The SEC disclosed its decision to extend the review period for a proposed rule change that would permit the Bitwise 10 Crypto Index ETF to be listed and traded on NYSE Arca. Initially scheduled for a Jan. 17, 2025, deadline, the decision has been postponed until March 3, 2025. The extension is reportedly intended to provide the SEC with more time to evaluate the intricacies of the fund, which seeks to offer investors access to a diversified portfolio of cryptocurrencies.

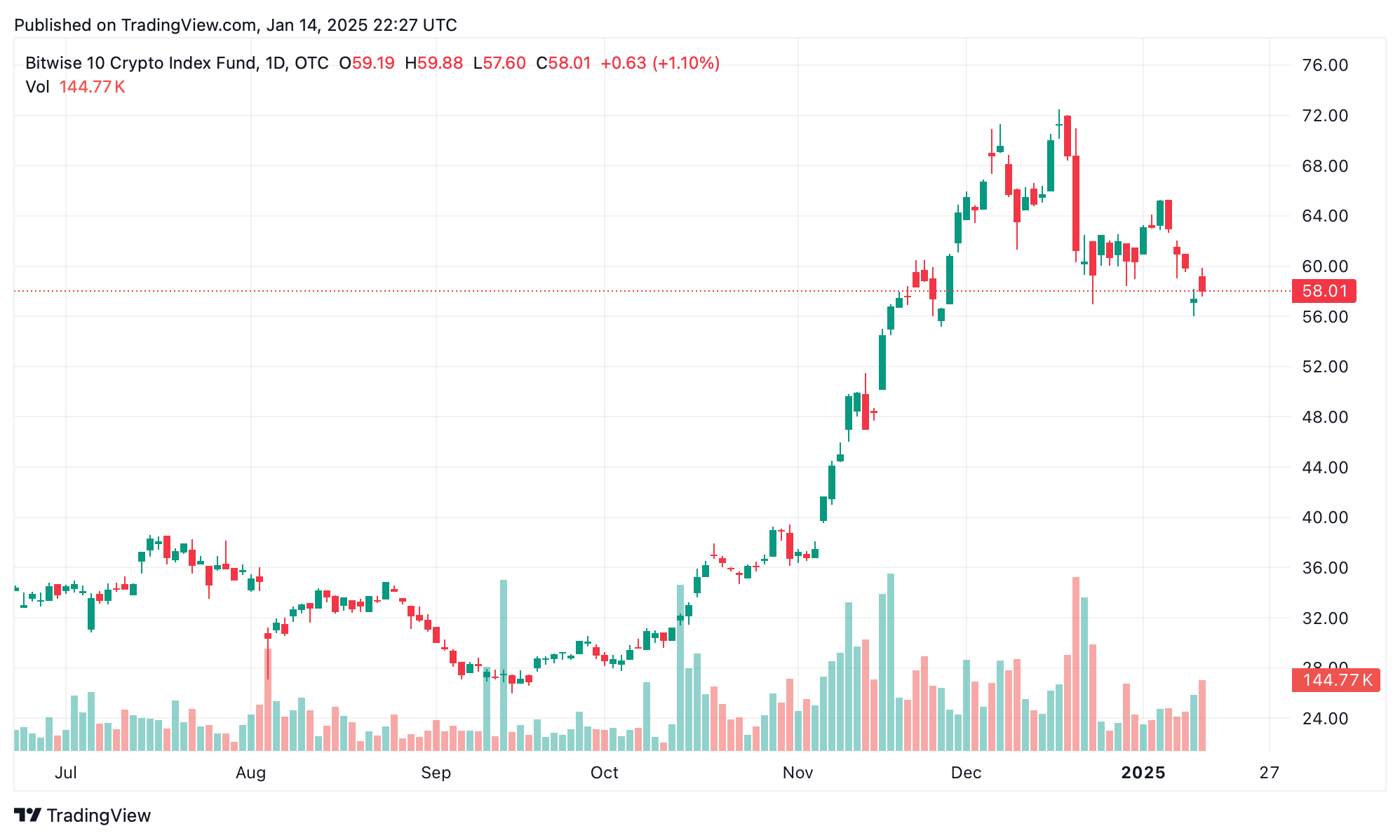

Bitwise 10 Crypto Index Fund

Managed by Bitwise Asset Management, the Bitwise 10 Crypto Index ETF mirrors the performance of the Bitwise 10 Large Cap Crypto Index. This benchmark includes the ten largest cryptocurrencies by market capitalization and is recalibrated monthly to reflect market dynamics and mitigate risks. The ETF aims to provide institutional and retail investors with a streamlined entry point into the cryptocurrency sector, addressing concerns related to security and market liquidity along the way.

Originally launched in November 2017, the fund represents Bitwise’s commitment to developing regulated and accessible crypto investment tools. Despite experiencing significant volatility since its debut, the fund has demonstrated considerable growth, delivering an annualized return of 32.2% as of late 2024. Nevertheless, the SEC has historically approached cryptocurrency ETFs with caution, citing persistent concerns over market manipulation, liquidity, and the safeguarding of investors.

Most of the stringent policy has stemmed from the Biden administration and people think this will change under Donald Trump. NYSE Arca, the exchange proposing to list the ETF, filed its rule-change request with the SEC in Nov. 2024. To date, the proposal has not received any public comments. According to federal regulations, the SEC is required to review such filings within 45 days but retains the authority to extend the timeline by an additional 45 days if further analysis is deemed necessary.

The decision to delay reflects the persistent regulatory ambiguity surrounding cryptocurrencies under the Biden administration, even as institutional interest in digital asset investments continues to expand. According to the SEC, the postponement will enable a more comprehensive evaluation of the proposal and its potential implications for market integrity and investor protection.

The newly established March 3 deadline is considered a pivotal moment for advocates of cryptocurrency ETFs, carrying potential consequences for the adoption of these products, specifically cryptos the SEC hasn’t approved, and the evolution of regulatory frameworks in the digital asset market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。