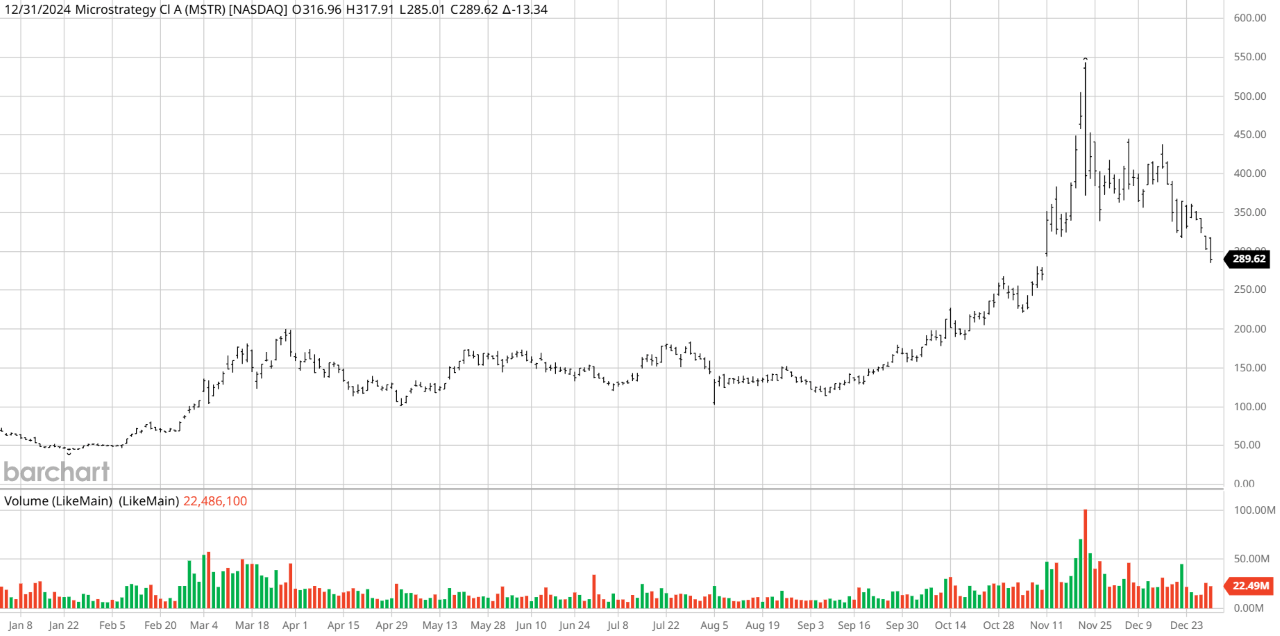

Software firm Microstrategy (Nasdaq: MSTR) saw revenues dip by 10% in 2024, yet it was one of the best performing stocks in the Nasdaq 100, according to Barchart.com.

The reason its stock shot up by more than 400% is because it holds the largest stash of bitcoin (BTC) in the world among public companies, and Matt Hougan, chief investment officer at crypto asset management firm Bitwise, expects hundreds of other companies to follow suit.

(Microstrategy stock performance 2024 / Barchart.com)

In a memo published on Monday, Hougan made the case for an imminent deluge of companies buying bitcoin to bolster their balance sheets, calling it an “overlooked megatrend” that has already kicked off.

“We’ll see hundreds of companies buy bitcoin for their treasuries over the next 12-18 months,” Hougan wrote, “And their purchases will lift the entire bitcoin market substantially higher.”

Whether a megatrend actually takes place remains to be seen, but one reason Hougan predicts such a pattern is the fact that Microstrategy is not the only company buying up bitcoin as a treasury asset.

Data from Bitcointreasuries.com shows forty-six public companies holding 591,539 BTC worth nearly $60 billion at today’s price, and representing 2.82% of the cryptocurrency’s twenty-one million total supply.

At least twelve other private companies are holding 368,043 BTC worth roughly $37 billion, making up 1.75% of all bitcoin.

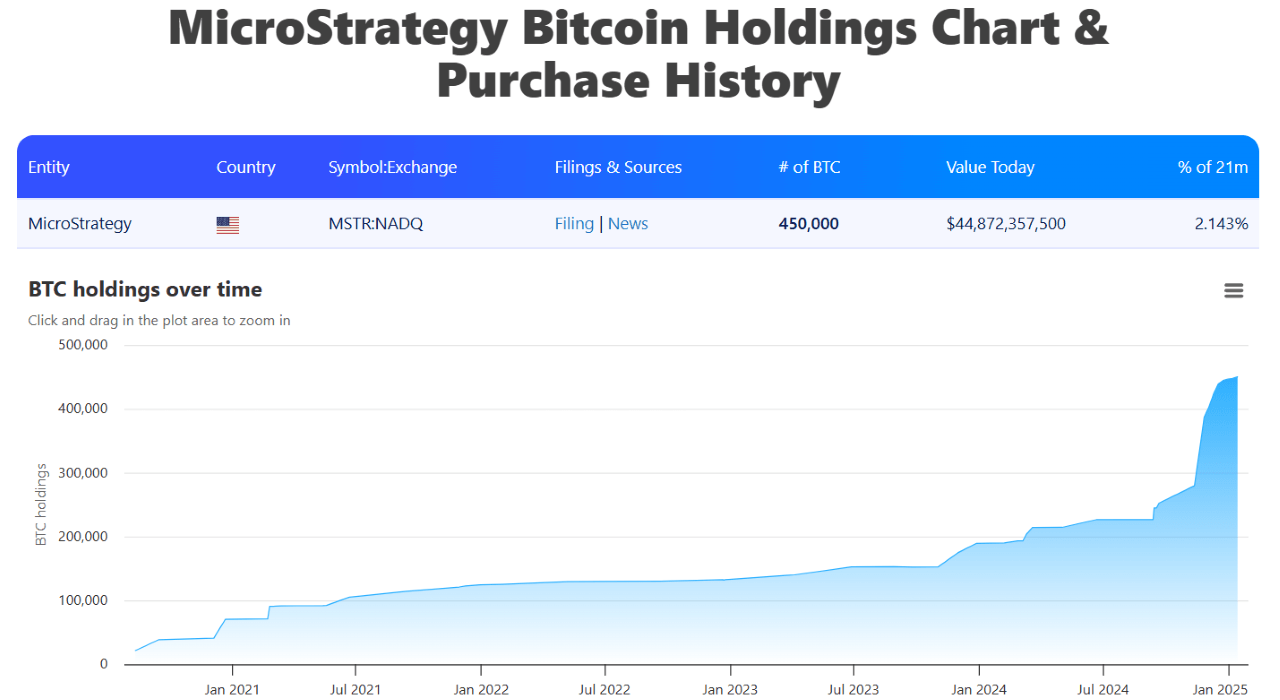

Microstrategy sits atop that list with 450,000 BTC worth nearly $45 billion, representing 2.12% of Bitcoin’s total supply.

(Microstrategy BTC holdings January 2025 / BitcoinTreasuries.com)

“Last year, Microstrategy bought approximately 257,000 bitcoin,” Hougan said. “A company the size of Chipotle bought more than 100% of the entire new supply of bitcoin in 2024,” he added. This is another key reason Hougan thinks a giant trend is on the horizon – if a midsized company like Microstrategy is able to accumulate so much bitcoin, how much more will corporate giants with significantly deeper pockets purchase?

A third reason Hougan anticipates a bitcoin buying frenzy from corporations this year is the emergence of regulatory tailwinds that have already resulted in a dramatic shift in attitudes towards crypto.

“It’s becoming much more commonplace – and popular – to own bitcoin,” Hogan wrote.

While the attitudinal shift began with the approval of the first spot bitcoin exchange-traded funds (ETFs) last January, Donald Trump’s strong endorsement of crypto at the 2024 Bitcoin Conference in July and his subsequent landslide victory in the November presidential election shifted the Overton window and placed bitcoin and crypto firmly in the mainstream.

Multiple anti-crypto regulators have stepped down – most notably SEC Chairman Gary Gensler – and alleged top-secret debanking efforts intended to undermine the crypto industry have been exposed and denounced.

“Last year, the CEO of one large publicly traded company faced huge hurdles in adding bitcoin as a treasury asset. The company risked negative media coverage, shareholder lawsuits, regulatory attention, and more,” Hougan explained. “But reputational risks have peeled back significantly in the past few months.”

Hougan, much like Microstrategy Chairman and Bitcoin celebrity Michael Saylor, also emphasized the importance of an accounting standard (ASU 2023-08) that recently went into effect and will likely have a positive impact on firms seeking to establish bitcoin treasuries by allowing them to report both price gains and losses instead of just the latter.

“If 70 companies were willing to add bitcoin to their balance sheets when, from an accounting perspective, it literally could only go down, imagine how many will add it to their balance sheet now,” Hougan said. “Two hundred? Five hundred? A thousand?”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。