, then DeFAI (DeFi + AI) is the next evolutionary stage aimed at making "decentralized finance truly accessible to the masses." The core value of DeFAI lies in "using AI to reduce the complexity of DeFi" and further broaden application scenarios, allowing more people to easily and safely utilize various blockchain financial services.

The core values of DeFAI are as follows:

Lowering operational thresholds: Users no longer need to manually switch between various complex interfaces; they can simply input natural language commands like "Swap 1 ETH to USDC, then provide liquidity to a certain pool," and AI can help complete multi-step operations.

Automated strategies: Arbitrage and investment strategies that previously required professional traders can now be run by AI agents, which can even automatically adjust risk parameters, allowing ordinary investors to enjoy quantitative-level tools.

Integrated data analysis: AI can simultaneously monitor community sentiment, KOL comments, on-chain transaction data, price trends, etc., and automatically place orders when conditions are met, providing operations that are more aligned with actual market conditions.

Categories & Representative Projects of DeFAI

- AI abstraction layer: This type of DeFAI project abstracts complex DeFi operations (Swap, Bridge, staking, etc.) through natural language, allowing users to input intuitive commands like "I want to swap 2 ETH for USDC and provide liquidity." Behind the scenes, AI agents automatically connect to multiple protocols, find the best paths, and optimize Gas consumption. This type of DeFAI project is the most common.

Representative Projects:

Griffin

Operates within the Solana ecosystem, supporting natural language trading, minting NFTs, and sniping new coins.

The Solana Foundation has repeatedly retweeted Griffain's posts.

Can work collaboratively through multiple agents and has customizable automation features.

Heyanon.ai (Anonymous)

Developed by the Danielesesta team, emphasizing "one-stop" cross-chain trading, lending, and yield strategy integration.

Backend connects to cross-chain bridges like LayerZero and instant price oracles like Pyth, assisting users in quickly completing complex operations.

Grift

Focuses on cross-chain functionality, integrating over a hundred public chains and more than two hundred DeFi protocols, making it easy for users to manage assets across chains.

Particularly emphasizes automated strategies and liquidity management, capable of handling multi-step trading processes.

Buzz

Won first place at the Solana AI Hackathon.

Users can not only input their trading intentions in natural language but also receive detailed information about liquidity pools, token locking, and smart money addresses.

Automated trading agents: With user authorization, these AI agents can automatically execute complex, multi-step trading strategies, such as "regularly buy ETH and deposit into a liquidity pool" or "automatically arbitrage after cross-chain bridging," allowing users to simply state high-level needs without manually handling details.

Representative Projects:

Calendar

Focuses on institutional-level quantitative trading and security; uses TEE (Trusted Execution Environment) to prevent strategies from being stolen or subjected to MEV attacks.

Allows for strategy simulation in an EVM fork environment before officially deploying to the mainnet, reducing operational risks.

Codfish 3x

Provides a "no-code" strategy development environment, allowing users to drag and drop components to create AI trading agents.

Integrates external APIs and machine learning prediction models to make trading strategies smarter.

Market analysis agents: These AI agents are used to integrate and analyze vast amounts of on-chain data, KOL tweets, and discussion trends, providing users with real-time and multi-faceted market insights. When combined with trading agents, they can automatically execute buy and sell orders.

Representative Projects:

AIXBT

Tracks over 400 KOLs and community interactions, capable of monitoring topic popularity and community sentiment in real-time.

Can answer user questions and provide real-time analysis or token trend predictions.

Quantitative

- Provides investment advice based on technical analysis of candlestick charts.

Conclusion

DeFi has previously blocked mainstream users due to high thresholds and operational complexity, forming a "niche circle" dominated by a small number of large capital users. However, with breakthroughs in AI in dialogue interfaces, strategy automation, and data integration, DeFAI opens up a new path for "decentralized finance." In the future, from simple natural language trading to advanced automated arbitrage, and even ecosystems of multi-agent collaboration, all will become more mature due to DeFAI.

Perhaps the next wave of a true "DeFi Summer" will arrive because of DeFAI, allowing more users to enjoy the potential benefits of decentralized finance in a low-threshold manner. At the same time, professional investors can also conduct more flexible and secure trading strategies. As blockchain and AI continue to deeply integrate, the wave of DeFAI is gradually expanding, which is worth looking forward to and continuously observing.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。