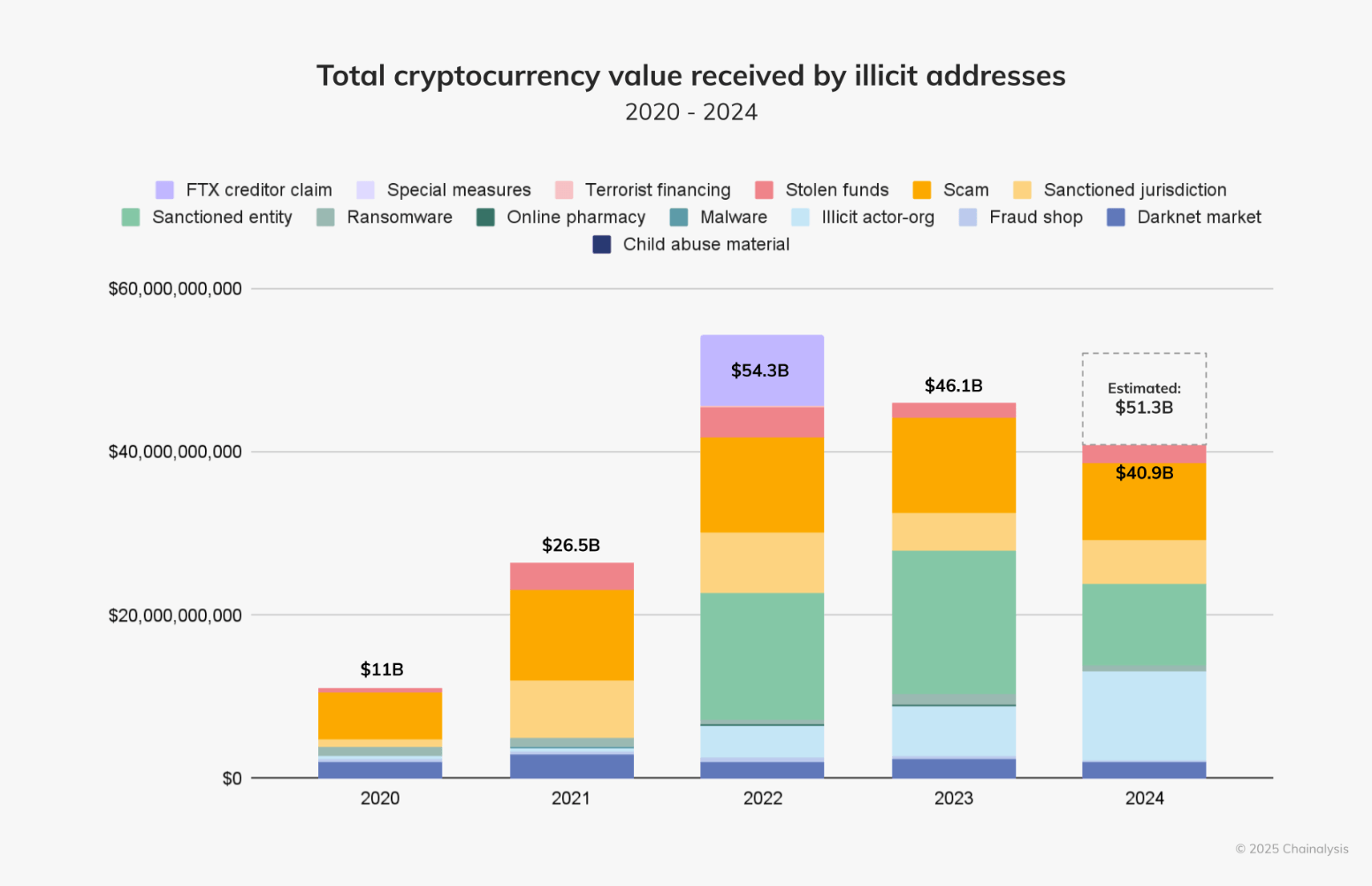

The report published by the Chainalysis team projects that the total volume of illicit crypto transactions for 2024 could surpass $51 billion as more addresses are identified. This surge is fueled by advanced laundering schemes, including services offered by platforms such as Huione Guarantee, and a growing focus on centralized exchange (cex) platforms as targets.

Source: Chainalysis study

Cybercrime remains a central concern, with North Korean hacking groups responsible for $1.34 billion in theft, representing 61% of all funds stolen in 2024. Much of this stems from high-level tactics involving stolen private keys. While ransomware attacks are generating hundreds of millions of dollars, victim payments have declined. Additionally, the study notes that enforcement actions against darknet markets and fraud shops have led to observable reductions in those specific sectors.

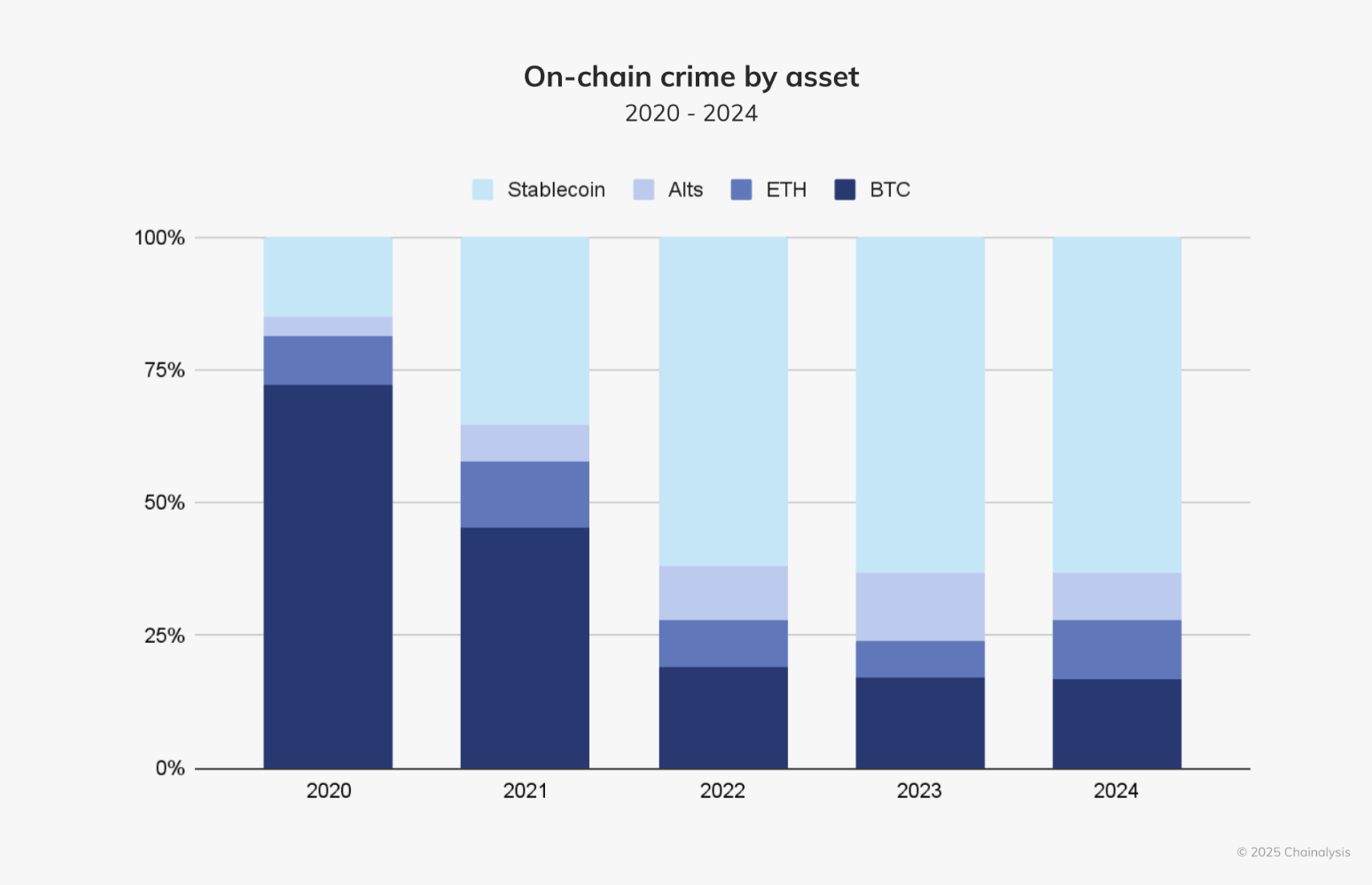

The Chainalysis report also sheds light on the increased integration of artificial intelligence (AI) into scams, enabling fraudsters to execute tailored schemes, including sextortion. Stablecoins have become more prominent in illicit activities due to their global liquidity, with sanctioned entities exploiting these assets to evade restrictions. In response, issuers such as Tether and Circle have taken action by freezing funds linked to criminal operations, demonstrating an ecosystem-wide effort to mitigate misuse.

Stablecoins essentially dominated illicit transactions throughout 2024, representing 63% of the total volume, as noted by Chainalysis’s findings. Their liquidity and versatility make them appealing for a range of illegal activities, including sanction evasion. However, the proactive measures taken by issuers to freeze suspicious assets reveal the dual nature of stablecoins as both tools for crime and instruments of enforcement.

Source: Chainalysis study

Although the proportion of crypto transactions linked to illicit activity dropped to 0.14% in 2024, down from 0.61% in 2023, Chainalysis cautions that these figures are expected to rise as attribution capabilities improve. The report emphasizes the challenges of combating the increasingly complex and professionalized world of crypto-related crime in this day in age.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。