Original | Odaily Planet Daily

Author | Nan Zhi

Since briefly rising above $100,000 on January 7, the market has taken a sharp downturn, with Bitcoin leading the entire cryptocurrency market down. Last night at 10 PM, Bitcoin dipped below 90,000 USDT, falling to a low of 89,256 USDT.

At the same time, Ethereum fell below 3,000 USDT, dipping to 2,920 USDT; SOL fell below 170 USDT, dipping to 168.8 USDT.

The total market capitalization of cryptocurrencies also saw a significant decline. According to CoinGecko, the total market cap at 10 PM yesterday was $3.27 trillion, down about 13% compared to January 7.

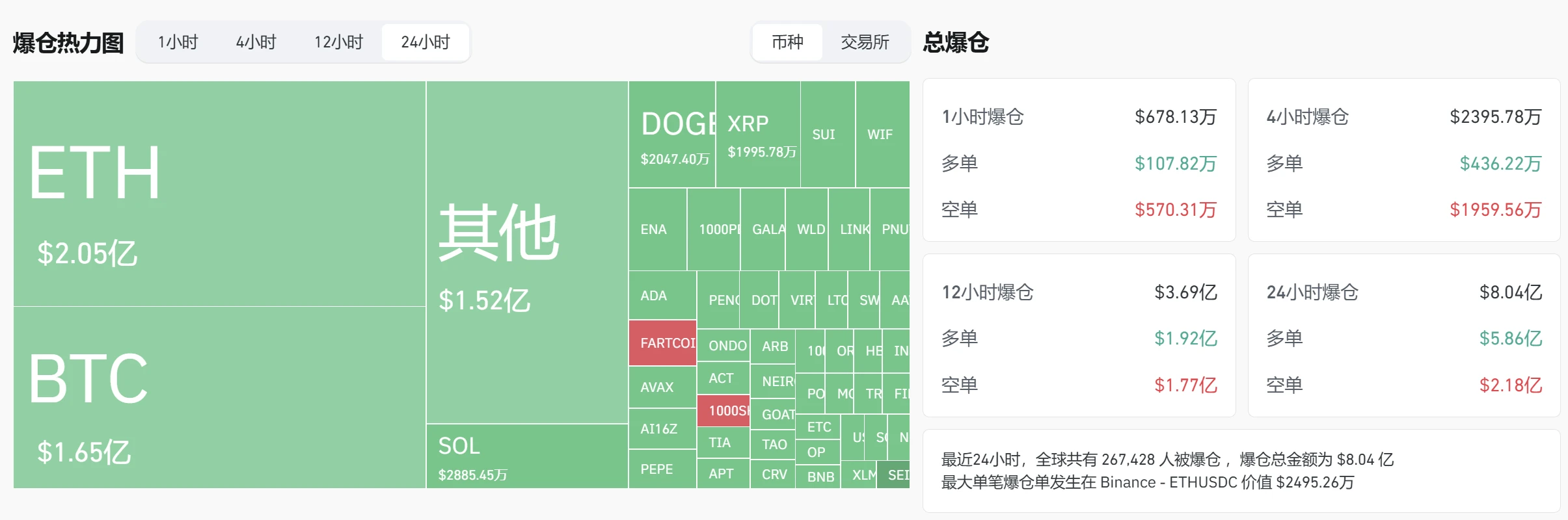

In terms of derivatives trading, Coinglass data shows that in the past 24 hours, the entire network experienced liquidations of $804 million, with a large proportion of long positions being liquidated, amounting to $586 million. In terms of cryptocurrencies, BTC saw liquidations of $165 million, while ETH topped the list with liquidations of $205 million.

Why the Significant Decline?

In fact, apart from the cryptocurrency market, major financial markets have also seen a comprehensive pullback recently. The Nasdaq index has dropped 4.15% over the past five trading days, and the Nikkei has fallen 2.8% over the same period. The fundamental reason is that non-farm payroll data significantly exceeded expectations, supporting the Federal Reserve's decision to slow down interest rate cuts.

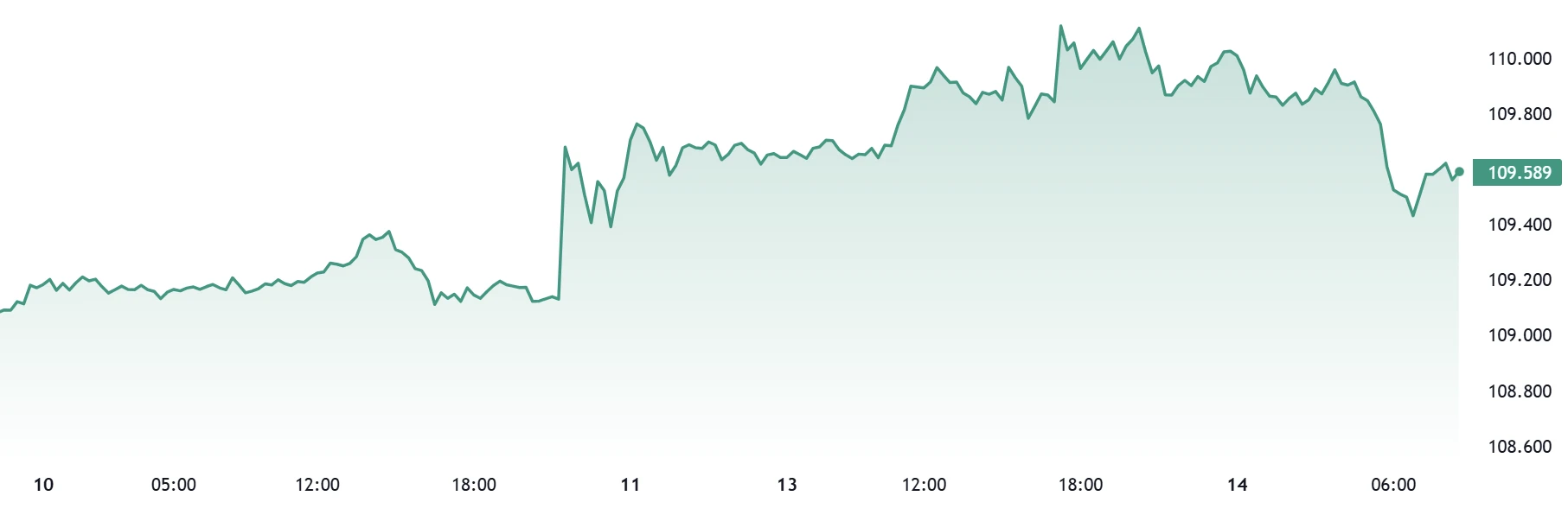

The non-farm payroll data released on January 10 showed that the adjusted non-farm employment population in the U.S. for December was 256,000, far exceeding the market expectation of 160,000, reaching a new high since March 2024. The unemployment rate was 4.1%, down from 4.2% in November. The market increasingly expects that the Federal Reserve will only make small interest rate cuts in 2025, while the dollar index DXY has risen, leading to a general decline in risk markets.

Dollar Index DXY

What are the Expectations for Interest Rate Cuts?

On January 10, according to CME's "FedWatch," the probability of the Federal Reserve maintaining interest rates in January is 97.3%, while the probability of a 25 basis point cut is 2.7%. The probability of maintaining the current rate in March is 74.0% (up from 59.6% before the non-farm data), while the cumulative probability of a 25 basis point cut is 25.4% (down from 37.9% before the non-farm data), and the cumulative probability of a 50 basis point cut is 0.6% (down from 2.5% before the non-farm data).

According to Jin10, U.S. interest rate futures pricing suggests that the Federal Reserve may not cut rates this year. Traders are increasingly not betting on how much the Federal Reserve will cut from the current rate range of 4.25% - 4.50%, which in turn has boosted the dollar against most other major currencies. Against the backdrop of rising inflation and borrowing cost expectations, U.S. Treasuries have been sold off this month, pushing up (10-year) Treasury yields and making investors more convinced that the Federal Reserve's room for rate cuts may not be as large as previously expected.

Brandywine Global portfolio manager Jack Mcintyre stated that the most critical variable for the Federal Reserve and the market remains inflation. Next week's CPI data will be more important. (Note: CPI will be released this Wednesday at 21:30.)

Institutional Views

Bitfinex: Market Optimism Towards Cryptocurrency Regulation May Limit Further Declines in Bitcoin

Bitfinex released a report analyzing that the reason for Bitcoin's decline is the increasing cautious sentiment in the market, driven by soaring U.S. Treasury yields and continuous outflows from spot Bitcoin ETFs. Notably, ETFs have seen outflows on 7 out of the past 12 trading days, with $718 million flowing out in just two days, in stark contrast to nearly $2 billion in inflows at the beginning of January.

Despite facing macro pressures, Bitcoin remains resilient—up 42% since the U.S. elections—outperforming stocks, which have erased their post-election gains. However, with the Federal Reserve signaling fewer rate cuts and a tightening financial environment, Bitcoin may face greater volatility in the short term. Nevertheless, under the leadership of newly elected President Trump, optimism regarding cryptocurrency regulation may still limit further declines in Bitcoin and keep it strong in the long term.

Analyst: January Sell-off in Bitcoin is Common, New Highs May Follow Significant Adjustments

Cryptocurrency analyst Axel Bitblaze stated that historically, January sell-offs in Bitcoin are common phenomena following halving events, citing examples from 2017 and 2021 when the market saw new highs after sell-offs:

In January 2017, a year after the 2016 halving, Bitcoin plummeted 30%, from $1,130 to $784. That year, Bitcoin's price skyrocketed 2,400%, reaching an all-time high of $20,000 in December.

In January 2021, the next halving year, Bitcoin's price fell over 25% from over $40,000 to just above $30,000 by the end of the month. By November, Bitcoin's price surged 130%, reaching an all-time high of $69,000.

Intouch Capital Markets Senior Forex Analyst: BTC Shows Technical Bearish Signals, Next Low May Be Around $88,000

Intouch Capital Markets senior forex analyst Piotr Matys indicated that Bitcoin may have formed a so-called head and shoulders pattern, suggesting a trend shift from bullish to bearish. Matys noted that breaking below the key support level of $91,600 indicates "strong technical bearish signals for Bitcoin." Fxpro chief market analyst Alex Kuptsikevich added that if bearish sentiment prevails, Bitcoin's next low may be around $88,000, with a possibility of a quick rebound to around $74,000 from there.

Last year, the debut of U.S. ETFs directly linked to Bitcoin, along with President Trump's outspoken support for the digital asset industry, pushed Bitcoin to an all-time high. However, this optimism has waned in 2025, with some analysts stating that traders are waiting for certainty after Trump's inauguration on January 20.

Bloomberg Analyst: Trump Will Revitalize U.S. Stocks, Not Worried About Short-term Bitcoin Pullbacks

Bloomberg senior ETF analyst Eric Balchunas stated that Bitcoin's biggest risk is the downward trend of the stock market (also known as the "baby boomer market"), which has both pros and cons. The good news is that Trump may go all out to keep the stock market rising, so personally, he is not too worried about these short-term pullbacks.

The Future is Bright, but the Road is Twisted

Although Bitcoin and Ethereum ETFs have recently begun to see net outflows, MicroStrategy continues to "buy, buy, buy." Yesterday, MicroStrategy announced it had purchased an additional 2,530 BTC for $243 million. Meanwhile, Nasdaq-listed companies like Heritage Distilling and Nano Labs plan to use Bitcoin as a strategic reserve, indicating that more large purchases may still be on the way.

On the other hand, the path for interest rate cuts in the first half of the year seems to be set according to market predictions, and the bearish expectations have been digested. On January 20, Trump will be sworn in as President of the United States, and his policy direction and final outcomes will become the most critical factors influencing the trends in the cryptocurrency market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。