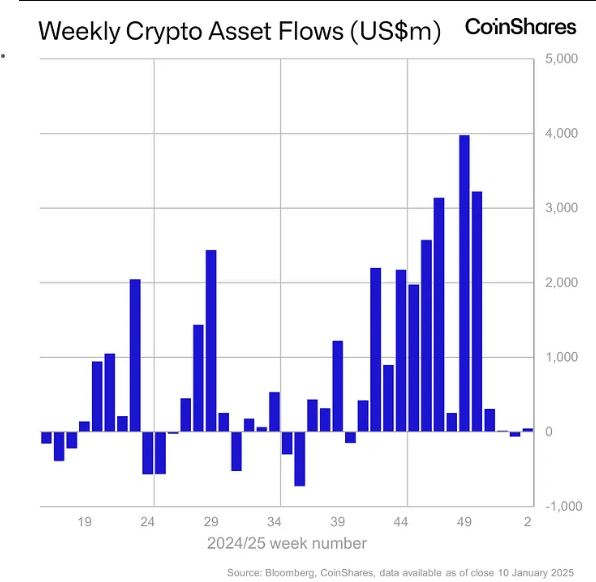

Coinshares’ weekly digital asset fund flows report revealed that digital asset investments experienced a modest inflow of $48 million last week.

Although about $1 billion came in the first half of the week, new macroeconomic data and the U.S. Federal Reserve’s minutes, which indicated a stronger U.S. economy and a more hawkish Fed caused outflows of $940 million in the second half of the week.

This could signify that the honeymoon period following the U.S. election is over and digital assets are once again heavily influenced by macroeconomic data.

Last week, bitcoin experienced inflows of $214 million, but it also witnessed the biggest withdrawals later in the week. Despite this, bitcoin is still the best-performing asset with inflows of $799 million so far this year.

Ethereum saw the most losses last week with outflows of $256 million. In comparison, Solana saw inflows of $15 million and XRP saw inflows of $41 million, mostly influenced by political and legal considerations. The inflows for XRP indicate increased optimism ahead of the SEC appeal deadline on Jan. 15.

Despite the general poor market performance, altcoins witnessed inflows. The most significant ones were Aave, Stellar, and Polkadot which saw inflows of $2.9m, $2.7m, and $1.6m, respectively.

On the country scale, the U.S. continued to lead with inflows of $79 million while Germany was a close second with inflows of $52.4 million. Switzerland saw the biggest outflows with $85.3 million and Hong Kong with $36.6 million in outflows.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。