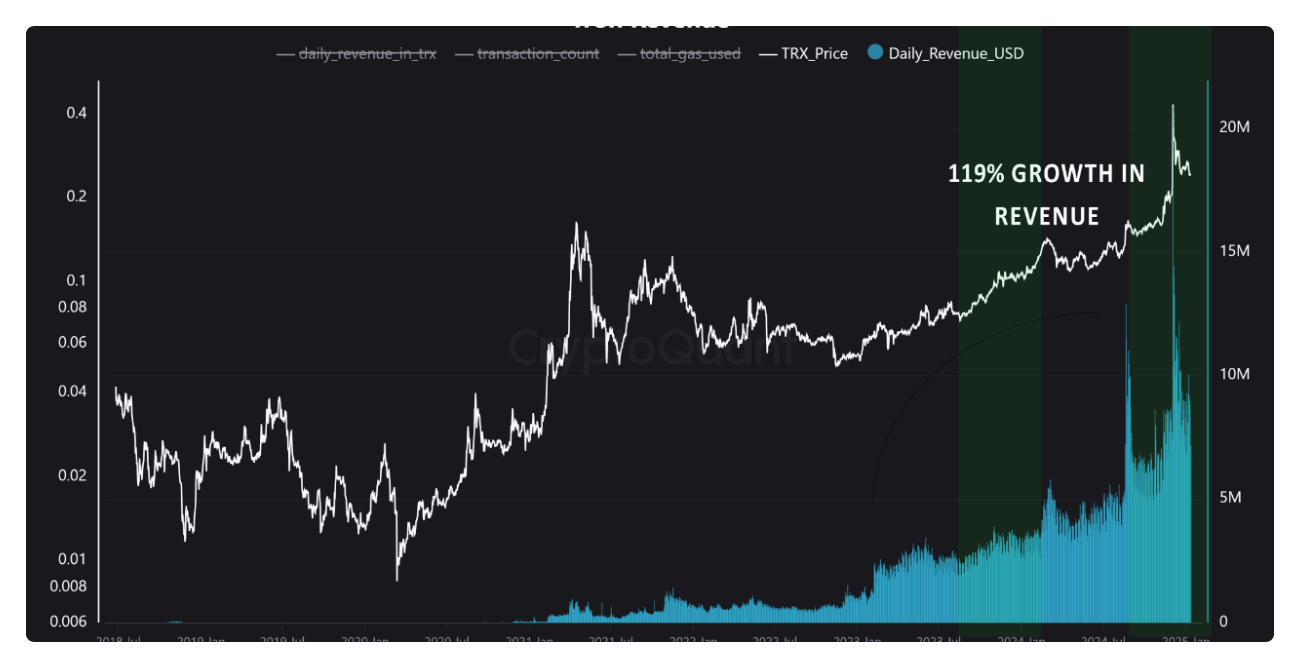

The network recorded $2.12 billion in revenue for the year, reflecting a 115.73% rise compared to 2023. Tron’s infrastructure and high transaction throughput have been key contributors to its success. With more than $60 billion in stablecoins under its umbrella—representing 34% of the global stablecoin market—Tron stands out. By early 2025, the network boasted 51,337,262 tether (USDT) holders, vastly surpassing Ethereum’s figures.

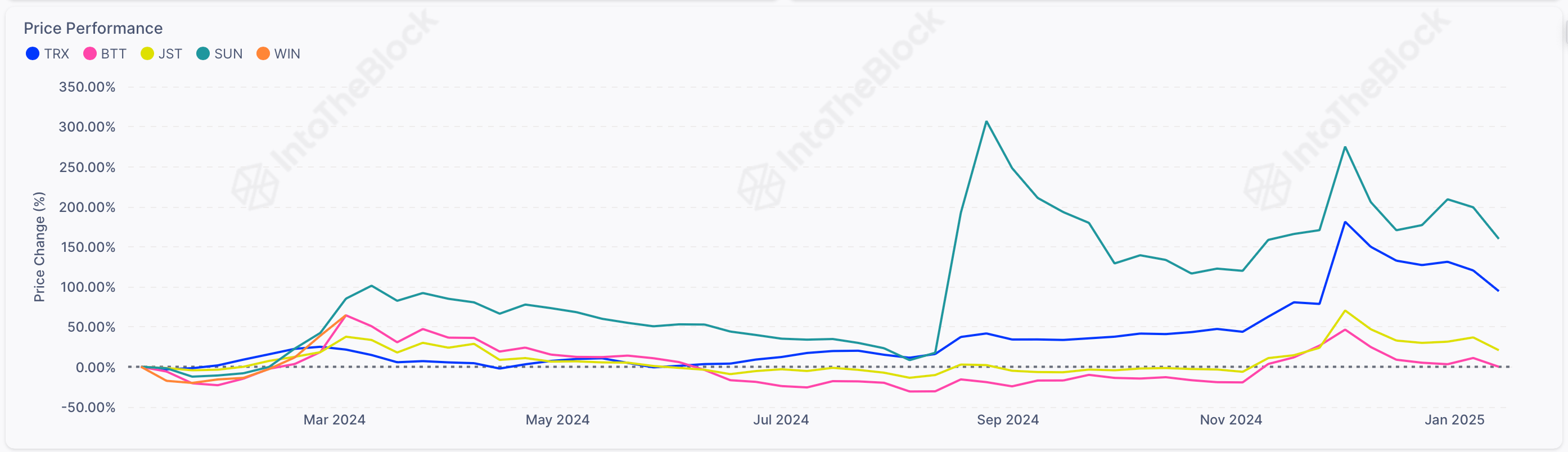

Tron token TRX and Tron-based tokens based on performance. Source: Intotheblock.com.

Examining its onchain metrics over the last year reveals a 29% quarter-over-quarter climb in daily transactions, peaking at 6.3 million by mid-2024. This was accompanied by a 64% expansion in active addresses over the year, indicative of growing adoption among developers and users in decentralized finance (defi) and gaming spheres.

Meme coin platforms, spearheaded by Sunpump, have invigorated Tron’s ecosystem, fostering engagement and generating considerable revenue. Tron’s scalable design and minimal transaction costs have continued to appeal to decentralized application (dapp) creators and users alike. Meanwhile, the TRX token experienced a 328% value appreciation, reaching an all-time high of $0.45. This performance highlights that 95% of TRX holders are currently profitable, as per intotheblock.com.

Source: Data from Cryptoquant and insights from community member Crazzyblockk

Tron’s rise has been buoyed by setbacks in rival networks and calculated strategic moves. “With this explosive momentum in daily revenue, Tron is setting a new standard for blockchain economic models,” remarked Cryptoquant community member Crazzyblockk. While Ethereum faces stiff competition from Solana, TON, ADA, SUI, XRP, and XLM in the smart contract coin and layer one (L1) race, Tron too has significant competition to deal with in 2025.

In 2024, SUI distinguished itself by processing an extraordinary 7.5 billion transfers, surpassing the performance of numerous other L1 networks, according to theblock.co’s L1 data. Other leading L1s in terms of last year’s performance include BNB and Cardano.

Even Bitcoin has emerged as a challenger, overtaking Tron in recent months in terms of value locked in defi. Presently, that is not the case as Tron’s value locked in defi has rebounded. As of now, Bitcoin holds $6.262 billion in total value locked (TVL), compared to Tron’s $6.618 billion.

An area of scrutiny is the concentration of TRX ownership, with 67% of the token supply held by whales. However, TRX volatility has significantly decreased, dropping from 2.29 in Dec. 2024 to 0.62 by early Jan. 2025, according to intotheblock.com stats. Despite ongoing challenges from competitors, Tron’s ecosystem is thriving in 2025, and token trajectory and innovative developments position it to remain a dominant presence in the blockchain sector.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。