Key Points

● The total market capitalization of cryptocurrencies is $3.5 trillion, down from $3.65 trillion last week, representing a 4% decline this week. As of January 13, 2025, the cumulative net inflow of the U.S. Bitcoin spot ETF is approximately $36.2 billion, with a net inflow of $300 million this week; the cumulative net inflow of the U.S. Ethereum spot ETF is approximately $2.45 billion, with a net outflow of $180 million this week.

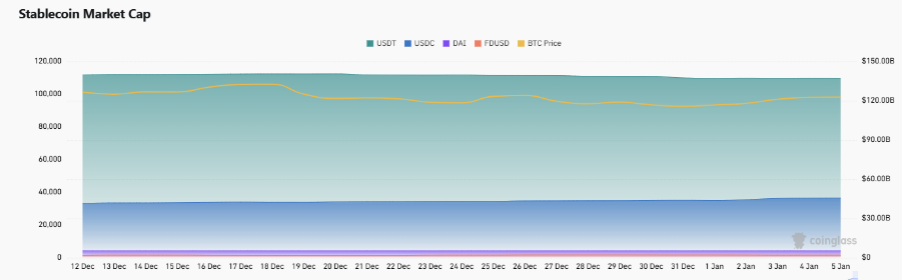

● The total market capitalization of stablecoins is $213 billion, accounting for 6% of the total cryptocurrency market capitalization. Among them, USDT has a market capitalization of $137.4 billion, accounting for 64.7% of the total stablecoin market capitalization; followed by USDC with a market capitalization of $45.7 billion, accounting for 21.5%; and DAI with a market capitalization of $5.4 billion, accounting for 2.5%.

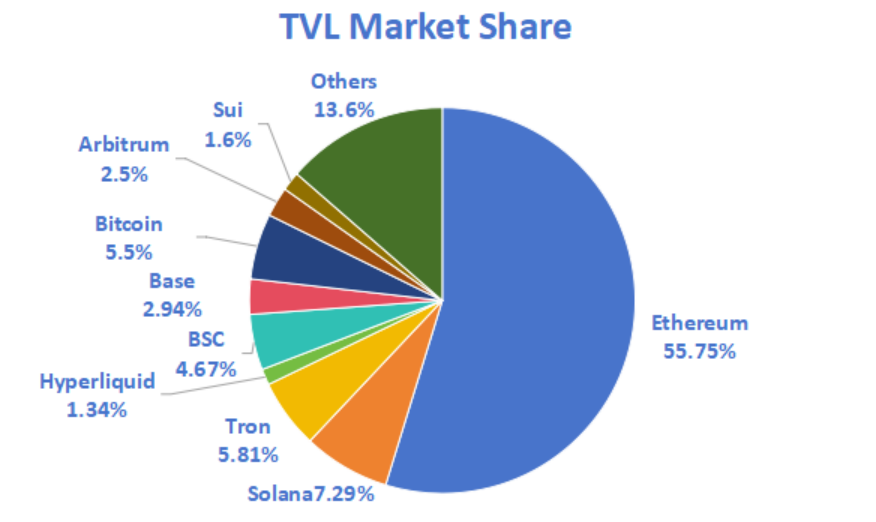

● This week, the total TVL (Total Value Locked) in DeFi is $118.7 billion, down 7.7% from last week. By public chain classification, the top three public chains by TVL are Ethereum with a share of 55.75%; Solana with a share of 7.29%; and Tron with a share of 5.81%.

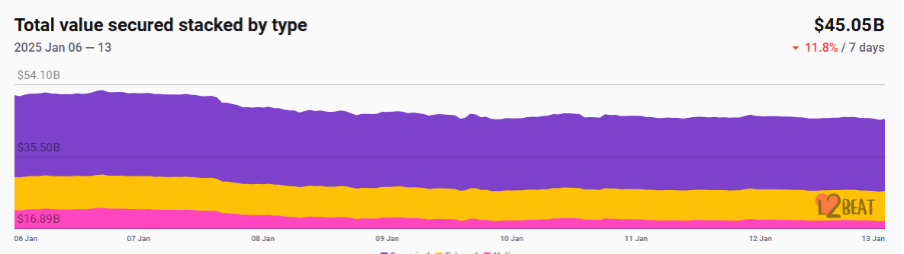

● From on-chain data, the daily trading volume of Layer 1 public chains shows a downward trend this week, except for the APT chain, with SUI experiencing the most significant decline at 54% compared to last week. In terms of transaction fees, ETH has decreased by 75.7% compared to last week. The total TVL of Ethereum Layer 2 has reached $50.68 billion, with an overall increase of 11.8% compared to last week. Arbitrum and Base occupy the top positions with market shares of 38.77% and 24.58%, respectively.

Innovative projects to watch: Cleopetra, which simplifies LP operations on DEXs and reduces impermanent loss through position monitoring to help users maximize profits; Neur, which provides open-source AI models for trading, NFT management, and portfolio tracking, and is referred to as Solana's assistant; Roastmaster9000, the first AI Roast virtual comedian, attracting attention from figures like Elon Musk and Anatoly Yakovenko with its humorous roasting style.

Table of Contents

1. Total Cryptocurrency Market Capitalization / Bitcoin Market Capitalization Ratio 2

3. ETF Inflow and Outflow Data 4

4. ETH/BTC and ETH/USD Exchange Rates 5

5. Decentralized Finance (DeFi) 6

7. Stablecoin Market Capitalization and Issuance 10

2. Hot Money Trends This Week 11

1. Top Five VC Coins and Meme Coins This Week 11

1. Major Industry Events This Week 12

2. Major Upcoming Events Next Week 14

3. Important Financing Events Last Week 14

1. Market Overview

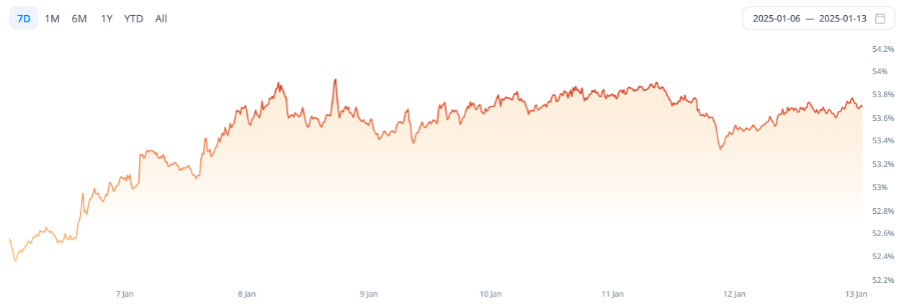

1. Total Cryptocurrency Market Capitalization / Bitcoin Market Capitalization Ratio

The total market capitalization of cryptocurrencies is $3.5 trillion, down from $3.65 trillion last week, representing a 4% decline this week.

Data Source: cryptorank

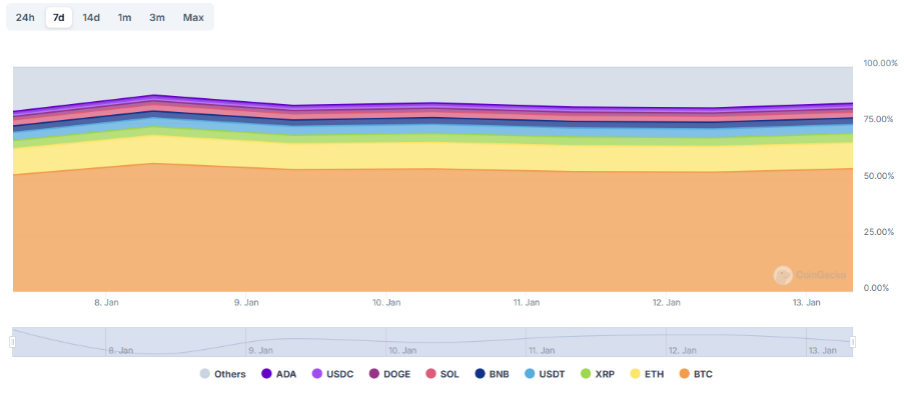

As of the time of writing, the market capitalization of Bitcoin (BTC) is $1.9 trillion, accounting for 54.2% of the total cryptocurrency market capitalization. Meanwhile, the market capitalization of stablecoins is $213 billion, accounting for 6% of the total cryptocurrency market capitalization.

Data Source: coingeck

2. Fear Index

The cryptocurrency fear index is at 61, indicating greed.

Data Source: coinglass

3. ETF Inflow and Outflow Data

As of January 13, 2025, the cumulative net inflow of the U.S. Bitcoin spot ETF is approximately $36.2 billion, with a net inflow of $300 million this week; the cumulative net inflow of the U.S. Ethereum spot ETF is approximately $2.45 billion, with a net outflow of $180 million this week.

Data Source: sosovalue

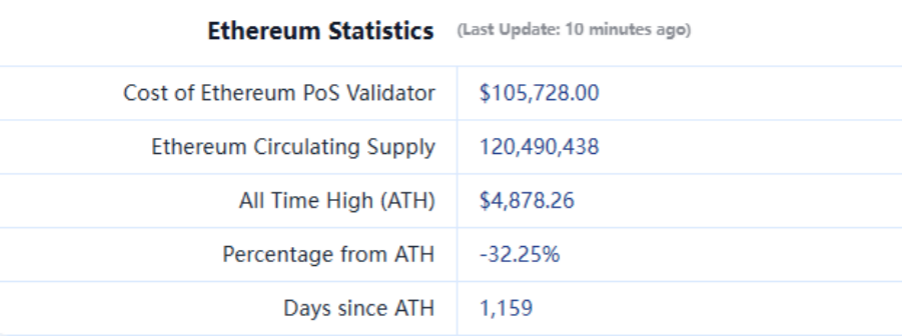

4. ETH/BTC and ETH/USD Exchange Rates

ETHUSD: Current price is $3,305, with a historical high of $4,878, down approximately 32.2% from the highest price.

ETHBTC: Currently at 0.034747, with a historical high of 0.1238.

Data Source: ratiogang

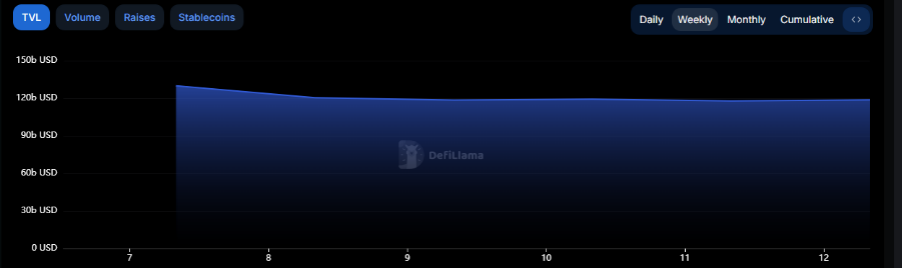

5. Decentralized Finance (DeFi)

According to DeFiLlama, the total TVL in DeFi this week is $118.7 billion, down 7.7% from last week.

Data Source: defillama

By public chain classification, the top three public chains by TVL are Ethereum with a share of 55.75%; Solana with a share of 7.29%; and Tron with a share of 5.81%. The overall share remains stable, with Ethereum still leading the DeFi space.

Data Source: CoinW Research Institute, defillama

Data as of January 13, 2025

6. On-Chain Data

Layer 1 Related Data

Mainly analyzing the current data of major Layer 1 chains including ETH, SOL, BNB, TON, SUI, and APT based on daily trading volume, daily active addresses, and transaction fees.

Data Source: CoinW Research Institute, defillama, Nansen

Data as of January 13, 2025

Daily trading volume and transaction fees: Daily trading volume and transaction fees are core indicators of public chain activity and user experience. This week, except for the APT chain, the trading volume of other public chains is on a downward trend, with SUI experiencing the most significant decline at 54% compared to last week. In terms of transaction fees, ETH has seen the largest decrease, down 75.7% compared to last week.

● Daily active addresses and TVL: Daily active addresses reflect the ecological participation and user stickiness of public chains, while TVL reflects users' trust in the platform. In terms of daily active addresses, the overall trend has declined except for BNB. The downward trend in TVL is significant, with the leading public chain ETH down 7.5% compared to last week.

Layer 2 Related Data

● According to L2Beat, the total TVL of Ethereum Layer 2 has reached $50.68 billion, with an overall increase of 11.8% compared to last week.

Data Source: L2Beat

Data as of January 13, 2025

● Arbitrum and Base occupy the top positions with market shares of 38.77% and 24.58%, respectively.

Data Source: footprint

Data as of January 13, 2025

7. Stablecoin Market Capitalization and Issuance

According to Coinglass data, the total market capitalization of stablecoins is currently reported at $213 billion, setting a new historical high, with a 0.5% increase over the past week. Among them, USDT has a market capitalization of $137.4 billion, accounting for 64.7% of the total stablecoin market capitalization; followed by USDC with a market capitalization of $45.7 billion, accounting for 21.5%; and DAI with a market capitalization of $5.4 billion, accounting for 2.5%.

Data Source: CoinW Research Institute, Coinglass

Data as of January 13, 2025

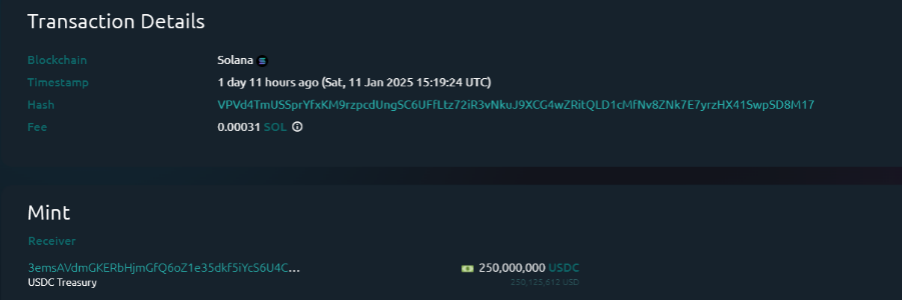

According to Whale Alert data, this week, the USDC treasury has issued a total of 650 million USDC, representing a 64.9% decrease in the total issuance of stablecoins compared to last week.

Data Source: Whale Alert

Data as of January 13, 2025

2. Hot Money Trends This Week

1. Top Five VC Coins and Meme Coins This Week

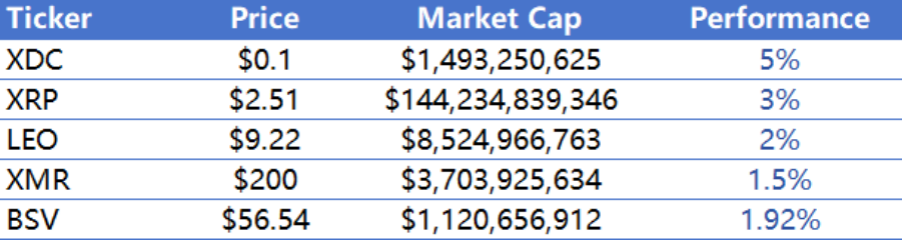

The top five VC coins with the highest increase over the past week

Data Source: CoinW Research Institute, coinmarketcap

Data as of January 13, 2025

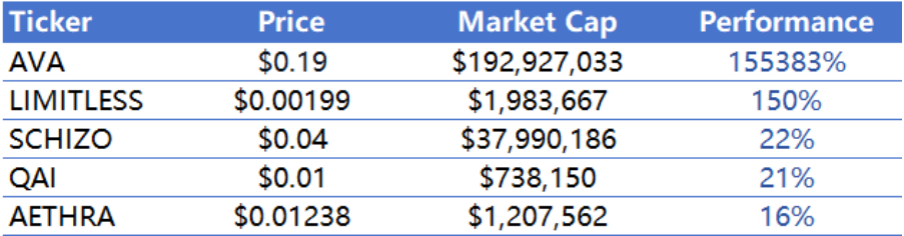

The top five Meme coins with the highest increase over the past week

Data Source: CoinW Research Institute, coinmarketcap

Data as of January 13, 2025

2. New Project Insights

● Cleopetra: Simplifies LP operations on DEXs and reduces impermanent loss through position monitoring to help users maximize profits.

● Neur: Provides open-source AI models for trading, NFT management, and portfolio tracking, referred to as Solana's assistant.

● Roastmaster9000: The first AI Roast virtual comedian, attracting attention from figures like Elon Musk and Anatoly Yakovenko with its humorous roasting style.

3. New Industry Dynamics

1. Major Industry Events This Week

● The full-chain AI Agent network Artela Network announced the ART token economic model and community airdrop schedule. The total supply of ART is 1 billion, with 62% allocated to the community. The community airdrop Wave 1 will open for queries on January 14 and will be available for claims from January 17 to January 23. Additionally, 18% is allocated to investors with a 1-year lock-up period, followed by a 24-month linear unlock; 15% is allocated to the team with a 1-year lock-up period, followed by a 36-month linear unlock; and 5% is allocated to early contributors with a 1-year lock-up, followed by a 24-month linear unlock.

● The on-chain options protocol Derive released its 2025 roadmap, announcing the launch of the DeFAI trading platform Derive Pro in the first quarter, which will be redesigned from scratch in collaboration with Messari to create an agent-centered trading experience. Derive Pro will use large language models to enhance three parts of the trading process: research, execution, and portfolio management. Additionally, Derive will expand the utility of its dUSD and equip its options AMM with customizable algorithms in 2025.

● Stablecoin issuer Tether will expand into the artificial intelligence (AI) film production field as part of enhancing its brand influence. Tether is hiring for a new AI filmmaker position that will use AI tools to produce short films and videos. According to the job description, these works will showcase Tether's products. The company has already hired 30 professionals in recent months to build its AI platform and plans to hire more filmmakers in regions such as Asia-Pacific, Europe, Brazil, Argentina, and Colombia.

● WA stablecoin issuer Usual announced on the X platform that it has recognized the community's concerns regarding its pegged stablecoin USD0++ significantly deviating from $1, and will implement a series of measures to address user concerns and stabilize the ecosystem. Usual launched the Revenue Switch feature on January 13, sharing its earnings from real-world assets and protocol operations with the community. The team expects monthly revenue of approximately $5 million, with an annual return rate exceeding 50% under current conditions, and distributions will occur weekly to solidify the actual value of USUAL, balance its economic model, and the revenue generated by the protocol. Additionally, the Usual Protocol team stated that it will launch a 1:1 early unstaking feature next week, allowing users to exchange USD0++ at a rate of $1, but they must forfeit part of their accumulated rewards as a penalty.

● The cross-chain settlement layer Union announced the launch of the Union Foundation, an independent organization dedicated to building a safer, decentralized, and interoperable Web3. Its core focus is to fund initiatives supporting the Union network and incentivize its development through maintenance, ongoing development, and the creation of decentralized applications (dApps), including grant programs and the Union Fellowship program. The Union Foundation announced that it will soon release a token economic model, and the Union mainnet is also set to launch.

2. Major Upcoming Events Next Week

● The community sales platform BuidlPad announced the launch of the Solayer community sales event, where buyers are eligible to receive a 100% LAYER token allocation in Solayer's token generation event without any lock-up. During the community sale, participants have the opportunity to receive a crypto debit card issued by Solayer. The subscription period for this sale is from January 13 to January 15.

● The airdrop claim period for Puffer Finance (PUFFER) is from October 14, 2024, to January 14, 2025.

● The on-chain options protocol Derive announced that DRV will be launched on January 15, 2025.

● The Shiba Inu ecosystem token TREAT announced its launch date as January 14. Previously, in April of last year, the Shiba Inu team raised $12 million by selling unissued TREAT tokens to non-U.S. venture capital investors to develop its new privacy-focused Layer 3 blockchain. According to official news, the TREAT token is the "utility and governance token" of its new privacy-focused Layer 3 blockchain, which is built on the Ethereum Layer 2 blockchain Shibarium.

● Ethena announced that Derive (DRV) will launch on January 15, with 5% of the supply allocated to sENA stakers.

3. Important Financing Events Last Week

● SoSoValue raised $15 million, with investors including Hongshan, Mirana Ventures, SafePal, etc. (January 8, 2025)

● Sol Strategies raised $27.5 million, with investors including ParaFi Capital, etc. Sol Strategies (CSE: HODL | OTC: CYFRF) aims to bridge traditional finance and the Solana ecosystem. As the only publicly listed company in North America dedicated to investing in and participating in Solana, it primarily focuses on exploring innovative opportunities in the blockchain space. (January 9, 2025)

● 0G raised $30 million, with investors including Hack VC, Delphi Digital, etc. 0G is a modular AI blockchain with a scalable programmable DA layer suitable for AI dapps. Its modular technology will enable frictionless interoperability between chains while ensuring security, eliminating fragmentation, and maximizing connectivity for a weightless and open metaverse. (January 9, 2025)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。