Author: Bai Ding & Shew, Xianrang GodRealmX

Recently, the USD0++ de-pegging issued by Usual has become a hot topic in the market, triggering panic among many users. The project surged over 10 times after being listed on top CEXs last November, and its RWA-based stablecoin issuance mechanism and token model bear some resemblance to the previous cycles of Luna and OlympusDAO. Coupled with the government backing from French Member of Parliament Pierre Person, Usual once garnered widespread attention and discussion in the market.

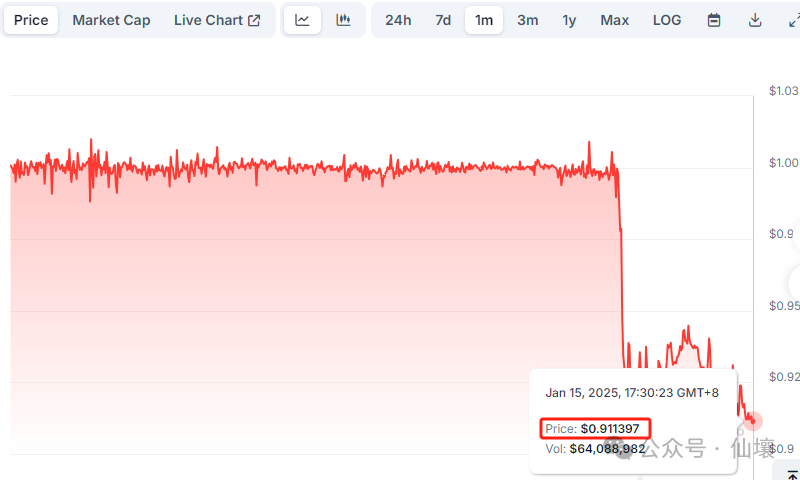

Although the public once held high hopes for Usual, recent "dramas" have brought it down from its pedestal. With Usual's official announcement on January 10 to modify the early redemption rules for USD0++, USD0++ briefly de-pegged to nearly $0.9. As of the evening of January 15, 2025, when this article is published, USD0++ is still hovering around $0.9.

Currently, the controversy surrounding Usual has reached a boiling point, and dissatisfaction in the market has erupted, causing a huge uproar. Although the overall product logic of Usual is not complex, it involves many concepts and intricate details, with multiple different tokens within a single project, making it difficult for many to have a systematic understanding of the cause and effect.

The author of this article aims to systematically sort out the product logic, economic model, and the causal relationship of the USD0++ de-pegging from the perspective of DeFi product design, helping more people deepen their understanding and reflection on it. Here, we also present a seemingly "conspiracy theory" viewpoint:

In a recent announcement, Usual set the unconditional floor price for USD0++ to USD0 at 0.87, aiming to liquidate the USD0++/USDC circular loan positions on the Morpha lending platform, resolving the main users involved in mining and selling, but without causing systemic bad debts in the USDC++/USDC treasury (the liquidation line LTV is 0.86).

Next, we will elaborate on the relationships between USD0, USD0++, Usual, and its governance token, clarifying the intrigues behind Usual.

Understanding Usual's Products Through Its Issued Tokens

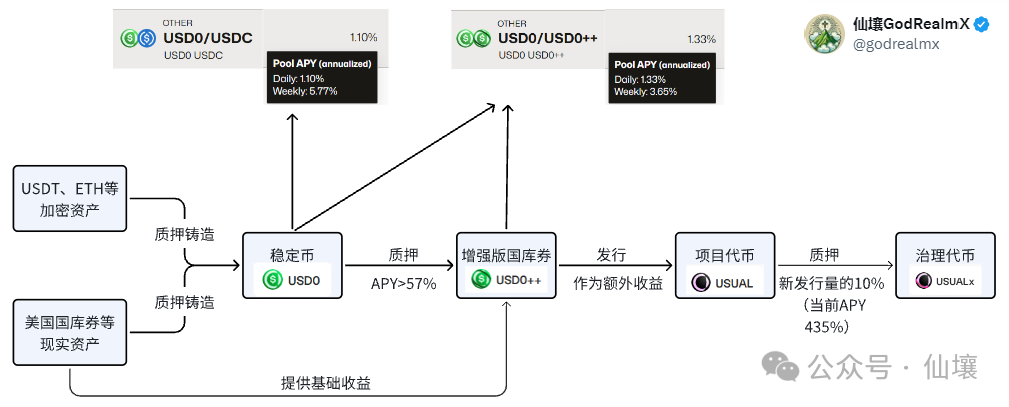

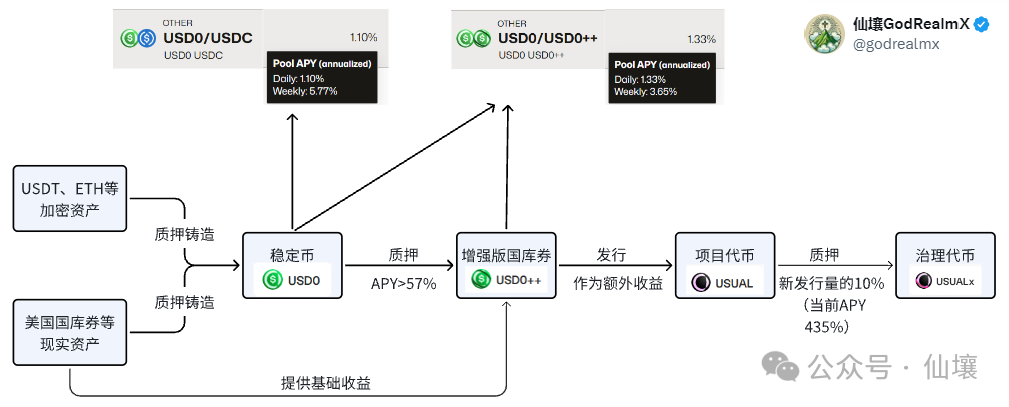

Usual's product system mainly consists of four types of tokens: the stablecoin USD0, the bond token USD0++, and the project token USUAL. Additionally, there is a governance token USUALx, but since the latter is not important, Usual's product logic is primarily divided into three layers based on the first three tokens.

First Layer: Stablecoin USD0

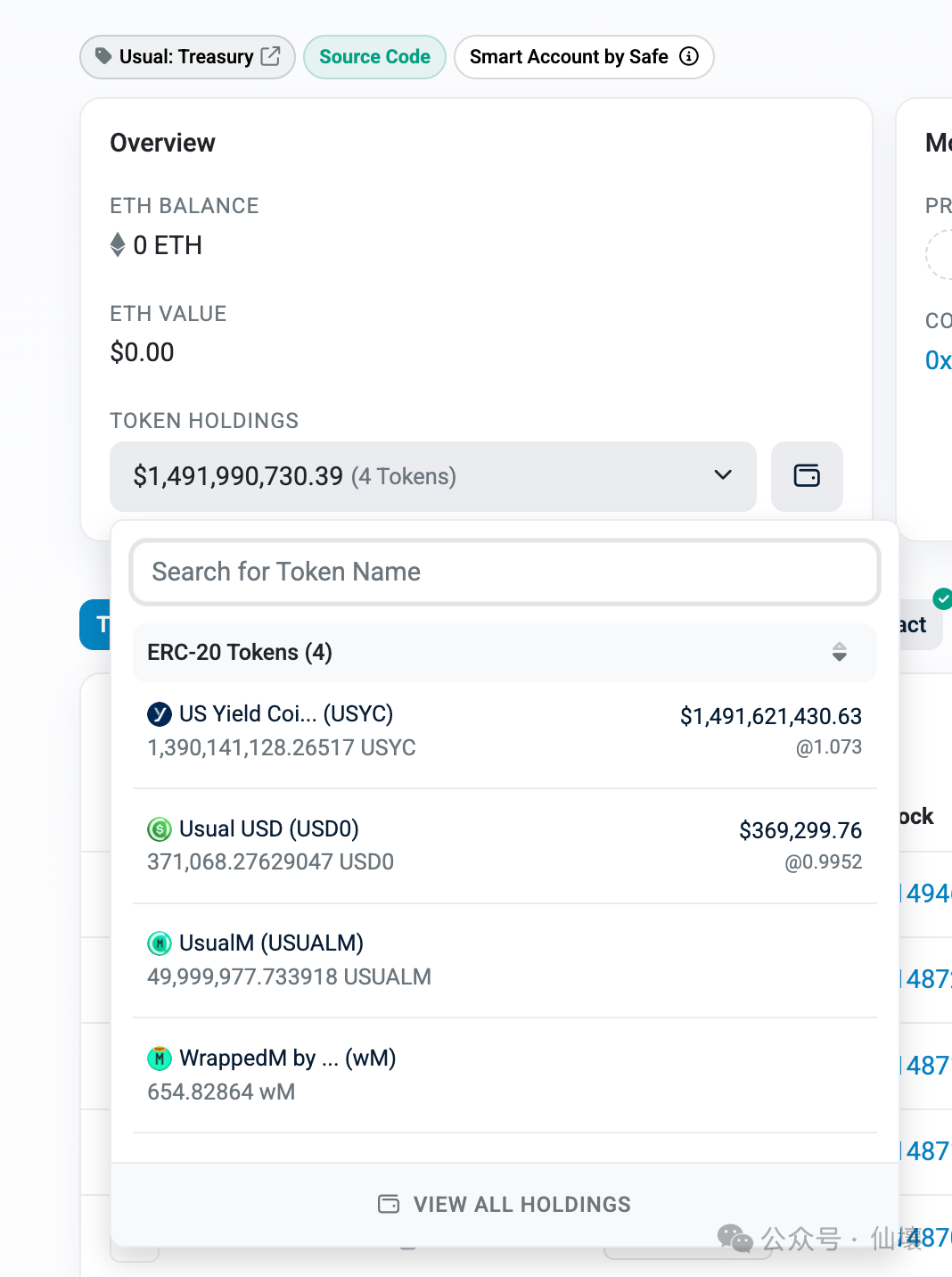

USD0 is a collateralized stablecoin, using RWA assets as collateral, with all USD0 backed by an equivalent value of RWA assets. However, currently, most USD0 is minted using USYC, and some USD0 uses M as collateral. (Both USYC and M are RWA assets backed by U.S. short-term treasury bonds.)

It can be found that the collateral for USD0 on-chain is located at

0xdd82875f0840AAD58a455A70B88eEd9F59ceC7c7, which holds a large amount of USYC assets.

Why does the treasury holding the underlying RWA assets contain a large amount of USD0? This is because when users burn USD0 to redeem RWA tokens, a portion of the fee is deducted, and this fee is stored in the treasury in the form of USD0.

The minting contract address for USD0 is 0xde6e1F680C4816446C8D515989E2358636A38b04. This address allows users to mint USD0 in two ways:

1. Directly mint USD0 using RWA assets. Users can inject USYC and other Usual-supported tokens into the contract to mint USD0 stablecoins;

2. Transfer USDC to RWA providers to mint USD0.

The first option is relatively straightforward; users input a certain amount of RWA tokens, and the USUAL contract calculates the dollar value of these RWA tokens, then issues the corresponding USD0 stablecoins to the user. When users redeem, based on the amount of USD0 input and the price of RWA tokens, the corresponding value of RWA tokens is returned, during which the USUAL protocol deducts a portion of the fee.

It is worth noting that most RWA tokens currently are automatically compounded, continuously generating interest through issuance or value appreciation. RWA token issuers often hold a large amount of interest-generating assets off-chain, the most common being U.S. treasuries, and then return the interest from these assets to RWA token holders.

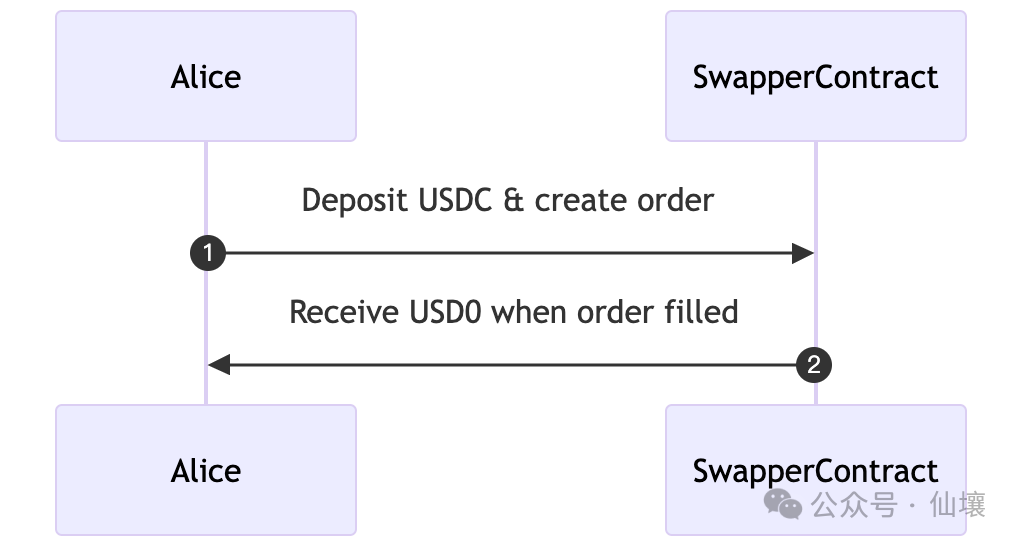

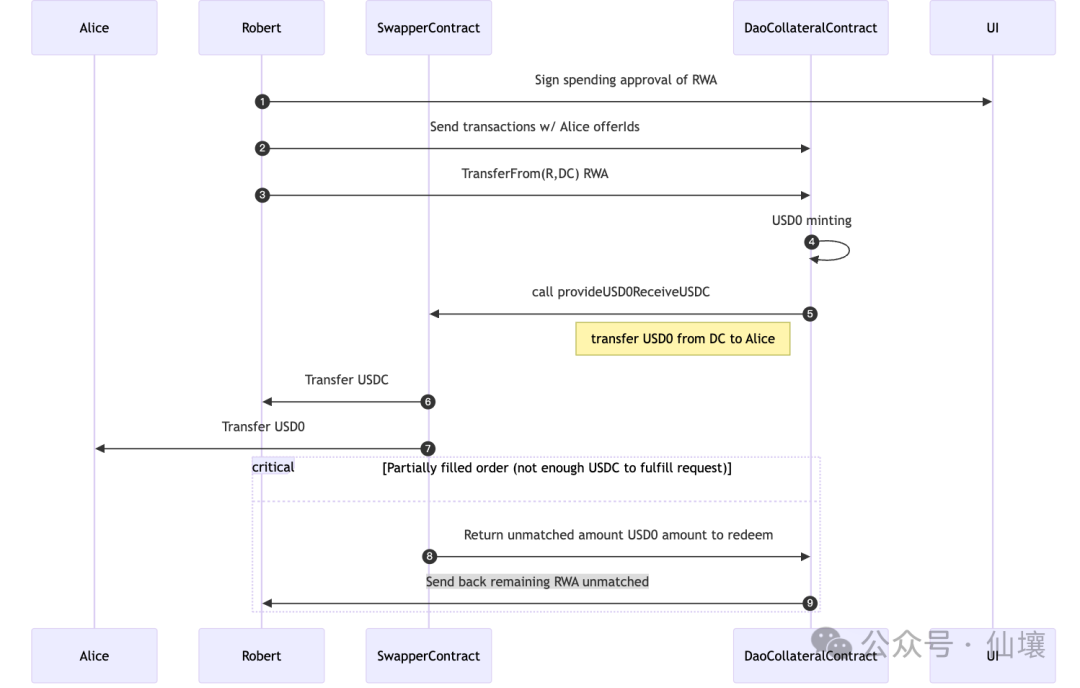

The second method of minting USD0 is more interesting, as it allows users to directly mint USD0 using USDC. However, this process requires the participation of RWA providers or payers. In simple terms, users need to place an order through the Swapper Engine contract, declare the amount of USDC they are willing to pay, and send the USDC to the Swapper Engine contract. When the order is matched, users can automatically receive USD0. For example, for user Alice, the perceived process is as follows:

However, in the actual process, RWA providers or payers are involved. In the example below, Alice's request to exchange USDC for USD0++ is responded to by RWA provider Robert, who directly mints USD0 using RWA assets, then transfers USD0 to the user through the Swapper Engine contract, and takes away the USDC assets that the user paid when placing the order.

In the image below, Robert is the RWA provider/payer, and it is clear that this model is essentially similar to gas payment; when you want to trigger some operations using tokens you do not have, you find someone to trigger the operation on your behalf using other tokens, and the latter then finds a way to transfer the "gains" from the triggered operation back to you, taking a fee in the process.

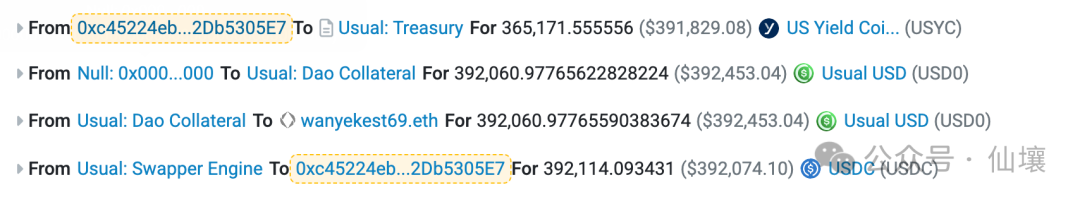

The image below shows a series of transfer actions triggered during the process of RWA providers accepting users' USDC assets to mint USD0 tokens:

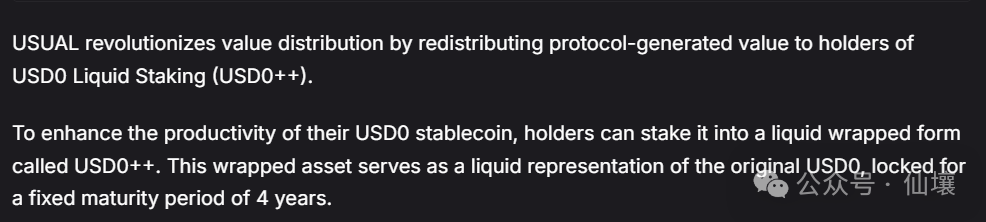

Second Layer: Enhanced Treasury Bond USD0++

In the previous text, we mentioned that users need to pledge RWA assets to mint USD0, but the interest generated from the automatically compounding RWA assets is not directly distributed to those minting USD0. So where does this interest ultimately flow? The answer is that it flows to the Usual DAO organization, which will then redistribute the interest from the underlying RWA assets.

USD0++ holders can share in the interest income. If you pledge USD0 to mint USD0++, becoming a USD0++ holder, you can receive the interest from the underlying RWA assets. However, it is important to note that only the portion of USD0 that corresponds to the minted USD0++ will have its underlying RWA interest distributed to USD0++ holders.

For example, if the underlying RWA assets used for collateral to mint USD0 amount to $1 million, and $1 million USD0 is minted, then if $100,000 USD0 is minted into USD0++, those USD0++ holders will only receive the interest income from the $100,000 RWA assets, while the interest from the remaining $900,000 RWA assets will become income for the Usual project team.

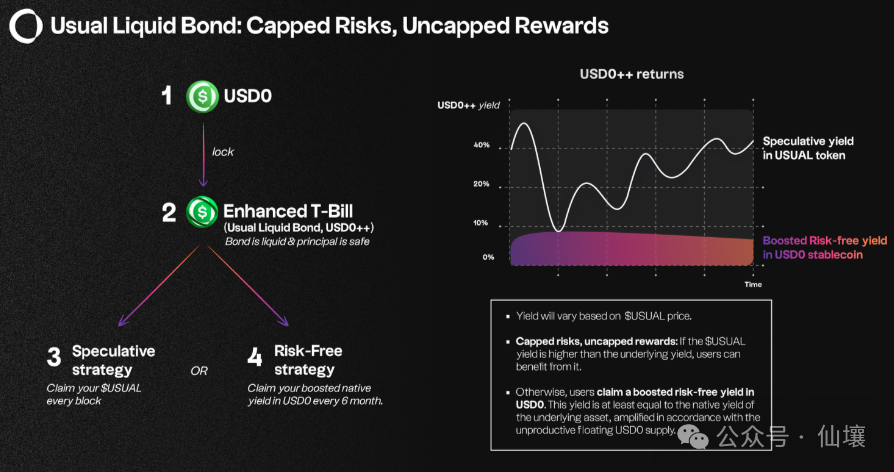

Additionally, USD0++ holders can also receive extra USUAL token incentives. USUAL will daily issue new tokens through a specific algorithm, and 45% of the newly issued tokens will be allocated to USD0++ holders. In summary, the income from USD0++ is divided into two parts:

- The income from the underlying RWA assets corresponding to USD0++;

- The income from the daily distribution of newly issued USUAL tokens;

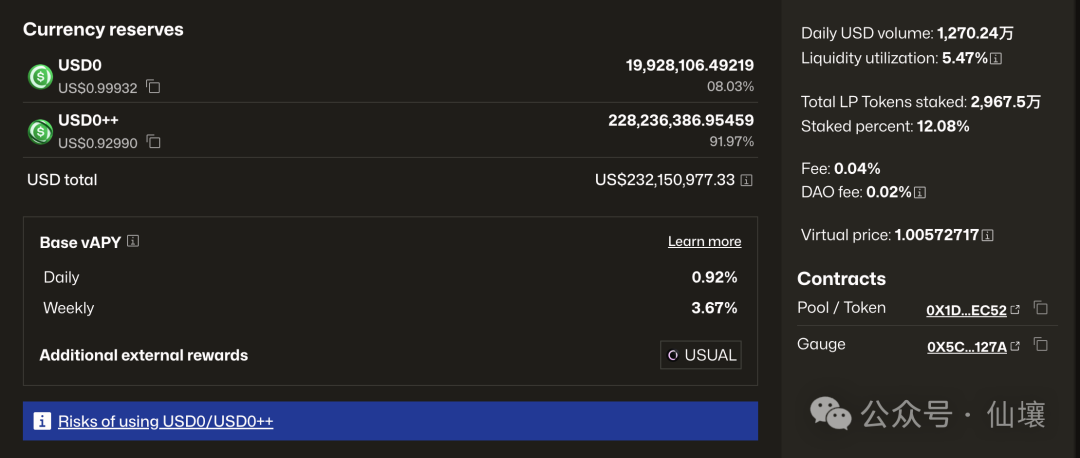

The image above shows the sources of income for USD0++. Holders can choose to receive their daily earnings in USUAL or USD0 every six months.

With the support of the above mechanism, the staking APY for USD0++ usually remains above 50%, and even after the incident, it is still at 24%. However, as mentioned earlier, a significant portion of the income for USD0++ holders is distributed in USUAL tokens, which can vary greatly with the price fluctuations of Usual. In light of Usual's recent tumultuous period, this yield is likely to be unguaranteed.

According to Usual's design, USD0 can be staked 1:1 to mint USD0++, with a default lock-up period of four years. Therefore, USD0++ is similar to a tokenized four-year floating-rate bond, and when users hold USD0++, they can earn interest valued in USUAL. If users cannot wait four years and wish to redeem USD0, they can first exit through secondary markets like Curve, directly exchanging USD0++ for USD0 in the USD0++/USD0 trading pair.

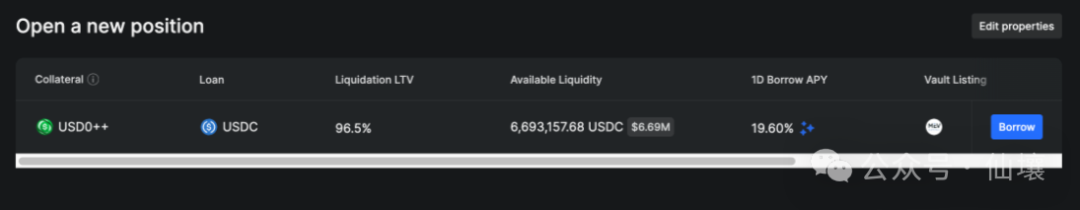

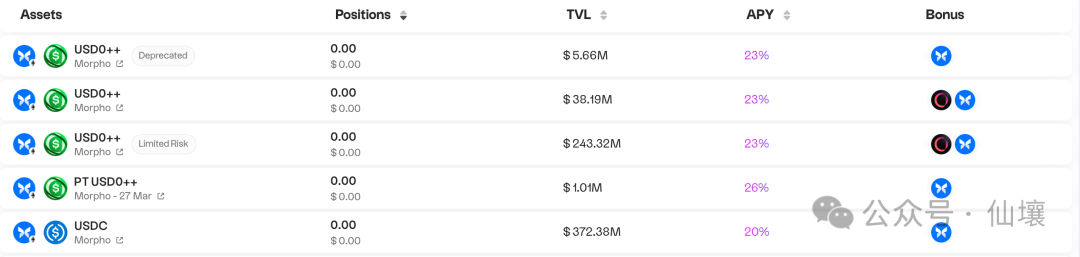

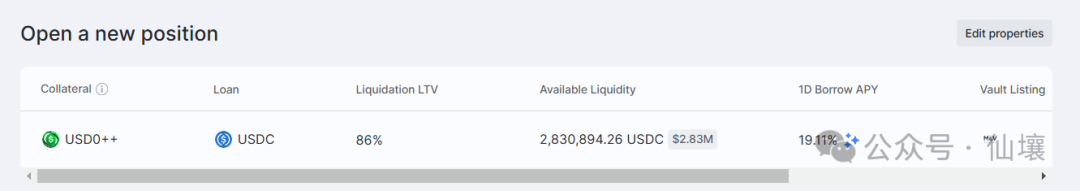

In addition to Curve, there is another option, which is to use USD0++ as collateral in lending protocols like Morpho to borrow assets such as USDC. At this point, users need to pay interest. The following image shows the lending pool in Morpho using USD0++ to borrow USDC, where the current annual interest rate is 19.6%.

Of course, in addition to the indirect exit paths mentioned above, USD0++ also has a direct exit path, which is also a recent factor leading to the de-pegging of USD0++. However, we plan to elaborate on this part later.

Third Layer: Project Token USUAL and USUALx

Users can obtain USUAL by staking USD0++ or purchasing it directly from the secondary market. USUAL can also be staked to mint governance token USUALx at a 1:1 ratio. Whenever USUAL is issued, USUALx holders can receive 10% of it. According to the documentation, there is also a mechanism for converting USUALx back to USUAL, but it requires a certain fee upon exit.

Thus, the entire three-layer product logic of Usual is illustrated in the following image:

In summary, the underlying RWA assets of USD0 generate interest income, part of which is distributed to USD0++ holders. With the empowerment of the USUAL token, the APY yield for holding USD0++ is further increased, encouraging users to mint USD0 and then convert it into USD0++, thereby obtaining USUAL, while the existence of USUALx can incentivize USUAL holders to lock up their tokens.

De-pegging Incident: The "Conspiracy Theory" Behind the Modification of Redemption Rules — Circular Loan Explosion and Morpha Liquidation Line

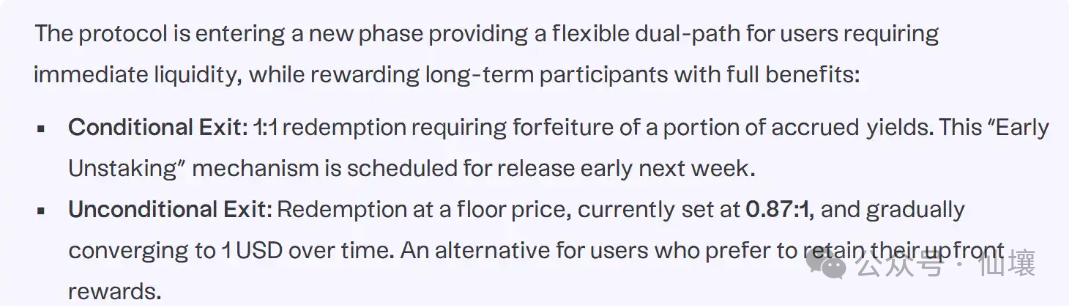

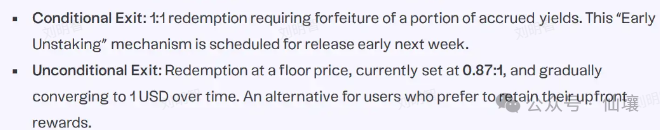

Previously, Usual's redemption mechanism allowed for a 1:1 exchange of USD0++ for USD0, essentially providing a guaranteed redemption. For stablecoin holders, an APY exceeding 50% is highly attractive, and the guaranteed redemption offers a clear and safe exit mechanism. Coupled with the backing of the French government, Usual successfully attracted many large investors. However, on January 10, the official announcement modified the redemption rules, allowing users to choose one of the following two redemption mechanisms:

Conditional redemption. The redemption ratio remains 1:1, but a significant portion of the earnings distributed in USUAL must be paid. This portion of earnings is divided into thirds: 1/3 goes to USUAL holders, 1/3 to USUALx holders, and 1/3 is burned;

Unconditional redemption, which does not deduct earnings but does not guarantee a minimum, meaning the redemption ratio for USD0 drops to a minimum of 87%. The official statement claims this ratio may return to 100% over time.

Of course, users can also choose not to redeem and lock USD0++ for four years, but this carries significant uncertainty and opportunity costs.

So, returning to the main point, why did Usual implement such seemingly unreasonable terms?

As mentioned earlier, USD0++ is essentially a tokenized four-year floating-rate bond, and a direct exit would mean forcing the Usual team to redeem the bonds early. The USUAL protocol believes that users committed to locking USD0 for four years when minting USD0++, and exiting early constitutes a breach of contract, requiring a penalty.

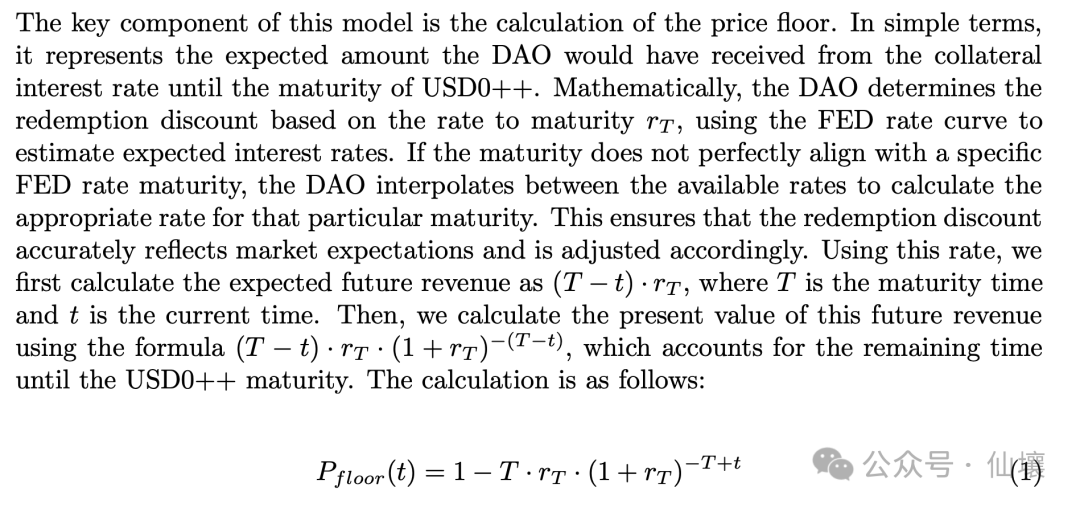

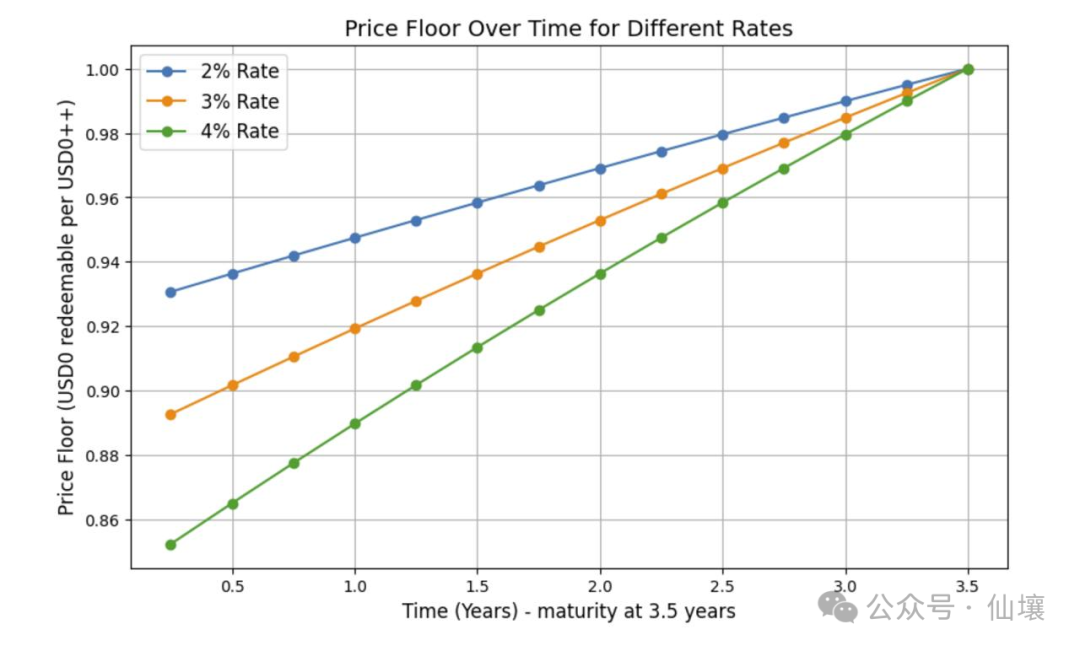

According to the USD0++ white paper, if a user initially deposits $1 of USD0, when the user wants to exit early, they must compensate for the future interest income on that $1. The assets ultimately redeemed by the user are:

$1 — future interest income. Thus, the forced redemption floor price for USD0++ is below $1.

The following image provides the method for calculating the floor price of USD0++ from the official USUAL documentation (which currently seems somewhat like a robbery logic):

The content of Usual's announcement will take effect on February 1, but many users began to flee immediately, creating a chain reaction. People generally believe that according to the redemption mechanism in the announcement, USD0++ can no longer maintain a rigid peg to USD0, prompting USD0++ holders to start exiting early;

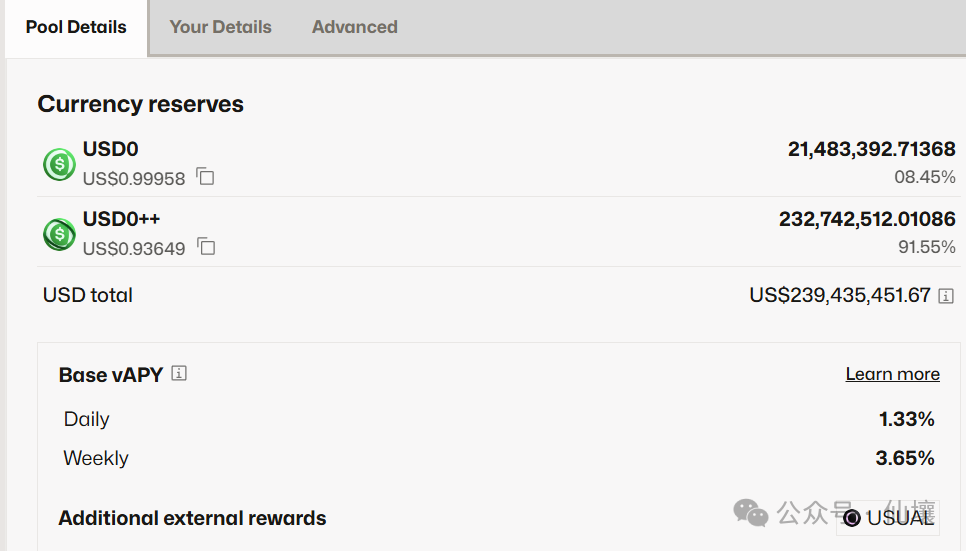

This panic naturally spread to the secondary market, leading to a frenzied sell-off of USD0++, causing a severe imbalance in the USD0/USD0++ trading pair on Curve, with a ratio reaching an exaggerated 9:91; additionally, the price of USUAL plummeted. Under market pressure, Usual decided to advance the announcement's effective date to the following week to raise the cost for users abandoning USD0++ to redeem USD0, aiming to protect the price of USD0++.

Of course, some argue that USD0++ was never a stablecoin but rather a bond, so the term "de-pegging" does not apply. While this viewpoint is theoretically correct, we must oppose it here.

First, the unspoken rule in the crypto market is that only stablecoins have "USD" in their name. Second, USD0++ was originally exchanged for stablecoins at a 1:1 ratio within Usual, and people defaulted to its value being equivalent to that of a stablecoin; third, the stablecoin trading pool on Curve includes trading pairs with USD0++. If USD0++ does not want to be considered a stablecoin, it could change its name and have Curve delist USD0++ or move it to a non-stablecoin pool.

So what might be the motivation behind the project's team blurring the lines between USD0++, bonds, and stablecoins? There could be two points. (Note: The following views contain conspiracy theory elements and are based on our speculation from some clues; please do not take them too seriously.)

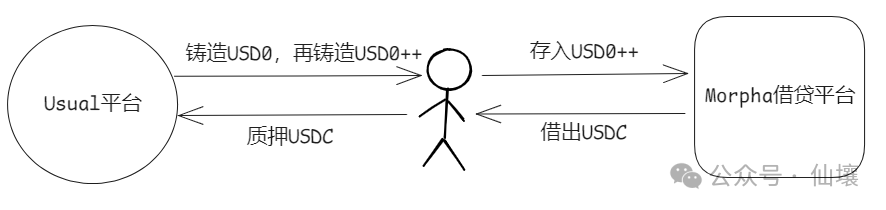

1. First, it is to precisely explode the circular loans. Why is the unconditional redemption floor ratio set at 0.87, just slightly above the liquidation line of 0.86 on Morpha?

This involves another decentralized lending protocol: Morpho. Morpho is known for creating a sophisticated DeFi protocol with just 650 lines of minimalist code. The traditional DeFi practice of "one fish, multiple meals" means that many users, after minting USD0++, would place USD0++ in Morpho to borrow USDC, and then use the borrowed USDC to mint USD0 and USD0++, thus forming a circular loan.

Circular loans can significantly increase users' positions within the lending protocol, and more importantly, the USUAL protocol allocates USUAL token incentives to positions within the lending protocol:

Circular loans brought Usual a better-looking TVL, but over time, there is an increasing risk of leveraged chain ruptures, and these circular loan users, relying on repeatedly minting USD0++, have acquired a large amount of USUAL tokens, becoming the main force for mining and selling. If Usual wants to develop long-term, it must address this issue.

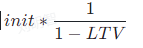

Let’s briefly discuss the leverage of circular loans. Suppose you borrow USDC, mint USD0++, deposit USD0++, and borrow USDC again, maintaining a fixed deposit/borrow value ratio (LTV) in Morpha.

Assuming LTV = 50%, your initial capital is 100 USD0++ (assumed value of $100), and the value of each USDC borrowed is half of the deposited USD0++. According to the formula for the sum of a geometric series, as you approach an infinite amount of USDC borrowed, the total USDC borrowed through circular loans approaches $200, indicating a leverage ratio of nearly 200%. The leverage ratios of circular loans at different LTVs follow the simple formula shown in the image below:

Those who previously participated in the circular loan from Morpha to Usual may have had an LTV higher than 50%, resulting in even more astonishing leverage ratios. It is easy to imagine the systemic risks behind this; if this continues long-term, it will inevitably lead to hidden dangers.

Now, let’s discuss the liquidation line values. Previously, the liquidation line LTV for USD0++/USDC on the Morpha protocol was 0.86, meaning that when the value ratio of borrowed USDC to deposited USD0++ exceeds 0.86, liquidation will be triggered. For example, if you borrowed 86 USDC and deposited 100 USD0++, as soon as USD0++ drops below $1, your position will be liquidated.

In fact, the liquidation line of 0.86 on Morpha is very subtle, as the redemption ratio for USD0++ and USD0 announced by Usual is 0.87:1, indicating a direct relationship between the two.

We assume that many users, under the belief in the USD0++ stablecoin, directly chose a very high LTV close to the liquidation line of 86% for the aforementioned circular loans, thus maintaining a large position with a high leverage ratio and obtaining substantial interest income. However, using an LTV close to 86% means that as soon as USD0++ de-pegs, it will lead to the liquidation of positions, which is the main reason for the large liquidations seen on Morpho after the de-pegging of USD0++.

It is important to note that even if the positions of circular loan users are liquidated at this point, there is no loss for the Morpha platform, because the LTV of the liquidated position at 86% is 100%. If priced in USD, the borrowed USDC is still less than the value of the collateral USD0++, meaning the platform does not experience systemic bad debts (this is crucial).

Understanding the above conclusion makes it easy to see why the liquidation line for USD0++/USD0 on Morpha was deliberately set at 86%, just slightly below the later announced 0.87.

From the perspective of the two versions of the conspiracy theory, the first version is that Morpha is the effect, and Usual is the cause: the setup of the USD0++/USDC vault on the Morpha lending platform was done by MEV Capital, which is also the manager of Usual. They knew that the guaranteed redemption price would be set at 0.87 in the future, so the liquidation line was set slightly below this number early on.

First, after the Usual protocol was updated and the announcement was made, it stated that the guaranteed redemption price for USD0++ was 0.87, and the reasons were explained in detail with specific discount formulas and charts in the USD0++ white paper. After the announcement, USD0++ began to de-peg and once approached $0.9, but remained above the guaranteed price of $0.87. Here, we believe that the redemption ratio of 0.87:1 in the announcement was not set arbitrarily, but was calculated precisely, influenced more by financial market interest rates.

The coincidence lies in the fact that the liquidation line on Morpha is 86%. As mentioned earlier, if the guaranteed price is 0.87, the USD0++/USDC vault on Morpha will not experience systemic bad debts, and it can conveniently liquidate the circular loan positions, achieving deleveraging.

The second version of the conspiracy theory is that Morpha is the cause, and Usual's later announcement is the effect: the liquidation line of 0.86 on Morpha was determined before the guaranteed price of 0.87, and later Usual, considering the situation on Morpha, deliberately set the guaranteed price slightly above 0.86. However, regardless of the version, there is certainly a strong correlation between the two.

2. Another motivation for the Usual project team may be to save the token price at the lowest cost.

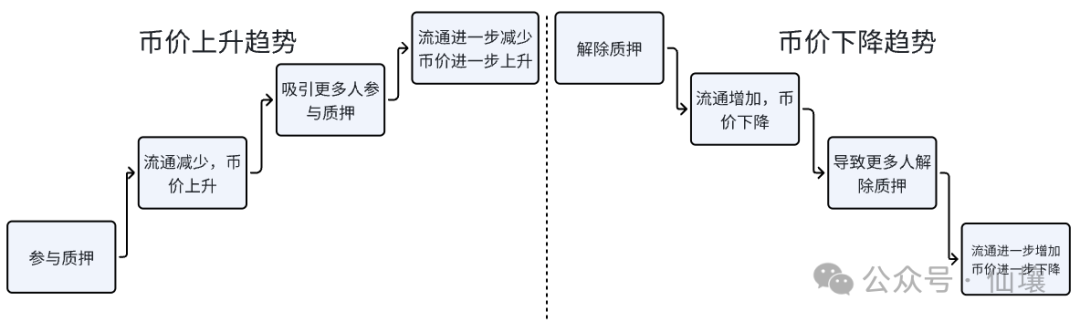

The economic model of USUAL-USUALx is a typical positive feedback loop, where the staking mechanism determines that such tokens usually rise rapidly when the price goes up, but once there is a downward trend, they will fall increasingly faster into a death spiral. Once the price of USUAL drops, the staking yield will also significantly decrease due to the combined effect of price and the number of tokens issued, triggering panic among users, leading to massive sell-offs of USUAL, creating a "the more it falls, the faster it falls" death spiral.

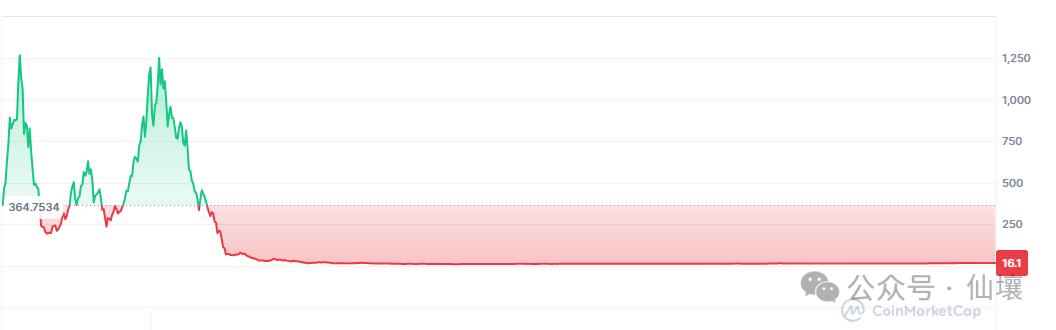

After reaching a high of 1.6, USUAL began to decline, and the project team may have realized the danger, believing they had entered a death spiral. Once in a downward range, they could only think of ways to raise the token price to save the market. The most famous example of such a project would be OlympusDAO during the last bull market, which had strong external liquidity injections that allowed its token OHM to form a double peak shape (according to the views of some participants).

After reaching a high of 1.6, USUAL began to decline, and the project team may have realized the danger, believing they had entered a death spiral. Once in a downward range, they could only think of ways to raise the token price to save the market. The most famous example of such a project would be OlympusDAO during the last bull market, which had strong external liquidity injections that allowed its token OHM to form a double peak shape (according to the views of some participants).

However, we can also see from the OHM chart that such projects often cannot escape the fate of their token price going to zero, and the project team is aware of this. Time equates to profit; some estimates suggest that the current monthly income of the Usual team is around $5 million. They need to weigh the pros and cons and consider whether they can keep the project alive for as long as possible.

However, their actions now seem to aim to avoid real monetary expenditure, instead trying to reverse the downward trend through gameplay and mechanism changes. In the conditional redemption, part of the earnings of USD0++ stakers is shared with USUAL and USUALx holders, with 1/3 being destroyed, while USUALx is obtained by staking USUAL.

The so-called conditional redemption is essentially a clear empowerment of the USUAL token, encouraging more people to stake USUAL to obtain USUALx, reducing its circulation in the market, thus providing a damping effect to support the price.

However, the project team's intentions are clearly difficult to realize due to a self-contradictory point.

Since such projects need to allocate a large proportion of tokens for attractive staking rewards to attract users, they must be low-circulation tokens. Currently, USUAL has a circulation of 518 million, while the total supply is 4 billion, and its staking incentive model must rely on a continuous unlocking of tokens to keep running. In other words, USUAL's inflation is quite severe; to curb inflation with the 1/3 destruction amount, the proportion of USUAL collected in conditional redemption must be sufficiently high.

Of course, this proportion is set by the project team themselves. In the conditional redemption model, the formula for calculating the number of USUAL that the redeemer must pay to the Usual platform from the interest is:

Where Ut is the current number of USUAL that can be "accumulated" for each USD0++; T is the time cost factor, defaulting to 180 days (set by the DAO); A is the adjustment factor, simply put, the official sets a weekly redemption amount X. If the redemption amount for that week exceeds X, A=1; if the redemption amount is less than X, A=redemption amount/X. Clearly, when there are too many redeemers, the amount of USUAL that needs to be paid increases. Both T and A are adjusted by the project team.

However, the problem is that if the conditional redemption channel requires users to pay too high a proportion from their Usual earnings, users will directly choose unconditional redemption, which may cause the price of USD0++ to drop again until it reaches the guaranteed price of 0.87. Coupled with the panic selling triggered by the project team's announcement, the release of stakes, and the decrease in credibility, it is hard to say that this is a successful strategy.

However, there is another interesting saying in the market: Usual has solved the dilemma of mining and selling in DeFi in its unique way. Overall, the guaranteed price of $0.87 set by the Usual project team, along with the conditional redemption mechanism, makes us suspect that the Usual protocol is intentionally manipulating the situation to force circular loan holders to give up their earnings.

What Will Happen in the Future and the Issues Exposed

Before the USUAL payment ratio for conditional redemption is released, it is difficult to judge which method most users will choose and whether USD0++ can return to its peg. As for the price of USUAL, it remains the same contradictory issue: the project team wants to simply reverse the death spiral through gameplay mechanisms instead of real monetary expenditure, but the unconditional guaranteed price of 0.87 is not low enough. Many people will ultimately choose unconditional exit rather than conditional exit, which means not enough USUAL can be burned to reduce circulation.

Stepping outside of Usual itself, this incident exposes three more direct issues.

First, the Usual official documentation has long stated that USD0 staking has a four-year lock-up period, but it previously did not specify the specific rules for early redemption. Therefore, this Usual announcement is not a sudden imposition of a previously unmentioned new rule, but the market is indeed in an uproar and even panic. This indicates that many people participating in DeFi protocols do not carefully read the project documentation.

As DeFi protocols have developed to this point, they have become increasingly complex, and simple and clear projects like Uniswap and Compound are becoming rarer, which is not necessarily a good thing. Users' capital in DeFi is often not small, and they should at least read and understand the official documentation of the DeFi protocols.

Second, even if the official documentation has long been written, it cannot be denied that Usual has the power to set and modify rules at will. The so-called parameters T, A, etc., are all controlled by them. In this process, there were neither strict DAO proposal resolutions nor inquiries for community opinions.

Ironically, the official has always emphasized the governance attributes of the USUALx token in the documentation, but there is no governance process in actual decision-making. It must be acknowledged that most Web3 projects are still in a very centralized stage. Combined with the first point, there are still significant issues regarding the safety of users' assets. We always emphasize technologies like TEE and ZK that can better ensure asset security, but the decentralization and awareness of asset security among project teams and users should also be focused on.

Third, the entire industry is indeed continuously evolving. With the lessons learned from projects like OlympusDAO, which have similar economic models, Usual began to consider reversing the downward trend as soon as its token price showed signs of decline. The past serves as a warning for the future; we often say that there are few truly grounded projects in Web3, but the overall industry ecosystem is rapidly developing. Previous projects are not entirely meaningless; their successes and failures are observed by later participants and may exist in other truly meaningful projects in different forms. At this point, when the market and ecosystem are not particularly prosperous, we should not lose confidence in the entire industry.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。